Things are getting interesting. Government programs got us through the pandemic, but now they are winding down. The next big crisis has not revealed itself, but we have plenty of significant problems to consider as franchising plans for the next few years of growth. There are two topics I would suggest franchisors focus on to prepare for the next couple years. I’ll start with the more obvious one, consumer behavior.

After 3 years of largely forced change, consumers are starting to show some consistent patterns. From a financial perspective, they are in decent shape, as the first graph suggests.

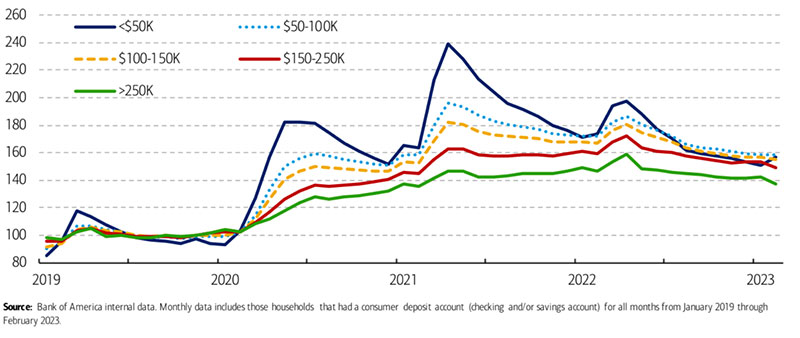

Monthly Median Household Savings & Checking Balances by Income for a Fixed Group of Households (2019 = 100)

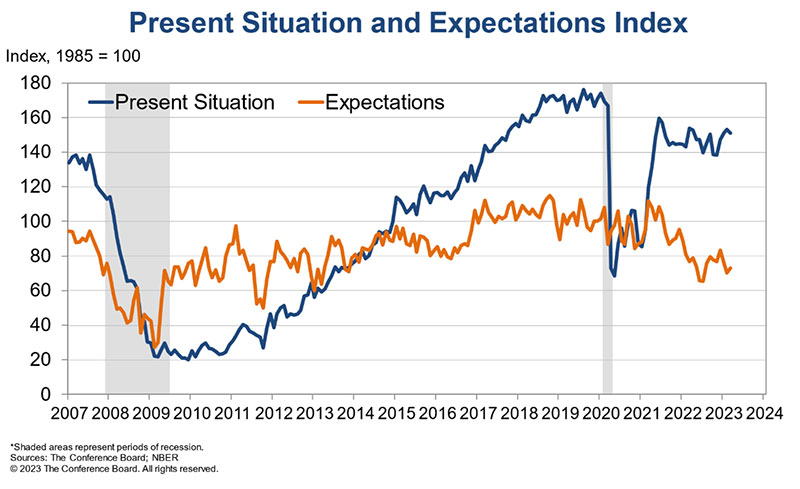

Note that deposits remain well above pre-pandemic levels across income cohorts. The clear implication is that consumers across all income segments are positioned in the near term from an “ability to spend” perspective. However, that leaves their to spend. Near-term attitudes about business conditions and the labor market are trending downward. Notably, the “Present Situation” line in the second graph has been range-bound for the past 2 years, while consumer expectations have continued to decline.

Consumer uncertainty suggests you put considerable emphasis on how your target demographic is adjusting and be prepared to move much more quickly than in the past with marketing and product changes as those adjustments show themselves. In 2023, consumers will be unpredictable and fickle. Brands will have to carefully consider the factors that affect shopping behaviors and respond accordingly. Even as many customers reduce spending, brands have an opportunity to keep customers engaged through multiple channels.

It’s pretty clear brands will be fighting for consumer discretionary dollars in a different environment than we’ve seen over the past decade or so. There will be no rising tide of consumer spending raising all brand boats for the next year, two, or longer. The 2021 spending pop is in the rearview mirror; the next year or two will see slow growth and possibly a recession.

The pandemic ushered in an unprecedented level of channel switching and brand loyalty disruption. A whopping 75% of consumers tried new shopping behaviors, with many citing convenience and value. Four in 10 (39%), mainly Gen Z and Millennials, deserted trusted brands for new ones. That restlessness is reflected in the fact that many younger consumers say they are still searching for brands that reflect their values.

In this environment, staying on a growth trajectory requires a granular understanding of customers, creating moments that matter for them through personalization. Advanced analytics can help identify reliable demand markers to determine where and how fast your customers are moving. Use forecasting models to locate pockets of growth, and act with speed to capture demand, win new customers, and reinforce the trust and loyalty of existing ones.

Wall of debt CRE looms

The second topic to pay particular attention to is real estate. Two issues are converging that will make site selection as important as marketing for franchisors.

- Issue 1. Almost $1.5 trillion of U.S. commercial real estate (CRE) debt comes due for repayment before the end of 2025. Whether it’s a retail space, office building, mall, or warehouse, the big question facing these borrowers is, Who is going to lend to them?

- Issue 2. Small and regional banks were the biggest source of credit to the CRE industry last year. As much as 70% of the other CRE loans that mature over the next 5 years are held by banks, many of them small and regional banks.

This wall of debt is set to get worse before it gets better. Maturities climb for the coming 4 years, peaking at $550 billion in 2027. All the development we have witnessed over the past 10 years anticipated a continuation of a low-rate environment. We no longer have that and are not expecting a return to single-digit financing rates in the window this mountain of debt will come due. Morgan Stanley estimates office and retail property valuations could fall as much as 40% from peak to trough, increasing the risk of defaults.

That leads to another unintended consequence for franchisors. Banks are moving quickly into conservative mode. Shoring up and expanding your banking relationships will be necessary in the next 24 months. We’re already getting requests to help banks sort through the expected portfolio performance of brands and adjust their sector and brand focus. You’ll need to know what we know about how credit boxes are changing and how portfolio adjustments are being made.

Dynamic consumer changes that are now with us and the coming repricing in the CRE industry will create growth opportunities. However, among the dozen functions franchisors are responsible for in the franchise business model—beefing up your site selection team, enhancing your marketing team’s consumer data analytics, and staying on top of lending relationships—must be front and center for you to realize your growth plans.

Darrell Johnson is CEO of FRANdata, an independent research company supplying information and analysis for the franchising sector since 1989. He can be reached at 703-740-4700 or djohnson@frandata.com.