For professionals across nearly every industry, the transformative impact of AI is reshaping work, driving productivity, and fostering innovation. This is especially true for the tax and accounting profession.

In recent years, small and midsized tax and accounting firms have increasingly adopted automation as a key strategy for streamlining their operations.

Initially, automation efforts targeted routine manual tasks, tax preparation, and back-office functions. But with the dawn of AI, these advantages are supercharged. Let’s explore how tax and accounting professionals can prepare for the challenges of tomorrow and stay ahead of the curve.

Jump to ↓

The transformative impact of AI on accounting productivity

One of the primary benefits of integrating AI into your firm’s daily workflow is that AI-enabled tax software can analyze vast volumes of financial data in a fraction of the time it would take a human accountant — identifying patterns, anomalies and trends with precision.

In addition, AI-powered tax research can help staff find targeted search results in less time. By providing professionally summarized answers, complete with citation links to relevant editorial content and source materials, even junior staff can quickly answer complex client questions with confidence.

Gauging sentiment on the power of AI

According to Thomson Reuters’ 2024 Future of Professionals report, 77% of professionals see AI as having a high or transformational impact on careers, up from 67% the previous year. This excitement surrounding AI is palpable given the tremendous value and time savings that AI-powered technology can bring to day-to-day work. Survey respondents predict that within the year, AI could free up as much as four hours per week.

