Direct plan of an MF scheme offers better returns than the regular plan of the same MF scheme. You know this but how much better? Let us look at 9 years of live data and see the difference. As we will see, even a small difference in return compounds to a very big amount as the time passes.

The mutual fund companies launched direct plans in January 2013.

Hence, we have over 9 years of performance history now.

Therefore, it is the right time to compare the performance between the direct and regular plans of the MF schemes and the impact of lower costs on portfolio values.

What are Regular and Direct plans in Mutual funds?

Each MF scheme has a direct and regular plan variant.

Example: Mirae Emerging Bluechip-Regular and Mirae Emerging Bluechip-Direct.

Both the variants have the same portfolio and the fund manager. Same in all aspects. The only difference is in the payment of commissions. Direct mutual funds do not pay any commissions. Regular (variant) of MF schemes pay commissions to distributors.

Because of commissions, regular plan variant has a higher expense ratio than the direct plan of the same scheme. Lower expense ratio in direct plans means lower cost.

And lower costs in direct plans translate to better returns than regular plans.

We know that the direct MF of X scheme will give better returns than the regular plan of the same scheme.

However, we cannot easy appreciate how a small difference in expense ratios (0.5% to 1%) can translate to a wide variation in absolute returns.

Earlier, we had to resort to assumptions to assess the impact. However, now, we have 9 years of data.

Let us see the impact.

We can do a very comprehensive exercise for this. However, to drive home the point, I will pick up the most popular fund in the select categories and show the impact.

- Nifty Index Fund –> UTI Nifty Index Fund

- Large Cap –> Axis Bluechip Fund

- Multicap –> Mirae Emerging Bluechip

- Mid Cap –> Kotak Emerging Equity Fund

- Small Cap –> SBI Small Cap

- Balanced Advantage Fund –> ICICI Prudential Balanced Advantage Fund

For active funds, I have simply picked one of the top three funds in the category (by size). My perception of popularity of a fund has influenced my choice. And yes, the fund must be around since Jan 2013.

Note: This is not a recommendation to invest in these funds.

You can do this exercise for your MF scheme and see the difference.

Direct plan gives better returns and this trend will continue

We will compare the performance on two aspects.

- Lumpsum of Rs 10 lacs invested on January 2, 2013

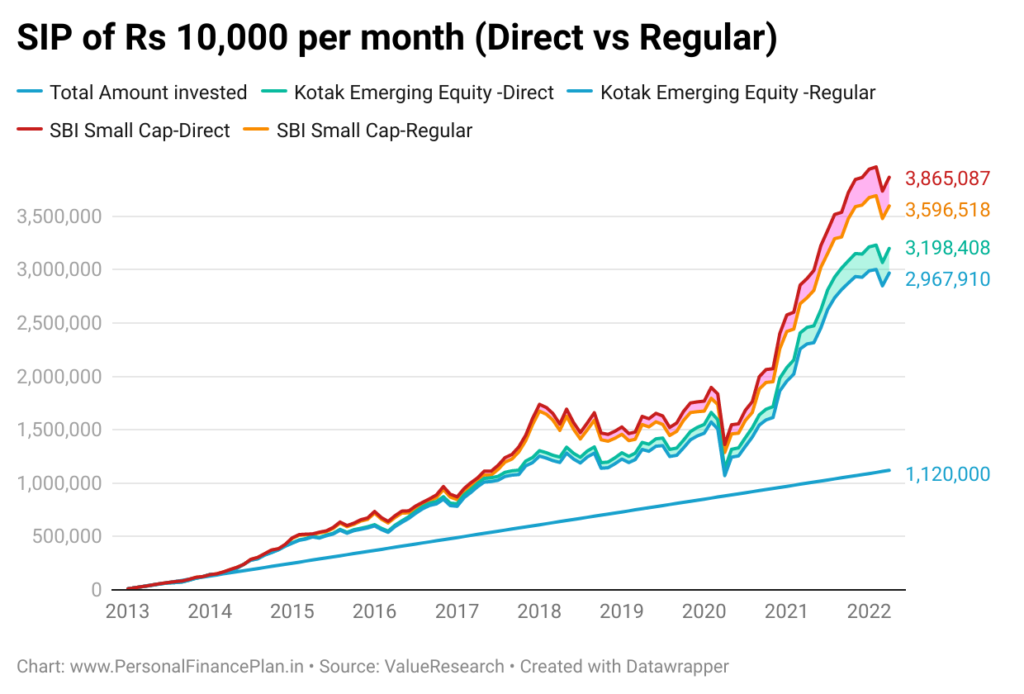

- SIP of Rs 10,000 per month on the first day of each month

To reduce the number of charts, I will club 2 funds in each chart. Do not focus on the relative performance of these funds. Focus only on the relative performance of regular and direct variants of each scheme.

