In this article, I would like to talk about how I am allocating my portfolio. I want to note that every single fund I have positively highlighted in my MFO articles is also one of my portfolio holdings. My money is where my mouth is, and you, the reader, get the good with the bad. Take what’s useful to you and throw away the rest.

Market background in Q4 2023

For 18 months, from Feb 2022 and Oct 2023, it was uniformly hard to own any major asset class. Then, on a given afternoon in October, the switch flipped. If investors squinted enough, we had gotten to a point where bonds had sold off enough to get to 5% yields, the S&P had gotten to a 15 multiple on earnings, and overall risk sentiment was sour. When the tide turned, the speed and breadth of US equities rallying in Q4 was too quick for most to adjust. I didn’t expect the turnaround. I was sure things would get worse.

Fortunately, the discipline of holding enough stocks despite my damp views, bailed me out. 2023 was looking bleak in August/September and ended great by the last week of December.

I made some changes to the portfolio at the beginning of December.

Equity Allocation:

Recognizing my own skepticism and that of others, I forced myself to increase my equity allocation to 65%. What did I buy?

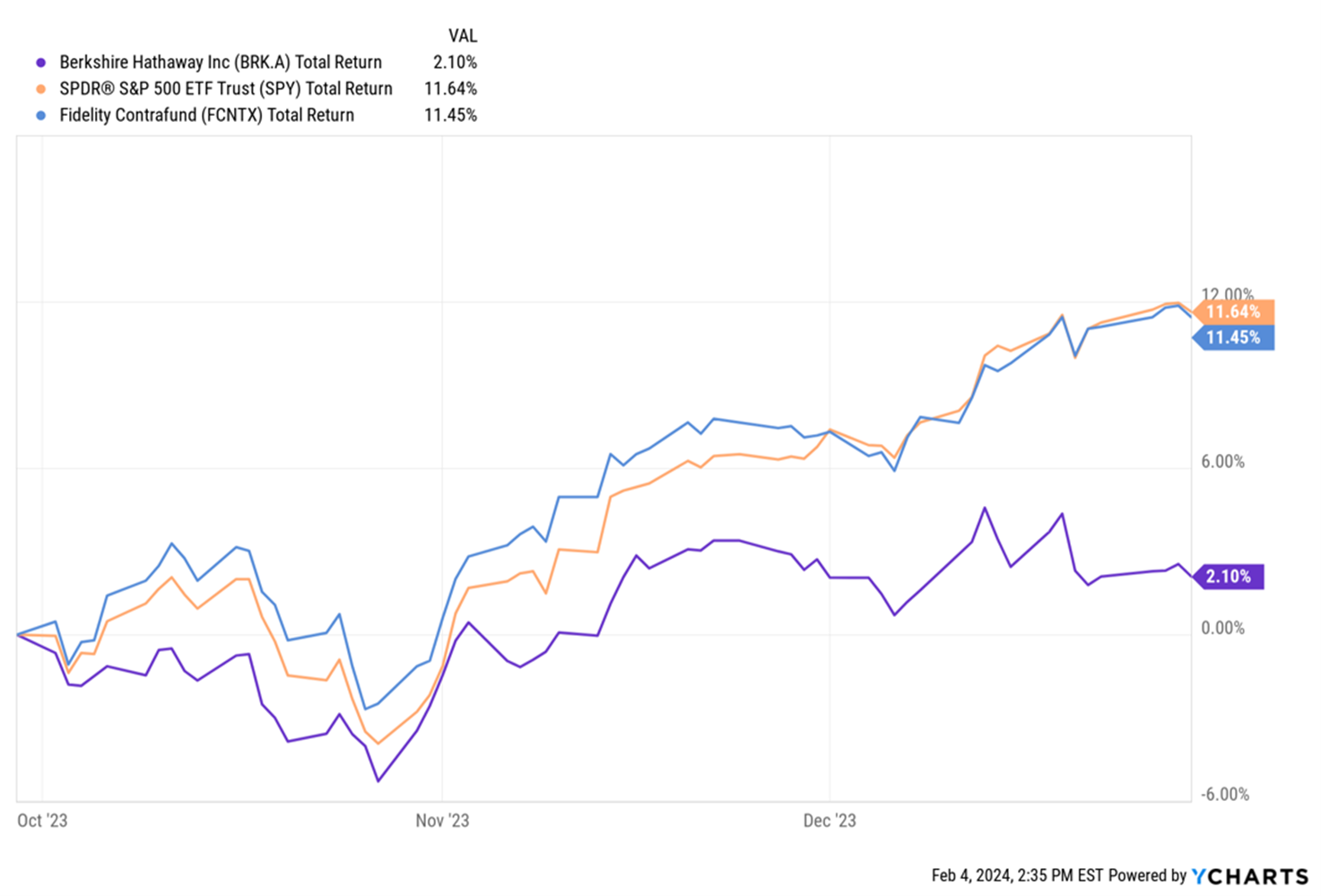

I constantly compare Berkshire Hathaway, the S&P 500, and Fidelity Contrafund as the three solid assets to choose from at any point in time. Berkshire had done me well in most of 2022-2023 but solidly underperformed in Q4 2023.

I’ve written about Berkshire before, so I won’t elaborate this time. But my analysis left me with a strong conviction that Charlie Munger’s passing away and Buffett’s charitable giving of Berkshire stock were weighing down the stock.

Faced with underperformance from Berkshire, I decided in December to add to the stock as a way to get long the US equity market. Most of my US Equity allocation today is in Berkshire. I wrote about this in my January column as well. We shall see how it goes.

Outside the US Equity bucket, all of my International Developed Markets and Emerging Market Equities are Actively Managed.

In International Equities, I hold:

MOWIX: Moerus Worldwide Value Institutional: The team at Moerus, led by Amit Wadhwaney, is unapologetically value-focused and has done a fantastic job over the last few years. They have a global mandate but are mostly invested outside the US which fits my book for diversification.

SIVLX: Seafarer Overseas Value: Under Paul Espinosa, this fund is a slow and steady horse. It needs a better value climate to fully flourish.

In Emerging Market Equities, I hold:

