It’s easy to be in denial about debt. But when anxiety and fear take over, it can affect more than just your financial life. If you feel paralyzed by crushing debt, know that there’s a way out: bankruptcy.

Whether you opt for Chapter 7 or Chapter 13 bankruptcy, it won’t be an easy road. But it can help you regain control of your life and get back on solid financial footing.

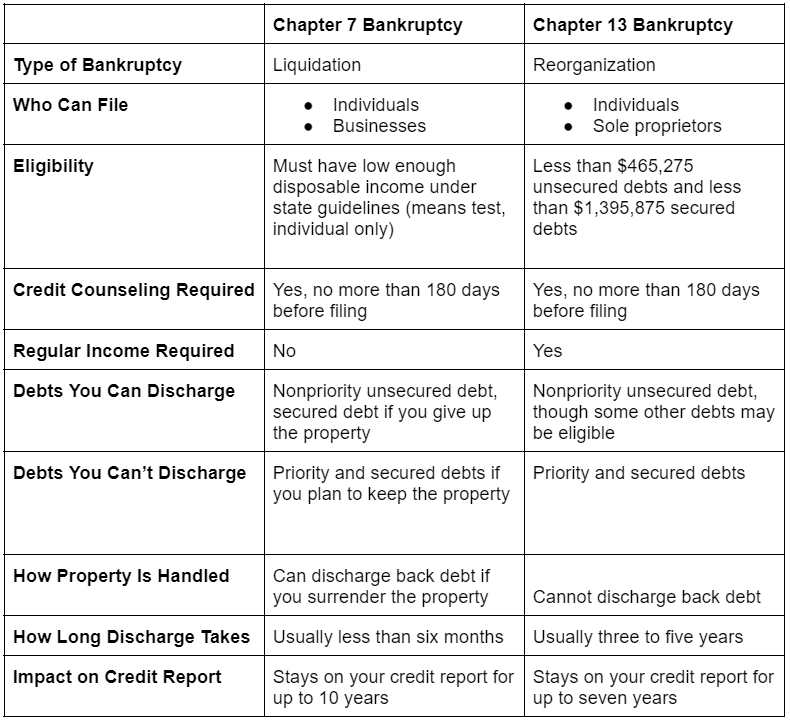

How it works depends on which one you choose. And that may depend on your individual circumstances. So it pays to understand the ins and outs of both before deciding which one’s right for you.

Chapter 7 vs. Chapter 13 Bankruptcy

Before you file bankruptcy, it’s vital to understand that some debts are treated differently in bankruptcy. Priority debts will stick around afterward, whether you choose Chapter 7 or Chapter 13. If you owe child support or alimony or have tax debt or federal student loans, you can’t use bankruptcy to eliminate them.

Motley Fool Stock Advisor recommendations have an average return of 618%. For $79 (or just $1.52 per week), join more than 1 million members and don’t miss their upcoming stock picks. 30 day money-back guarantee. Sign Up Now

Bankruptcy also might not eliminate any secured debts you have. Secured debts are anything that’s backed by collateral, usually the thing you’re buying with the loan, such as your mortgage payments or car loans.

That doesn’t mean you have to surrender your home or car when you file bankruptcy. Instead, you can continue making payments on those debts, though how that happens depends on which type of bankruptcy you choose. If you still owe on them, you continue to pay your secured loans after the bankruptcy is over too.

In both cases, when you file for bankruptcy, the court issues an automatic stay, which prevents your creditors or collection agencies from attempting to collect your debts. Both types of bankruptcy can help you keep certain types of property and give you a bit of breathing room. Both also require credit counseling no more than 180 days before filing.

But there are some crucial differences between Chapter 7 and 13 bankruptcy.

Chapter 7 Bankruptcy – The Quick and Easy Option

Chapter 7 is generally the quicker and easier option, as it’s usually over within a few months and entirely discharges any qualifying debt. It’s a liquidation bankruptcy, meaning the trustee might sell (liquidate) your assets to pay down your debts. If you only have unsecured, nonpriority debts and don’t have a lot of assets, Chapter 7 is usually the better option.

During Chapter 7, the bankruptcy trustee, an individual the court assigns to represent your estate in bankruptcy, can sell your belongings, whether they’re high-value items like a boat or motorcycle or lower-value items like furniture or designer clothing.

Chapter 7 does have income limits, so you might not qualify if you earn too much or if your debt-to-income ratio, the amount of debt you owe versus how much you make expressed as a percentage of how much of your income goes toward debts, isn’t high enough. That in addition to your family size is what the government calls a “means test.”

Debts you can discharge in Chapter 7 bankruptcy include:

- Credit card debt

- Medical debt

- Past-due rent

- Personal loans

- Past-due federal and state income taxes (at least three years old)

- Past-due utility bills

- Past-due attorney’s fees

- Civil court judgments

Secured debts, which are backed by property, such as a car or house, get treated differently in Chapter 7. You can discharge any back debt on them, provided you give up the collateral. If you want to keep the property connected to secured debts, you must reaffirm the debt and continue making payments. You need to be up-to-date on payments to do so.

If you’re behind on secured debts, there’s a risk of losing the collateral (such as your home). Even if you don’t discharge it, the trustee can sell it if there’s enough equity built up.

But you might qualify for an exemption, depending on the property type. An exemption protects your property from creditors. But if you owe a lot, the exemption might not be enough to fully protect you.

There are several advantages to Chapter 7 bankruptcy.

- You can wipe out unsecured debts (and potentially secured debts), giving you a fresh start.

- It happens quickly, in as little as a few months.

- It gets creditors and collection agencies off your back.

But there are some significant disadvantages you should consider:

- The bankruptcy trustee can sell certain possessions.

