Introduction:

In the March 2024 MFO, I introduced the two main developments in Options in recent years.

Zero-Day Options and Options-Based Funds. We learnt about the history of options, the market players involved and benefitting from Options, and started getting deeper into the Funds.

In April MFO, through the 2nd and 3rd articles in the series, I hope to dive deeper into Options-based funds.

In this article, I want to understand the motivations of the investors in these funds and of the fund managers involved. We want to look at a small selection of these funds qualitatively so we can appreciate the diversity within the Options Based Fund universe.

From Stocks & Options to Options-based Funds

Options buyers have one of two goals in mind: leverage or protection.

Option sellers are on the other side of this coin. By underwriting protection or leverage, option sellers are rewarded with option premium, which is repackaged and called “income” by some.

Options-based funds have two components:

- The first is to pick an equity sleeve: S&P 500 Index, Large Caps, Value stocks, Nasdaq, Actively Managed or Passive, etc.

- The second is to repackage the three themes of options market players: leverage, protection, and income.

Every Options fund is a combination of an Equity Sleeve and an Options strategy.

A Twist in Time

Equities are considered permanent instruments. If a company survives in its current form, the stock lives on permanently. Once an investor buys a stock, there is nothing further to do to preserve the status as a partial owner of the enterprise and earn its profits and dividends.

Not so with Options. Each Option comes with a time frame. Zero-day options literally expire the same day (0 days). A 1-year option expires after a year, etc.

A Twist in Strike/Price

An investor is a long stock at whatever price they buy the stock.

Not so with Options. Each Option comes with a Strike Price. At the Option expiry, one compares the Strike price of the Option vis-à-vis the then Stock price to determine if the Option expires in-the-money or out-of-the-money.

Options-Based Funds: All this activity must mean Options Funds are Active Funds

Options-based funds have to make 4 choices (maybe 5 choices)

- What’s the equity sleeve going to be?

- Is this fund going to provide leverage, offer protection, or earn income?

- What’s the maturity of the options expiry the manager chooses?

- What’s the strike price of the options the manager chooses?

The 5th choice: Should the options traded match the Equity sleeve?

But why do we need Options Based Funds? (a) Financial Democratization

Despite the exponential increase in options volumes over the decades, many investors have not participated in options. The jargon, the pricing, the trading and execution, and a host of other obstacles have kept investors away.

The goal of the management teams offering Options-based funds is to continue on the journey of options democracy. If professional fund managers can offer their options skills, end investors might get the benefit from the power of options without paying the cost of education. Instead, the cost is paid through a fund management fee. This is not much different than Active or Passive Funds charging investors a fee to put together a long Equity or long Bond portfolio we call a “fund”.

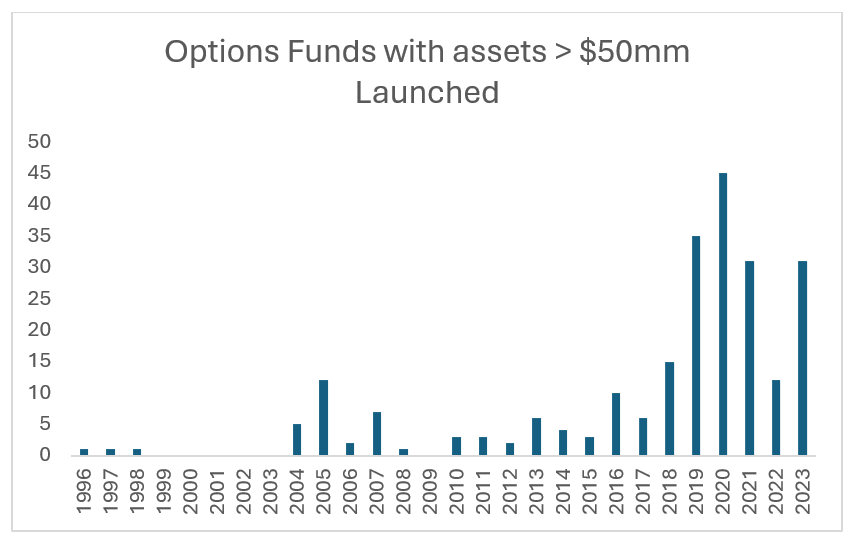

As the chart below shows us, Options-based funds have picked up momentum starting in 2018. The Y-axis shows the number of Options funds with current assets greater than $50mm started in each year.

