On September 1, 2022, Fidelity launched Fidelity Hedged Equity (FEQHX) which is also available in five Fidelity Advisor share classes.

The goal is Fidelity Hedged is to provide capital appreciation. Presumably, it’s also to provide capital appreciation with less volatility than the stock market, hence the “hedged” piece. The strategy is to invest in an S&P 500-like stock portfolio. That means some growth and small value but mostly large cap. The managers then apply “a disciplined options-based strategy designed to provide downside protection” mostly by buying put options, which appreciate when the relevant underlying asset depreciates. Generally, the hope is to gain most of the market’s long-term return with a fraction of its volatility. The downside is that, even if the strategy is executed well, you sacrifice some of the market’s upside.

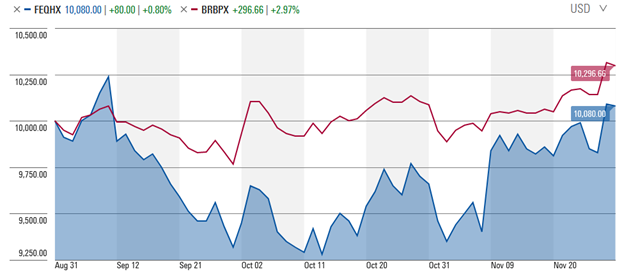

To date, the fund has done just that: it dropped markedly less than the S&P 500 in its first six weeks of operation and rose markedly less over the rebound in the following six weeks.

The managers are Eric Granat, Mitch Livstone, and Zach Dewhirst. Of the three, only Mr. Dewhirst has previously managed mutual fund assets.

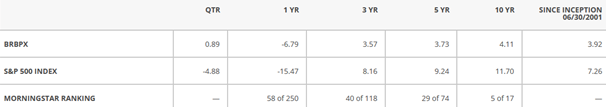

If you’re looking for a more experienced team pursuing an essentially similar strategy, you should look at Bridgeway Managed Volatility, which we’ve profiled twice in the past. The fund’s consistent record gives you a good sense of what the strategy offers:

And, while the comparison is short, Bridgeway (in red) has executed the strategy better so far than has Fidelity (in blue).

The Managed Volatility homepage has a fair amount of information about the strategy and its record.

The Fidelity Hedged has gathered $47 million in assets, with no investment minimum and an expense ratio (after waivers) of 0.55%. The fund’s homepage is light on content, understandably, since it’s both new and Fidelity (a famously content-light bunch), but it provides the essentials.