- You’re at the risk of a foreclosure on your home or repossession of your car, as it doesn’t give you the option to catch up if you’ve fallen behind on payments.

- The bankruptcy can stay on your credit report for a decade.

- Your credit score will drop, though it may not be that much and might be preferable to debt.

Chapter 13 Bankruptcy – Debt Reorganization and Payment Plan

If you don’t qualify for Chapter 7, Chapter 13 is the way to go. Unlike Chapter 7, Chapter 13 requires you to pay off your debts through a payment plan created by the bankruptcy trustee. Chapter 13 is a reorganization bankruptcy since the payment plan rearranges your debts.

Note that there is a limit to how much debt you can have to qualify for Chapter 13. You need to have less than $465,275 in unsecured debts and less than $1,395,875 in secured debts.

The trustee will rank your debts under the payment plan to ensure priority debts (such as alimony) get paid in full by the time the plan is complete (in three to five years). The plan will also account for secured debts you have and, if you can afford to pay them, unsecured debts. The amount you pay under the payment plan is based on your monthly income.

Chapter 13 takes longer than Chapter 7, in some cases up to five years. How long depends on the repayment plan. If your income is below the state’s median monthly income, your plan lasts three years. If you earn more than the state median income, it lasts five years.

Chapter 13 bankruptcy lets you discharge a few more debts than Chapter 7. The additional debt types you can discharge in Chapter 13 include:

- Debts for malicious and willful injury to property (but not to a person)

- Debts to pay for nondischargeable tax obligations

- Debts connected to property settlements in a divorce or separation (other than support obligations like alimony and child support)

- Outstanding debts from a previous bankruptcy in which the court denied your discharge

- Retirement account loans

- Any homeowners association or condominium fees due after your filing date

- Certain noncriminal government fines and penalties

You must continue making payments on secured debts if you want to keep the property associated with them. The benefit of Chapter 13 is that it allows you to reschedule the debt and potentially reduce the value of some property types, such as a car.

With Chapter 13, you can continue to make payments on secured debts once the payment plan is complete. You don’t have to pay them in full within three to five years.

While Chapter 13 doesn’t entirely erase your debt, there are several reasons people often view it more favorably than Chapter 7.

- It creates a payment plan to make your debt more manageable.

- It impacts your credit score less than Chapter 7.

- You can keep your house and other assets as long as you pay the debts connected to them.

- It gets creditors and collection agencies off of your back.

But there are still some significant disadvantages.

- The process takes much longer than Chapter 7.

- You might have difficulty making payments under your payment plan unless you make and stick to a budget.

- The bankruptcy will stay on your credit report for seven years.

- Your credit score will drop, though it may not be that much and it may be preferable to staying in debt.

Which Is Right for You: Chapter 7 or Chapter 13 Bankruptcy?

Whether it’s best to file Chapter 7 or 13 largely depends on your income and what types of debt you have.

You Should File Chapter 7 Bankruptcy If…

Overall, Chapter 7 bankruptcy is best for lower-income Americans who are in way over their heads. Chapter 7 bankruptcy is a better fit if:

- Your Income Is Below the Median in Your State. You need to pass a means test to be eligible for Chapter 7. You automatically pass the test if you earn less than the median monthly income in your state.

- You Don’t Have a Lot of Assets. Your bankruptcy trustee can sell your stuff to pay off creditors during Chapter 7. While there are exemptions, it’s usually better for a debtor not to have a lot of assets or possessions when they file for Chapter 7 bankruptcy.

- You Mainly Have Unsecured Debts. If you owe back taxes, alimony, child support, or student loans, bankruptcy won’t help. You’re still on the hook if you have secured debts and want to keep the collateral. Chapter 7 isn’t a magical get-out-of-debt-free pass. But if you have credit card debt, medical bills, or unsecured personal loans, Chapter 7 can give you a fresh start.

- You Don’t Have Enough Disposable Income to Repay Your Debts. You can pass the means test even if your income is above the state median, provided your disposable income (what’s left over after you pay for all your necessary expenses) isn’t enough to cover your monthly debt payments.

You Should File Chapter 13 Bankruptcy If…

If you have ample income but still struggle to make your payments, Chapter 13 might be a better fit. Chapter 13 bankruptcy is a better fit if:

- Your Income Is Above the State Median. To qualify for Chapter 13, you need to have a regular income. If you don’t pass the means test for Chapter 7, Chapter 13 might be your better option.

- You Own Your Home or Car. Filing Chapter 13 can keep your home out of foreclosure, as you have the option of catching up on your mortgage payments. You can also catch up on other types of secured debt, such as your car loan.

- You Don’t Have Too Much Debt. Chapter 13 has an unsecured debt limit of $465,275

and a limit of $1,395,875 for secured debt. If you owe more, Chapter 11, which is usually reserved for businesses, might be the better choice for you.

- You Can Afford the Monthly Payment. To get a discharge from Chapter 13, meaning you’re free of all your unsecured debts, you need to complete your payment plan. That means you need to be able to afford the monthly payment. If you believe your income will remain steady in the future, you can feel pretty good about filing Chapter 13.

Final Word

Whether you end up filing for Chapter 7 or Chapter 13, bankruptcy isn’t something to rush into. The bankruptcy courts seem to recognize that, as all filers need to complete a credit counseling course during which they learn about their debt repayment options and carefully evaluate whether bankruptcy is the best choice before they file.

But ensure you speak with a bankruptcy attorney to get a better sense of what your bankruptcy options are first. It’s very difficult to successfully file bankruptcy without one.

Speaking with a fiduciary financial advisor can also help you decide if Chapter 7 or 13 will provide the relief you need or if another debt relief option, such as negotiating with your lenders or getting on a debt management plan, is the right choice.