“Small value” is one of the market’s most inefficiently priced corners, and it has long been the home of famously successful and iconoclastic investors, from Joel Tillinghast with his love of low-priced stocks to Chuck Royce, who obsessed with tiny blue chip companies. So here’s an easy question:

Over the past quarter century, what has been the most successful small value fund you could have bought?

If you’re one of the five people nationwide who would have answered “Aegis Value,” congratulations! You got it!

While the past guides us, we must live in the future. Scott Barbee believes there may be a once-in-a-generation wealth-creating opportunity in certain Canadian energy stocks. Aegis Value Fund has done the work and owns some of these stocks. Barbee’s track record over 25 years means we should pay close attention to what he is saying. If you never buy into his fund, you should still read the article to understand how a master investor thinks through opportunities.

My synopsis of our long and engaging conversation will highlight five issues:

- The Aegis Value track record

- Barbee’s background and perspective

- The nature of his investable universe, and,

- This rare and fascinating opportunity in a corner of the energy market.

We’ll start with the fund.

Introduction to Aegis Value

Aegis Value invests in a portfolio of about 70 very, very small North American companies. They look for stocks that are “significantly undervalued” given fundamental accounting measures, including book value, revenues, or cash flow. The managers consider themselves “deep value” investors. As of July 2023, 62% of the portfolio is invested in Canadian stocks and 24% in the US.

Many analysts consider microcaps to be a distinct asset class rather than just a subset of small caps. Microcaps are generally covered, at most, by a single analyst. The stocks in microcap portfolios tend to be one-fifth to one-tenth the size of those in small cap portfolios. They tend to be thinly traded, have high insider ownership, and are more likely to be acquired by a larger firm, all of which means that their stock prices are subject to large moves that are not driven by broader market forces. It is not an arena that rewards dilettantes.

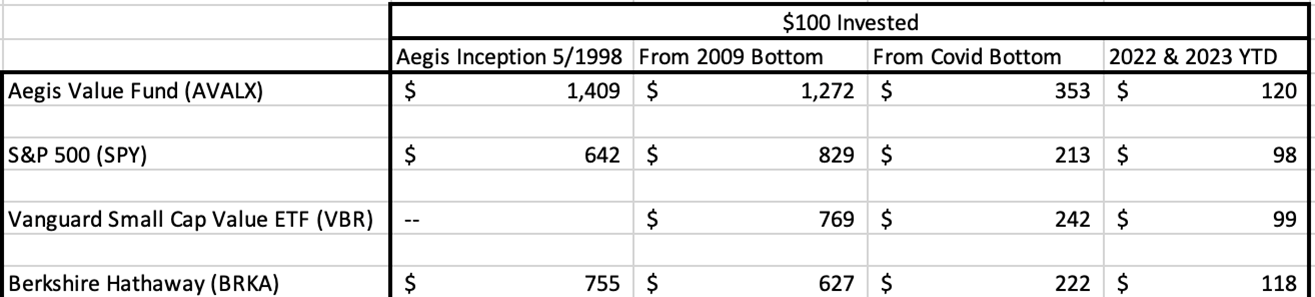

Fortunately, Aegis is guided by one of the longest-tenured and most successful teams in the arena. Aegis has the highest returns of any small-cap value fund over the 25 years since launch and has been a top 5 fund over the past 20-, 15-, 10- and 5-year periods. The Mutual Fund Observer has previously profiled the Aegis Value fund and Scott Barbee in 2013 and 2009. While badly dated, those profiles do talk a bit more about the manager’s process and perspectives.

I recently had a long conversation/Q&A with Barbee about his views on the market, his lived history in the markets, the Aegis portfolio, and many things in between. I enjoyed his honest, down-to-earth, conviction-driven thought process, the answers that come out of such analysis, and what promise it holds for investors.

Scott Barbee on Scott Barbee

“My dad worked for Aramco, and I grew up in Saudi Arabia. I am a mechanical engineer by training. Before starting Aegis, I worked for Chevron for a couple of summers and for Simmons & Company, an oil service investment bank. When I research energy and precious metals companies – the fund owns a lot of those right now – part of the analysis, and one that I enjoy, is to get into the scope of engineering for the mining projects. This is not the kind of work that can be outsourced to a computer or quantitative engine for algorithmic trading strategies. I am often a contrarian, but not always, understanding that sometimes the crowd can be correct.”