But why do we need Options Based Funds? (b) A different way to achieve Portfolio Smoothing

Many of the readers will be familiar with a 60/40 Stock-Bond portfolio. When Stocks zag, the hope is that Bonds will zig. Together, the portfolio will be smoother. By diversifying across asset classes (stocks and bonds), and within asset classes (portfolio of stocks), an investor hopes to earn the risk premium embedded in asset classes while smoothening the ride.

Options Based Funds offer yet another approach to Portfolio Smoothing: 10 funds close-up

I asked @yogibearbull to define Beta of an ETF/(stock portfolio) to our readers.

He wrote, “beta of an ETF comes from linear regression of monthly returns with monthly benchmark returns (SP500 for US equity funds). Beta is the slope, or short-term volatility; alpha is the intercept, or manager’s magic. An ETF with beta of 0.80 means that if SP500 went up +1% that day, the ETF will likely go up +0.80%.”

Broadly speaking, the lower the beta of a portfolio, the lower the volatility. While a 60/40 lowers the portfolio’s overall beta through the negative correlation between stocks and bonds, Options funds lower the beta through the selection of the Active Sleeve and the Options strategy.

For example, JHEQX, the JP Morgan Hedged Equity Fund, an $18 Billion fund, has been around for 10 years. Here are the annual betas of this fund according to Portfolio Visualizer:

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 ytd |

| Beta | 0.56 | 0.48 | 0.61 | 0.24 | 0.39 | 0.53 | 0.30 | 0.45 | 0.41 | 0.55 | 0.43 |

The Beta of JHEQX to the S&P 500 has never been higher than 61%. In fact, the average Beta of the fund since 2014 has been 43%.

Thus, this fund would never make 100% of the returns of the S&P on the way up AND would never lose as much as the S&P on the way down.

For many investors, this lower beta is IMPORTANT. Why?

To be candid, investors want to both be in US equities and not fully committed. Investors are willing to trade off some return for a smoother path.

Options Based Funds thus offer the promise of smoother returns.

The Many Shapes and Sizes of Options Funds:

| On S&P 500 | On NDX | On Singles | On Global | |

| Overwriting/Income | JEPIX/JEPI, GATEX, GSPKX, DIVO | JEPQ, QYLD | TSLY, NVDY, YieldMax ETFs | EXG, ETW, BOE |

| Hedged Equity | JHEQX, JHQDX, BUFR | CIHEX | ||

| Put underwriting | GLSOX, IRONX |

This table is another way to show the different strategies employed by Fund managers and the different equity sleeves. There are over 300 funds, so, this is just a gross classification. Each fund is built differently.

