Investing is a game of winning or losing, defined, most of all, by economics. Of course, we never truly know what direction the economy is heading. However, you can hedge your bets for better or worse depending on the quality of your decisions.

When an economic downturn hits, such as the one we could be potentially experiencing now, investments generally suffer losses. GDP growth in Q1 fell short of expectations, declining by 1.4%. If that trend holds through the end of Q2 and we register another quarter of GDP decline, we’re officially in a recession by definition.

So, as investors, how should you be preparing? Invest in real estate.

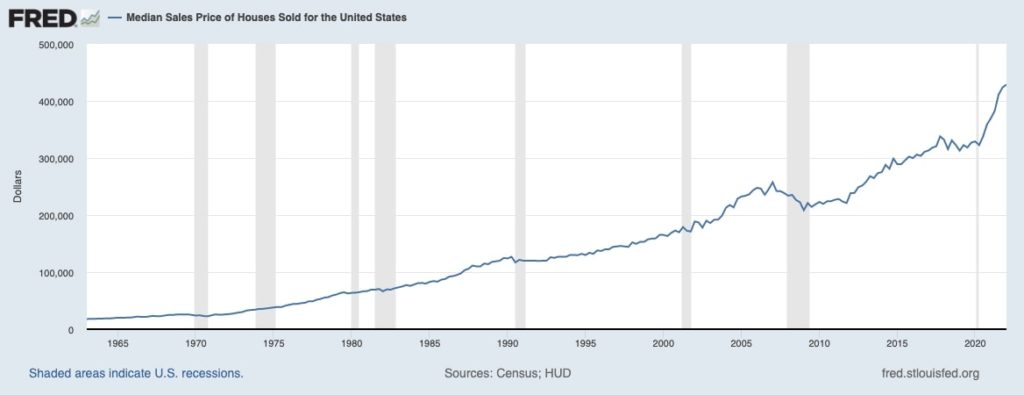

Real estate values have continued to increase despite numerous recessions over the last 60 years. Sometimes, they’ve increased during the recession itself.

Even in the Great Depression, investors won big on real estate stocks in particular.

But why is this so, and what does this mean for you as a rental property owner? Again, what can you do to benefit from buying investment properties?

Let’s talk about it.

Why is Buying an Investment Property Attractive Even in Bad Economies?

Real estate is one of the most stable investments when the economy is nosediving. Rental housing generally serves as a natural hedge in market volatility. This is mainly because homeownership rates suffer a dip during economic downturns like recessions.

As a result, property owners become renters, leading to higher demand for rental properties in such situations. If the economic downturn is accompanied by an early decline in real estate market values—which is often the case—there’s a chance that there would be a brief window of time where you could purchase properties at a discounted price.

By sticking to the formulas we’ve all learned in real estate and paying no attention to feelings, you can make informed decisions, buy a property with a good cash flow, and make a profit, all during a recession.

3 Reasons to Invest in Real Estate During a Recession

1. Housing is always a basic need

When an economic crisis hits, people lose their jobs, income, and potentially their homes. During these periods, it can be quite easy to find renters. Housing is a basic need, and there is always a demand for housing. We can hold off on buying a new phone or a new car, but it would be rare to find someone voluntarily deciding to live on the street.

You won’t have serious problems finding tenants if your rental property isn’t neglected. Proper management of your properties and buying your home in a great location are crucial to maximizing the benefits of your investment property.

2. Residential real estate over commercial real estate offers comfort during recessions

You might think that commercial real estate is more dependable than residential real estate. After all, some companies have survived a flurry of economic crises since the 18th century, so they’re experienced enough to stay afloat.

But if our experience with COVID-19 told us anything, commercial real estate isn’t as straightforward as it seems. Many businesses closed down, old and new, whether by economics or by force. We find ourselves in an interesting spot and must consider the external threats to commercial real estate right now, such as supply chain issues and the rising cost of gas.

On the other hand, residential homes aren’t subject to the economics of business and the global economy. People need a place to live, regardless of what’s happening in the world.

3. Real estate tends to be more stable

The Great Depression and dot-com bubble flipped the stock market on its head, but investors in the residential estate space didn’t suffer as severe losses. In fact, single-family rental assets recorded positive values as a sector at the tail end of the Great Recession.

Small-scale residential real estate investments aren’t a part of daily trading activities like stocks. As such, they provide stability when stocks are volatile.

As a rental property owner, buying investment properties is undoubtedly an attractive and worthy adventure with many economic benefits. But before you write that check, here are tips to help you make a great home-buying decision and maximize your investment properties in the long run.

Tips To Keep in Mind When Buying Investment Properties

Below are two rules to follow that will help maximize your real estate investment.

- Consider the location

- Think about cash flow

1. Consider the location

When evaluating rental properties to buy during an economic crisis, get the full lay of the land. It’s vital to remember that the goal is to buy the location, not the house. Therefore, scout out areas with stable employment and job growth potentials.

The job market can upset your rental income plans. Tenants may be unable to pay rent and relocate to another area if they’ve been laid off and have difficulty finding a new position.

What’s more, consider lifestyle too. For example, areas close to downtown are more desirable for renters. However, when an economic crisis comes around, residents might wind up changing their location sentiments. Be sure to track the trends. Are people looking for urban dwellings? Suburban or rural?

In 2020, we saw a significant shift towards the suburbs and rural areas due to the rise of remote work and a desire for more space. Will this change with the next recession?

2. Think about cash flow

Another rule to help you make the best real estate deals is keeping cash flow top of mind. For example, suppose you’re looking to include a rental property in your portfolio during an economic crisis. In that case, check out properties with excellent cash flow. These are properties with cash still coming in after removing expenses and mortgage payments.

Such rental properties will help minimize the risk of even a recession.

Bottom Line

No one wants to suffer in a bad economy. It upsets our finances and could dramatically reverse the course of our lives. But for rental property owners, this doesn’t have to be your story. Instead, an economic downturn can place you at a vantage point where you can benefit from the crisis.

Remember, even in economic uncertainty, you get to tip the odds in your favor—depending on the quality of your decision when investing in the rental property market.