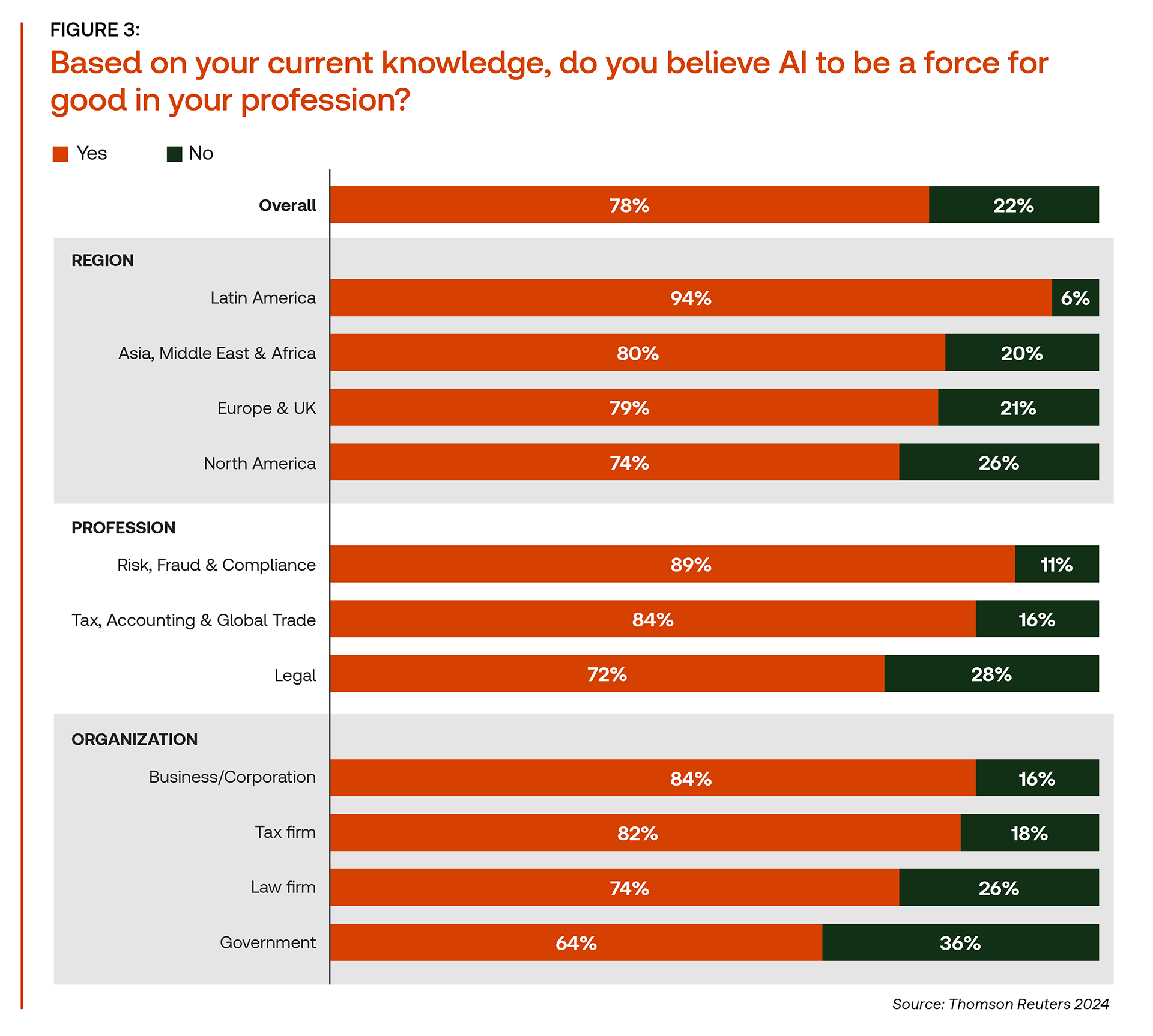

In addition, the majority of survey respondents across all industries believe AI can be a force for good — even 82% of tax and accounting professionals. However, some hesitance remains in terms of ensuring AI is used ethically and without compromising sensitive data, which are specific areas of concern for accountants.

Strategic trends for tax professionals

For accountants, AI’s unique ability to analyze data can be a transformative force. Advanced analytics like predictive modeling and forecasting can help anticipate future trends and outcomes based on historical data. This enables tax and accounting professionals to identify potential risks, opportunities, and market trends for clients.

With these advanced abilities comes a shift in mindset. By harnessing the power of AI, your firm can broaden its focus from traditional tax compliance to providing clients with meaningful insights and personalized advisory services. In an increasingly competitive landscape, this is an invaluable strategic advantage that lends itself to a more profitable and sustainable value-pricing model.