By Size

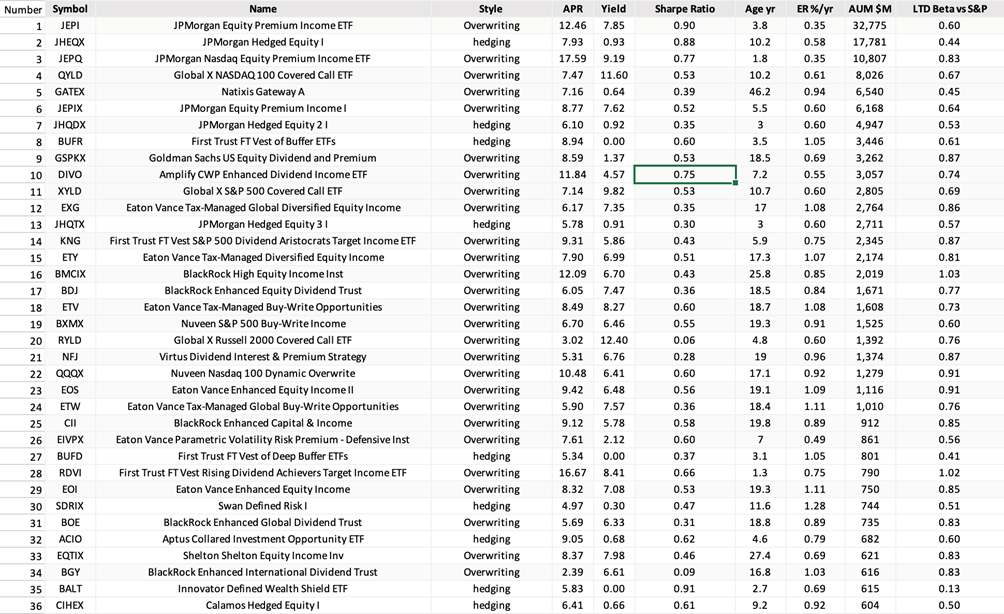

These are 23 funds with over $1bn USD AUM. I’ve created a table with the top 36 funds with assets of $600 million and higher.

Take a close look at the 4th column labeled APR (Annualized Percent Return).

Some funds like RYLD (Fund #20) have returned only 3.02% a year.

Others like JEPQ (Fund #3) have returned 17.59% per year.

We also see that Yields (5th column) and Sharpe ratios (6th column) vary dramatically across funds.

Options funds are quite different enough in their make-up, which explains the differences in Returns, Yield, and Sharpe Ratios.

One thing we can rely on to be similar for all these funds is an Expense Ratio that’s more in line with Actively Managed funds. 83bps average of all the funds in the group excluding the largest ETF, JEPI (Fund #1), which has a reasonable expense ratio of only 0.35%.

Let’s take a closer look at some of these funds. I’ve tried my best to capture the essence of the funds. I am taking a little liberty with the details to keep us moving:

- JEPI and JEPIX: JP Morgan Equity Premium Income (#1 and #6 above)

The Open-ended fund, JEPIX was launched in Sep 2018, and the ETF, JEPI, in May 2020. Together they hold almost $39B in assets. While the stock portfolios are slightly different between the fund and the ETF, they are the same to us. JEPI has a lower Exp. Ratio than JEPIX.

The funds hold a low beta, low volatility stock portfolio. They intend to pick stocks actively and hold about 130 stocks (not the 500 stocks in the S&P 500). Each week, the fund sells an ~2% Out-of-the-money call on the S&P 500 on ~ 20% of the Notional portfolio.

Such a fund employs a strategy known as “Covered Call Overwriting”. By selling calls on 80% of the portfolio at any given time, they hope to earn income from the option premiums. Along with the dividend earned on the underlying stocks, these funds have a high distribution rate of between 8 to 12% since inception.

Why does this fund attract money: Investors like steady distributions from dividends and call premiums. They like the idea of picking stocks that have a lower beta than the SPX. Investors understand their upside is capped in exchange.

- DIVO: Amplify CWP Enhanced Dividend Income ETF (#10 above)

DIVO with $3B in Assets also uses a Covered Call Overwriting. It has even fewer stocks in the portfolio (28 stocks). DIVO writes 1month call options on some of these stocks (about 7 or 8 stock options).

We start seeing how these products differ. One writes calls on the S&P 500 Index, and the other writes call options on some individual stocks.

One holds a low beta portfolio of 130 stocks, the other holds only 28 stocks.

- GSPKX: Goldman Sachs US Eq Dividend and Premium (GSPKX) (Fund #9)

Been around since 2005 with assets of about $3.5B. This fund is a Covered Call Overwriting similar to JEPI/JEPIX. It holds 280 actively picked stocks and sells Call Options on the S&P 500 Index. The fund tries to preserve the upside by overwriting ~40% of the Notional portfolio. When future volatility is high, and call prices are thus higher than average, the fund may sell as little as only 15% of the Notional in call options.

