Having an occupied property rented substantially below market price is a problem that’s afflicted many real estate investors. Every month a property is rented below market rate is lost money (or at least, the opportunity cost of lost money). Yet, jacking the rent up will likely lead to a vacancy and even more lost rent, at least in the short term. You will also likely have an angry tenant on your hands and definitely might carry the bad karma of pushing someone to move out of the home they’ve lived in, potentially for a long time.

So what should you do?

Should you leave the rent in place? Not renew the tenant’s lease? Bring the rent immediately to market price? Somewhere in between?

Unfortunately, there is no perfect solution because much of it depends on your situation and what you are looking to accomplish. Fortunately, there are guidelines to help.

How Below-Market Rent Typically Occurs

This article will not go into how to find and set the market rent price for a property. (For that, see here.) Instead, it will focus only on what to do when a tenant is paying well below market rent.

First, however, there are typically three reasons why you will find yourself in this position. Knowing these can help you prevent yourself from getting into this position in the first place.

1. Inherited residents

Sometimes we buy properties that already have a tenant in them. This is virtually always the case with multifamily properties. Fortunately, tenants often know that when a property changes hands, the rent will likely go up (especially if the new owner makes capital improvements). This is why many are nervous when hearing a property is up for sale. But it also means most won’t be surprised when they see their rent increased.

2. Not raising rents annually

I would argue that you should always raise the rent upon renewal, even if it’s just $5 per month. You do not want your tenants to be surprised by a rent increase. Many smaller landlords find themselves with severely below market-rented properties because they refuse to raise the rent (or don’t come close to keeping up with the market). They do this often because they’re afraid of a vacancy. But it ends up costing a lot more to have a severely under-rented property. So, make sure to raise rents every year.

3. Long-term month-to-month tenants

Normally, landlords don’t allow month-to-month leases upfront. In my company, if we switch to month-to-month at the end of a lease term, we charge $100 to $250 extra per month. Still, sometimes you find yourself with a long-term tenant on a month-to-month lease. And since there is no renewal date, there’s no reminder for you to increase the rent. This has even happened to us with month-to-month tenants who have lived in the same property for three or four years, and all of a sudden, their previously above-market rent is now below-market.

Again, you can’t be afraid to lose someone by raising the rent. So, make sure to put your month-to-month tenants on an annual rent increase schedule, just like with annual leases. Setting up a reminder in any property management software shouldn’t be hard.

Why This is So Important

In the current economy, I would contend a fourth reason has entered the fray: It is very hard to keep up with this scorching hot market.

It used to just be when we inherited a resident who lived in a property before we purchased it or an old month-to-month lease that fell between the cracks. But now, it feels like just about everything we lease is below-market rent. And I can say confidently that it isn’t just us who feel this way.

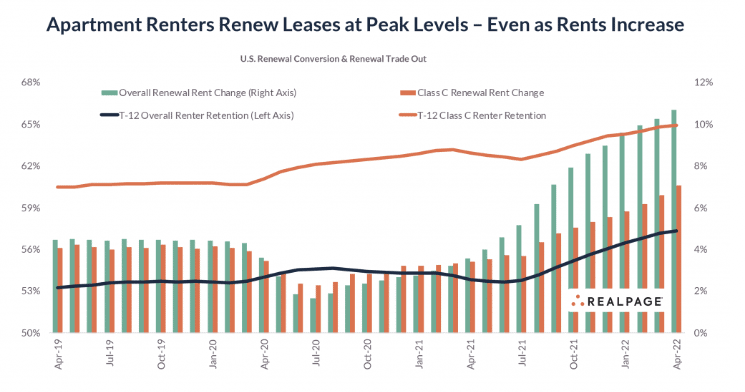

Nationwide, rents haven’t shot up as much as real estate prices, but they have still gone through the roof. A recent Realtor.com report found the median asking rent for properties on the market has gone up 16.7% year-over-year, substantially more than wage growth and even more than inflation in a very high inflation year.

This, of course, varies by the city and state, with some seeing even higher rates of rent growth. A recent Rent.com report finds even faster rent growth, with some metro areas having truly obscene year-over-year rent increases. From their analysis, for example, Newport, Virginia, and Greensboro, North Carolina, had increases of 74.2% and 60.7%!