“My dad worked for Aramco, and I grew up in Saudi Arabia. I am a mechanical engineer by training. Before starting Aegis, I worked for Chevron for a couple of summers and for Simmons & Company, an oil service investment bank. When I research energy and precious metals companies – the fund owns a lot of those right now – part of the analysis, and one that I enjoy, is to get into the scope of engineering for the mining projects. This is not the kind of work that can be outsourced to a computer or quantitative engine for algorithmic trading strategies. I am often a contrarian, but not always, understanding that sometimes the crowd can be correct.”

Scott Barbee on Aegis Value Fund

“The fund started in 1997, at the tail end of the mutual manager celebrity status era. Managers like Michael Price and Peter Lynch were still venerated. But since then, the mantle of the celebrity managers appears to have moved to the hedge fund universe, which seems like the investment of choice for the wealthy. Meanwhile, retail investors have switched to index investing and don’t have a desire for active mutual funds. We are an odd duck in that we do detailed work on stocks as if we were a hedge fund without charging the performance fees.”

Aegis is a small, five-person team. As of June 2023, employees and their families have a combined $48 million investment in the fund out of the fund’s total assets of $342 million. Barbee has been continuously managing the fund since the start of the fund in 1997. There are benefits that come out of having the same person run the fund successfully for this long. All investors make mistakes, and Mr. Barbee admits to his share of them. Good investors learn from past mistakes and shepherd the investments better in the next market cycle. Barbee is deeply self-aware, self-critical when required, and optimistic enough about the portfolio’s future to have the required psychological balance.

The fund has made investors money since its inception by finding and investing in stocks of deep value and small capitalization companies in the USA and Canada. This particular segment of the market is not what David Snowball would call “low ulcer.” Rather this is the crossroads where scamsters, accounting and balance sheet frauds, flawed business models, fallen angels, and misunderstood companies all meet. When the economy goes sour, investors in the zip code are prone to panic selling. Barbee’s successful track record and the occasional large drawdowns his fund has endured reflect the perils of this illiquid and highly volatile market segment.

“As a deep value investor, if you get it wrong, you can get hit. It’s one thing to forecast Cisco earnings wrong in 1999 and lose money conventionally, but if a deep value manager loses money failing to spot an accounting scam in a small mining stock, that can really damage their reputation,” said Barbee.

Performance for the bean counters

A low ulcer fund it is not, but, boy, is this man good at sticking to his craft and compounding capital!!

A successful trade from the past

Junior Gold miners

“Between 2012 to early 2016, there was about an 85% decline in the stocks of junior gold miners. Given this collapse, we sensed all the scamsters had left for greener pastures in crypto, cannabis, or whatever. Who was left was a precious metals billionaire geologist and other technically savvy investors collecting assets on the cheap. A lot of gold stocks were showing up on our watchlist, and we could afford to be selective. As an engineer, I spoke to the management teams that were putting these assets into production and figured the assets were likely to work. At that time, both traditional cyclical assets and precious metals were being puked by CIOs (Chief Investment Officers) on account of their high volatility. We bought these high volatility precious metal discards believing these stocks offered an opportunity for strong returns uncorrelated with the rest of the portfolio.”

To be correct about deep value, the buyer of stocks has to believe that the seller’s view of the world is somehow wrong. Otherwise, why bother buying? Barbee’s contrarian view helps. But he is not buying stocks in a random shotgun manner, spraying money all over the place. There is a process.

