I have been tracking the amount I invest for my goals for more than 11 years. It has been a life and game changer for my family. Whether you track your spending or not, I believe tracking the amount we invest is crucial.

Today I can invest more for retirement than my target investment. That was not the case when I started. In 2011 I noticed I was consistently investing less than the target. For several months in 2013, 14, and 15, I could not invest due to higher expenses and struggled to make up for it.

By target, I refer to the output of a thorough retirement planning calculation. If you are wondering, “why did he stop investing due to higher expenses? Why did he not use an emergency fund?” ask yourself, “how will you refill a depleted emergency fund?”, “How will you handle an unexpected recurring expense?” There are many situations in life when the emergency is bigger than the emergency fund.

The number one benefit of tracking investments: You are aware of your future goals, you appreciate how much you need to invest for them, and whether or not you can invest that much, you have a target. Knowing where you stand is the first to appreciate how far you need to travel if you need some inspiration to get started, check the personal financial audits from our community linked at the end of the article.

Number two: I often listen and re-listen to the excellent money management classic The Richest Man in Babylon, and each time I learn something new, I find a new article idea. One of the earliest known mentions of “pay yourself first”. When we track investments, we get a sense of accomplishment – that is, we find some balance between current and future expenses (the reason we invest).

Number three: When you pay yourself first (if you can), tracking expenses become unnecessary (IMO) and essentially an academic exercise. Budgeting is essential when money is tight and you struggle to meet ends. Once you can regularly find a surplus – which is when paying ourselves first is possible – budgeting is unnecessary. We invest first and spend the rest.

Budgeting builds discipline and gives you an insight into personal inflation. Once you appreciate the importance of discipline in spending and the rate of inflation, your overall portfolio has to keep pace with after-tax, it becomes superfluous. However, it is a therapeutic regimen for some: What 25 Years of Tracking Expenses Taught Me.

If you need some assistance in this regard:

For someone under 30 reading this, I urge you to do everything possible to get to this position first – where you can invest some amount (any amount) regularly. This is the first step to building wealth.

The next step is to try and increase the amount we can invest by as much as possible every year. Our income should increase, but our expenses should not grow at the same rate! Again quoting the richest man in Babylon – increase thy income!

If you believe your income is low and you do not see it increasing too much in future, then do everything possible to learn new skills or have a side hustle to increase your income.

Children with financially secure parents should be told to qualify, build skillsets as much as possible, and become professionals or entrepreneurs instead of run-of-the-mill salaried guys in their early 20s. There will be a long struggle, and you will not be able to invest anything in your 20s or even up to your mid-30s. Still, you can easily catch up later with essential money management commonsense and higher salaries.

The results of a retirement calculator would always look impossible to achieve (otherwise, there is something wrong with the computation!). See, for example, We lost sleep after using a retirement calculator! This is how we recovered. However, we must have the hope, perhaps even a vision, that we will earn more and invest more in the future.

The trick to succeeding with anything in life is to work consistently without expectations and any sign of an obvious reward for our efforts. Investing systematically is a simple example of this activity. Tracking investments helps you stay on course. It reminds you of the progress you have made or reminds you (painfully) of the distance that you need to cover.

For our family, diligent goal-based investment planning and tracking for 10-plus years have been life changers. It has transformed us from middle-class subsistence to financial freedom: Fourteen Years of Mutual Fund Investing: My Journey and lessons learned.