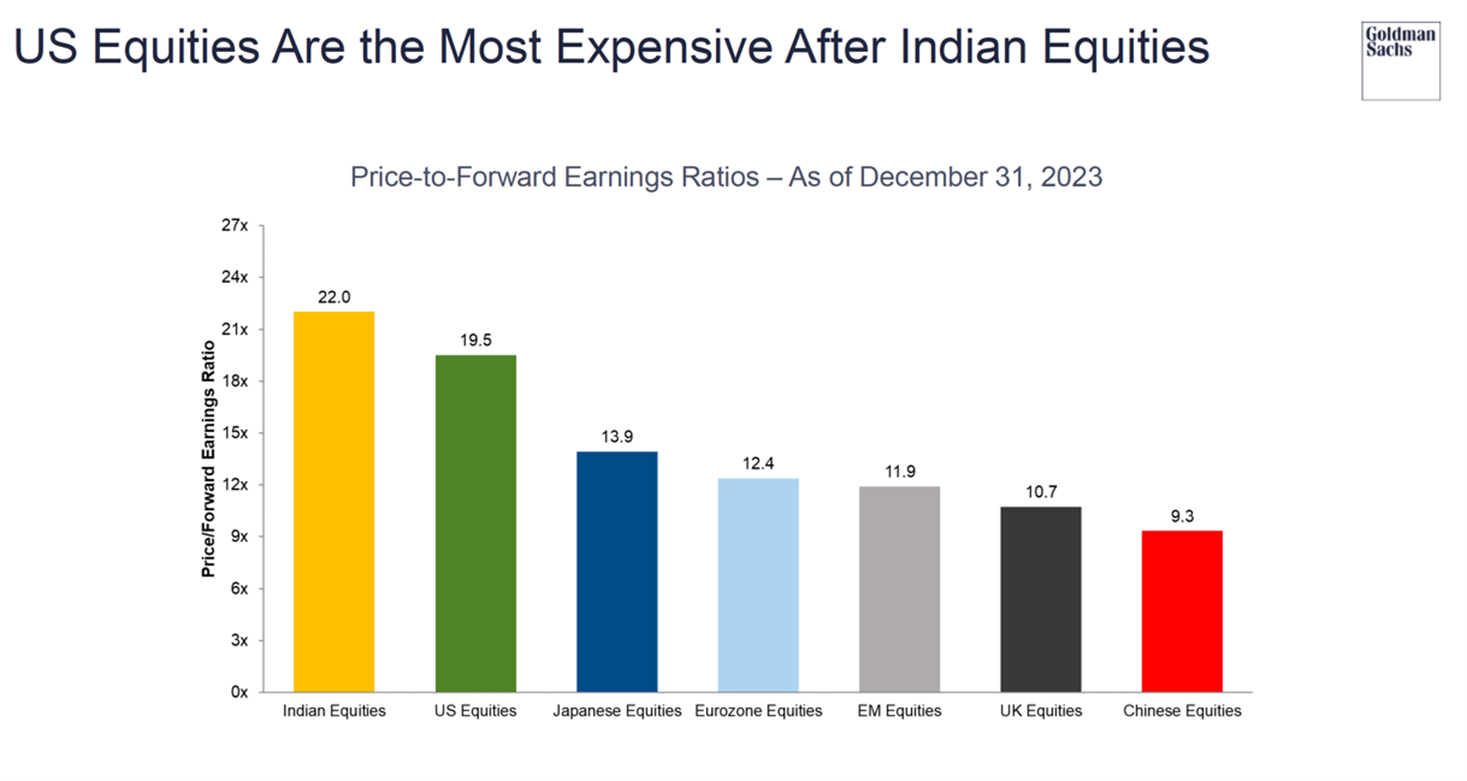

India Private and Hedge funds: Through my friends at Mumbai-based, ChrysCapital Private Equity, and Singapore-based Duro India Opportunities Fund, India continues to be a substantial equity holding for me. However large sections of Indian equities look frothy and even pricier than US stocks. A new investor in India must wait for an external shock now and buy on corrections. Local money is captive and is gushing into stocks, and one needs to be very careful buying India here. If holding for 10 years, it’s ok, but people always have a long-term view and panic in the short run. Instead, wait for the panic to buy/add.

In addition, I hold three mutual funds:

- APDYX: Artisan Developing World Advisor

- PZIEX: Pzena Emerging Market Value

- SIGIX: Seafarer Overseas Growth and Income

I consider Lewis Kaufman at Artisan to be a consummate Growth Equity investor. Rakesh Bordia at Pzena and Andrew Foster at Seafarer are the steady Value hands. Seafarer needs a wave of good luck. Andrew is one of the most even-keeled EM investors I’ve met. He will have his day in the sun soon. A balance of two growth and two value EM managers would be perfect. I need to look into and find an opportunity to add to GQGIX (GQG Partners Emerging Market Equities). Rajiv Jain is running the finest equity shop these days. This would be the 2nd of the growth managers I’d add.

