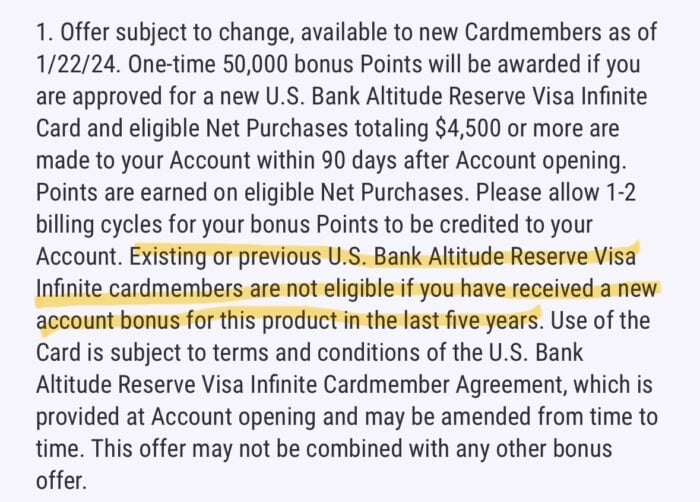

2024.4 Update: The terms&conditions has been updated, and this card is now churnable. You just need to wait for 5 years since the previous welcome bonus. HT: USCardForum See.

2022.9 Update: This card used to require existing US Bank relationship to apply online. Now the requirement is removed. However, it is still recommended to have a US Bank checking account before applying in order to significantly improve approval chance.

Application Link

Benefits

- 50k offer: earn 50,000 bonus points after spending $4,500 in first 90 days.

- Points are worth 1.5 cents/point (fixed value) when redeemed for travel via “Real-time Rewards”. So the 50k sign-up bonus is worth about $750.

- $325 annual travel+dining credit per cardmember year. It can be used for travel purchases made directly from airlines, hotels, car rental companies, taxis, limousines, passenger trains and cruise lines; or for dining purchases including dining-in and take-out. Note that unlike other premium credit cards, the travel credit is calculated per cardmember year, so you can only get travel credit ONCE during the first cardmember year.

- Earn 3X points for every $1 on mobile wallet spending, including Apple Pay/Google Pay/Samsung Pay, etc.

- Earn 3X points for every $1 on eligible travel purchases. Earn 5X points on prepaid hotels and car rentals booked directly in the Altitude Rewards Center.

- Earn 1X points for every $1 on other purchases.

- [Update] 8 free visits to Priority Pass Select (PPS) lounge per Priority Pass Select membership year (not Cardmember year). You can also bring guests, but they count towards the visit times.

- This is a Visa Infinite card, and it has most of the Visa Infinite benefits (but not including Visa Infinite Discount Air).

- Visa Infinite Hotel Collection

- Visa Infinite Hotel Privileges

- Visa Infinite Car Rental Privileges

- Minimal credit limit is $5,000 (compared to $10,000 for typical Visa Infinite Card).

- 12 complimentary Gogo inflight Wi-Fi sessions per calendar year.

- Up to $100 credit for Global Entry or TSA Pre application fee.

- 6 hour trip delay insurance.

- No foreign transaction fee.

- No annual fee for authorized users. The authorized user card is basically useless though. It does not come with a separate free PPS card (“Enrollment with no membership fee is limited to one Cardmember per Account (including authorized users)”).

Disadvantages

- Annual fee $400, NOT waived first year. $75 annual fee for each authorized user. Note that the annual fee does not count towards the minimum spending requirement (and this is true for all credit cards)!

- Free PPS lounge visits are limited to 4 times per year, unlike other premium cards which usually do not have times limit.

Recommended Application Time

- We recommend you apply for this card after you have a credit history of at least two years and you are very comfortable with the credit card game.

- You are not eligible for the welcome bonus if you have received the welcome bonus in the last 5 years.

- This card used to require existing US Bank relationship to apply online. Now the requirement is removed. However, it is still recommended to have a US Bank checking account before applying in order to significantly improve approval chance.

Summary

This card is featured to have 3x (~4.5%) rewards on mobile wallet spending, which is especially useful for people using Samsung Pay. The effective annual fee is only $75 which is pretty impressive, but the downside is that the travel is reset per cardmember year not calendar year. From the past experience, US Bank is likely to cut some of the above benefits in the future, so please take the chance if you would like to enjoy them.

A lot of data points show that US Bank may shut down all your accounts if they think you purchased too many GC, and we are not clear how they define “too many”. So it’s better to avoid GC, and especially don’t purchase large amount of GC to earn 3x on mobile purchases.

Best Downgrade Options

Related Credit Cards

After Applying

- To check the application status, you can visit this webpage or call (800) 947-1444. If you see the 7-10 days message, it just means they will do a manual review and the outcome could be either approved or denied.

- US Bank reconsideration line: (800) 947-1444.