Tax season is upon us – and it looks different from years prior. With major federal tax law changes affecting 2023 returns, many individuals will likely ask why their refund wasn’t as large this year. To help cut through the perplexity, use our sliced-up infographic to find answers to this year’s top tax season questions.

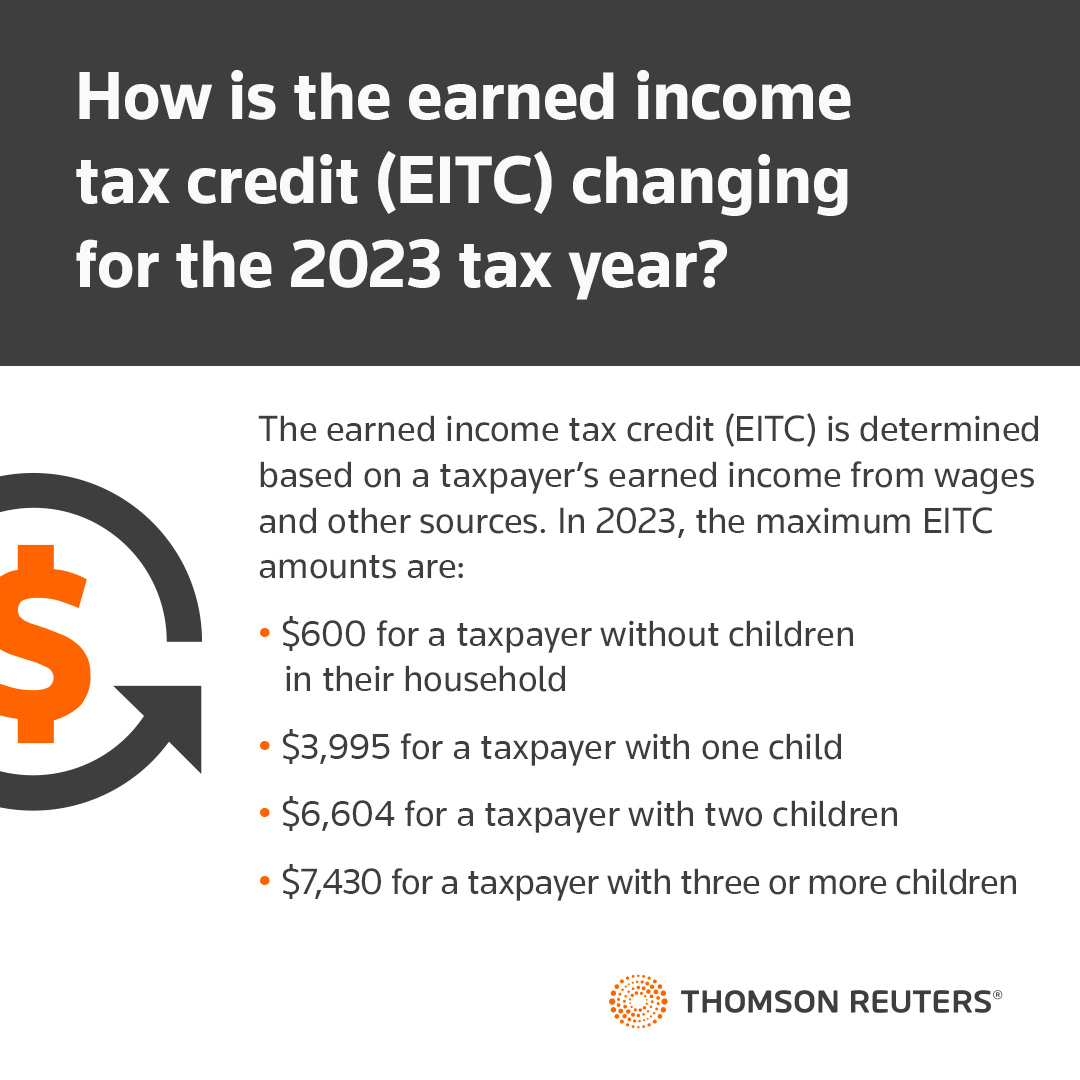

The earned income tax credit (EITC) is determined based on a taxpayer’s earned income from wages and other sources.

