In these uncertain times, captive insurance is increasingly being utilized by business owners to protect the business, to decrease taxes and to build wealth. In a nutshell, captive insurance is a business strategy that allows owners to create their own private insurance company to manage risks and protect their profits. However, the wealth accumulated within the captive can also be used over time to amass a substantial retirement asset for the business owner. That money can fund many of the owner’s needs or wants at different stages of life without early withdrawal penalties.

Captives allow business owners to accumulate wealth much faster than they can through many other retirement strategies. That’s because the money paid into the captive—in the form of insurance premiums—is considered a business expense. Typically, a business owner is taxed on the profits of their business (up to 40% at the federal level alone). Then the owner tries to build a retirement nest egg on their after-tax profits (approximately 60%). With a captive, however, 100% of the money the owner contributes to the captive is accumulating toward retirement—and that money is investable

Additionally, when people contribute to qualified retirement plans, there is a limit to how much money they can put in, and they are taxed at ordinary income rates of up to 40% when it comes time to withdraw the funds. With captives, there are no contribution limits. And when owners pull money out of the captive, they are only taxed at the capital gains rate (0%, 15% or 20% depending on AGI).

Six Key Advantages

There are six key advantages of using captives as a retirement planning tool for your business owner clients. Let’s take them one at a time:

1. Accelerate Wealth Accumulation

Captives can accelerate the owner’s wealth accumulation efforts in four key areas:

• Retirement. An entrepreneur either sells their business or passes it on to the next generation. However, all of the money accumulated in the captive is the owner’s to keep, even if they sell the business to an outside party. Even better, all the premiums paid into the captive remain tax exempt as long as they are held in the captive.

• Long-Term Care. Many people don’t realize that money can be pulled out of the captive to fund long-term care (LTC) and insurance for LTC. There are special insurance products that allow owners to keep their premiums and invest them. Then if they need LTC, the funds are available for them. If not, their heirs get to keep the money.

• Education. A captive is essentially a stockpile of money that owners can tap for a child’s or grandchild’s education expenses, or to pay off children’s student loans. Even better, they can access funds any time they’re needed for education expenses. Unlike many qualified retirement accounts, there’s no minimum age required to draw on the money without penalty.

• Dreams. As mentioned above, owners can retire early and pull money out of their captive for any reason without facing early withdrawal penalties, including dream purchases and vacations.

2. Facilitate Estate Transfer To Future Generations

A captive transfers assets from a business owner’s estate to future generations in the most effective method possible. Captives allow business owners to pile up cash. Ideally, an owner would be down to their last remaining dollar in their captive on the day they pass away. But since that perfect timing is not likely to happen, the owner can distribute what’s left in their account tax-free to their heirs when they pass. Even better, heirs can withdraw all of the funds remaining in the account tax-free because they will receive a step-up in basis. Let’s say an owner makes contributions totaling $1 million to their captive over the years and the captive grows to $3 million when they pass. The owner’s heirs can take out the full $3 million without owing any inheritance tax, capital gains or income tax on the money. Talk about a legacy!

3. Function As A Non-Qualified Retirement Or Deferred Compensation Plan

Stock ownership in a captive insurance company is a great alternative to supplemental non-qualified retirement plans and deferred compensation plans. The less money an owner draws down from a retirement account, the more money is available for growth. Let’s say an owner needs $10,000 a month for living expenses in retirement. They might have to withdraw $14,000 from a retirement account to net $10,000 (i.e., after paying the 40% ordinary income tax). However, if they have a captive in place, they might only need to withdraw $10,000 (or $11,500 at 15% capital gains rate) to pay the lower taxes. This difference allows the funds in the captive to keep growing, which in turn allows the owner to take even more money out later down the road. Additionally, their qualified retirement accounts can keep growing without having to cut into them as much.

4. Function As ‘Golden Handcuffs’ Or Golden Parachute For Key Employees

Employee loyalty is the key to keeping a business running smoothly. A captive allows the business owner to fund insurance policies designed to keep employees loyal. Business owners can fund policies that will create a tax-free retirement plan for key employees. There can even be a restriction built in that stipulates an employee only gets the money if they stay at the company for a certain number of years. If they leave early, then the business owner keeps all the premiums. This is a safe and cost-efficient way to keep the golden handcuffs on key employees. Stock ownership in a captive insurance company can also be used to reward a key employee for past performance or for other merit.