- BDJ: Blackrock Enhanced Dividend Trust (Fund # 17)

This is one of various Blackrock funds that offers call overwriting along with long equities. 80% of the $1.7 Bn fund is invested in US Equities and the remaining 20% in the UK and Europe. This fund’s equity sleeve holds more than just US stocks, which makes it different than the funds above. The fund overwrites a part of the portfolio by selling 1-2 month calls on a fraction of the stocks. Like many other overwriting funds, Blackrock’s Investment approach for this fund is built on 3 pillars: Portfolio built on Dividend growth, Focus on High-Quality Companies, and Seeks to Reduce Portfolio Volatility.

- JEPQ: JPMorgan Nasdaq Equity Premium Inc ETF (Fund #3)

As the name says, the fund is the Nasdaq 100 equivalent of JEPI and JEPIX (Fund #1 and Fund #6). The underlying stocks are Nasdaq 100 stocks (it actually holds 87 stocks and Nasdaq futures) and it writes call options on the Nasdaq 100 Index. The fund has $11.4B in assets.

- QYLD: Global X NASDAQ 100 Covered Call ETF (Fund #4)

Similar to JEPQ in that the fund holds Nasdaq 100 stocks. It sells a 1-month Nasdaq At The Money Spot calls (that is, each month it sells a call on the Nasdaq close to the level of the market at the time of trading the call option). QYLD has $8.1B in assets.

Each of these funds is a painting. The fund manager decides which underlying stocks to buy, hopes they have some alpha in stock picking (or they might own the passive index), collects dividends, decides whether to sell call options on the S&P 500, on the Nasdaq 100, or on a small section of the stocks, what percent of the notional portfolio to overwrite, and the length of these options. Given the Assets held by these funds, it’s safe to assume that people want to invest in these call overwriting, income-generating, funds.

I’ve only pointed out a few of the larger buy-write funds focused on US stock portfolios. There are similar funds on Emerging Markets, on International Indices, and on Global Indices. Almost every bank offers their clients direct exposure to buy-write strategies through Over-the-counter structured products. The sizes involve dwarf the sizes in these listed funds. Before we close out the buy writes, I’d like to point out a fund strategy that is starting to accumulate assets quickly.

- YieldMax ETFs: TSLY, NVDY, APLY, CONY, OARK… (not in the table above)

These funds own just one stock or ETF each – Tesla, NVIDIA, Apple, Coinbase, ARKK, etc. Each week they write out of the money call options expiring on the coming Friday.

Their idea is to take the call overwriting and the distribution from option income to the extreme. As an example, NVDY, YieldMax™ NVDA Option Income Strategy ETF, a $ 300mm fund holds $300mm of NVIDIA stock and sells $300mm of weekly calls. Over a year, if volatility stays high, the fund will overwrite NVIDIA 52 times (52 weeks). The distribution rate will be 109.59% (that is if you take what the fund pays out in income from options sold and multiply by 12).

TSLY, YieldMax™ TSLA Option Income Strategy ETF, has an annualized distribution rate of 62.7%.

What’s going on here? There is a lot of options speculation. Billions are being spent on Options by all stripes of investors. This fund wants to sell to those buyers. There’s now over $2B in the over 15-20 ETFs offered by this fund family.

A recent article pointed to 2 approved ETFs that will overwrite Zero-day options daily. If you like weekly overwriting, you are going to love daily!

Moving on, we next look at some Hedged Equity Funds now.

How is a Hedged Equity fund similar to and different than the Call Overwriting funds?

The similarity is in the Equity sleeve, or the underlying stocks, indices, or baskets held by Hedged Equity Options fund. Just as the Overwriting funds could own either the S&P 500, or the Nasdaq, or a small group of stocks, or an international index, the same goes for Hedged Equity funds. They could be passive or actively picked stocks.

The difference is how the two categories use Options. Overwriting funds only sell calls. Hedged Funds use Options to provide a downside buffer. Many funds are buying Puts or Put Spreads to control the losses of the Equity Portfolio. Most of these funds will sell Calls to finance some or all of the costs associated with buying the Puts or Put Spreads.

