There have been a lot of articles and headlines coming out recently saying that inventory is up, the real estate market is cooling down, and a crash may be coming as well. There are many articles that are saying sales are down as well and insinuating that prices are down too, even though they are not. I am a real estate agent and investor in Northern Colorado and I have access to my MLS stats to show if inventory is increasing, and if so, by how much. Many people will say I am biased because I am an agent, but I made a lot of money in the last crash from selling foreclosures for banks and it was so much easier to buy properties back then. I am not wishing for a crash, nor am I wishing for a crazy real estate market as we have had. I think a normal real estate market would be better for everyone. Instead of trying to bring my wishes to fruition, I like to look at the facts and see what may or may not happen.

Why are people predicting a crash or correction?

There are a lot of people predicting a real estate crash or correction. There are many different reasons for the predictions, some good, and some wishful thinking. I feel many people are predicting a crash because they want houses to be cheaper whether they want to buy one to live in or invest in.

The national media and social media have been making these predictions for years, some even for ten years! There was a prediction there would be a massive double-dip recession and an even bigger real estate crash around 2012 after things were starting to recover. The media wants to get attention. They get paid for how much attention they can get so they write scary headlines that hopefully will get shared. Some of the headlines are getting borderline ridiculous with how far off from the data in that article those headlines are!

It is tough to know what to believe and what not to believe. I like to look at the numbers and the facts. I also like to look at the last crash as I went through that as an investor and agent. I learned a lot and looking back on that time, there were many warning signs that something crazy was coming. Many of us did not know what that crazy would be or how bad it would be.

Why would real estate prices decrease?

There are many ideas on why real estate prices will decrease. Here are the most popular you will see:

- Real estate prices are high: A lot of people think that just because prices are high, they must come down.

- Interest rates have gone up: When rates go up, it makes payments more expensive and a popular theory is that high rates make prices go down because of that.

- A recession is coming: Many also assume all recessions come with a downturn in real estate.

- Population changes: Some feel the low birth rate in the United States or baby boomers dying off will cause a correction.

Most people who are predicting a correction are saying that housing in the US is too unaffordable to keep going up or that demand will fall off due to higher rates and other factors. The problem with these theories is they all ignore the supply problem. There are not enough houses in the US and there has been a shortage for years. Lowering demand a little bit will not add more houses to the market. If supply is restrained it is very hard for prices to correct.

This video goes over all of these factors with the data to back it up:

During the last crash, there was massive over-supply from too much building and the opposite is happening now.

How low is the current housing inventory?

Even though most of the reasons for a correction or crash do not give reasons why supply will increase, they assume supply will increase if demand decreases. We see articles all over talking about inventory increasing and sales going down.

The first thing to understand is that sales going down does not mean prices are. When you hear that sales are going down, it means that the number of houses selling has decreased, not that prices have decreased. In fact, many of the articles that talk about sales going down will say prices are still going up at the same time. Sales going down can be a sign of demand decreasing or it can be a sign of inventory decreasing and fewer houses available to buy.

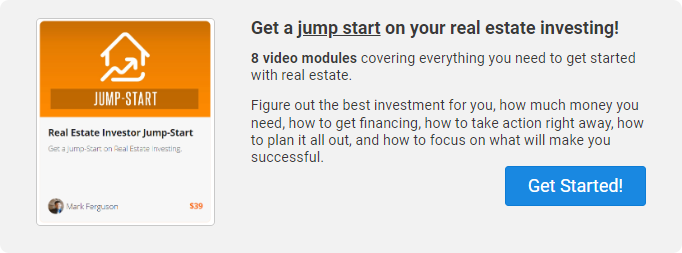

Logically, you would think that if demand goes down, supply will increase. However, that would only happen if supply and demand are perfectly matched right now. If there are more buyers than sellers at the moment and demand decreases a little bit, there could still be more buyers than sellers and we could still have a supply shortage. We have to look at the scale of how short the supply is versus how many buyers want to buy. The chart below shows historic inventory in the US:

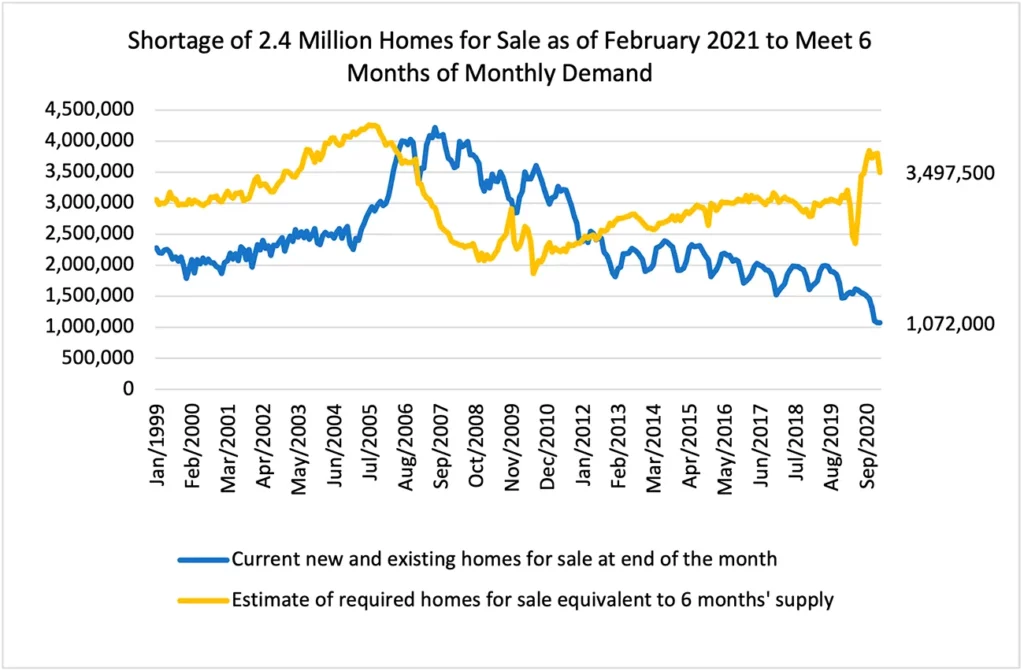

This chart is a couple of years old but inventory has decreased even more in 2021 and 2022. the number of houses dropped into the 800ks in 2021! We have had record low after record low after record low for houses for sale in the US. The chart also shows the estimate for how many houses are required to meet current demand. The chart below shows more current data.

You can see inventory popped up in the middle of 2021 and it is popping up again in 2022. From the previous chart, you can see it does that every year. It is nothing new to have inventory increase in the spring and summer and then decrease in the fall and winter.

When we look at historic trends you can see inventory is not just a little low, it is extremely low and this is why there are so many multiple offers on homes and houses selling for more than the asking price.

How much is the housing inventory increasing?

We have seen the articles that say housing inventory is increasing, price drops are decreasing, etc. But how much of a change is there?

Here is some great data from Realtor.com:

- The inventory of homes for sale has increased for the first time since June 2019.

