“Bits and Pieces” is a collection of things that I have learned over the past few months. David Snowball suggested that I write articles about transitioning into retirement. This “Bits and Pieces” article contains a few recent insights resulting from these articles.

This article is divided into the following sections:

BERKSHIRE HATHAWAY as a mutual fund

I wrote an article about Berkshire Hathaway stock last month in the Mutual Fund Observer newsletter, “If Berkshire Hathaway was a mutual fund, what would it be?” Charles Boccadoro informed me of the risk and performance for BRK.A is available in the MFO Multi-Screen tool. He points out that Berkshire Hathaway has the advantage of not having an expense ratio like funds, and can hold large amounts of cash, but more importantly in my opinion, is that it has no taxable distributions until you sell it which can defer income and proceeds from sales will be taxed at the lower capital gains rates if you hold it for more than a year. Charles adds that there are 443 funds that hold BRK.A or BRK.B share classes.

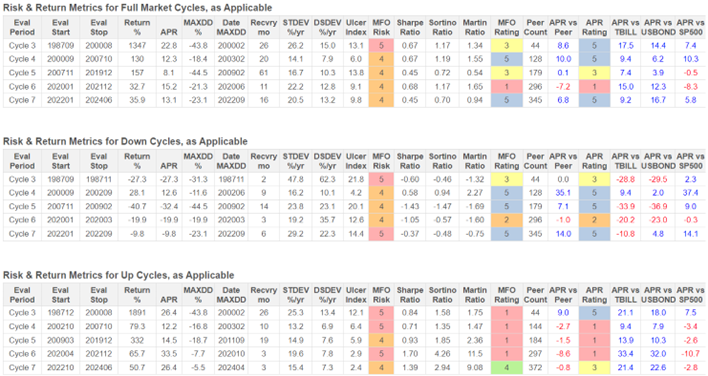

I created Table #1 using the MFO Compare Tool to show the performance of Berkshire Hathaway to the S&P 500 over Full Market Cycles, Down Cycles, and Up Cycles. My first observation from the Full Market Cycle section is that BRKA outperformed the S&P 500 by 7 to 10 percentage points annually from 1987 until 2007, but underperformed by less than one percentage point from 2007 to 2019. My interpretation of the recent modest underperformance is that easy monetary policy and Quantitative Easing lowered interest rates and inflated some equity prices while government spending during the financial crisis and pandemic prevented or reduced the severity of recessions. Mr. Buffett is a value investor.

My observation from the Down and Up Cycle sections is that Berkshire Hathaway outperforms the S&P 500 during Down Cycles but underperforms during Up Cycles. Holding cash to buy at lower valuations is a key part of Berkshire Hathaway’s strategy. Secondly, when interest rates are higher, as they are now, the holding costs of cash equivalents are lower.

Table #1: Berkshire Hathaway (BRKA) Performance

While writing this article, on Wednesday, July 24th, the S&P 500 fell 2.3%. BRK.B fell only 0.28%. Berkshire Hathaway is on my “Watchlist to Buy” next year. I want to own it in a tax-efficient brokerage account. The reason that I am waiting to buy is that selling other funds to buy it will generate taxable income for this year.

TAXES ON SOCIAL SECURITY

When I was working full-time, taxes were annoying but pretty straightforward. As a retiree, I was appalled to discover that they’re now annoying and complicated.

One change going from being employed and having taxes withheld automatically to being a retiree is that I have to make estimated tax payments to avoid penalties and interest on amounts underpaid on Federal and state taxes. Last year was my first full year of retirement, and working internationally the prior year along with deferred compensation had a modest unexpected increase on my Federal and state taxes owed along with a potential Medicare income-related monthly adjustment amount (an “IRMAA,” which is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income) that I want to avoid.

This year, I started taking Social Security Pension Benefits. Federal income taxes may be owed if your combined income exceeds $25,000 per year filing individually or $32,000 per year filing jointly. For more information, I refer you to, “IRS Reminds Taxpayers Their Social Security Benefits May Be Taxable”.

My plans include continuing to do Roth conversions gradually over the next three years before the required minimum distributions start. This avoids higher tax brackets and large increases in the Medicare IRMAA.

I am overweight in tax-deferred assets because of the types of accounts available during my accumulation stages. I switched to investing in Roth IRAs around 2007. Having assets spread across after-tax accounts, tax-deferred accounts like Traditional IRAs, and tax-exempt accounts like Roth IRAs allows an investor the flexibility to withdraw from the most advantageous account considering market fluctuations and evolving tax rules. It also allows flexibility in locating investments to be most tax-efficient.

IRS Form W-4V is a Voluntary Withholding Request which can be filled out and sent to the IRS to have 7%, 10%, 12%, or 22% withheld from Social Security Benefits. I like simple and put my withdrawals on autopilot.

