Explore the ROI of corporate tax technology investments and strategies to simplify advanced technology adoption.

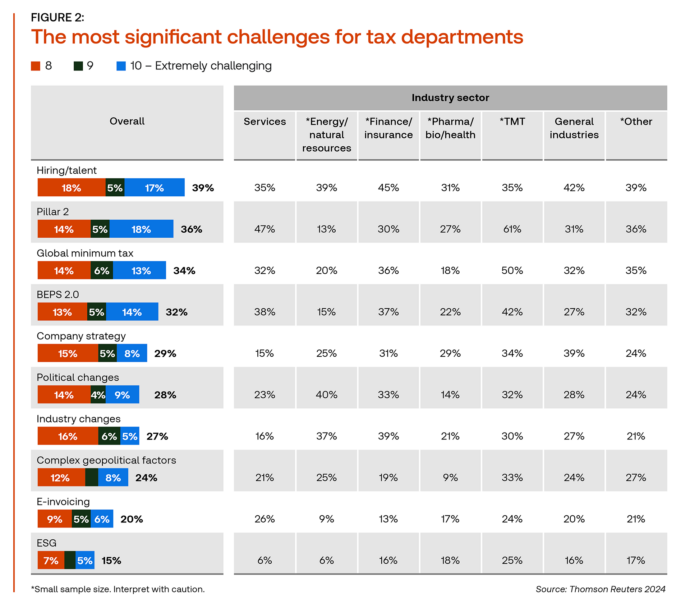

Corporate tax departments are facing mounting pressures due to a talent shortage and increasing regulatory complexities, such as Pillar 2 and Global Minimum Tax (GMT) requirements. The 2024 State of the Corporate Tax Department report by Thomson Reuters Institute highlights these pressing issues, making a compelling argument for increasing technology budgets to unlock new levels of efficiency and strategic value.

Corporate tax departments are often stretched thin, making them susceptible to audits and penalties. Currently, only a small fraction of the average tax department’s budget is dedicated to technology. However, nearly half of tax professionals surveyed (48%) expect their technology budgets to increase beyond the usual annual rate. This blog will help your tax department understand potential long-term benefits of technology investments and provide strategies to ease technology adoption.

Highlights:

|

Jump to ↓

Making a case for advanced technology investments

The report reveals that under-resourced tax departments are more likely to incur audits and heavy penalties. For instance, 72% of respondents from under-resourced departments experienced tax audits in the past year, compared to 54% from adequately resourced departments. The average penalties incurred for under-resourced departments were $50,000, significantly higher than the $20,000 for well-resourced departments.

Investing in technology improves business efficiency and offers a high return on investment by reducing compliance costs, minimizing errors, and freeing up resources for strategic initiatives.

These key points highlight the ROI of technology investment:

- Reduced data errors: Automation can significantly reduce the time spent on repetitive and manual tasks. For instance, direct tax compliance tools, already implemented by 63% of respondents, can automate data entry and calculations, reducing errors and freeing up time for more strategic activities.

- Streamlined compliance: With evolving international tax laws, staying compliant is more challenging than ever. Tax provision solutions, used by 41% of respondents, help departments accurately calculate liabilities and ensure compliance with complex regulations. This reduces the risk of costly penalties and audits.

- Strategic Focus: The report indicates that tax professionals currently spend 61% of their time on tactical tasks but would prefer to allocate only 46% to such activities. By increasing the technology budget, departments can automate routine tasks, allowing professionals to focus on strategic, value-added activities that benefit the company long-term.

- Enhanced operational models: About 21% of well-equipped tax departments plan to recruit more qualified tax professionals in the next two years. Additionally, 20% aim to utilize third-party resources, while 11% plan to depend more on their current team. Despite facing resource limitations, companies can still achieve significant improvements in performance by making strategic investments in technology, which in turn boosts their operational efficiency and model.

- Proactive approach: More than two-thirds of respondents described their departments’ approach to technology as reactive or chaotic. By investing in advanced tools and solutions, departments can shift to a more proactive stance, anticipating and addressing issues before they become critical.

|

|

Overcoming barriers to technology adoption

Despite the clear benefits, many tax departments struggle with technology adoption due to resource constraints and leadership challenges. The report highlights that 49% of respondents feel ill-equipped to make improvements to their technology or automation. The primary barriers include a lack of time to plan or investigate new technologies (67%), budget constraints (65%), and inadequate talent for technology implementation (65%).

In light of these challenges, many tax professionals see technology as a potential savior. Automation and advanced tax solutions can help bridge the talent gap by streamlining processes and reducing the burden on existing staff.

Corporate tax departments should consider the following seven strategies to ease advanced technology adoption:

- Assess current technology usage: Conduct a thorough audit of your current technology stack to identify gaps and areas for improvement.

- Prioritize technology in budget planning: Given the potential ROI, technology should be a priority in corporate tax department budget allocations. By demonstrating the long-term cost savings and efficiency gains, tax leaders can make a compelling case for increased tech investment.

- Leverage AI and advanced analytics: Utilize AI-driven tools for predictive analytics, compliance monitoring, and strategic planning.

- Collaborate with IT: Work closely with your IT department to ensure seamless integration of new technologies into your existing systems.

- Focus on training and development: Equip team members with the knowledge and skills to leverage new technologies so departments can maximize the benefits of their tech investments.

- Adopt a phased approach: A phased technology implementation approach allows departments to gradually introduce new tools, assess their impact, and adjust as needed.

- Partner with external expertise: For departments struggling with internal resources, partnering with external tax technology providers can be a viable solution. Outside providers can offer the tax expertise and support needed to implement and optimize new advanced technology tools such as Thomson Reuters ONESOURCE suite.

The benefits for higher corporate tax departments budgets are clear

As the 2024 Corporate Tax Department report states, the path to maximizing tax department efficiency lies in embracing advanced technology. By advocating for increased technology budgets, corporate tax professionals can ensure their departments are well-equipped to navigate the complexities of modern tax compliance and planning. The benefits are clear: reduced financial risks, enhanced compliance, and the ability to focus on strategic initiatives that drive long-term business success.

Download the full report to gain greater insights for your corporate tax department.

|

|