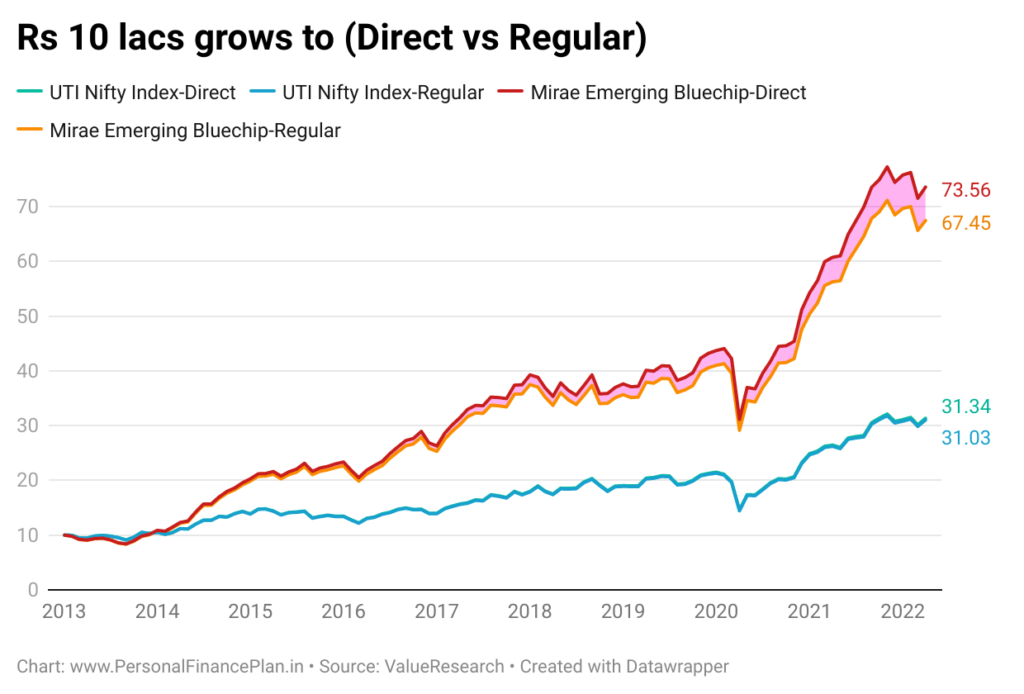

UTI Nifty Index and Mirae Emerging Bluechip

Kotak Emerging Equity and SBI Small Cap

Axis BlueChip and ICICI Prudential Balanced Advantage

Easy to see you earn better returns in direct plans.

Remember, for each scheme, the direct and regular variants started at the same NAV in January 2013.

The NAV of the direct plan has grown faster (than NAV of the regular plan) since then.

Why?

No commission in direct plans –> Lower Cost –> Higher returns –> Faster growth in NAV

The portfolio (gross) returns are the same for both regular and direct plans. The direct plan inches ahead because of lower costs. The cost difference may look small (0.5-1.0%) but it makes substantial difference over the long term. In all the active funds shared above, you have lost over 1/10th of the returns to distribution costs. That is a massive hit. And this is just in 9 years.

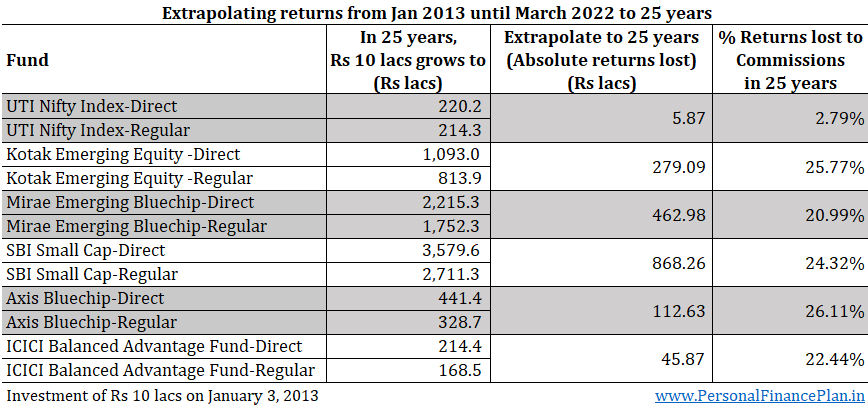

Extrapolate this to 25 years (not right but this will show the extent of returns forgone). If we were to assume that the funds were to give the similar returns for a period of 25 years, the commissions in regular plans can eat almost a quarter of your returns.