Yet these rather shocking statistics are a bit misleading. The issue is that they are only comparing new rental listings with those from last year. As NPR notes,

“Government consumer price data show that the average rent Americans actually pay—not just the change in price for new listings—rose 4.8% over the past year, which is a higher than usual rate of increase.”

So, if rents went up almost 17% last year, but the average tenant only paid just shy of 5% more for rent, then that would infer there are a lot of occupied properties with tenants paying below market rent these days.

Below-market rented properties are an endemic problem for landlords right now.

Understanding Tenant Psychology

Tenants are not surprised to see rent increases. Unfortunately, they are surprised (and quite upset) to see really large ones. Indeed, we’re starting to see more and more pieces in the media about the outrage of large rent hikes.

We have even heard prospects tell us they didn’t renew their lease simply because the increase was too high despite the fact it was actually less than we were charging. Investor G. Brian Davis makes a similar point based on his experience,

“A good rule of thumb: don’t raise the rent by more than 5% per year. Any more and the sharp rent increase often jolts the tenant into moving—even if you’re raising the rent no higher than nearby market rates.”

Of course, this is assuming the property was rented at market rates beforehand.

Still, Brian’s thoughts fit with a survey of 1166 renters Buildium did a few years back. As they found,

“Most tenants will only tolerate a rent increase of 1-5% every 1-3 years, while nearly one-third feel a rent increase is never reasonable.”

Even back then, a raise of 1-5% every 1-3 years wouldn’t come close to keeping up with inflation. The average tenant (like everyone else) isn’t always the most realistic.

But still, it’s important to understand that people don’t like big changes, especially negative ones. And in negotiations, if someone feels insulted, they will often refuse to do a deal even if it makes sense. While I don’t recommend negotiating lease terms with your tenants, even a simple “take it or leave it” request is a negotiation. And increasing the rent to market price in this rental market can come off as insulting.

How to Decide

Ethical considerations

So, what should you do?

First and foremost, some people feel guilty about raising the rent to market rates, especially if it’s a long-term tenant who is paying substantially under market. And even more so if raising the rent to market will likely require them to move.

The most important thing to internalize here is that there is nothing immoral about charging the market rate. It may be jarring to some tenants, and they may even get mad at you. But you could simply turn it around and note that they have been living in that home at a discount for some time. Of course, the discounted rent was what had been agreed to, so they were not doing anything immoral either.

Thereby, I would lean toward seeing this as simply a business decision. That being said, if you are in a good and comfortable spot and can afford to charge your tenant less than market and feel that would benefit them more than the extra money would benefit you, then go ahead and charge less.

Just see it as an act of charity and not a business decision. But also, understand it is an act of charity you won’t get any credit for.

Financial considerations

According to RealPage.com, on average, 57% of tenants renew their lease each year, up substantially from 2010.

That means, in normal times, you have a greater than one-third chance of having a vacancy each year.

Now, I think you can do better than that by offering a good property with quality maintenance. Indeed, our average stay is about four years, and Jeffrey Taylor (Mr. Landlord) has boasted of getting to six years with his unique property management ideas.

But there are good ways and bad ways of getting low vacancy. And keeping your rents really low is a bad way.

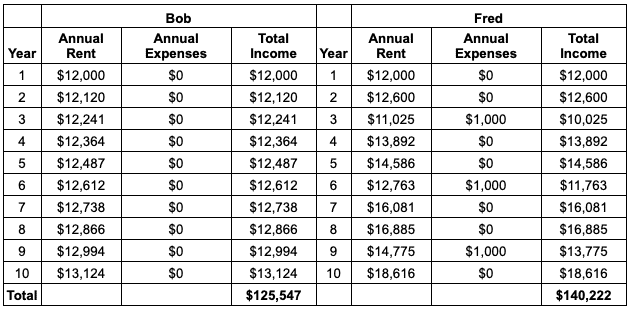

For example, let’s say Bob and Fred both lease identical properties at $1000/month. Bob increases his rent by only 1% each year while Fred increases it by 5%. Bob has no vacancies (best case scenario), whereas Fred has a move out every third year, and the vacancy lasts two months, and he incurs $1000 in turnover expenses above what the deposit covers. (We won’t count maintenance or capital improvements as we’ll assume they are the same.)