The Watchlist

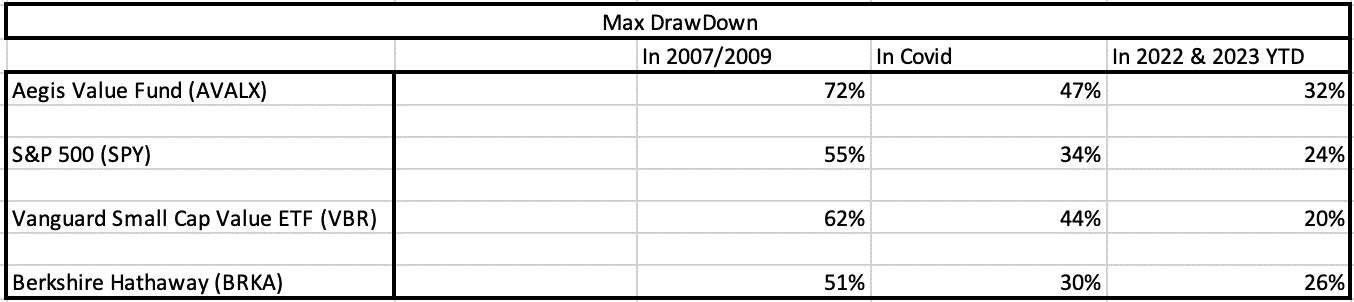

Barbee keeps track of how many stocks are showing up in his deep value universe watchlist. He shared the chart with the readers below.

“The number of stocks which show up as small-cap, deep value, as of June 2023 are among the highest since the 2008-2009 crisis and the Covid pandemic. Usually, the number of names on the watchlist is correlated to the high yield spread. The more distressed the high yield market, the greater the number of stocks on the list. But right now, interestingly, the high yield spread is very low. Yet, we are seeing a lot more candidates.”

Given that the stock market is trading close to its all-time highs, I asked Barbee how he reconciles this large number of candidates. There are multiple reasons, he says.

First, he points to research by Cliff Asness at AQR that shows the value factor, a measure of the valuation disparity between growth and value stocks, is at historically high levels. “Clearly, many growth stocks are high because of the Artificial Intelligence (AI) enthusiasm. That needs to be sorted out. But the watchlist is also unusually high today because many bank stocks are trading at a discount to book value. The held-to-maturity securities losses from higher interest rates do not hit the book value immediately. Adjusted for those losses, the list would be smaller.”

The Macro view

Our conversation is making it clear that Barbee is nervous about the macroeconomic fundamentals. He very much considers the macro condition when selecting deep value stocks.

“Historically, we would be willing to hold a bit more cash, like we did in 1998-2000.” Currently, the fund holds about 4% in cash. “But the level of debt, fiscal imbalance, the amount of debt coming due in the next two years, and the weakness in the economy lead me to believe that we are going to experience more inflation and dollar debasement in the next few years. Presently, the Federal Reserve is very hawkish and is willing to create damage to fight inflation. But the moment the economic weakness becomes clear for all to see, we suspect the Central Bank will become a lot more dovish.”

“Can you tell me precisely where you see the problem in the economy outside of Commercial Real Estate (CRE),” I asked Barbee, “Who and where is going to be in trouble?”

Barbee believes that outside of CRE, the problem lies with Leveraged Loans of Private Equity funds. He points to research on PE buyouts by Verdad Advisers. From a May 2022 report, Private Equity: Still Overrated and Overvalued, we can see that PE firms buyouts multiples, and debt leverage used has dramatically gone up. “When the economy slows,” says Barbee, “the PE firms are going to get hit twice – once from slowing earnings and a second time from rising rates.”

I’ve read many of his semi-annual reports, and Barbee has consistently railed against high-priced mega cap growth. Fortunately, he hasn’t shorted them, nor does he play in bonds. Barbee directs his energy and views into honing his portfolio, which brings us to energy companies.

