This is the last article in a series that describes what I learned in the year following retirement. After fifty years of working, military service, and getting two university degrees, I took the first year as “Me Time”. I once worked with an Australian who was fond of saying that he had his $100 in the bank, meaning that he was financially secure. I have reached the end of the rainbow after decades of investing and financial planning. I just signed up for Social Security, which, combined with pensions, will cover normal spending needs, plus I have my $100 in the bank.

This past year, I put my investing on autopilot with Fidelity Wealth Management and Vanguard Personal Advisory Services managing my long-term investment buckets. I am surprised at how much relief I feel putting these plans into action and how much time it has freed up. I am ready to look beyond the rainbow and create a map of the good life in retirement.

This article is divided into the following sections:

REACHING THE RAINBOW

I had a rocky start to my career but was able to finish strong with peak earnings in my later years. I began evaluating scenarios mid-career of retiring at 57, 59 ½, 62, and 65, not because I wanted to retire early, but in case I had to. The benefits of working a few years longer were shocking. Brian J. O’Connor does an excellent job in Bad News: Early Retirement Can Create a Financial Crisis, which summarizes the risks of retiring early based partly on a study by Allspring Global Investments. He describes that someone retiring at 62 is three times more likely to run out of money than someone waiting until age 65 to retire.

The five decades regarding personal finance since I graduated from high school have been characterized by the following:

- First Decade: Military service, attending university, stagflation, working temporary jobs.

- Second Decade: Globalization, layoffs, mergers & acquisitions, starting a professional career, marriage, MBA (between layoffs).

- Third Decade: Professional development, Dotcom Bubble, buying a home, setting goals using Vanguard’s retirement tool.

- Fourth Decade: Working internationally, entering management positions, financial crisis, building a home, using the Fidelity retirement tool, beginning DIY financial planning, hiring fee-only financial planner, using Schwab robo-advisor, developing an investment model.

- Fifth Decade: Peak earning years, COVID, merger, retirement planning, retirement, cancer, relocation, hired a financial planner, writing articles for Seeking Alpha and Mutual Fund Observer.

Needless to say, things often don’t go according to plan. You may not be able to work as long as you would like to complete your financial plans. There are financial speed bumps along the way. Ultimately, I worked until age 67, which is beyond the normal retirement age for both my employer pension plan and social security. Working longer means that you are still adding to savings instead of drawing from them. The impact on Social Security benefits is described later.

Setting Goals

Setting a goal to have a certain amount saved by retirement always seemed a little esoteric to me because there are so many variables. However, I have always kept an eye on the size of the prize. Fidelity’s guideline is that people should try to save at least their salary by age 30, three times their salary by age 40, six times by 50, and eight times by age 60. The median salary in the 55 to 64 age group is about $76 thousand. That would imply that the savings of a typical person nearing retirement should be between $450 thousand and $600 thousand.

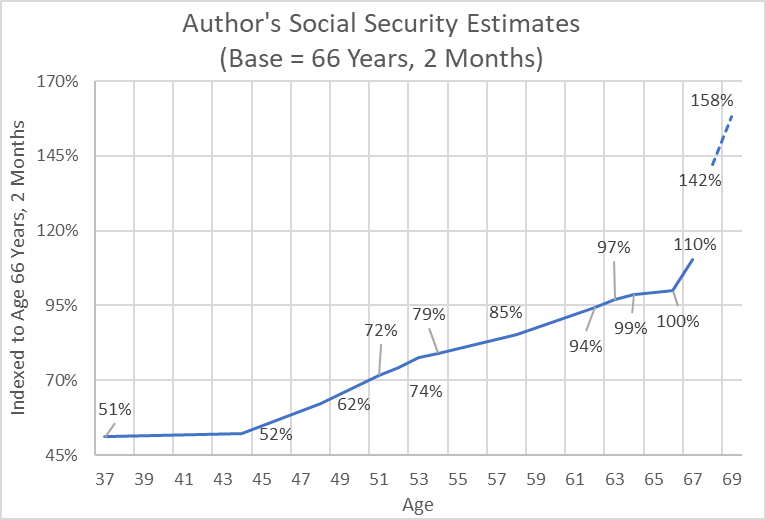

The Wealth Calculators provided by DQYDJ estimate that to be in the top 50% for households in the 65 to 69 age group, one would need a net worth of $272 thousand, including home equity. The Fidelity Guideline is an attainable stretch goal. Having $1 million in net worth is in the top 20%, and to be in the top 10% requires at least $1.9 million. This does not include pensions, annuities, and social security. A Pension Present Value Calculator from Financial Algebra shows the present value of a $4,000 monthly pension at 6% interest for 25 years has a present value of $624 thousand. It does not take into account adjusting pensions for cost-of-living adjustments like Social Security and some pensions do. Another important factor is whether the savings are in Traditional IRAs, where taxes are owed on distributions.