AI usage for productivity in the tax and accounting profession

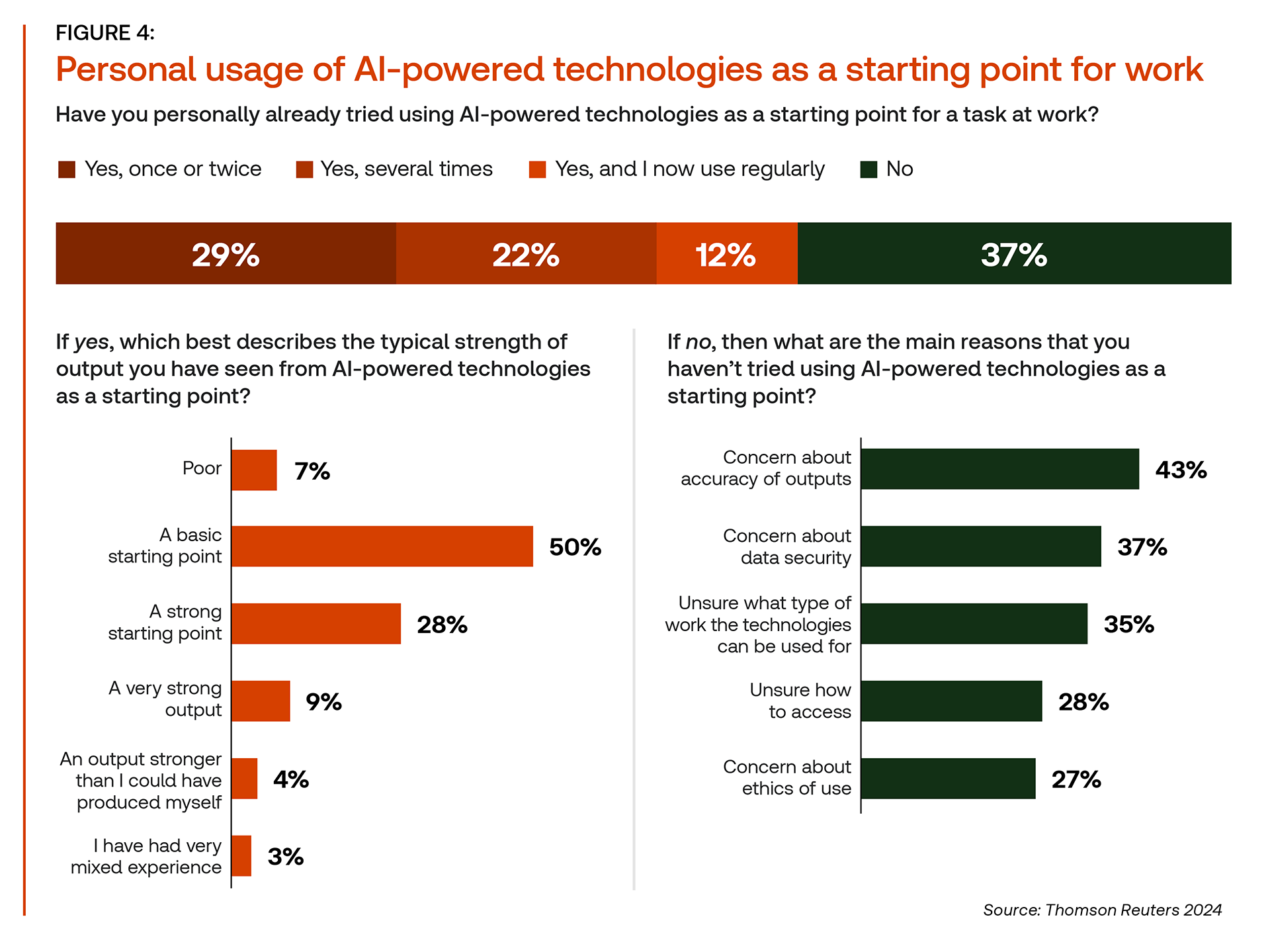

In terms of current adoption and usage of AI, 50% of those surveyed said new AI-powered technologies typically provide a basic starting point, but that they still need to do the majority of the work themselves. Another 28% said it was a strong starting point and that they just need to edit.

When it comes to tax research, AI offers significant benefits. Professional tax research typically involves multiple searches, meticulous review of relevant materials, and the creation of a cited summary that is straightforward and understandable. This can often take hours, especially for junior staff who need to vet answers through senior colleagues.

But with an AI-powered tax research solution, accountants can save time and transform tax research challenges with easy-to-digest answers synthesized from trusted resources and vetted sources, along with citations for fast verification.

The importance of responsible AI use

Even amidst all its benefits, the enormous potential of AI is tempered by concerns about data security and ethical use. Addressing these realities requires clear principles and guardrails for responsible AI usage.

Building trust in AI requires transparency, benchmarking, and standards. Educating your staff on ethical AI usage and employing only industry-specific AI-powered tax solutions can help bridge this gap while also ensuring accuracy, security, and professional safeguards necessary for tax and accounting firms.