How is the EITC changing?

-

- For 2023, the maximum earned income credit is $7,430 for those with three or more qualifying children.

- For 2023, the maximum amount of earned income on which the earned income tax credit will be computed is $7,840 for taxpayers with no qualifying children, $11,750 for taxpayers with one qualifying child, and $16,510 for taxpayers with two or more qualifying children.

- For 2023, the phaseout of the allowable earned income tax credit will begin at $16,370 for joint filers with no qualifying children ($9,800 for others with no qualifying children), and at $28,120 for joint filers with one or more qualifying children ($21,560 for others with one or more qualifying children).

- The amount of disqualified income (generally investment income) a taxpayer may have before losing the entire earned income tax credit is $11,000 for 2023.

Maximum EITC amount

An eligible individual is allowed an EITC equal to the credit percentage of earned income (up to an “earned income amount”) for the tax year, subject to a phaseout. The maximum EITC for 2023 is $600 (for taxpayers with no qualifying children), $3,995 (one qualifying child), $6,604 (two qualifying children), and $7,430 (three or more qualifying children).

SECURE 2.0 Act

- While many of the tax benefits related to the COVID-19 pandemic have expired or reverted to their pre-pandemic levels, expanded health insurance subsidies are extended through 2025. (Tax Planning and Advisory Guide—Health Care Reform—premium tax credit expansion)

- The SECURE 2.0 Act (the “Act”) was passed on December 29, 2022. Among the key retirement provisions in the Act are: Expanding automatic enrollment in retirement plans; increasing the age for the required beginning date for mandatory distributions; a higher catch-up limit to apply at ages 60, 61, 62, and 63; and eliminating the additional tax on corrective distributions of excess contributions. The Act also includes several smaller non-retirement tax provisions, including changes to ABLE accounts under Code Sec. 529A and modifications to the rules governing charitable conservation easements under Code Sec. 170.

- Specifically for 2023, the Act:

- Increases the age for the required beginning date to start taking mandatory distributions. (Tax Planning and Advisory Guide—Retirement Plans for Self-Employed—requires minimum distributions)

- Modifies the rule regarding the 10% early distribution tax as it relates to firefighters and public safety officers. For more details on the Act’s changes to retirement planning for both 2023 and 2024, see the Retirement section below. (Tax Planning and Advisory Guide—Retirement Plans for Self-Employed— exceptions to the early distribution tax).

Student loan interest deductions

- Interest paid on a qualified student loan is deductible up to $2,500 per return, except for married taxpayers filing separate returns, for whom it is denied. This deduction phases out at higher income levels. Taxpayers who might fall within the phase-out range for the student loan interest deduction this year should try to shift income to next year so that their current-year income falls below the phase-out threshold.

- Student loan interest deductions might be lower this year for some taxpayers due to COVID-19 relief that reduced the interest on certain student loans to 0% and suspended certain student loan payments. Taxpayers should consider whether making additional student loan payments before December 31 will enable them to fully utilize the student loan interest deduction.

- The allocation of payments between principal and interest for purposes of the deduction may not match the allocation stated on Form 1098-E from the lender or loan servicer. A taxpayer may be able to claim a deduction for payments allocated to the principal by the lender to the extent the payments represent unpaid capitalized interest. For tax purposes, a payment generally applies first to stated interest that remains unpaid as of the date the payment is due, second to any loan origination fees allocable to the payment, third to any capitalized interest that remains unpaid as of the date the payment is due, and fourth to the outstanding principal.