Figure #1 shows estimated net worth, including home equity by age group from DQYDJ.

Figure #1: Net Worth Percentiles by Age in the United States (2020)

Source: DQYDJ based on the Federal Reserve Survey of Consumer Finances (2019)

My main goal has been to save the maximum allowable contribution to employer-sponsored savings plans, along with some discretionary savings targets. Savings and income goals have impacted my behaviors. I would rather drink a $0.35 cup of my favorite cup of coffee at home rather than a $5 latte, even though I savor the lattes. Pamela Vachon conservatively estimates in Here’s How Much You’ll Save Making Coffee at Home that a typical coffee drinker can save $736 by drinking their coffee at home. This same logic applies to many purchases. We cut our discretionary expenses when I retired, and recently reassessed our spending to cut out another $500 per month, mostly in financial subscriptions. Our living expenses have not gone down, but our priorities have changed.

Lifetime Budgets

How much is required for retirement should be derived from a lifetime budget taking into account sources of income, expenses, and including the expected return from investments, and estimated inflation. Fidelity has a retirement planning tool that is available to account owners. Vanguard has one that is available if you use their Personal Advisory Services. Of course, there is the DIY spreadsheet approach that I also use. The cost of living can vary dramatically by state, as shown by Robin Rothstein in Examining The Cost Of Living By State In 2023. John Csiszar estimates that typical 401k savings will last less than seven years in some states: The Average 401(k) Is Worth $300K at Retirement Age — How Long It Would Last in These 10 States.

Financial Planners

I am a strong advocate of using a financial planner, although I reached this conclusion late in my career. Social Security, Medicare, and tax rules can be complicated. Financial literacy is important to help us understand the tradeoffs between risk and return. Financial planners can help with these topics. What I have found is that it may take a financial planner and tax accountant to advise on these topics. Rodney Brooks describes why you might need a tax accountant and a financial planner in Should You Consult a CFP or CPA to Plan for Retirement? Sam Lipscomb describes why you might want an advisor who specializes in Social Security in Financial Advisors for Social Security. I took the Do-It-Yourself route, which has been time-consuming. Robert Powell describes certain advisors who specialize in Medicare in How Financial Advisers Can Help Clients With Medicare. I use Alight, which is a retiree benefit from my former employer, to identify the best Medicare plans.

Edelman Financial Engines has financial services with fees based on a percentage of assets. There are also a variety of resources available to find independent financial planners, such as FPA PlannerSearch and The National Association of Personal Financial Advisors. I wrote Battle of the Titans for Portfolio Management, comparing Fidelity to Vanguard. I am using both and will evaluate in several years if I have a strong preference for one over the other.

Understanding Social Security

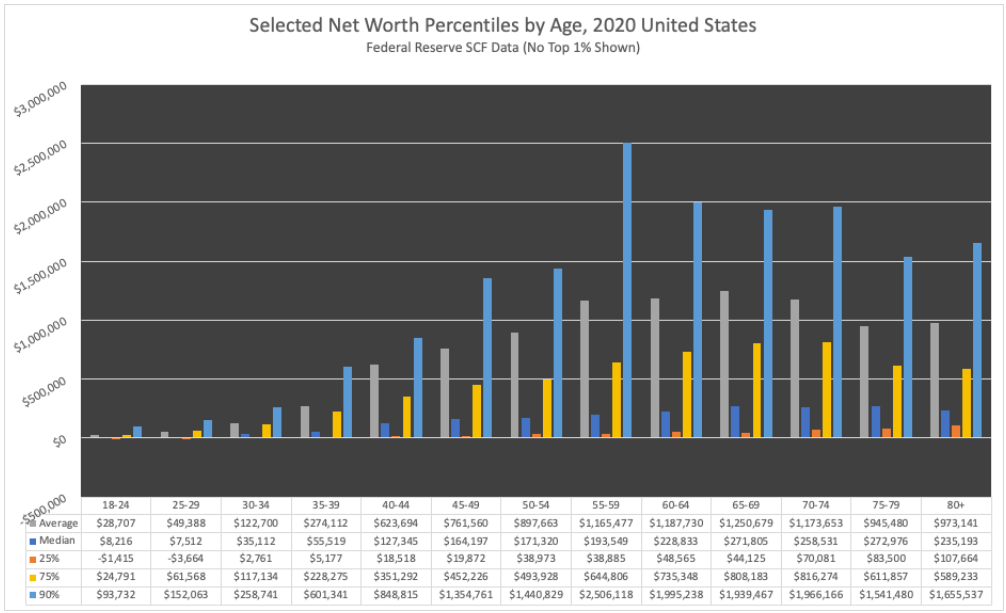

I have tracked my estimated Social Security (SS) pension as part of financial planning. The base case in Figure #2 is the SS pension that I would have drawn at full retirement (66 years and two months), shown as 100%. Your SS pension is based on “the average of the highest 35 years of indexed earnings divided by 12 (to change the benefit from an annual to a monthly measure)”. As we enter into our peak earning years, our social security benefits are likely to increase. This was particularly important in my case.