The role of AI-driven productivity in a collaborative future

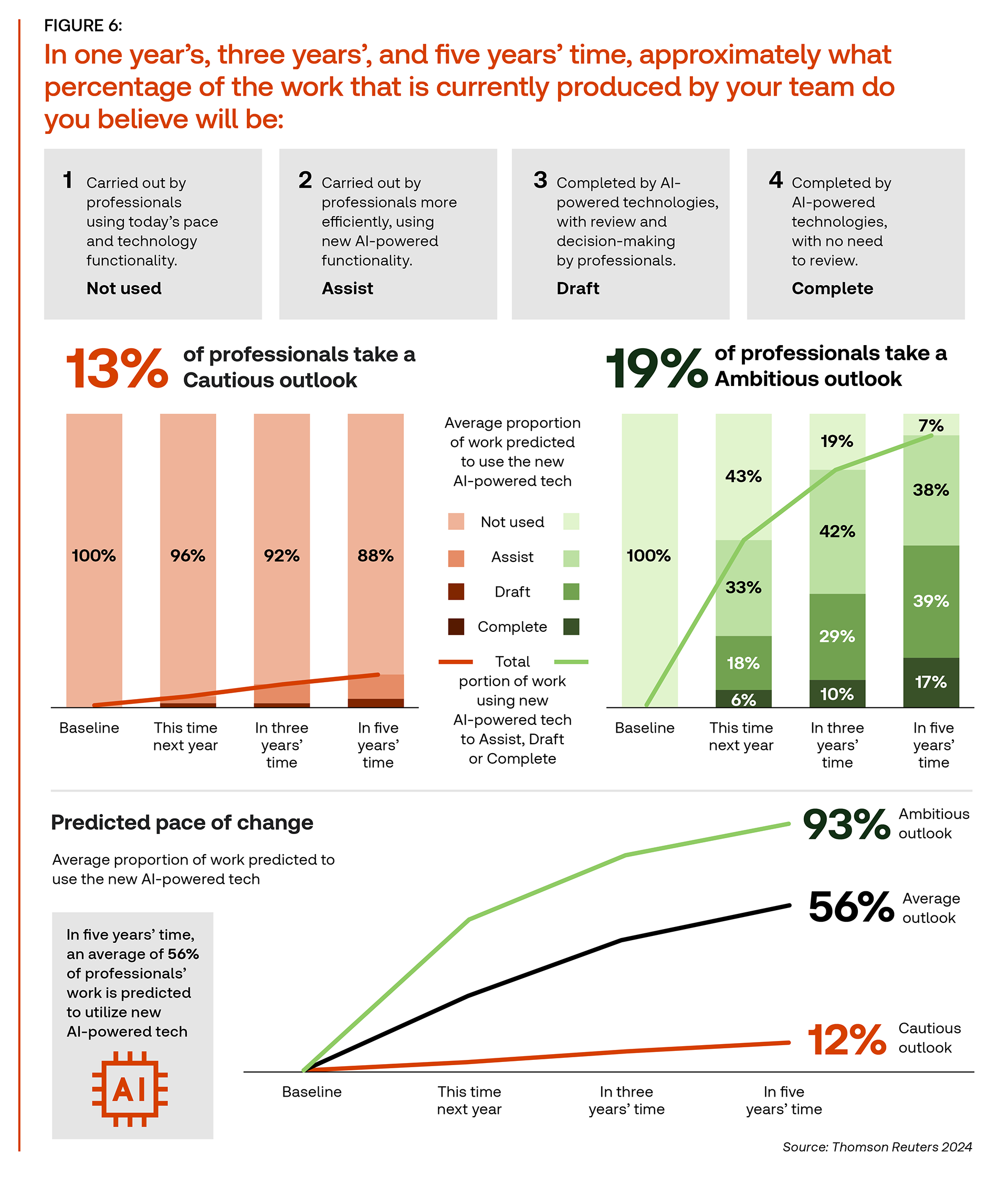

When survey respondents were asked what percentage of work currently produced by their team will be completed with AI-powered technologies, the results pointed to rapid AI adoption in the workplace with technology providers as the main influencers.

On average, professionals predict that over half of their work will utilize new AI-powered technologies to at least some extent within the next five years. From Thomson Reuters’ standpoint, it is likely that all professionals will have a generative AI assistant within the next five years to assist them in their daily work.

The future of AI for accounting firms

By integrating AI-powered tax technology, accounting firms can not only enhance their operational efficiency but also better serve clients with meaningful data-driven insights that improve financial well-being and strengthen relationships.

As AI continues to shape the future of work, accounting firms that invest in AI early can gain a competitive edge by getting ahead of the learning curve and realizing a faster return on investment.

At the end of the day, the integration of AI represents a transformative opportunity to enhance productivity, unlock new insights, and elevate the client experience. By embracing AI-driven technologies, your firm has an opportunity to be at the forefront of driving value creation and meaningful growth for both your clients and your firm.

For deeper insights and strategies to stay ahead, explore the 2024 Future of Professionals report, below.

|

|