FIDELITY PERSONAL ADVISORY SERVICES

At a Big Picture level, I follow a pretty simple investing plan (three distinct “buckets,” one for each of my major objectives). Lately, I’ve been using Fidelity services to handle some of the finetuning for me. Here’s a word about how that’s been working.

I follow the Bucket Approach with Bucket #1 for short-term living expenses, Bucket #2 mostly for covering expenses for the next ten years, and Bucket #3 which is largely for money that may be passed on to heirs (legacy). Complicating this simple concept are after-tax accounts (brokerage), tax-deferred accounts (Traditional IRAs), and tax-exempt accounts (Roth IRAs). I am overweight in tax-deferred assets and wish to have more in tax-exempt and tax-efficient after-tax accounts.

Fidelity Go is a Robo Advisor service with fees that range from 0% to 0.35%. Fidelity Wealth Management fees range from 1.5% to 0.5% for amounts ranging from $500,000 to $2 million so there is an incentive to have them manage more of our money. For $2 million managed through Fidelity, they offer the Fidelity Private Wealth Management. Fidelity describes advisory fees for Fidelity Wealth Management as:

The advisory fee does not cover charges resulting from trades effected with or through broker-dealers other than Fidelity Investment affiliates, mark-ups or mark-downs by broker-dealers, transfer taxes, exchange fees, regulatory fees, odd-lot differentials, handling charges, electronic fund and wire transfer fees, or any other charges imposed by law or otherwise applicable to your account. You will also incur underlying expenses associated with the investment vehicles selected.

Earlier this year, Fidelity ran an optimizer to determine asset allocations for multiple goals for my accounts to achieve retirement goals and accounts to achieve legacy goals. The end result was that I increased allocations to stock in accounts included in the legacy goals that will be passed on to heirs. More recently, it was a small step to enroll in the Personalized Portfolios services which manages assets across accounts to reduce the impact of taxes. Some of the accounts included in the Personalized Portfolios are self-managed where I save on management fees.

Fidelity created a personal plan (360-degree) plan with both retirement and legacy goals. Fidelity classifies my retirement asset allocation as “Conservative”. Our accounts with legacy goals are classified as “Aggressive Growth”. The major change was to switch from single account management to “Household Tax-Smart Strategies”. Fidelity provided us with a list of funds and allocations that they will be transitioning us to. One recommendation was to increase allocations to short-term fixed-income investments which I did as part of annual rebalancing.

PORTFOLIO FEES AND PERFORMANCE

It’s a good practice to review asset allocations, performance, and fees annually with spot checks quarterly. This year we asked ourselves why we were paying over 1% in management fees for a special purpose account with a balanced allocation when we could incorporate it into our overall portfolio and invest it in a single equity fund, saving management fees. We transferred it to Vanguard and are transitioning it to a tax-efficient equity fund.

We use wealth management services at both Fidelity and Vanguard. In June of last year, I wrote, “Helping a Friend Get Started with Financial Planning” about helping a friend by the pseudonym “Carol” select a Financial Advisor. She asked me recently, why I responded to her question of whether Fidelity or Vanguard was better with, “I don’t know and will tell you in about a year.” Fidelity fees are around 1% for my selection of services and assets managed while fees at Vanguard for their Personal Advisor Select are 0.3%. We have no advisory fees on investments that I manage which collectively are the more conservative.

There are several advantages to using advisory services. I gain from their expertise in asset allocation. They perform asset rebalancing. Some funds with lower fees or active management are only available to clients of advisory services. As we age, we will have cognitive decline and may need assistance. We may not have the time, expertise, or interest in managing investments or may just prefer assistance. Having a Financial Advisor may help us stick to a plan during stressful downturns. Finally, it is important to have financial advice and plans in place for our loved ones in case of our passing.

We have invested at both Fidelity and Vanguard throughout our careers and upon retirement chose to leave assets at both companies and to use the advisory services at both. We get the low-cost buy-and-hold strategy of Vanguard along with the more active business cycle approach of Fidelity along with higher fees. We keep fees low by managing a portion of the assets ourselves. After-tax performance for similar allocations is the other side of the equation. I am pleased with advisory services from both Fidelity and Vanguard but have not been with either long enough to make a reasonable comparison. We may decide to consolidate at some point.

Carol has been with Vanguard for almost a year now. I spent some time showing her how to evaluate her funds, allocations, and performance. Vanguard also manages assets across accounts as one portfolio. She was very pleased with how much she had made in the past year. I also helped her prepare a list of questions for her meeting with her advisor. She was also pleased with his responses and has a follow-up meeting.

Closing

The decline in “Defined Benefit Pensions” and the rise of tax-advantaged accounts shifted more of the financial responsibility to employees. “Financial Literacy” is important for people to know how to manage their money. Having an advisor is no substitute for “Financial Literacy” but it does ease the burden.