Updated on 20/4/2022.

A pitch deck is a brief presentation, often created using PowerPoint, Keynote or Prezi, used to provide your audience with a quick overview of your business plan. You will usually use your pitch deck during face-to-face or online meetings with potential investors, customers, partners, and co-founders.

Raising money from an angel or venture capital investor for your startup is challenging and time-consuming at any stage. Therefore, it requires creating a great pitch deck showcasing the company’s valuable insights to the investors.

Here is a video for you to further understand what a pitch deck is:

In this article, there are 13 slides pitch deck templates along with practical advice to help you build an eye-catching pitch deck. Also, check out our other articles based on 38 Pitch Deck Template Examples for more references as you begin the process of building your own ultimate pitch deck template!

Being creative with the deck’s design is not recommended. Classic templates similar to the one below have been brought into play in many successful investor pitches. However, in some instances, rearranging the order of the slides can make sense if you want to stress specific key points. For example, starting with a slide on the team members might be relevant if they have impressive backgrounds tied to the startup’s product or industry.

Download the Pitch Deck Template and discover the tips to create the ultimate pitch that will convince investors you are the next unicorn.

What Should Your Pitch Deck Template Include?

- The Title

This slide is the most important in your pitch deck template as it makes the first impression on your potential investors about your startup. Use a low-key design and make sure it includes your logo. It is recommended to insert a date on your title slide as well, it might be helpful to keep track of your pitch decks when you will update them with new data.

2. The Mission

The mission statement is a short, simple slide at the beginning that announces your company aspiration or in other words, the end goal you are trying to reach. For an early-stage startup, it will guide investors into the idea that is driving your venture forward.

3. The Problem

This slide should answer all the following questions: What are the pain points your company is addressing and why? How big is the problem? Who are you solving the problem for? Who are the target customers?

The problem slide must provide an overview of your market and show how existing solutions do not solve the problem. Back up your bullet points with some statistics to illustrate the importance of the problem.

4. The Solution

This slide should showcase what your company is doing and how by mentioning the benefits of your product for the customers. Do not hesitate to popularize technical vocabulary so that anyone could understand it.

5. The Product

What are the key features of the product? Why is it unique?

You need to show what your product looks like and give an overview of your customer journey.

Images and visuals can play an important role here if you want to guide investors through your user experience.

6. The Market Size

Investors want to see how large the addressable market is. For example, if you are selling a service to university students, do not show the size of the entire education market, but of the student category, you are specifically targeting. It is also helpful to include the numbers of the TAM (Total Addressable Market), SAM (Segmented Addressable Market), and SOM (Share of Market) so investors can have an idea of the targeted market size. Try to put as much effort as you can into your numbers.

7. Business Model

The business model slide describes how you will create revenue (subscription, ads, affiliate, rev share, etc.). At this point, it is unnecessary to include financial data and forecasting.

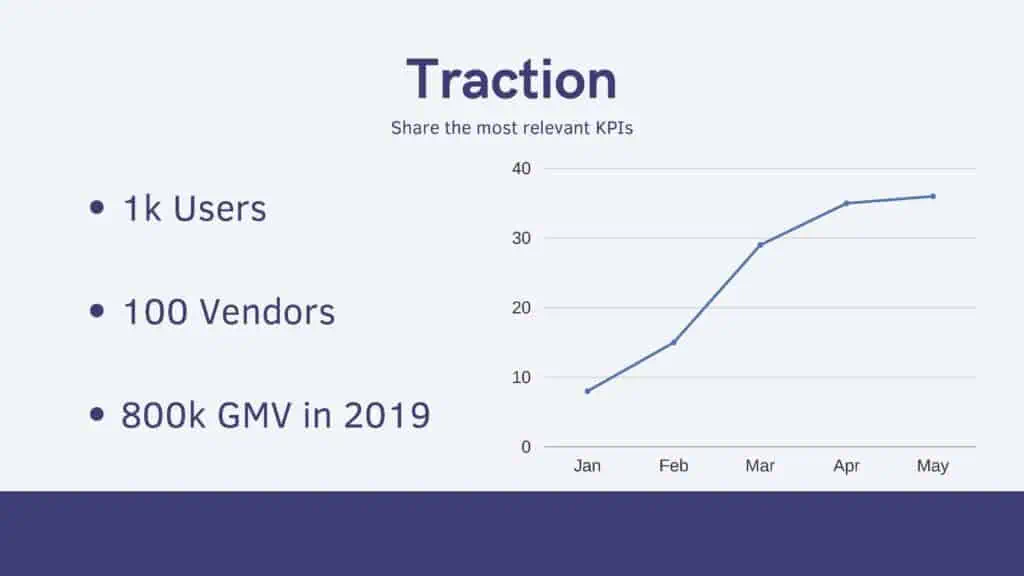

8. Traction

In this section of your pitch deck template, share the most relevant metrics according to the KPIs of your company. Outline the major milestones you have reached in users, product, downloads, revenue, growth, endorsements, partnerships, etc. since the time you launched.