Here is what the ledger would look like:

Despite the extra vacancy, Fred still does better by over 10% and brings home about $15,000 more.

So, in general, with all things being equal, it makes sense to increase the rent to market. This is especially true with apartments as the value of an apartment is directly related to its income, unlike with a house or even a duplex. This is because the value of an apartment is based on its cap rate, which is determined by taking the net operating income and dividing it by the purchase price.

A lower rent means a lower net operating income which means a lower price.

However, there are times when it’s not wise to push rents to market. Everything depends on your situation, as I noted above.

For example, if you have a glut of rehabs or turnovers right now, you should be more conservative with rent increases. This issue has haunted us at times as we are constantly growing. In such times, we know extra turnovers will cause additional holding costs as we don’t have the resources to start more new projects.

So, if we get excess turnovers, we may have to leave properties empty for a month or more before work can start on them. By looking at our business holistically, we see that while it may make sense to increase the rent to market for that property by itself, it doesn’t make sense for our business.

Another possibility would be if the property is not in particularly good condition. Perhaps it’s being rented below market because, in part, it’s not in marketable condition. In this case, the two options you have are:

- Increase the rent to market for its condition (i.e., from $500 to $750/month instead of a market rate of $1000).

- Give the tenant notice to vacate. This is tough but often the best choice. If you want to be kind, you can offer to pay for some of their moving expenses. (Or you may have to—see the next section.)

Lastly, you may decide to move the tenant to market incrementally over several years. For example, if they are at $600 and market price is $1000, go up to $750 next year, then $900, then to market.

This is tempting and can make sense sometimes. But I would recommend against doing it simply because it feels better than increasing the rent straight to market. If you do it incrementally, it should be because it’s the most economically rational thing to do.

In general, however, the rule of thumb is that you should lean on the side of raising the rent to its market level as quickly as possible.

However, this particular rental market may be an exception. Rents are going up at an unsustainable rate. You can get a substantial rent increase and likely do so without a vacancy, even without going all the way to market levels. In this abnormal market, it probably makes sense to have your rent increases be a bit under market. (Maybe 10% instead of the national average of 16%, for example.) Rent increases will inevitably slow, and you should be able to catch up soon. And this way, it’s less likely to offend your tenant and have an unnecessary vacancy.

Legal considerations

Lastly, it’s important to understand that some cities and states restrict how much a landlord can charge in rent or increase the rent per year. For example, in New York City, some apartments have rent control. And in Oregon, they passed a law restricting rent increases to “7% plus inflation annually.” In addition, if landlords give a “no fault” eviction notice, it must be served 90 days in advance, and the landlord must pay a relocation assistance fee (one month’s rent).

So, make sure to check your local and state laws and act accordingly.

How to Actually Raise the Rent

One of the most important things to understand in business is that people get more upset about their expectations not being met than bad things happening. This is why it’s so important to set expectations right from the get-go. You should tell people during their lease signing that rent will likely go up each year. It’s not a bad idea to say a similar thing to the residents after you buy a property with inherited tenants too.

When you do send a rental notice (usually 60-days before their lease ends), I would do so in writing and not over the phone. It’s probably wise to both mail and email the notice. The notice should be respectful and professional and include a brief explanation if it’s more than a 1-3% increase. For example, “inflation has increased substantially” or “the property has not seen a rental increase in four years.” Say “property,” not their names. Otherwise, it sounds like you’re accusing them of mooching or something like that.

This will allow them a chance to cool off if they get mad about it and also not commit themselves to moving if their first response is anger. (It’s also important to have everything in writing.) If they do call angry, stay calm (people will mirror the tone of voice of the person they’re talking to) and explain the reasons for the increase. Like with the letter, I would try to keep the explanation short and to the point.

An example letter can be found here.

Conclusion

Generally, it’s important to keep up with rent increases to avoid finding yourself in this situation. But particularly in this market, you will find yourself with a below-market rented property from time to time. The key is treating the tenant fairly but approaching this as a business decision. Because in the end, that’s what this is, business.

Run Your Numbers Like a Pro!

Deal analysis is one of the first and most critical steps of real estate investing. Maximize your confidence in each deal with this first-ever ultimate guide to deal analysis. Real Estate by the Numbers makes real estate math easy, and makes real estate success inevitable.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.