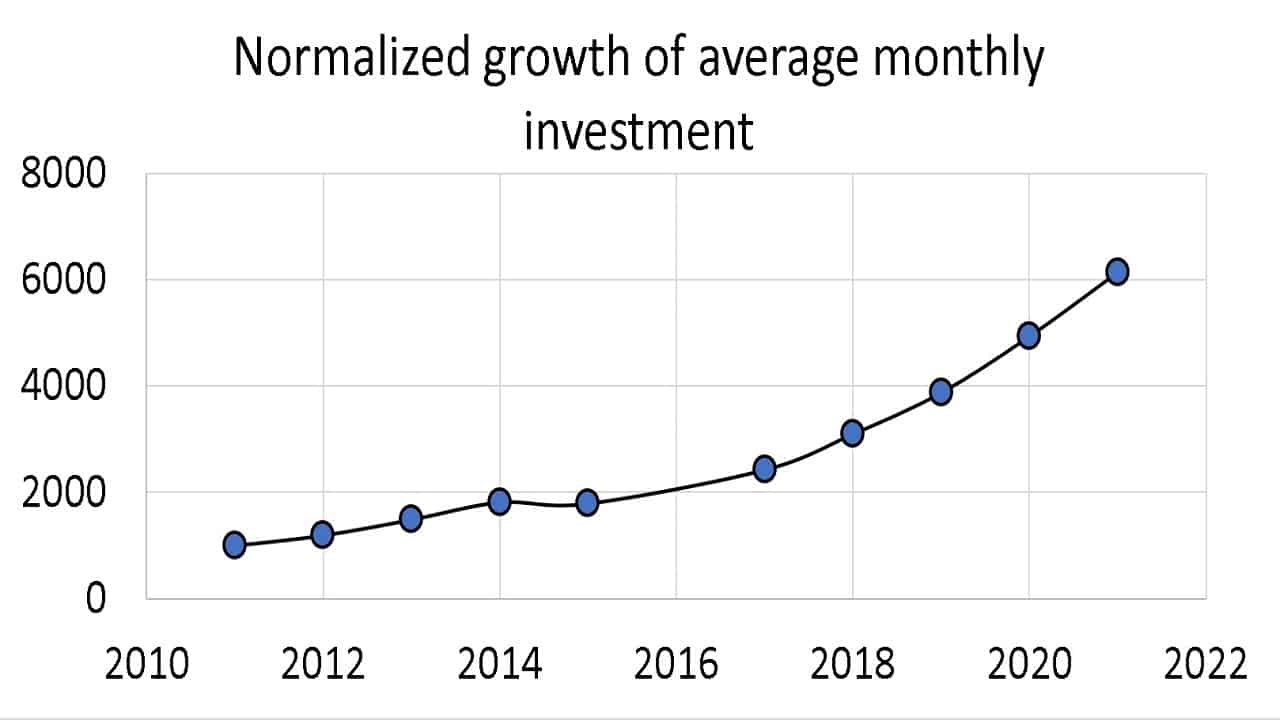

This is the average rate of increase in monthly investments for retirement. I lost the 2016 data due to a hard drive crash. I started investing in mutual funds in a small way in June 2008, but it was only from 2010/11 that I started proper goal-based investing.

| Year | Average Rate of increase in monthly investments |

| 2022 | -6% (Jan-Aug) |

| 2021 | 24% |

| 2020 | 27% |

| 2019 | 25% |

| 2018 | 28% |

| 2017 | 35% |

| 2015 | -1% |

| 2014 | 22% |

| 2013 | 25% |

| 2012 | 19% |

I recommend maintaining a 10% increase in investments yearly or 70-100% of your monthly expenses. This will get tougher with time, but try we must. Investing 2-3 times monthly expenses would be necessary for early financial independence aspirants.

In my case, it is a sheer providence that I have been able to achieve an investing annualised growth of 18.8% consistently (rate of increase in investments each year). My investment annualised return, that is, the rate of increase in market value is about 15% (from June 2008 to Sep 2022) – less than my investing CAGR 🙂 and fluctuates a lot more! See: My retirement equity MF portfolio return is 2.75% after 12 years! I tracked my investments more often than I have tracked their value. So I see this as a just reward for the effort.

The normalised growth in the average monthly investment made is shown below until 2021. I am investing about 6.6 times more than the amount invested in 2011.

Tracking investments each month for each goal has the same benefits as tracking our exercise regimen with an app or watch. It gives you a small measure of control over the controllable and lowers your fear of the future.

Many youngsters assume paying ourselves first would be depriving ourselves of the pleasures of life. This is not true. The sole purpose of money in our lives is to get spent for our benefit. Investing is a way to ensure we can continue to spend happily in the future. So we need to find some balance between spending today and developing an ability to spend in the same way tomorrow. How we find this balance is personal and up to the individual.

This is the template I used to track investments: Download the free monthly financial tracker. Users of the freefincal mutual fund and stock portfolio tracker can upload this sheet onto their existing Google Sheets file.

Need some inspiration to get started?

Check out some personal financial audits from readers.

Do share this article with your friends using the buttons below.

Use our Robo-advisory Excel Tool for a start-to-finish financial plan! ⇐ More than 1000 investors and advisors use this!

- Follow us on Google News.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Join our YouTube Community and explore more than 1000 videos!

- Have a question? Subscribe to our newsletter with this form.

- Hit ‘reply’ to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Explore the site! Search among our 2000+ articles for information and insight!

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over nine years of experience publishing news analysis, research and financial product development. Connect with him via Twitter or Linkedin or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation for promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over nine years of experience publishing news analysis, research and financial product development. Connect with him via Twitter or Linkedin or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation for promoting unbiased, commission-free investment advice.

Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter what the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts you and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu gets a superpower!” is now available!

Most investor problems can be traced to a lack of informed decision-making. We have all made bad decisions and money mistakes when we started earning and spent years undoing these mistakes. Why should our children go through the same pain? What is this book about? As parents, what would it be if we had to groom one ability in our children that is key not only to money management and investing but to any aspect of life? My answer: Sound Decision Making. So in this book, we meet Chinchu, who is about to turn 10. What he wants for his birthday and how his parents plan for it and teach him several key ideas of decision making and money management is the narrative. What readers say!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. – Arun.

Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or you buy the new Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low volatility stock screeners.

About freefincal & its content policy Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified from credible and knowledgeable sources before publication. Freefincal does not publish any paid articles, promotions, PR, satire or opinions without data. All opinions presented will only be inferences backed by verifiable, reproducible evidence/data. Contact information: letters {at} freefincal {dot} com (sponsored posts or paid collaborations will not be entertained)

Connect with us on social media

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

Your Ultimate Guide to Travel

This is an in-depth dive analysis into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically with links to the web pages and hand-holding at every step. Get the pdf for Rs 199 (instant download)

This is an in-depth dive analysis into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically with links to the web pages and hand-holding at every step. Get the pdf for Rs 199 (instant download)