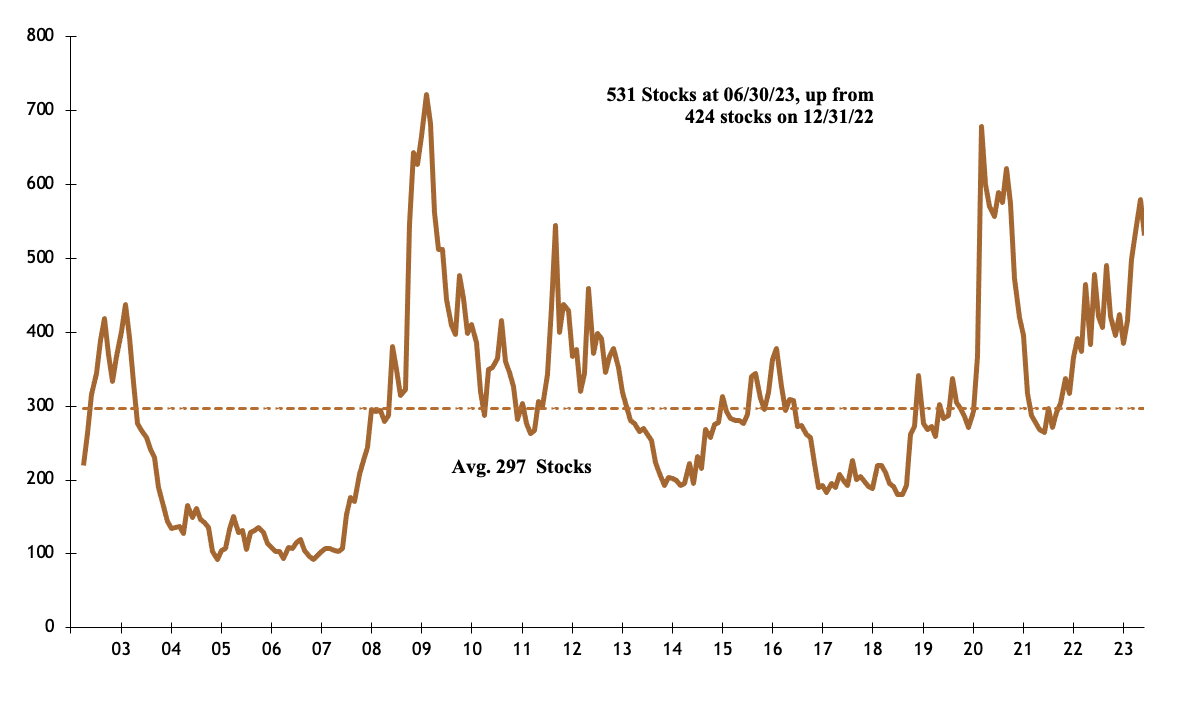

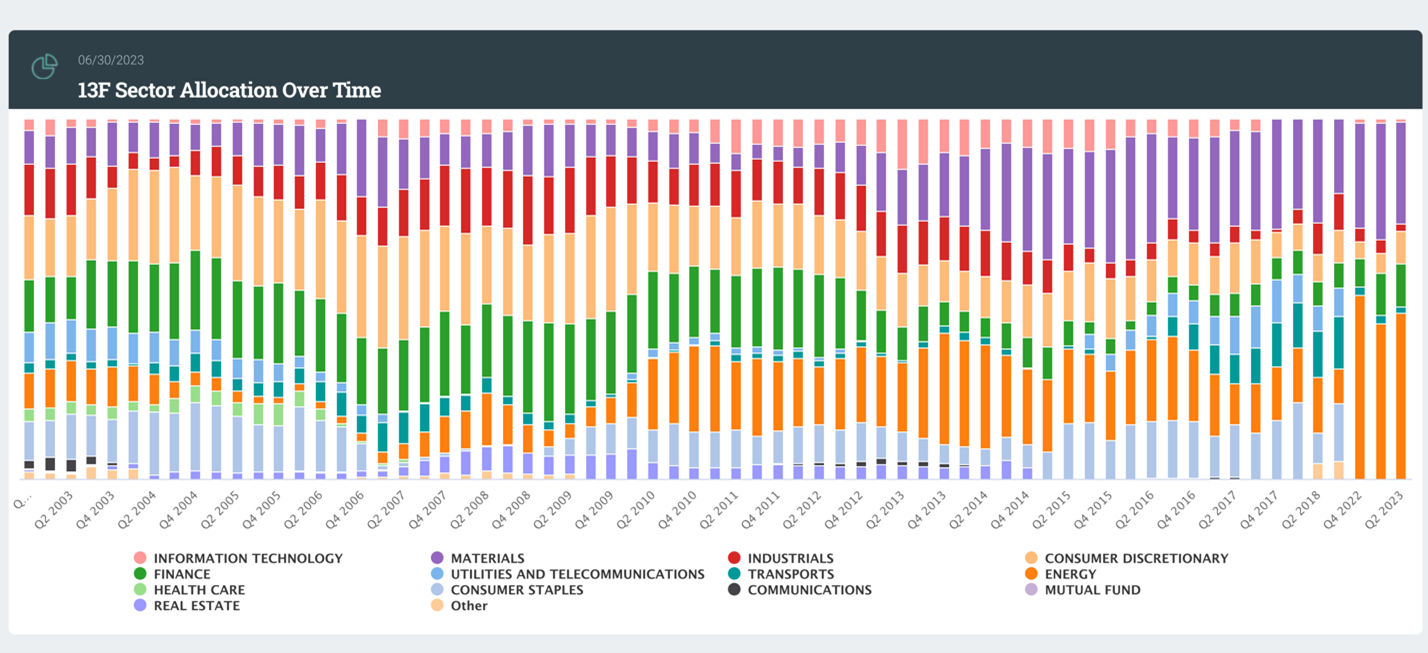

The Aegis portfolio

Energy and Materials stocks make up almost 88% of the fund.

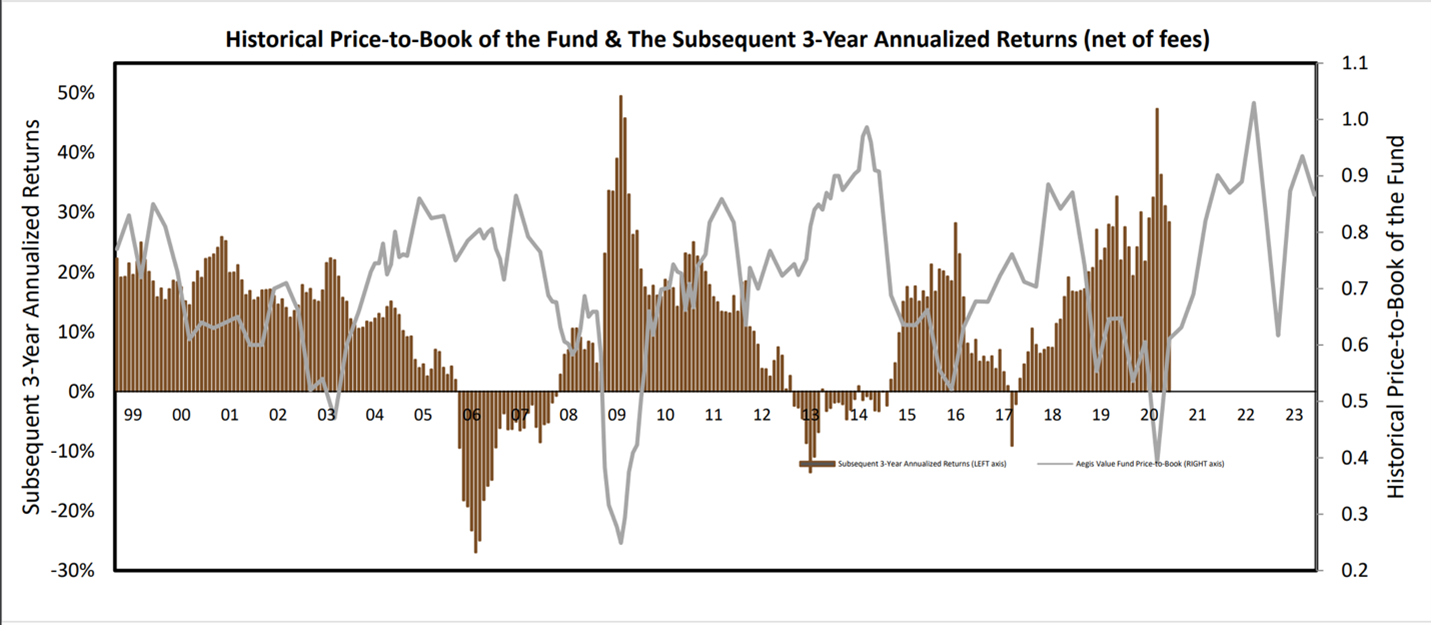

The chart below is from the Aegis fund’s presentation. Focus on the grey line which shows the Price to Book value of the fund’s positions. The funds historical average Price-to-Book has rarely traded at a premium to Book Value. Right now, the P/BV of the fund’s positions stand at 0.87x (or a 13% discount to Book).