Figure #2: Changes in Author’s Estimated Social Security Benefits

Working until age 67 displaced a year with low income with a peak earning year. Someone retiring early at age 62 will have approximately 32% lower benefits than retiring at full retirement age, excluding the impact of earnings and inflation.

I evaluated different dates for starting SS Benefits and applied for the benefit to start early next year instead of waiting until age 70. One should take into account Spousal and Survivor Benefits when making these decisions. Reaching the end of the rainbow includes leaving my wife in the best possible financial condition in case I pass away before her.

CLOUDY DAYS

Our parents and grandparents were farmers and ranchers. They experienced crop failures, droughts, dust bowls, depressions, inflation, and world wars. I had a rocky start in my career due to not developing a clear career path early and to downturns in the business cycle. These experiences developed a strong desire to always have a margin of safety.

People are often surprised that pensions cover less than they anticipated or that savings don’t last as long as they expected. Some have had to choose to continue working or go back to work. Then, there are unknowns, such as health issues that arise. The boogeymen that concern me are high Federal debt and budget deficits, geopolitical risks, climate change, underfunded pensions and Social Security, stagflation/inflation, sequence of return risk, political polarization, and high crime rates.

As I was about to submit this article, I ran across one more pertinent source by Chris Kissel at Money Talks News, 12 Hard Truths About Retirement. These points are well worth understanding before retiring.

- Medicare won’t be free

- Social Security won’t go very far

- You will wish you had saved more

- Housing will remain your biggest expense

- Your dreams may not match reality

- You may spend more than you expect

- Divorce will be a serious threat

- You might not work — even if you planned to

- If you’ve never volunteered before, you won’t start in retirement

- Retirement can be especially lonely for single men

- Health issues will likely catch up with you

- You may be disappointed — at first

We have tried to address these risks by using the bucket approach, diversifying investments, building up pensions, working a little longer, delaying Social Security benefits, and living beneath our means. We elected pension options with 100% survivor benefits. Delaying social security until full retirement age increased Spousal and Survivor Benefits. Increasing financial literacy and using financial planners reduces risk. Eating healthy and staying active improves well-being.

In the short term, government shutdowns and strikes will dampen an already slowing economy. September and October are following seasonal trends for stocks to dip. I have set a date in October to do a Roth Conversion while stocks are hopefully lower. I am overweight cash equivalents and short-term bond funds and ladders and underweight equities.

ASSESSING MY FIRST YEAR IN RETIREMENT

Before I retired, I created an ambitious Bucket List of things to do in the year following retirement. I fell far short of completing the list. I accomplished everything on the list, just not to the extent that I wanted. We did complete our financial planning and estate goals, a major xeriscape project around the house, installing a solar system, and arranged for a kitchen remodeling project to begin soon. I have been dedicated to the gym as planned. I also completed things not on the list, such as building raised bed gardens and volunteering to remove snow for senior citizens. My biggest regret was wasting too much time following political drama, and not enough time reading quality books.

My day starts with reading the news broken down, focusing on ten categories that concern voters the most according to a recent poll. I take a deeper dive into these subjects. It surprised me that approximately twenty-five percent of homeless people are actually employed, but can’t afford housing. I read about what states and cities are doing to reduce homelessness. My wife and I attended a fundraiser for a local organization that helps provide “sustainable housing, supportive services, and education to families and individuals”. I visited their office to ask about opportunities to volunteer. I applied to be a volunteer and expect to start in November.

My goals have changed somewhat. Turning over long-term investment buckets to financial advisors shifted my interests to other goals. I have reassessed what remains on my list and reprioritized it. The list is still valid, and I will continue to work on it.

THE GOOD LIFE IN RETIREMENT

I have lived overseas for thirteen years, and traveling abroad is not a priority. What appeals to me is to visit places nearby. This month, I went to a national park to see the aspen leaves changing color. I am currently reading a history book of Colorado, which enriches travel to nearby places.

My map of the good life in retirement is not so different from what I envisioned a year ago. I had thought it out well. I have reprioritized my goals loosely as follows based on the time that I expect to spend, some of which overlap. I am updating the details for each of the categories.

- Family

- Health/Gym

- Volunteering

- Reading quality books

- Following current events and news

- Home improvements, maintenance

- Exploring Colorado and nearby states,

- Nature trails and scenic drives

- Parks, museums, and culture

- Social

- Retirement planning/investing/financial literacy

- Visiting interesting restaurants/breweries/wineries

This bucket list forms my map of the good life in retirement.