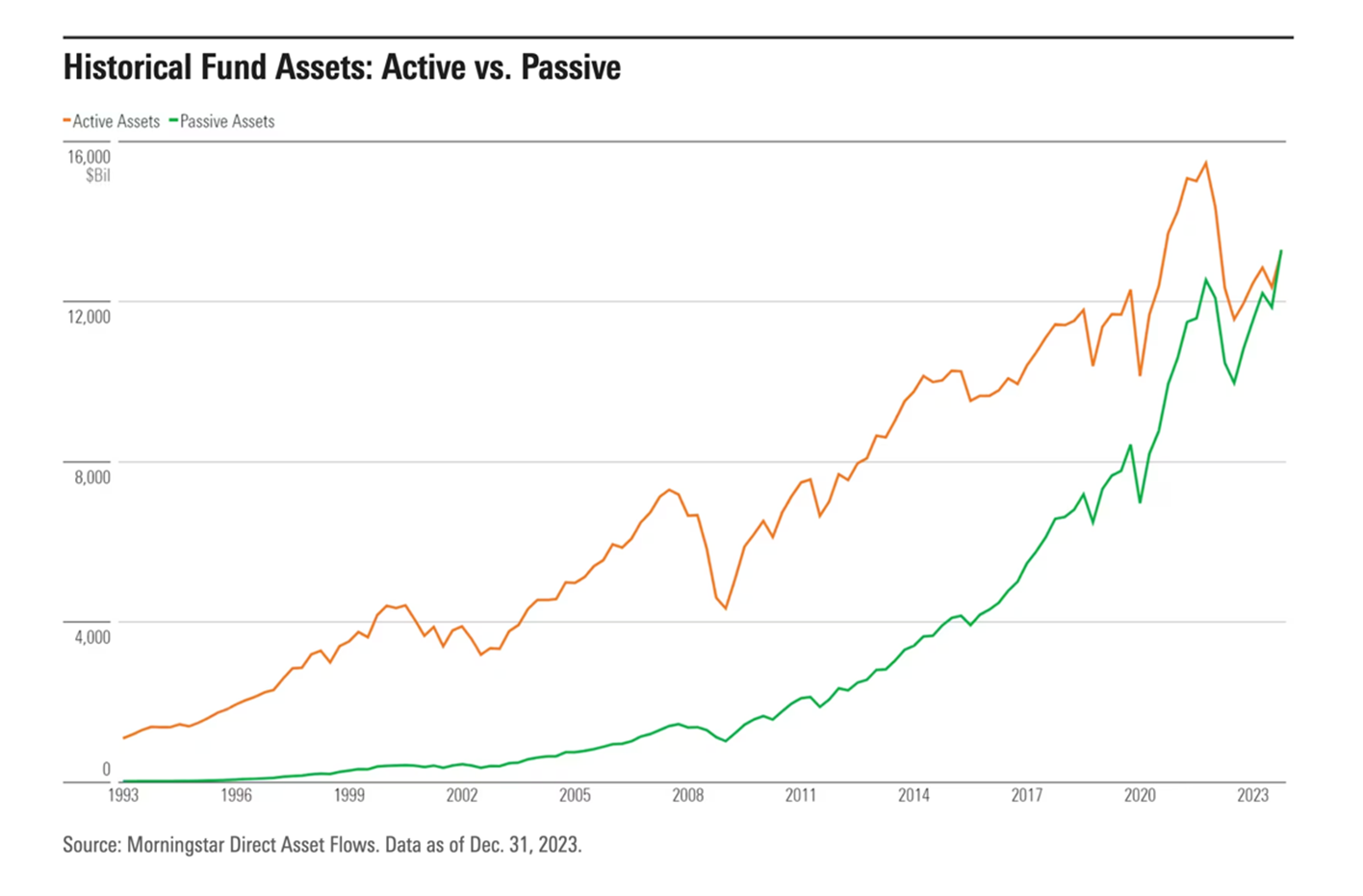

I recently read in a Morningstar column by Adam Sabban, “It’s Official: Passive funds Overtake Active Funds”, that International Passive funds have now taken over International Active funds in AUM. That’s a mistake. International Passive is a dog with fleece. I was wrong 2-years ago when I thought Passive was the way to go everywhere. Passive is still ok in the US but a real problem in EM and internationally.

Small Cap Value:

I am not a good small-cap investor. I don’t understand how the market values very small companies. Everything looks tasty in small caps. I have no idea how to distinguish between two tar sands companies in Canada or coal producers in Indiana. Fortunately, I have Scott Barbee and Justin Harrison at Aegis Value (AVALX). I went to meet them in McLean, Virginia last November and was treated to a very nice Turkish lunch. We talked about Scott’s bullish views on commodities, his views on how ESG and woke investors have destroyed investor capital into tar sands and coal at the risk of energy independence for the world’s population, and why many companies in those sectors have free cash flow to mature their debt and buyback shares. All we need is for Oil prices not to collapse. They don’t have to go up; it’s enough if they stop going down.