Comparatively, the S&P 500’s Price to Historical Book Value currently stands at 4.3x (the index trades at 430% premium to the book value).

“Although the Aegis fund’s book value is much lower than the broader markets’, how do you explain the relatively high book value of the positions in the fund right now compared to history,” I asked. There are implications for future returns when the fund’s P/BV is that high (even though its much lower than the S&P).

“Book value is not an indicator you use by itself,” started Barbee. “You have to look at it in the context of leverage held by the company as well as the longevity of the assets held by the company,” which led to his focus on the companies the portfolio holds.

“The higher P/BV may reflect the high inflation we have experienced in the recent past. The Book Values are not valued higher to adjust for the replacement cost of the assets.”

I asked how he thinks the situation will work itself out. Will companies mark their book values higher?

Barbee points to a piece Warren Buffett wrote in 1977, How Inflation Swindles the Equity Investor, and then explains the fund’s position in energy stocks.

“Does the company really have low-cost debt? Are the assets really long-term in nature? How much leverage does the company have? To beat the inflation swindler, I like the fund’s energy holdings. Right now, in energy, the crowd might be wrong.

- Investors are expecting a recession and a decline in crude oil consumption during the recession. People are thinking about the most recent pandemic driven recession. But if you go back to previous recessions, there is very little dent in energy use.

- We have China and India trying to ascend into wealthier, more industrialized nations, and that trend is not going away.

- The idea of abundant renewables is nice to talk about but difficult to execute. Over the last ten years, $3.8 trillion has been spent on alternative energy. Yet, fossil fuels as a percentage of energy consumption have declined from 82% of total use to 81%!

- Banks are forcing energy companies to reduce leverage

- ESG is causing many investors to divest from energy companies

- The perverse effect of bank + ESG led deleveraging is that higher interest rates have not been painful for energy companies (unlike the pain in CRE and PE Leveraged Loans).

- Because of these non-economic actors being involved in the energy space, energy poverty is a far more likely problem.

- Shale oil wells fracking production data show peaking production.

- China is still opening up slowly. What happens when growth speeds up there?

- Russia does not have access to Western oil production expertise. They can get by for the first year or so, but then production starts slowing.

- We have gone from 97 million barrels per day of Liquid Fuel consumption in 2021 to 102 in 2023.

- (This one got me): From 2007 to 2023, cumulative inflation has been 45%. Today’s 70$ price of Oil is ~$45 in 2007 dollars. Do you remember the price of oil roughly traded at $120 in 2007?

- Energy companies are slimmer today, more efficient, and despite the much lower oil price, have Free Cash Flow yield in the high teens and low EBITDA multiples. They are using cash flow to pay down debt and then repurchase shares. These are hugely accretive transactions to existing shareholders.

- At today’s oil prices, many energy companies could pay off their debt and buy back all their stock within 5 to 7 years out of projected cash flows.

- Several Canadian stocks, like MEG Energy, in the portfolio have reserve lives of 25+ years.

Aegis has found companies with excellent fundamentals, where I believe the crowd is wrong, and where there may be a generational wealth building opportunity.”

“What could go wrong in the thesis?” I asked.

“There could be another pandemic, there could be massive improvements in battery technology, or there could be a heavy depression. In 2014 to 2016, the portfolio performed very poorly. The portfolio was down 55%. We held levered energy service companies. Now, we hold companies with extremely long-life assets and significantly less, and in many cases zero, financial leverage.”

Conclusion

It was an intense discussion, a thorough and detailed investment perspective from a fund manager dedicated to his craft. Many people in the investment world believe the crowd is wrong. After all, one needs a certain level of ego to buy and sell stocks – remember the efficient market hypothesis. You could have a blue sky, God is great, Cathie Wood view of the world. Or you can scour the markets for small, cheap companies, that have all the ingredients to compound capital. This is what Scott Barbee does. And it’s worked for the fund’s long-term returns.

The truly difficult thing, one even Scott Barbee doesn’t know, is how big the next drawdown in the fund is going to be. I get the sense he knows bearing volatility is part of his job. That there is $48 million of employees and family money in a $320 million fund goes a long way in providing confidence that Barbee believes in his ability to compound capital. I believe so too. I am an investor in the fund.