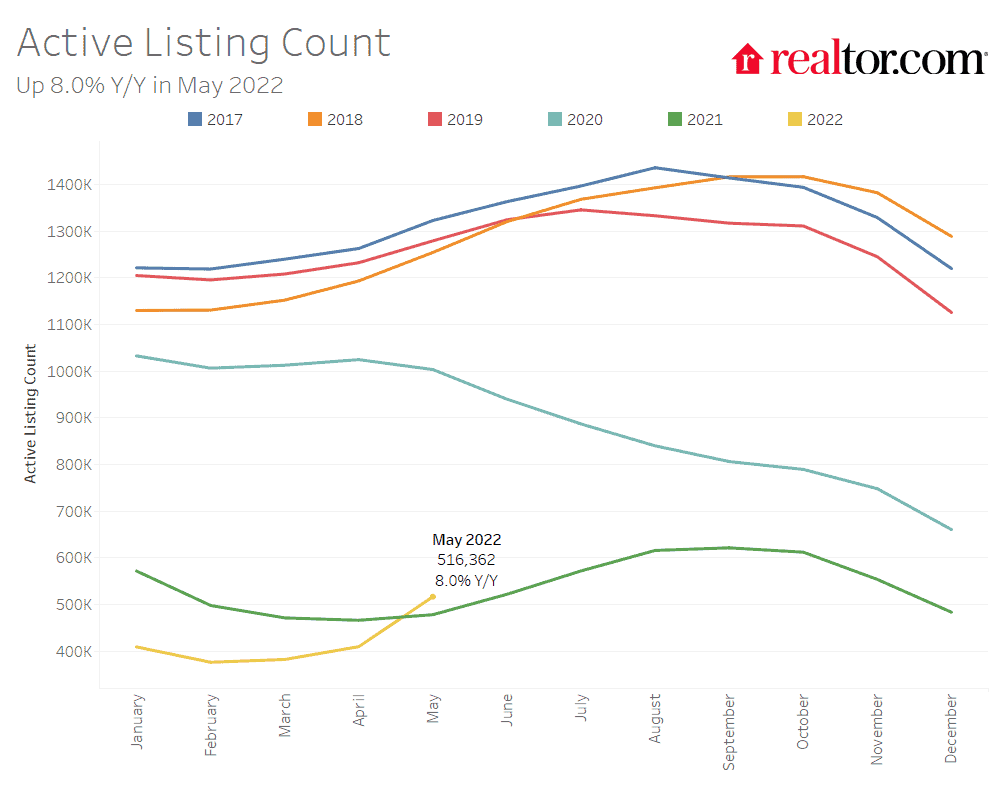

- The national inventory of active listings increased by 8.0% over last year, while the total inventory of unsold homes, including pending listings, still declined by 3.9% due to a decline in pending inventory.

- The inventory of active listings was down 48.5% compared to May 2020 in the early days of the COVID-19 pandemic. In other words, there are still only half as many homes available.