If you have important partnerships or customers, you can also highlight them here.

9. Milestones & Projections

Estimate what the key metrics from your traction slide will be over the next year. Also share any significant product or growth milestones (features launch, city expansions, etc.). It shows investors what growth you believe is attainable and offers them a glimpse into where you want to take your company in a foreseeable future.

10. The Marketing Plan

Also called the ‘go-to-market’ slide. This is where you explain what are the strategies that will help you penetrate the market and gain users. If you are an early-stage startup, you will usually start with strategic partnerships, distribution channels or before that, content marketing and social campaigns.

You might include your preliminary customer acquisition costs per customer and the projected lifetime value of a customer.

Bear in mind that diagrams, statistics and maps are a great way to attract your audience’s attention.

11. Competitive landscape

The purpose of this slide is to demonstrate that you know your industry how you differ from the other players. You must show investors that you have a comprehensive view of your competitors and that you are aware of the market dynamics and its players. Include information on other businesses and services that will be competing for the same customers and highlight your key differentiating features.

Do not ignore major competitors to make your business look stronger. Instead, show investors that you have considered every potential obstacle and have a plan to overcome it.

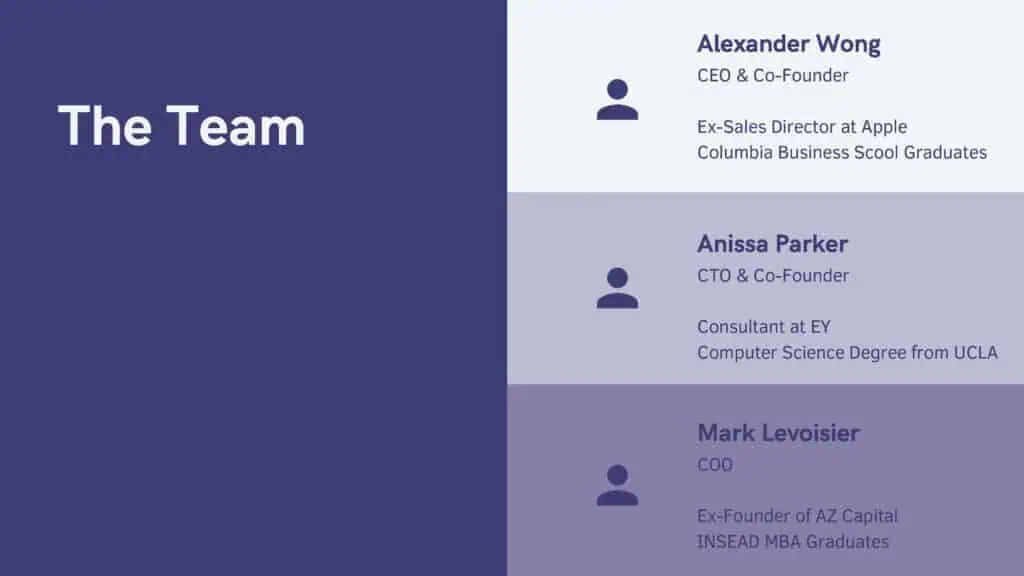

12. Team

Share the key members of the team and their backgrounds. Include professional headshots with the name, position, and most significant professional achievement. Investors want to see relevant skills and experience; they are investing in your company as much as they invest in your team. You need to show that you have the ability to make the venture a success. Board members, advisors and consultants can be added to bolster credibility.

13. Fundraise

State how much are you raising, for how much equity and what the outcome of that investment round will be. Explain how you will allocate your funds (e.g., technology and product development, new hires, capital expenses, marketing, etc.) and how long you think the financing will last. If you have raised money previously, this would be a good place to include how much and from which and what type of investors.

Ultimate Pitch Deck Template “DON’TS”

All the great content aside, there are a few “don’ts” for some content to not be included or is not recommended to be a part of your pitch deck template. This type of content in your pitch deck template will either become repetitive or unnecessary, impacting the result on your investors. A few DONT’s of creating a pitch deck template are listed below:

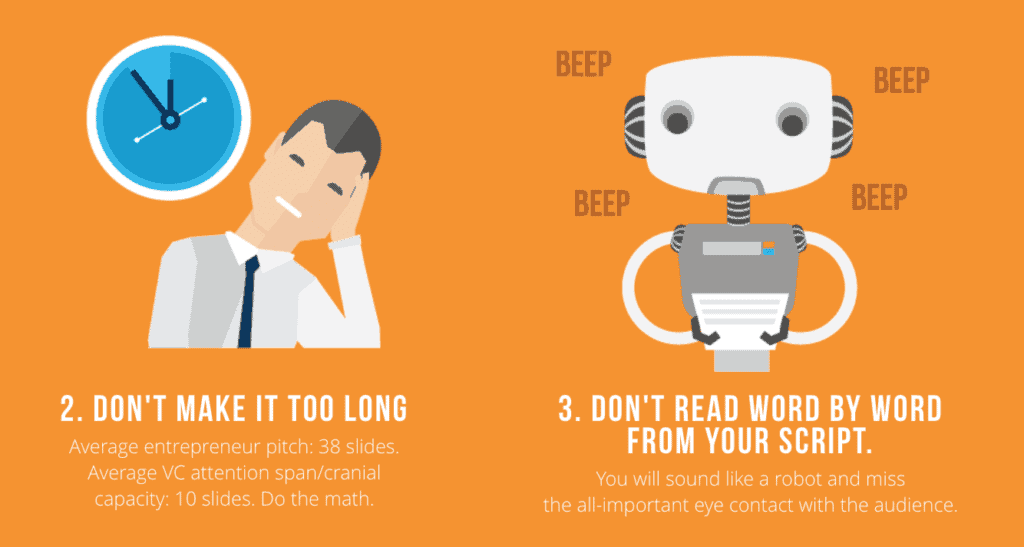

- Don’t add a long detailed history about how you came up with your business idea in your pitch deck template. Manage the timing of the meeting and cover all aspects of your company, not just the product. Managing your time effectively is key in order to talk about the important aspects of the attention span of the investor.

- Don’t hold cue cards for each slide of your pitch deck template. This will distract you from making eye-contact with the investors, more of reading from the cards in a monotonous tone. Try to understand and know your figures and background so you are able to present it confidently.

- Don’t assume that the investors know your market in depth. Make it a point to add this into your pitch deck template, know the size and detail of your target market but don’t overemphasise it. It is good to show your awareness because the business world is competitive and one of the investors may know of a competitor you have not come across before.

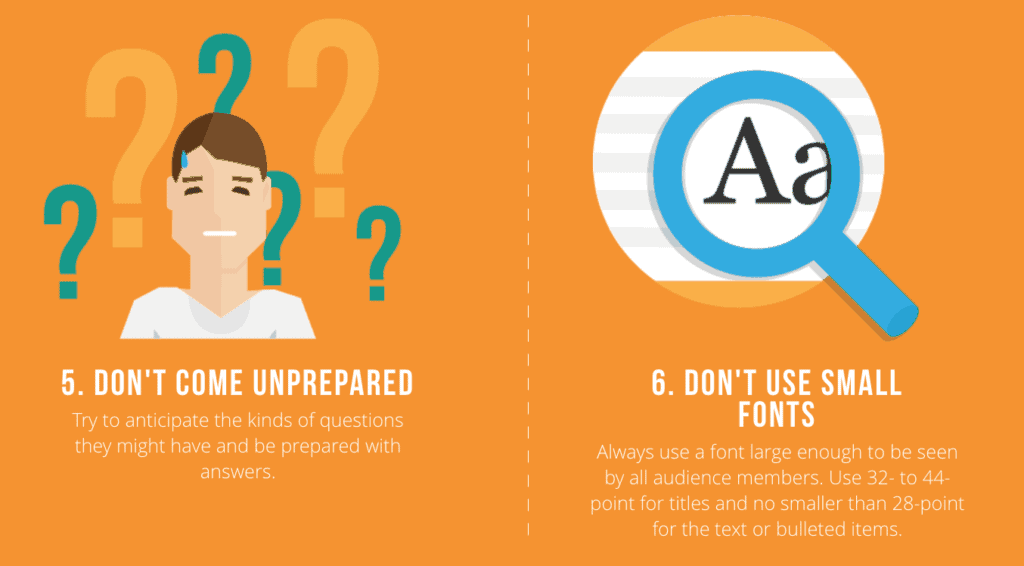

- Don’t come unprepared. Filling your pitch deck template with large chunks of text may tempt them to skimp over your proposal. The investors and yourself can be easily distracted, so you don’t want to bore your investors with too much information. Not that detail is wrong, but in timely presentations, it is better to keep it short and straight to the point. In addition to this, be prepared to be asked all sorts of questions broadening over to multiple aspects of your business, whether it is future projections or your existing marketing plans. Be prepared with answers.

- Don’t use small or cursive fonts. If during your presentation, investors lean forward or squint to read the prints, they will only remember how hard it was to see your pitch deck presentation. Having attractive typography is crucial.

On A Final Note

A startup founder’s ultimate success is dependent on others buying into his or her vision. Your progress is contingent upon your ability to pitch the value of who you are, what you’re doing and why it matters.

Highlight your financials visually and clearly on your pitch deck template. Keeping it concise and simple because will help to create a positive impact because investors have no time to read endless pages with projected numbers. Stick to the point and prove to the investors that your business has a USP worth investing in. If your idea is truly ready for investment, then the research, evidence and traction will prove it!