On the surface, the Netherlands seems like a no-brainer for international eCommerce. By GDP, they are the 7th-richest country in Europe and 17th in the world. They are passionate online buyers—96% of the population is online and 52% of online buyers already shop across borders—and the Dutch have the sixth-highest disposable income in Europe.

They are extremely proficient in English and are one of the world’s largest exporters—it’s a recipe for success. However, there are of course challenges:

- Strong domestic competition

- Specific buying and payment preferences

- Weak mobile and social commerce infrastructure

- Enhanced GDPR rules & regulations

None of these is insurmountable. There is massive opportunity for cross-border selling to the 17 million citizens of the Netherlands. Let’s take a closer look at what companies should expect—and how they can improve their odds—when entering the Dutch eCommerce market.

The state of eCommerce in the Netherlands

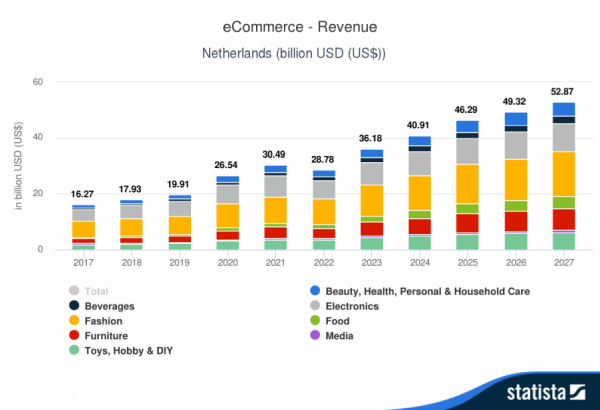

As a digital-focused nation with a very affluent population, the Netherlands has an unsurprisingly strong and established eCommerce market. It is predicted to overtake its Covid-19 spike (over $30bn) later this year. This points to a strong and stable eCommerce market that was boosted, but not artificially inflated, by the pandemic.

Fashion and electronics dominate market share of online purchases, while other groups—like personal care and food—grew substantially over the last few years.

This stability is crucial for businesses looking to attract Dutch consumers. It shows that there is a strong future and that investment in Dutch eCommerce—in both time and money—can be a reliable option. The Netherlands has long had the infrastructure, strong retail market, and high level of digitization needed for heavy eCommerce adoption—the pandemic has simply accelerated the timeline.

With online orders shooting up nearly 50% between 2019 and 2021, this is an extremely healthy market.

eCommerce Growth Opportunities in the Netherlands

As the 7th-ranked eCommerce market in Europe, foreign businesses could be hesitant to stray into this very established $30bn market. However, analysts forecast an increase in online buying across key retail categories, including food, furniture, hobbies and DIY.

Electronics and fashion merchants should be particularly excited, as these are forecast to grow significantly up to 2027.

Mobile commerce

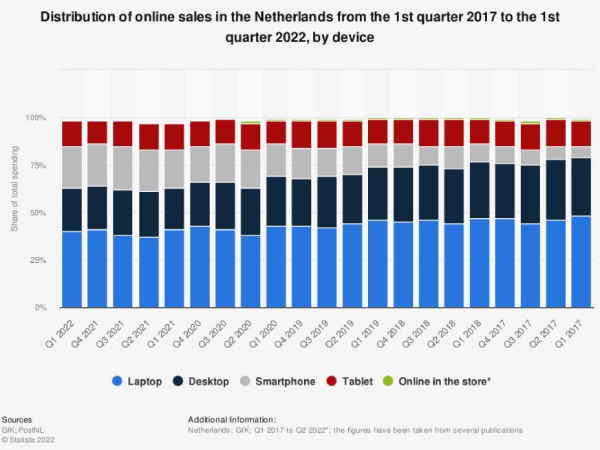

An attractive proposition for any large eCommerce retailer is mobile selling. The Netherlands has huge smartphone penetration (96.1%) but when it comes to mobile shopping, still lags the rest of Europe in terms of spend—only 36.9% is attributable to smartphones and tablets.

So what makes mobile eCommerce attractive? The rate of growth. The Netherlands might have the fastest-growing mobile eCommerce market in Europe, with adoption rising from around 18% in 2017 to over 35% in Q1 2022. Cross-border merchants should enter the competition with fully-optimized mobile shopping and checkout.

Hybrid experiences + fast delivery

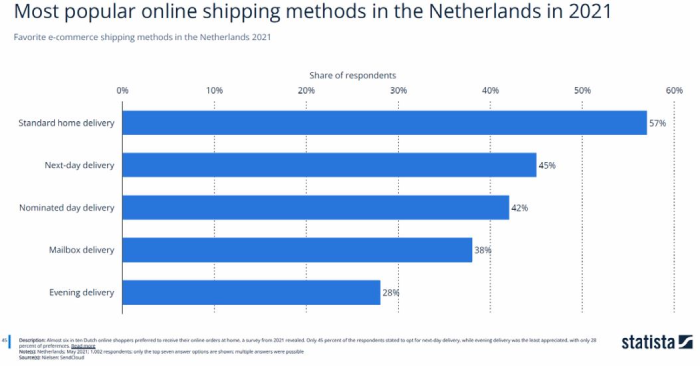

With widespread adoption of domestic retail marketplaces such as bol.com and Coolblue, Dutch shoppers have come to expect the same rapid order fulfillment offered by giants like Amazon.

18% of Dutch shoppers want same-day delivery and over half, 58%, expect it as an option for orders placed before noon. Both next-day delivery and click-and-collect services have become extremely popular.

