Someone will always be getting richer faster than you. This is not a tragedy.

I’ve heard Warren say a half a dozen times, “It’s not greed that drives the world, but envy.”

Envy is a really stupid sin because it’s the only one you could never possibly have any fun at. There’s a lot of pain and no fun. Why would you want to get on that trolley?

Charles Thomas Munger (1924-2023)

Each year I share with readers my unenviable portfolio. By design, my portfolio is meant to be mostly ignored for all periods because, on the whole, I have much better ways to spend my time, energy, and attention. For those who haven’t read my previous discussions, here’s the short version:

Stocks are great for the long term (think: time horizon for 10+ years) but do not provide sufficient reward in the short term (think: time horizon of 3-5 years) to justify dominating your non-retirement portfolio.

An asset allocation that’s around 50% stocks and 50% income gives you fewer and shallower drawdowns while still returning around 6% a year with some consistency. That’s attractive to me.

“Beating the market” is completely irrelevant to me as an investor and completely toxic as a goal for anyone else. You win if and only if the sum of your resources exceeds the sum of your needs. If you “beat the market” five years running and the sum of your resources is less than the sum of your needs, you’ve lost. If you get beaten by the market five years running and the sum of your resources is greater than the sum of your needs, you’ve won.

“Winning” requires having a sensible plan enacted with good investment options and funded with some discipline. It’s that simple.

My portfolio is built to allow me to win. It is not built to impress anyone. So far it’s succeeding on both counts. I built it in two steps:

- select an asset allocation that gives me the best chance of achieving my goals. Most investors are their own worst enemies, taking too much risk and investing too little each month. I tried to build a risk-sensitive portfolio which started with the research on how much equity exposure – my most volatile niche – I needed. The answer was that 50% equities historically generated more than 6% annually with a small fraction of the downside that a stock-heavy portfolio endured.

- Select appropriate vehicles to execute that plan. My strong preference is for managers who:

- have been tested across a lot of markets

- articulate distinctive perspectives that might separate them from the herd

- are loath to lose (my) money

- have the freedom to zig when the market zags, and

- are heavily invested alongside me.

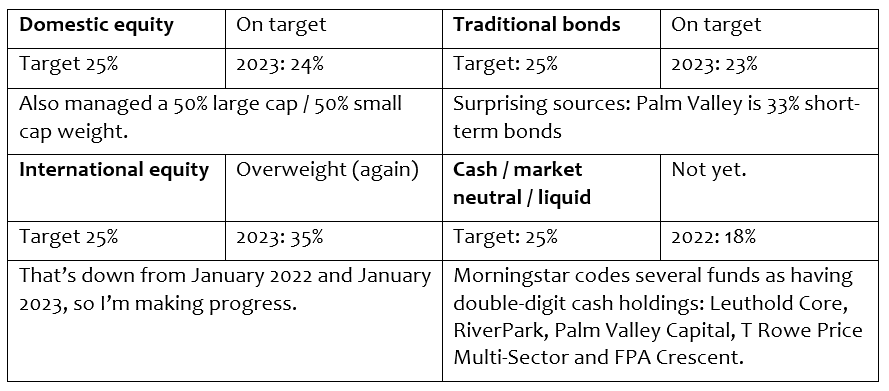

My target asset allocation: 50% stocks, 50% income. Within stocks, 50% domestic, 50% international; 50% large cap, 50% small- to mid-cap. Within income, 50% cash-like and 50% more venturesome. I have an automatic monthly investment flowing to five of my nine funds. Not big money, but a steady investment over the course of decades.

So here’s where I ended up:

As it turns out, I inadvertently recreated the famous Vanguard Wellington balanced fund, as least for 2023:

| Equity | 2023 return | Max drawdown | Standard deviation | Ulcer Index |

Sharpe Ratio |

Martin Ratio |

Yield | |

| Snowball 2023 | 59% | 14.3 | -6.1 | 10.3 | 2.2 | 0.90 | 4.13 | 2.1% |

| Vanguard Wellington | 66 | 14.3 | -6.0 | 11.1 | 2.5 | 0.84 | 3.70 | 2.2 |

My non-retirement portfolio is invested in ten funds. Here’s the detail for the non-retirement piece:

| M-star | Lipper Category | 2022 weight | 2023 weight | 2023 return | APR vs Peer | MAXDD % | |

| FPA Crescent | 4 star, Gold | Flexible Portfolio | 22.0% | 23 | 20.3 | 8.5 | -6.2 |

| Seafarer Overseas Growth and Income | 5 star, Silver | Emerging Markets | 17.0 | 16 | 14.3 | 2.4 | -11.3 |