The difference between the NAVs of regular and direct plans will only widen as the time passes. And this is a mathematical construct. This gap between the NAV of the direct plan and the regular plan will widen irrespective of fund performance.

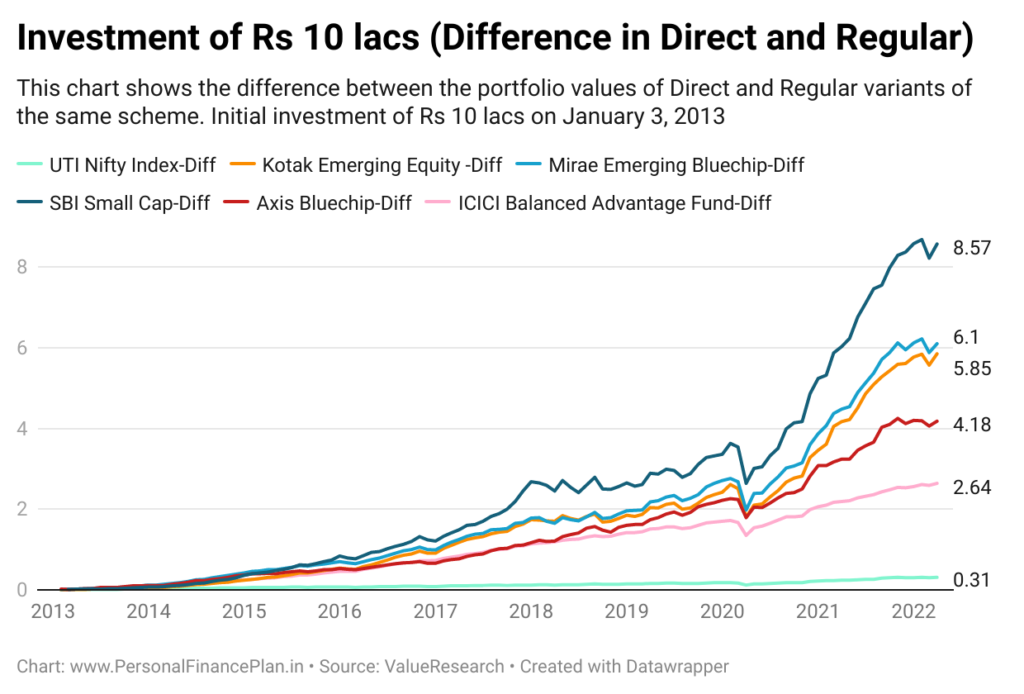

Refer to the chart below. In this chart, I show how the difference between the portfolio value (Rs 10 lacs invested on January 3, 2013) in direct and regular plan has widened over the last 9 years.

The trend is secular.

You will see a small dip (say March 2020) at a few places in the chart. That is just the fall in absolute difference due to market fall. Let us understand with the help of an example.

Let us say you invested Rs 1 lacs. The investment grows to 2 lacs in regular plan and Rs 2.2 lacs in direct plan. The gap is Rs 20,000. Market corrects. Both fall ~10%. The portfolio will regular plan falls to Rs 1.8 lacs. The portfolio in direct plan falls to Rs 1.98 lacs. The difference falls from Rs 20,000 to Rs 18,000. Hence the dips.

The difference will continue to increase.

A common misconception is that the direct plans have higher NAVs. Hence, you will get a lesser number of units (than regular plans). That is right but immaterial. What matters is which variant will give better returns going forward. And it will be the direct plan. I have addressed this question in this post. In fact, the NAV of the direct plan is higher than NAV of regular plan because direct plan has given better returns. Remember, both the direct and regular variants started at the same NAV in January 2013.