Cross-border sellers must be prepared to bring innovation to the Netherlands, where adoption of ‘phygital’ strategies will be necessary to compete with domestic brands.

Social media and Marketing for Dutch Consumers

The Dutch start more purchasing journeys on search engines (54% to 48%) than other nations. They’re also less inclined to research brands or products on social media—just 20% compared to 75% globally. More effective strategies are promotional emails and using social media for brand awareness.

The Dutch B2B market is bigger than B2C and is still growing impressively. Right now, 48% of B2B orders are placed online. In the next 3 years, it is expected that eCommerce revenue will hit $54bn.

Major Cross-Border Markets in the Netherlands

Software

Despite its small population, the Netherlands is the world’s 10th biggest software market. There are opportunities for crossborder sellers of all sizes to sell effectively. Enterprise software makes up a third of software revenue, estimated to hit $5bn by 2028. However, the Netherlands also has a dominant productivity software segment as well as success in system infrastructure software and app development.

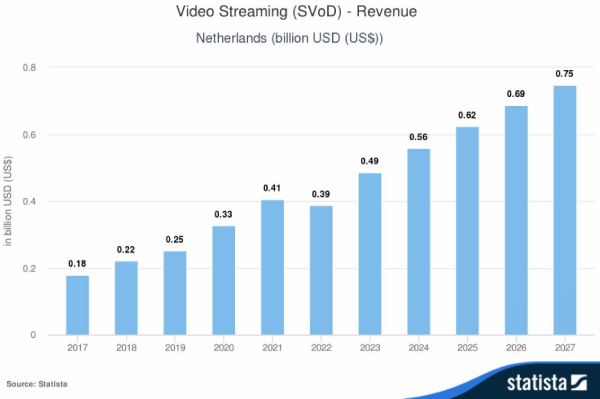

Subscriptions

Despite a general feeling of discontent with subscription surveys, the Dutch subscribe to 14 services per month and the segment is growing rapidly at 7% YoY. Video streaming services are growing at double that rate (14% CAGR) and are expected to reach $750m in revenue by 2027.

The other big players in subscriptions are food (59% of the category), personal care (10%) and beverages (6%).

50% of Dutch subscribers would value more transparency in terms of billing and account management, so this could be a competitive advantage for new players in the market.

Online Dutch Payment Options

When it comes to accepting online payments, there is only one word: iDEAL.

iDEAL is an inter-bank payment system that accounted for nearly 70% of all online payments in the first half of 2021. The provider owns 96% of the bank transfer market and should be a prominent option for every single transaction in the Netherlands.

This is a stark contrast to Europe, the Middle East and Asia, where bank transfer is significantly less popular than credit cards, debit cards and digital wallets. Of course that still leaves 30%. By offering a small selection of other methods, it should be possible to capture the vast majority of orders.

Increasing Conversion Rates for Dutch Shoppers

The Dutch are extremely proficient in English. In fact, it’s nearly a 50:50 split between shoppers with their browser set to English versus Dutch, according to 2Checkout platform data. Therefore localization to both languages is important.

Other expectations to meet during checkout include the range of payment methods detailed above, local currency, and social proof during checkout. For example, the number of units sold, reviews for that product, etc.

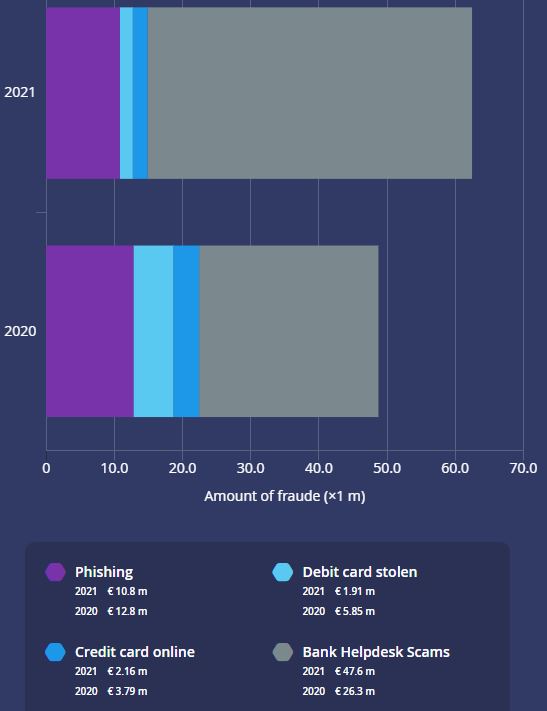

Due to high levels of digital fraud in the Netherlands—particularly phishing and chargebacks—the use of 3D Secure and 3DS2 are essential. These are applied to 90% of transactions and have significantly reduced buyer concerns about fraud. As a crossborder seller, these suspicions may be higher for your products than domestic brands, so demonstrable security is paramount.

As in every market, it is essential to test your checkout experience and optimize for the highest conversions.

Data handling and protection

The Netherlands has taken steps to enhance consumer privacy rights with the Dutch GDPR Implementation Act. This includes protections around additional organizations, notification requirements, and personal data processing.

Any crossborder seller must be aware and compliant with Dutch privacy laws, as these may not reflect your domestic rules.

To learn more about the eCommerce market in the Netherlands and how to approach cross-border selling with maximum confidence, read our eBook: eCommerce in the Netherlands: A Merchant’s Cross-Border Guide to Online Sales.