5. Facilitate Buy Sell, Buy In Or Buy Out Arrangements.

A captive can be very effective for facilitating the purchase of a business, buying into a business, or buying out someone from a business. Captives create a stockpile of cash that can be leveraged into purchasing another business or real estate. This can create another asset that produces revenue for the owner.

6. Function As Alternative To Qualified Retirement Plans

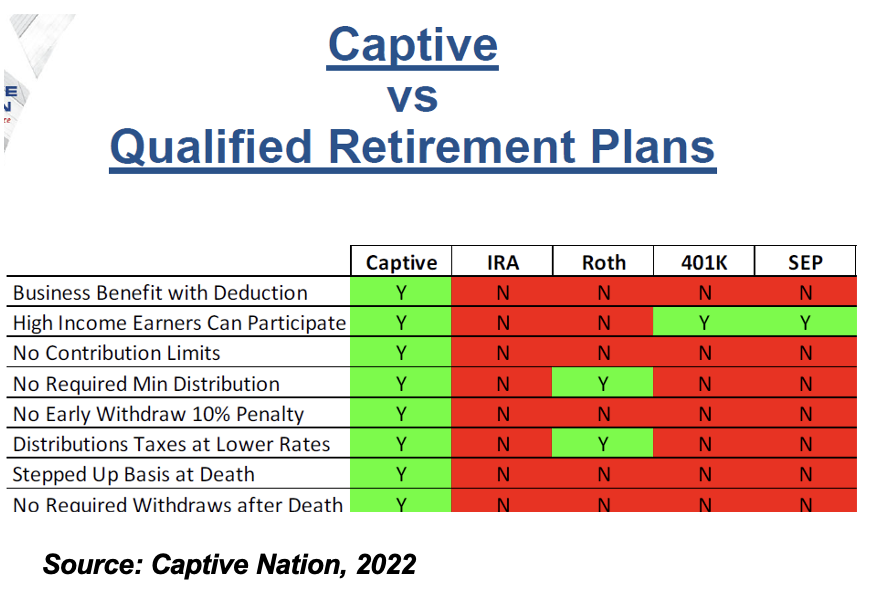

Ownership in a captive insurance company can provide far better accumulations and income for retirement in five important ways.

1. Business benefit. One of the biggest distinctions between a captive and a qualified retirement plan (IRA, Roth, 401k, SEP, etc.) is that with a captive, you have a business benefit (i.e., insurance) that comes with the deduction. When you put money into a qualified retirement plan, yes, that contribution is deductible, but there is no business benefit. You’re just taking money out of your business. With a captive, you get the same deduction, but you have a very powerful tool (insurance) to cover all kinds of risks to your business.

2. No income limits or contribution limits. While IRAs and Roths have income limits and contributions limits, a captive essentially does not. And while 401(k)s and SEPs do not have income limits, they do have certain contribution limits and restrictions. With a captive, you can sock away several million dollars into your “retirement fund” under the right conditions. In fact, a captive can be a great way to “catch up” on your retirement nest egg if you haven’t been able to contribute as much as you’d like in the past due to tough business conditions or other life circumstances.

3. No required minimum distributions (RMDs). With qualified plans, you must start withdrawing funds from your account at age 72 and that money is taxable unless it’s in a Roth. With a captive, there are no RMDs. You can keep the money in your account until the day you die.

4. No early withdrawal penalty. Unlike qualified retirement accounts, there’s no 10% early withdrawal penalty in a captive if you need to use the money before reaching age 59-1/2. And withdrawals are only taxed the capital gains rate (0%, 15% or 20%), compared to the ordinary income rate of up to 40% on withdrawals from non-Roth qualified retirement accounts.

5. Stepped up basis. When you pass, the stock in the captive is marked up to fair market value. That way, your heirs face no capital gains tax on that money, making captives a highly efficient way to transfer wealth.

Conclusion

While all of the ancillary benefits discussed above have significant value to business owners, keep in mind that those benefits cannot be the main reason for forming a captive. The captive must be formed primarily for the purposes of risk management, insurance protection and asset protection. That being said, it’s hard to argue with the benefits of captive insurance.

Ken Huffman, CPA, is the president of Captive Nation in Fort Worth, Texas.