| Grandeur Peak Global Micro Cap | 4 star, Bronze | Global Small- / Mid-Cap | 15.0 | 16 | 12.5 | -2.4 | -12.6 |

| T Rowe Price Multi-Strategy Total Return | 3 star, NR | Alternative Multi-Strategy | 9.0 | 10 | 5.1 | -1.8 | -0.4 |

| Palm Valley Capital | 3 star, neutral | Small-Cap Growth | 8.0 | 9 | 9.5 | -7.7 | -1.0 |

| T Rowe Price Spectrum Income | 3 star, Bronze | Multi-Sector Income | 7.0 | 6 | 7.9 | 0.1 | -4.3 |

| RiverPark Short Term High Yield | 3 star, negative | Short High Yield | 6.0 | 6 | 5.6 | -4.5 | -0.2 |

| Cash @ TD Ameritrade | 6.0 | <1.0 | 0 | o | – | ||

| Brown Advisory Sustainable Growth | 4 star, Silver | Multi-Cap Growth | 5.0 | 6.0 | 38.9 | 6.5 | -9.6 |

| Matthews Asian Growth & Income | 5.0 | 0.0 | – | – | – | ||

| RiverPark Strategic Income | 4 star, negative | Flexible | 4.0 | 9.4 | -2.4 | 0.5 | |

| Leuthold Core | 5 star, Silver | Flexible | 4.0 | 11.7 | -0.1 | -4.2 |

Things to notice:

-

Portfolio weights are virtually unchanged from 2022 to 2023.

That reflects the fact that my strategic allocation hasn’t changed.

-

I liquidated Matthews Asian Growth & Income.

That’s a fund I bought when Andrew Foster was still the manager; it is an absolute model of sanity and reliability. Recently Matthews International has undergone a vast number of changes, with new executives and media people coming in, managers flowing out, funds being liquidated and ETFs being launched. Over the past five years, the fund has earned just under 1% a year. I concluded that (a) I was overweight on international and emerging stocks and (b) MACSX had the dimmest prospects going forward.

-

I deployed most of my cash.

The cash at Schwab wasn’t strategic, it was just a residue of an earlier transaction awaiting a new home. And I found one. Or two.

-

I added Leuthold Core.

I’ve always admired LCORX. The managers are exceptionally dedicated and risk-conscious. While it sits in the same “box” as FPA Crescent, its quantitative discipline sets it apart. It adds some fixed-income exposure to my portfolio and complements my own cautious style.

-

I added RiverPark Strategic Income.

I noted in our March 2023 issue I was in search of additional fixed-income exposure, and I’ve resolved to find a fund whose performance is not tied to the fate of the broad fixed-income market. That reflects two facts:

-

My long-term strategic allocation is out of whack – I’m too exposed to international stocks and too little exposed to fixed income, so more fixed income is good.

-

I think most bond strategies are stupid. Or, at the very least, they are mostly dependent for their success on a very hospitable external environment, which I doubt will describe the remainder of this decade.

That led me to explore funds that bore the name “strategic income.” They were drawn from a half-dozen Lipper categories and used a dozen strategies, all with the goal of generating income independent of the broad investment grade bond market.

Four funds stood out for their risk-adjusted performance over the past five years, including Osterweis Strategic Income and RiverPark.

-

The retirement addendum

My retirement funds are gloriously boring. The vast bulk of my assets are in two target-date funds. T. Rowe Price Retirement 2025, a low-cost five-star fund that regularly clubs its competition, and TIAA-CREF Lifecycle 2025 Retirement, a low-cost four-star fund that was the best Augie was offering. The latter fund will soon be renamed “Nuveen.”

The key driver of my retirement at this point is momentum. While I continue to contribute about 18% a year to retirement (leave me alone: I have a used Toyota, a small house, and a modest appetite), I’m close enough to the goal line that market forces rather than my additions are driving things. After the first day on which I lost $20,000, I stopped looking.

I have about 5% of my retirement in T. Rowe Price Emerging Markets Discovery, an EM value find, and about 5% in TIAA Real Estate Account. Real Estate had the second down year in its history in 2023 and I could imagine moving that money into a fixed annuity instead.

Bottom Line

You have no reason to envy my investments. I have no reason to envy yours. I don’t know how much my brother-in-law’s portfolio made. I don’t care whether I beat the market, I care about whether I have a good life and make a difference in the lives of others. My early modeling said that I needed to earn 6% a year, minimum, to have the resources to do all that. Happily, I’ve gotten there.