Last week, the Fed raised its benchmark interest rate by half a percentage point, a slowdown from previous sprints. Still, the federal funds rate is at its highest since 2007. While traders are betting the Fed will begin reducing the federal funds rate in the second half of 2023, historical trends suggest a different timeline. And while economists from major firms are split on where and when rates will peak, Fed policymakers have signaled that rates will likely remain elevated until 2024.

Why the varying estimates? No one is certain how long it will take for high-interest rates to impact the job market or whether we will enter a recession. Inflation has been stubborn (albeit declining) largely due to low unemployment and supply chain issues, experts say.

When Has the Fed Cut Interest Rates Historically?

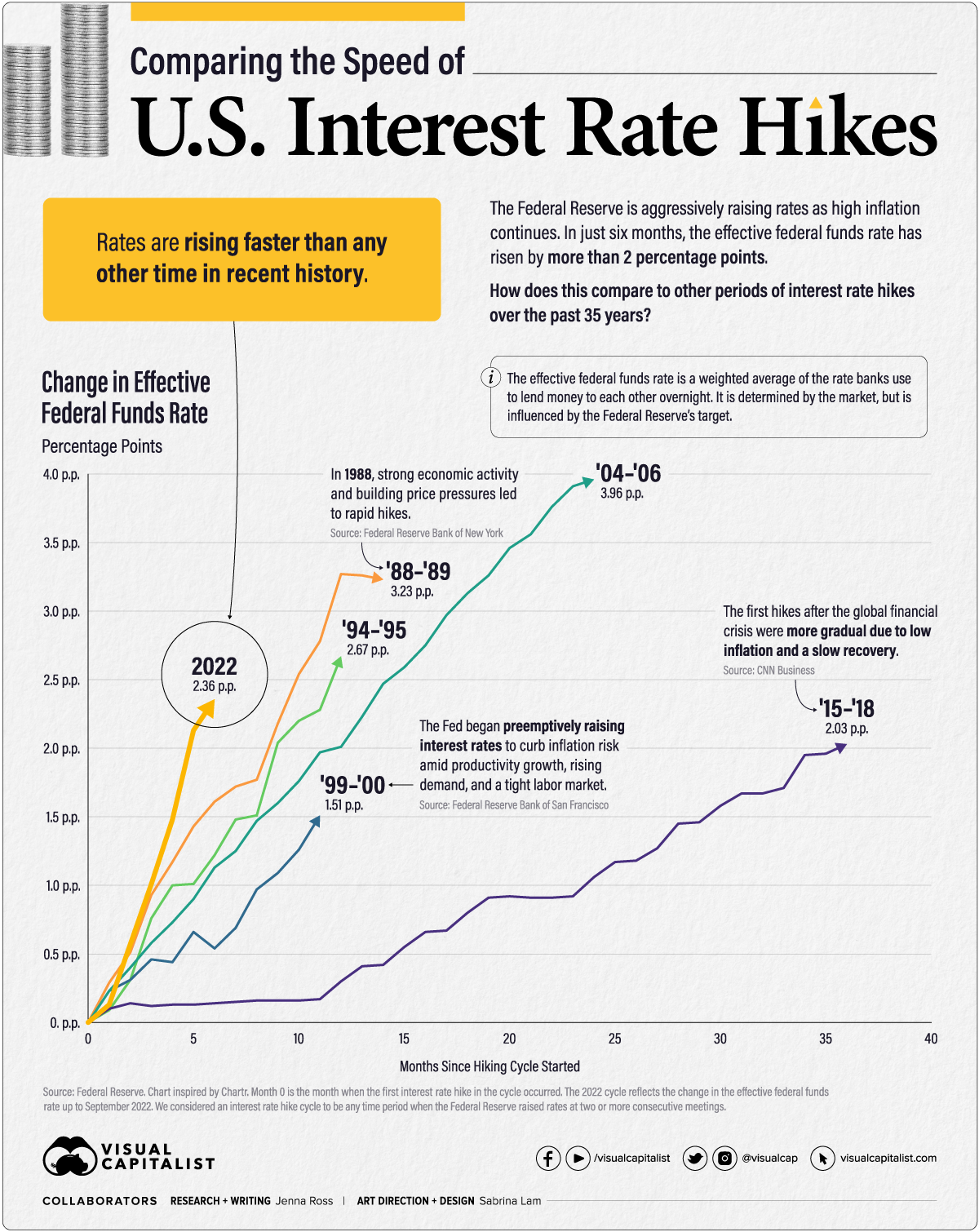

Interest rates have peaked for an average of 11 months over the last five cycles. In past rate hike cycles, however, the Fed acted earlier to tame inflation and gradually raised rates.

Since high inflation in 2022 was initially thought to be a temporary, “transitory” result of the global pandemic, inflation was allowed to exceed target for 12 months before the Fed took action. This led to the fastest rate hike cycle, a rise of more than two percentage points in only six months. With inflation stickier than in the past, a longer-than-average holding period may also be required.

Fed policymakers forecast additional increases in 2023 to a range of 5%-5.25%. Rate cuts are not expected to happen before 2024. But that’s not set in stone. The Fed’s own forecast clashes with trader expectations, while history seems to support the Fed’s timeline. Still, a sooner decrease is possible if a deep recession takes hold, analysts say.

What Are Economists Expecting This Time Around?

Financial firm Morningstar expects inflation to turn around faster than the Fed currently forecasts, predicting rate cuts in the second half of 2023 that continue into 2024. The firm contends that the Fed is attempting to “talk” the market in the direction of maintaining tight financial conditions while dropping bond yields over the last two months and slowing economic growth, suggesting the fight to control inflation will end in 2023.

Barclays initially expected rates to come down in the third quarter of 2023 as well but has pushed back the forecast to November of 2023 due to the resilience of inflation. But the firm’s estimates remain ahead of the Fed’s schedule due to a high likelihood of an upcoming recession. And Morgan Stanley continues to predict the first cut happening in December of 2023. Researchers at JPMorgan Chase say the Fed could cut rates next year as well—but only if factors like increasing unemployment, lower inflation, and weakening economic activity converge in time.

Meanwhile, most of the investors the bank surveyed don’t expect rates to fall until 2024. Economists at Goldman Sachs agree. Chief Economist Jan Hatzius says inflation has been more persistent than expected and doesn’t expect rate cuts until 2024.

Still, Bloomberg Economics is nearly certain a recession will take hold within a year, and most economists agree. Some say if unemployment rises enough, the Fed may rest its attempts to hit the target inflation rate of 2% since there are signs the inflation rate will remain above that target for the foreseeable future. In any case, future rate increases into 2023 are probable, which will impact mortgage rates as well. Even in a best-case scenario, most experts don’t expect mortgage rates to come down until the end of 2023, and they could stay elevated into 2024 if a resilient economy requires the Fed to be more aggressive.

On The Market is presented by Fundrise

Fundrise is revolutionizing how you invest in real estate.

With direct-access to high-quality real estate investments, Fundrise allows you to build, manage, and grow a portfolio at the touch of a button. Combining innovation with expertise, Fundrise maximizes your long-term return potential and has quickly become America’s largest direct-to-investor real estate investing platform.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.