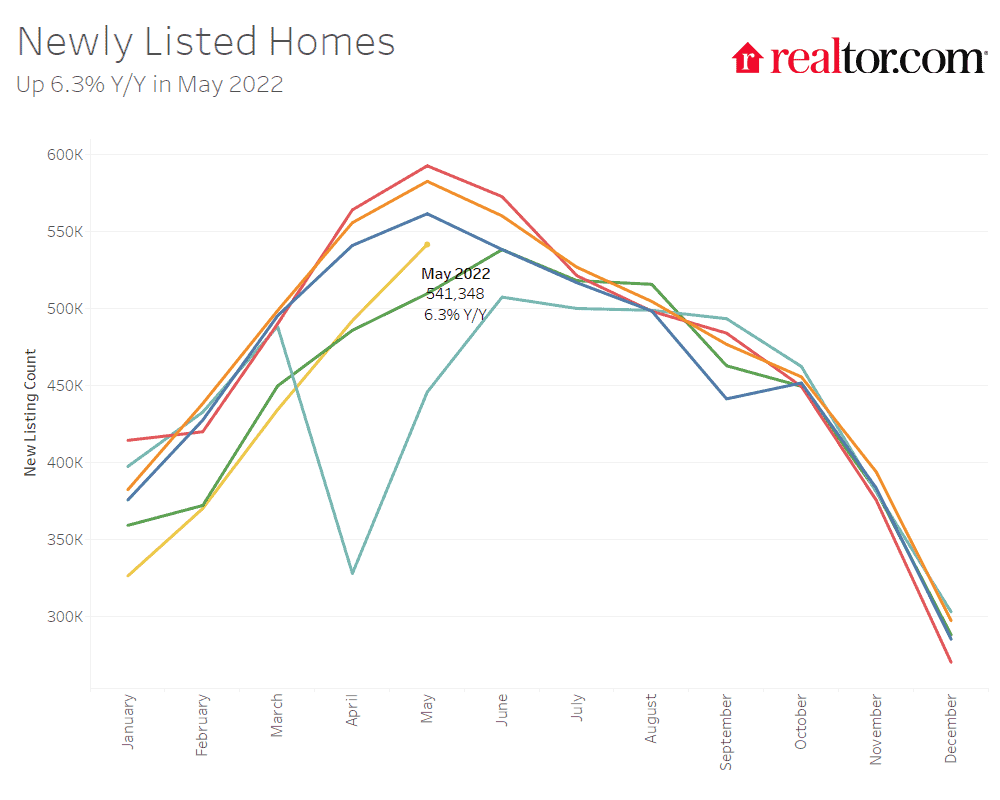

- More new listings entered the market in May than any other month since June 2019.

- Newly listed homes were up 6.3% nationally compared to a year ago, and up 4.6% for large metros over the past year.

- Sellers still listed at rates 6.4% lower than typical 2017 to 2019 levels prior to the pandemic.

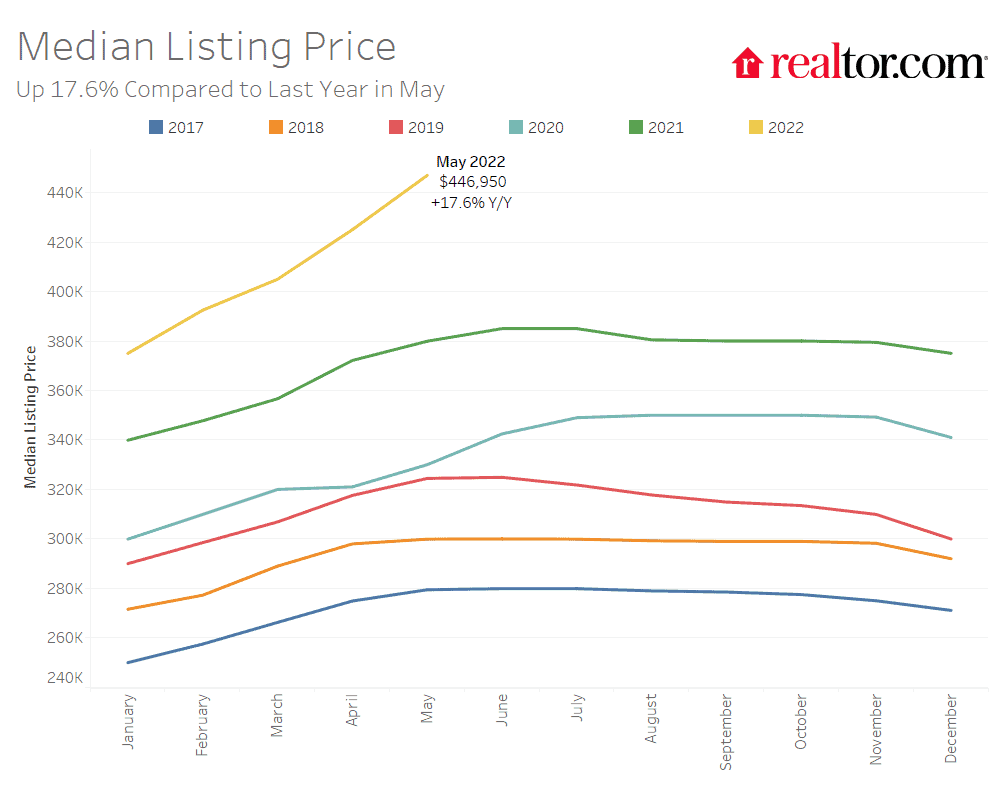

- Housing remains expensive and fast-paced with the median asking price at a new high while time on market is at a new low.