Aegis has been investing since 1998 and they’ve made a handsome return in small-cap value stocks. Being in small caps, the fund sometimes gets volatile and has drawdowns to match. One has to decide the right allocation and hold on to the fund for the long run.

I added Aegis under EM and International given its holdings are concentrated in Commodity stocks right now. I tend to think of commodities as an alternative to the US Dollar.

What I don’t own

Before I go into Fixed Income, I’d like to mention what I don’t own. I own no allocation-based funds and no funds with Options embedded in them (buffers, dividend income…). I do not own Crypto. I don’t own any leveraged or inverse funds of any kind. I don’t own any TIPS, any long-duration bonds, or any closed-end funds. Some of these I don’t own because I am trying to avoid them. For some others, I don’t know the products very deeply yet (Closed end).

I had a teacher in high school, a Sir Vadavkar, who used to tell us, THE MORE I KNOW THE MORE I KNOW THAT I DON’T KNOW.

I’ve come to respect his wisdom with age, and I want to keep things simple in my portfolio.

Fixed Income Allocation

Municipal Bonds: As a New York City resident taxpayer, I’ve had to deeply think about how I want to receive my income. (Just as an aside, I like Berkshire Hathaway not paying me dividends and distributions. If the company can find a way to use the cash wisely, it saves me a tax burden for now.)

My bond broker from Raymond James has stitched together a thoughtful portfolio of the most highly rated NY municipal bonds. The interest from them is triple tax exempt. Municipal bonds do not behave like US Government bonds. In a recession, when Treasuries rally, I do not expect Munis to rally. Muni bonds are like rental income from houses. The payments are safe and there is no tax due. About 15% of my assets are in Muni bonds.

Treasury Bills: I hold about 2 years of household expenses in Treasury Bills. I know I am conservative, but I prefer it that way. Most people hold about 3-6 months of expenses in T-Bills, but I have a huge preference for liquidity having spent too many years where there wasn’t any cash in the bank. About 10% of my wealth is in T-Bills.

Bond Funds: I hold 4 bond funds for 10% of my portfolio. All of them are known to the MFO community.

- CBLDX: CrossingBridge Low Duration High Yield Fund

- RSIIX: RiverPark Strategic Income

- APFOX: Artisan Emerging Market Debt Opportunities

- OSTIX: Osterweis Strategic Income

I like the low duration, high-quality managers, and high coupons from these funds. If I was a non-taxable entity, I would hold a lot more of my wealth in these funds. As a NY resident, ordinary income from these funds is punitive. Ordinary income is taxed at high rates and increases my tax brackets. A certain fund manager I’ve interviewed before likes to make fun of me for trying to manage my tax bill. Be patient, my friend. I have young kids who need new shoes all the time. I need a few more years.

If I could add in one place, where would I add?

I find commodity stocks cheap. I’ve seen them much cheaper and much more expensive than their current price. But I feel that the combination is different this time. They are working off debt and buying back stock and have a large free cash flow. Unfortunately, I don’t have the confidence to buy commodity stocks like Buffett has confidence in buying Occidental. There are days when I do thank myself for knowing I am stupid and not going with my instincts. But I can do better, and more research is called for.

What do my friends say I am doing wrong? What are my friends doing that’s different?

“All of it”. “It’s not enough that I win, my friend must fail 😊”…they say

Some of my friends think that my equity exposure, especially US equity exposure is too high. They find Berkshire Hathaway too complicated to analyze. They are ambivalent about the mutual funds.

They find US stocks prohibitively expensive. They like international stocks. “Find my names that don’t report their annual statements in English.” They like Japan, especially corporate restructuring, and value Japan. They like Mexico.

Within the US, they like Russell 2000, which has been on the short side of the Tech-small cap long-short hedge fund trade. They believe if the equity market continues to hold up, the Russell has to start playing.

That’s all folks!

Happy portfolios are all alike; every unhappy portfolio is unhappy in its own way.