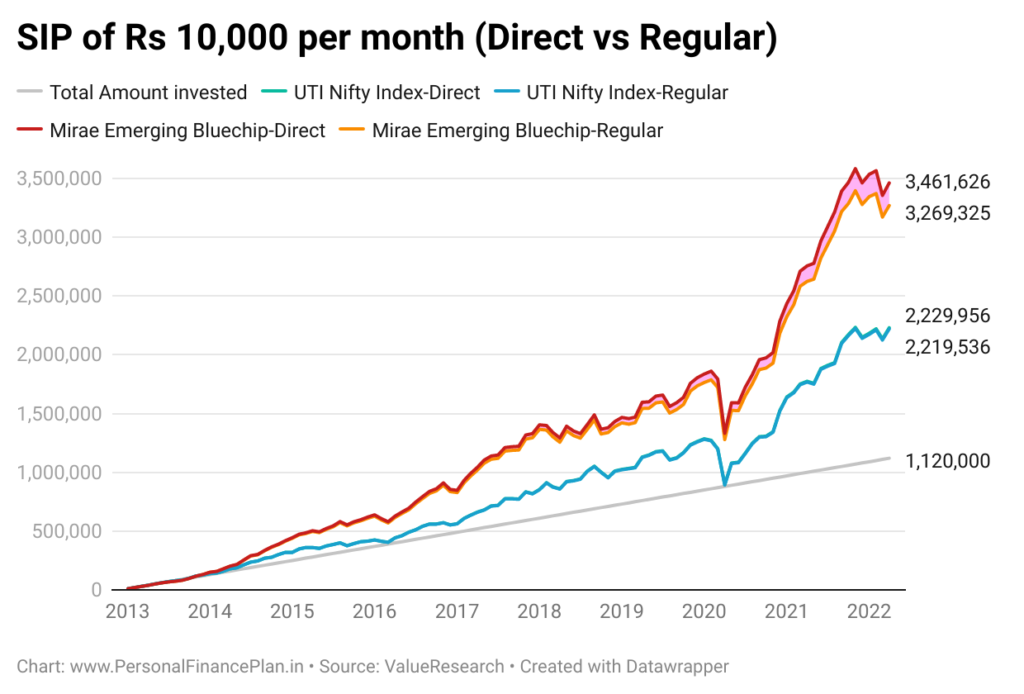

SIP does not paint a different picture

And there is no reason it should paint a different picture.

I plot the data for the SIP of Rs 10,000 on the 1st of each month since January 3, 2013, until March 2022. 112 installments have gone in until now. Total investment of Rs 11.2 lacs.

An interesting point: The SIP started in Jan 2013. In early 2020, the portfolio value in UTI Nifty Index goes down and touches in the amount invested. So, 0% returns in over 7 years. SIPs do not guarantee good returns.

No surprise here.

This difference will continue to grow.

The results will vary across schemes, fund category and AMCs. Debt MF schemes are likely to pay lower commissions compared to equity funds. Within the equity space, actively managed equity funds pay higher commissions. Passive index funds pay lower commissions. You can check the difference for your funds.

What should you do?

If you are a Do-it-yourself investor, then it is criminal to invest in regular plans. You incur an additional cost for nothing. Now, it is not a question of operational convenience either. The platforms such as MFU, Kuvera, PayTM Money, Zerodha Coin and Groww allow you to invest in direct mutual funds from multiple AMCs from a single interface.

If you seek professional assistance, you need to make a choice.

You can work with a distributor and invest in regular plans. You pay nothing to the distributor. The AMC pays the distributor on your behalf and adjusts the payment within the NAV. Therefore, even though you do not write a cheque, you still pay for the advice and operational convenience. With regular plans, there is always potential for conflict of interest. The intermediary might prefer to push products that offer higher commissions. Your interests may take a backseat. Not necessarily though. There are many distributors who are doing an excellent job.

Alternatively, you can work with a SEBI registered investment advisor (RIA). Pay for the advice and invest in direct plans. SEBI RIAs can have different work and compensation models. A fixed-fee model, a percentage of asset based or a blend of the two. There is no right or wrong model. The compensation should be fair to both the investor and the adviser.

If you are a new investor and just want a quick way to start investments, reach out to advisers who work on 5-hour per client approach. Their approach will be cost-effective for you.

If you are a serious investor, want a customized solution for your hard-earned money and be more involved in the decision-making, you can work with RIAs who prefer a more consultative process and spend more time with the investors.

Additional Links/Source