- The May national median listing price for active listings was $447,000, up 17.6% compared to last year and up 35.4% compared to May 2020.

- In large metros, median listing prices grew by 13.0% compared to last year, on average.

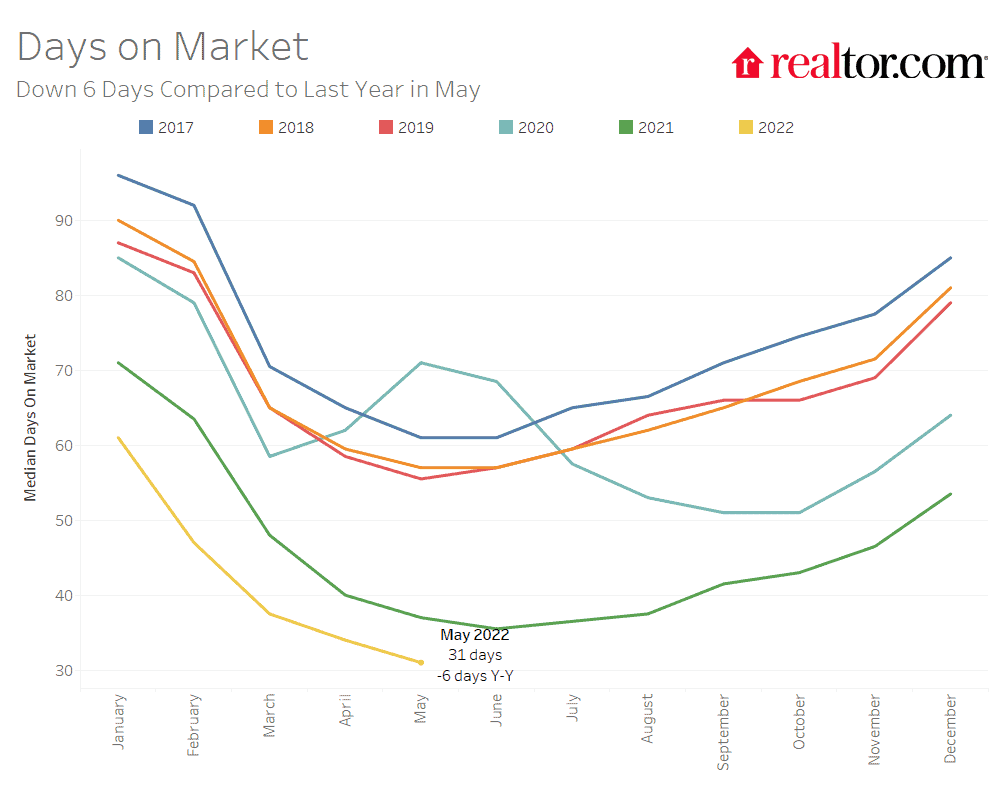

- Nationally, the typical home spent 31 days on the market in May, down 6 days from the same time last year and down 40 days from May 2020.

Here are some great charts from that report:

What we can see is that new listings are finally up over last year for May by a little bit. However, they are way down from the years past which still had very low inventory compared to historic averages. As you can see, prices are still going up!

What about my local market in Colorado?

In Colorado, we have had massive price increases and record low inventory for years as well. I can see my local MLS data and how many new listings we have and what the trends are here. Overall, we have more sales, fewer listings, and higher prices than last year. Yes, even with interest rates going up! You can see all that data in the video below:

Conclusion

Is inventory increasing? Yes! It is increasing but it almost always increases this time of year and it is just barely more than it was last year nationally and last year was an insanely low year for inventory. We are still nowhere near normal and we have nowhere near enough houses for everyone who wants one. There are about 20k more houses for now than there were last year, but there are about 500k to 700k fewer listings now than 2 to 5 years ago. We would have to see active listings double to even get back to normal, not increase by 7 or 8%.