By adding Puts/Put Spreads, the fund manager hopes to dampen the effects of selloffs on an equity portfolio. For some investors, smooth returns are more important than large returns. Although it is the job of equities to generate volatility on the way to earning compounded returns, not everyone can take the volatility punches.

- GATEX: The Natixis Gateway Fund has been around since 2001 (Fund #5)

This $ 6.5B AUM fund owns 219 actively picked Stocks + a put collar. A put collar is a combination of long put and short call.

The fund sells ~ 2-month S&P 500 call options, which are ~2% out of the money (that is, 2% above the market level at the time of selling the options), and it does so on 95% of the notional value of equities held.

The fund also holds Put Options on about 95% of the portfolio. The fund has bought puts on the S&P 500 Index, which are ~ 2 ½ months out and ~ 6.5% below the market level.

- JHEQX/JHQTX/JHQDX: JPMorgan Hedged Equity, Hedged 2, & Hedged 3 Fund (Fund #2, #7, and #13)

These are three different JP Morgan funds, very similar to each other, and separated only by a small twist. Together, they have $25 Billion in Assets, making them one of the biggest strategies in the market. All 3 funds hold around 170 US large-cap stocks (thus, actively managed).

If we dive deeper into one of the funds, JHEQX, which has been around since 2014, we see the fund owns a “Put-Spread-Collar” (PSC). The fund owns a 3-month hedge by buying a 95% Put, selling the 80% Put, and financing this Put-Spread with a Call so the out-of-pocket is zero at the time of the trade. This Strike of the call depends upon the cost required to purchase the 95-80 Put Spread.

The idea is that an investor in this fund:

- Holds Actively Managed Large Cap Equities (more or less like the S&P 500)

- Earns the dividend

- Takes the stock market risk for the 1st 5% of the portfolio

- Is protected starting 5% all the way to 20% sell-off in the market

- Then, takes all of the downside once again after 20%

- Caps Equity upside at approximately 6% from the current level

JHEQX executes this Put Spread Collar every 3 months in Dec, March, June, and Sep.

The other funds, JHQTX and JHQDX, do it Jan, April, July, October and Feb, May, Aug, Nov respectively. There are no other conceptual differences between these funds.

Having $25 Billion in a strategy is no joke. This tells us that the market yearns for a product like this. Thus, we now see hundreds of funds that offer some kind of “Hedged”, “Buffered”, “Capped”, “Protected” in their investment mandate.

- BUFR: First Trust FT Vest of Buffer ETFs (Fund #8)

A final example of a Hedged fund is BUFR. The ETF itself is made up of 12 monthly ETFs, so it’s a fund of funds. It owns an equal 8.33% weight in funds FJAN, FBEB, FMAR….FDEC.

FJAN is itself made up of only four 1-year options. If we peel the union FJAN is:

- Long the S&P 500 Index (it does this through options)

- Long a 100-90 Put Spread (as opposed to the 95-80 Put spread we saw above)

- Short a Call 13-14% above the market

Because it holds no stocks at all and replicates its long S&P 500 Index exposure through Options, there are some funky things this FJAN and thus BUFR can do which improve tax treatments for a very specific group of investors.

FJAN alone has $750 million in Assets and BUFR has $3.5 Billion in assets.

The same fund manager offers Buffer, Moderate Buffer, and Deep Buffers for every single month and tens of other ETFs.

Diversity of the Many

Each of these funds is a painting. The fund manager decides which underlying stocks to buy, hopes they have some alpha in stock picking (or they might own the passive index), collects dividends, decides whether to sell call options on the S&P 500, on the Nasdaq 100, or on a small section of the stocks, what percent of the notional portfolio to overwrite, and the length of these options. In the Hedged funds, the manager will want to own puts or put spreads along with all of the above.

Conclusion

The goal thus far in the article was to pick out some large funds and show how they are similar and different to each other. I hope the reader has a sense of the diversity in these funds.

Diversity and variety are a good idea, but does it make money? Is it financially good? How can we compare such different funds to decide if they are a smart investment?

We hope to look at that in the 3rd article.