3. Slash Your Expenses

No one likes to hear this step. But it’s necessary for two reasons.

First, if you’re going to save more, that money needs to come from somewhere. It could come from extra side income (more on that momentarily), but it also usually that means spending less, so you can commit more money to your retirement savings and investments. Try house hacking as the fastest single way to supercharge your savings rate.

The second reason is slightly more nuanced. Successful retirement is about reaching financial independence, and financial independence requires that you replace your active income with passive income from investments.

The less money you spend in a given year, the easier it is to cover those expenses with income from your investments.

If that sounds like a simple concept, consider that every extra dollar you spend requires exponentially more money invested to cover it. For simplicity, we’ll use the 4% Rule to illustrate this point.

The 4% Rule states that on average, you can count on withdrawing around 4% of your nest egg each year, to pay your retirement expenses, without fear of running out of money in your lifetime. That means you need 25 times as much money saved in your retirement portfolio as your annual spending.

In other words, for every thousand dollars you spend in a given year, you need $25,000 saved and invested.

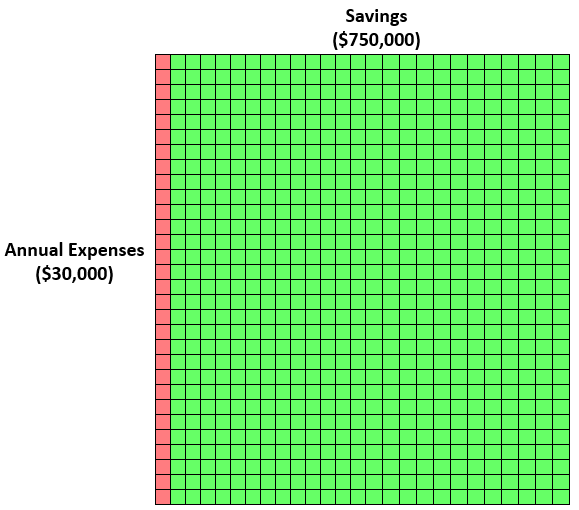

Like visuals? Zach from FourPillarFreedom illustrates this point with elegant simplicity, using tiny blocks. The red block above represents $1,000 in spending in a year. The green blocks are all the investments you’ll need to cover it.

If you want $30,000/year in passive income, that means a nest egg of $750,000. Here’s how that looks visually:

Get the idea? Every extra dollar multiplies your needed nest egg exponentially, by 25 times.

Chris Mamula of Can I Retire Yet proposes a few questions to help you get there. “Could you downsize your home or move to a lower cost of living area? Could you go from a two-car household to a one car household? Ideas such as these could free up capital tied up in homes and cars, while simultaneously lowering ongoing expenses.”

4. Earn More Money While You’re Still Healthy & Working

Your 40s and 50s are your peak earning years. Meanwhile, your kids are probably older, so you’re not in zombie mode getting up three times each night to feed them.

You have connections. You have marketable skills. In other words, you’re in a perfect position to push a little harder and earn some extra cash.

I chatted with Michelle Schroeder-Gardner from Making Sense of Cents about her thoughts on catching up on retirement investing. “My top tip for someone who is wanting to accelerate their retirement savings and investments would be to find ways to make more money.

“That could mean getting into rental real estate, finding a part-time job, starting a side business, reaching for that next promotion, and more. I always like to point out that the average person watches over 30 hours of TV a week. That time could be used towards making more money instead!”

When I asked Michelle if she had any more detailed ideas to help people get their side hustle going, she didn’t disappoint. Here’s her list of 75 Ways to Make Extra Money, to help get those creative juices flowing!

And — spoiler alert! — one of those ideas is, of course, buying rental properties.

5. Rental Properties: How to Bend the 4% Rule

According the 4% Rule, you’d need $1,000,000 in retirement savings in order to generate $40,000/year in passive income. That’s a tall order for most of us.

But the 4% Rule was conceived based on equities and bonds. Equities are unstable, bonds are low-yield… but what about residential rental properties? A recent study analyzed all investment types over the last 145 years, and found that residential rentals beat out equities to offer the best returns, especially when the economists adjusted for risk and volatility.

Rental properties are an income-focused investment, unlike most equities, which rely on appreciation in value for most of their returns. Using rental properties, investors can bend the 4% Rule, using less cash to create more income.

Rental properties are an income-focused investment, unlike most equities, which rely on appreciation in value for most of their returns. Using rental properties, investors can bend the 4% Rule, using less cash to create more income.

Why? First, investors can use far more leverage (other people’s money) to buy real estate compared to other asset classes. For a small down payment, investors can buy a high-value, high-income-producing asset.

Second, rental property returns are far more predictable than equity returns. Before purchasing, Investors can accurately forecast a rental property’s cash flow., by accounting for long-term average expenses when calculating real estate cash flow. (Use our free rental income calculator to run the numbers for any property.)

Rental properties protect against inflation, too: landlords can raise the rent every year to keep pace with (or surpass) inflation. The same can’t be said for bond or stock returns, which you have to adjust for inflation.

Finally, landlords have control over their returns. They can optimize their property management practices, by automating rent collection, conducting periodic inspections, conducting extensive tenant screening, etc. And if landlords want to charge dramatically higher rents, they can always improve their property to command higher revenue.