Californians might be facing new taxes, again.

Waves were stirred last week when Assemblymember Chris Ward (D-San Diego) introduced the California Speculation Act (AB 1771).

The bill is the Assembly’s latest attempt to curb rising housing costs and bludgeon investor profits. If passed, the Act would add an additional 25% tax on the capital gain from the sale or exchange of residential properties within three years of its initial purchase.

In other words, California lawmakers are trying to disincentivize investor activity in the state’s housing market. Yet, the bill’s language will also affect the traditional homeowner, including the most vulnerable.

An Overview of the California Speculation Act

The California Speculation Act carries the following provisions:

- Homeowners would be taxed up to 25% on capital gain if they sell their home within three years of purchase.

- The tax applies to all “Qualified Taxpayers”.

- Applies to most residential properties with few exemptions.

- First-time homebuyers and affordable housing units are exempted.

- Properties sold within three years are subject to a 25% tax. After three years, the rate declines by 5% each year until seven years have passed.

- Collected taxes would be put towards community investment, with 30% designated for affordable housing.

- If passed with a 2/3 vote in the Assembly, the bill would become law on January 1, 2023.

What’s The Story Behind It?

California’s housing market is notoriously expensive. San Francisco usually charts at number one for the most expensive real estate market in the U.S. State tax rates are also among the highest in the nation.

AB 1771’s intention is to lower home prices by preventing investors from taking advantage of the market with cash offers. According to the bill’s sponsor, Chris Ward, the Act will dissuade institutional investors who buy up homes with cash and flip them at inflated prices soon after.

“We’ve heard of people getting into their first home getting beat by cash offers,” Ward said at a news conference. “When investors fall out of the buying pool, that will give regular home buyers a chance to buy a home,”

For Ward, prices are a major problem. As a representative of San Diego, historically one of the more affordable spots in California, he’s overseen skyrocketing real estate appreciation that’s put San Diego on par with San Francisco, a voting issue that does not bode well for him.

Unfortunately for Ward, his bill is being faced with significant opposition.

According to detractors, the main issue facing California’s real estate crisis is the severe lack of housing supply. Demand has been through the rough over the past few years and supply has been exceptionally slow in catching up.

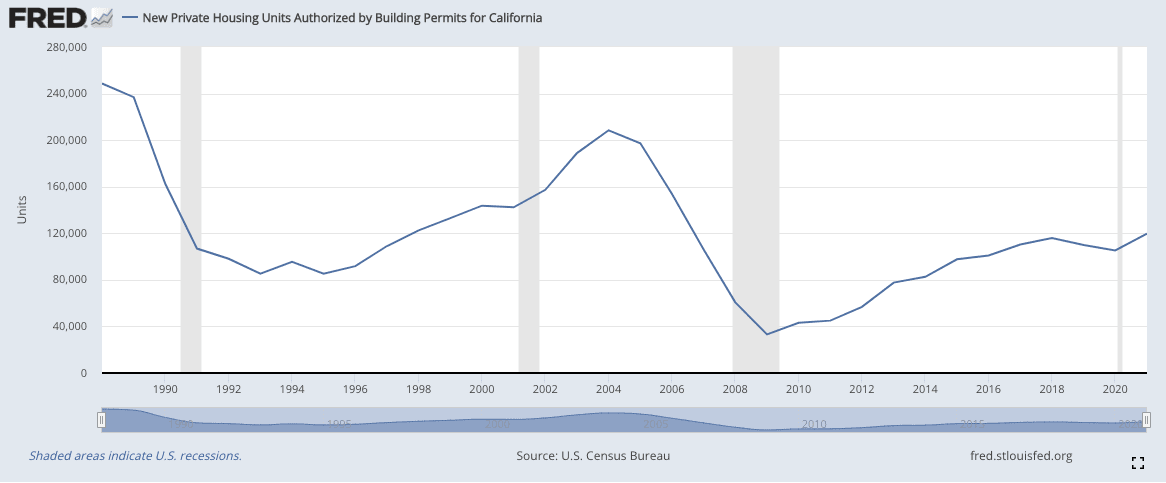

California housing starts in 2021 totaled about 120,000. That’s a slight uptick from 2020, but right on par with the last four or so years. It’s way down from 2004 or 1988 levels though, where total units rose well above 200,000. The state is also below its construction goals, which is targeted to fall around 180,000 units per year.

In essence, California is short several million housing units and is still not on track to meet demand. This, paired with high tax rates, has created a catastrophically overpriced market, locking out millions and putting an enormous amount of pressure on low-income and first-time buyers.

In fact, many real estate experts are pointing out that the Act would likely exacerbate the inventory crisis.

“California has a meaningful affordability crisis. Unfortunately, this bill would tax most homeowners and investors alike, leading to an even worse lack of inventory, one of the leading reasons for housing price escalation. We believe this is well-meaning legislation with significant unintended consequences,” said Nema Daghbandan, Partner at Geraci LLP, the General Counsel for the American Association of Private Lenders.

A leading issue with the bill is that it applies to all qualified taxpayers. Unless you’re on active-duty military service or deceased, you’re considered a qualified taxpayer. If you were to sell your home within a seven-year period, then you will be subjected to the tax, investor or not.

The argument, of course, is that most Californians don’t sell their homes that quickly, which is true. For instance, residents of Los Angeles tend to keep their homes for a median length of about 16 years.

However, it begs the question of whether it’s an infringement of the property rights of sellers? Let’s say you bought a home in Los Angeles in 2020 but were just offered a fantastic job in San Francisco. The catch is that you need to relocate.

Should you be taxed up to 25% for needing to move? A joint statement by multiple California real estate trade associations, including the California Association of REALTORS®, says absolutely not.

“According to the Neighbor 2020-2021 American Migration Report, over 20% of those surveyed stated they planned to move based on job changes, financial challenges, or additional space requirements. Under AB 1771, property owners with a growing family seeking to move into a larger home, downsizing due to the job loss of one of the occupants, or even those who must relocate to act as a caregiver for a loved one who became ill would be harshly penalized for simply needing to move” the letter stated.

The statement continued to scorn the bill, citing critical data that suggests investors who paid with cash only made up 3.8% of all transactions in 2021. It also ensured to address the bill’s primary reasoning, which is to lower prices.

“Further, [the bill] does nothing to ensure that first-time or other homebuyers are guaranteed access to homes, nor does it create more housing opportunities. Rather, the bill will cause unintended consequences for the market by reducing the number of homes available for sale. In January 2022, new home listings continued to drop by the double digits – with listings declining from 13,301 in January 2021 to just shy of 10,000 in December 2021. The reduction in listings would be exacerbated by this bill as it incentivizes investors to actually hold on to their properties longer and would force homeowners who need to sell to wait – further depressing California’s ownership housing supply.”

Closing Thoughts

Overall, the California Speculation Act is a senseless attempt to curb housing prices and will likely cause more harm than good to the real estate market.

By targeting all qualified taxpayers instead of investors specifically, it’s hard to see this bill as anything more than a government money grab off the backs of highly valued homes.

We’ll keep you updated on further developments.