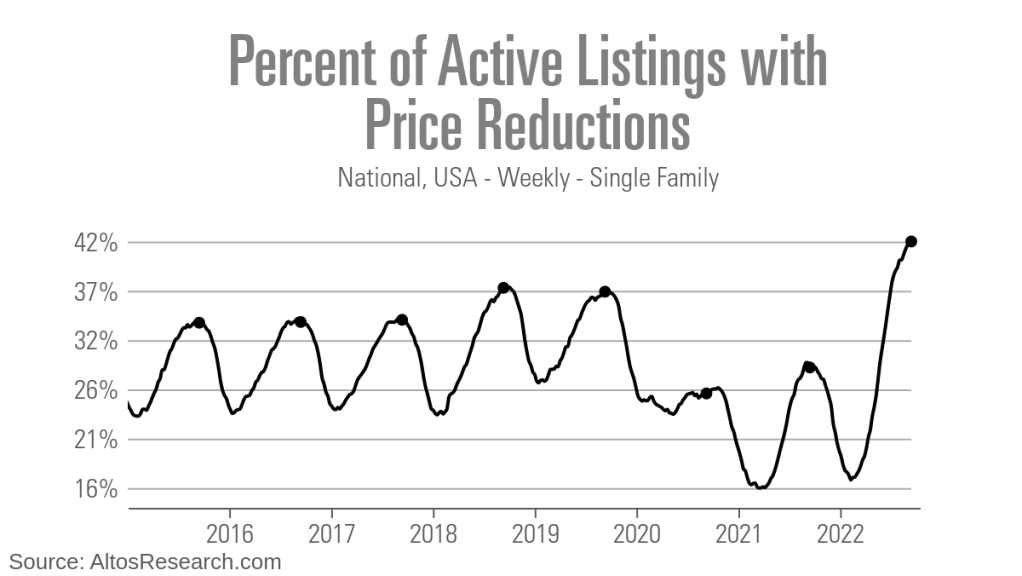

In May, I wrote about the signs to watch for a real estate market slowdown. It’s now October, we’ve had the biggest spike in mortgage rates we’ve seen in decades, and all the signs of a slowdown are here: Inventory is rising. The price of new listings is dropping. More homes are taking price reductions. And, there are fewer immediate sales.

Of course, some of what we’re seeing is exacerbated by seasonality — prices normally retreat in the fall, and there’s much less activity over the winter. But it’s clear that the dramatic shift in the market is about more than just seasonal fluctuations.

The big question is: how long will the market contraction last and when should we expect things to heat back up?

Let’s look at what the data can tell us:

1. Home buyers got spooked when mortgage rates passed 5.5%.

Homebuyers are understandably very sensitive to mortgage interest rates. In April, May and June, when rates spiked dramatically from 3% to 6%, we saw inventory rise as buyers pulled back. Rates peaked in late June and then fell back down to around 5% in July and August. At this point, buyers actually perked up a bit and got more active. We could measure this change because inventory stopped rising nationally during those months.

As soon as rates spiked above 5.5% in September to 6.5% or even 7%, buyers once again stopped abruptly. Inventory and price reductions have resumed climbing now.

Key takeaway: when imagining the possible outcomes for the 2023 market, it looks like that 5.5% threshold may be very important. We could see demand return the next time mortgage rates drop.

2. There’s a chance for more pronounced inventory growth.

We’ve been expecting inventory to grow through the middle of October, but if buyers continue to stay on the sidelines, then inventory could continue to grow into late October or even November, which would be very unusual. The holidays usually see far fewer sellers — most sellers wait until January to list their homes. But there are always some sellers (for a variety of reasons) that list and sell in November or December. Those reasons don’t stop, so inventory could continue to build.

Key takeaway: If inventory grows late in October or into November, then a bearish signal will be lit for home prices in the future.

3. We still have a significant shortage of homes available.

Given that we may see unseasonal inventory trends in the coming months, I now anticipate that we’ll end the year at around 490,000 homes for sale. This figure is ahead of last year’s home inventory levels — and slightly more than we had in 2020 — but it is still near record lows. And, it is less than half of the “normal” level of about one million homes on the market.

At the moment, most homeowners are locked into lower interest rate mortgages, they have solid equity in their homes and they have jobs — they don’t have to sell. It could take several years of higher interest rates to get us back to the previous “normal” levels of active inventory.

Key takeaway: There’s no tsunami of listings coming to the market. While home prices are dropping in many areas, this restricted inventory may help prevent a crash.

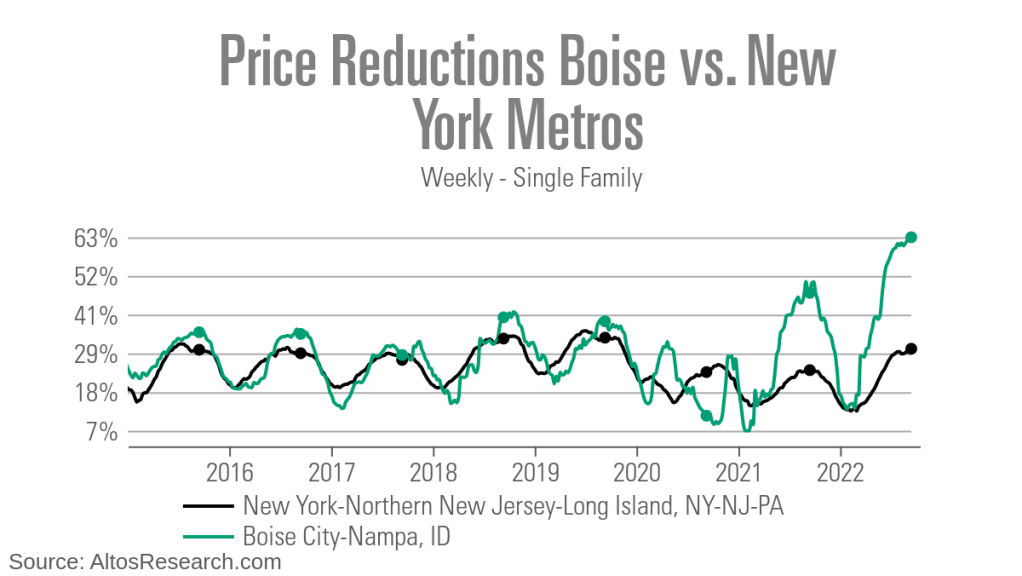

4. Some markets are hurting more than others.

While there was still solid demand for good properties up until August, we saw some markets struggling as early as May. In particular, markets that overheated during the COVID-19 pandemic are seeing a big correction now.

Take Boise, Idaho for example. Days on market has risen from 20 days to 60 days over the past year. Price reductions are way up at 63% of the market, and the median price has dropped 20% from its peak in May. Other markets seeing a similar pattern include Austin, Texas, Phoenix and Salt Lake City.

By contrast, markets that didn’t have nearly as much of a boom in the past two years, like some of the New York City suburbs, are seeing a much more modest slowdown.

Key takeaway: It remains to be seen whether markets like Boise, Idaho are the canary in the coal mine, or if some markets will weather the storm fairly well, even in the face of significantly higher mortgage rates. We’ll be watching our data closely.