Reduced Threshold for Required Electronic Filing

The Taxpayer First Act (TFA, PL 116-25) contained a provision that permitted the IRS to issue regulations to reduce the 250-return threshold that triggers the electronic filing mandate of wage statements (Checkpoint Payroll Guide ¶4261) and information returns (Checkpoint Payroll Guide ¶4264). The IRS released final regulations in February 2023 that reduced the e-filing threshold mandate from 250 returns of a single type of information return to 10 information returns in aggregate for the 2023 tax year (2024 filing year). This is a significant decrease and will trigger more electronic filing in the 2024 processing year. Payroll-related forms impacted by the reduced threshold include:

-

- Form W-2

- Form 1099 series, including Form 1099-NEC, 1099-MISC, and 1099-R.

- Affordable Care Act returns, including Form 1094 series, Form 1095-B, and 1095-C.

- Forms 3921 and 3922

- Form 5498

- Form 8027

Employee Retention Credit Processing Moratorium

The IRS announced a moratorium on the processing of new Employee Retention Credit (ERC) claims through December 31, 2023, in response to a surge in questionable claims resulting from aggressive ERC promoters and marketing (Checkpoint Payroll Guide ¶20,905). The ERC, now expired, was established during the height of the COVID-19 pandemic to provide relief to businesses and workers. New claims may be filed, however, the IRS will be pausing processing until at least 2024.

The IRS noted that the number of fraudulent ERC claims has increased. However, for those taxpayers with legitimate claims, the ERC may be claimed for the 2020 tax periods by April 15, 2024, and for the 2021 tax periods by April 15, 2025, using Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund.

“Employers and practitioners should revisit any ERC tax credit claims to ensure eligibility. The IRS provides an ERC eligibility checklist for assistance. If any questions arise, look for the future IRS guidance on the withdrawal and settlement programs to help navigate this complicated subject.”

– Christopher Wood, CPP, Senior Editor

Employee Retention Withdrawal Process and Settlement Initiative

The IRS will be introducing a withdrawal process that allows taxpayers to withdraw a previously filed ERC claim. For businesses that already received an ERC payment, the IRS is establishing a special settlement program that will allow taxpayers to make repayments for the improperly received ERC payment. Details on the withdrawal process and settlement initiative are forthcoming (Checkpoint Payroll Guide ¶20,905).

FUTA Credit Reduction

Under the Federal Unemployment Tax Act (FUTA), employers generally pay FUTA tax on the first $7,000 in wages for each employee each year. The FUTA tax rate is 6.0%. However, most employers benefit from a 5.4% FUTA credit, resulting in a FUTA rate of 0.6% on the first $7,000 in wages per employee, each year (Checkpoint Payroll Guide ¶4075).

During the COVID-19 pandemic, several states took federal loans to keep their unemployment trust funds solvent. States that default on these loans for two or more consecutive years are subject to a reduction in credits otherwise available against the FUTA tax.

Currently, California, Connecticut, Illinois, New York, and the U.S. Virgin Islands are listed by the U.S. Department of Labor as potential FUTA credit reduction states for 2023. These tax jurisdictions have until November 10, 2023, to repay their loans or their FUTA tax credit will be reduced. All of these tax jurisdictions were subject to a FUTA credit reduction for 2022.

Itemized deductions: charitable contributions

Individuals may deduct contributions to charitable organizations up to a certain percent of their “contribution base” (generally, AGI). Through 2025, that percentage is 60% for cash contributions and 30% for noncash contributions.

For year-end planning, it’s beneficial to review whether an individual has charitable contribution carryovers from a prior year. If income will decline, care should be taken to use the carryovers before they expire.

An individual with low basis, highly appreciated stock may want to consider funding a charitable remainder trust with the stock. The trust can sell the stock without incurring any income tax and make distributions over time to the current individual beneficiary (or beneficiaries) that will be taxed at the then-current rates in the years of distribution. The donor can also claim a charitable deduction in the year the trust is funded, equal to the value of the charitable remainder interest, subject to limitations.

Interested in learning more on year-end tax planning? Watch our recent Year-end Tax Planning Webcast or Download our recent White Paper “11 life changes to review with accounting clients“.

On-Demand Webcast

|

|

White Paper11 life changes to review with accounting clients

|

|