As we continue our chat with Tracy Davis, a tax technology expert at Thomson Reuters, she shares some great insights on how tax technology managers can team up with other departments to align tech projects with greater business goals. She also dives into best practices for tax technology integration, how to stay current with the latest updates, and paints a picture of the future workforce.

Part 1: A tax leader’s perspective on evolving corporate tax roles and technology integration

I’d like to hear your thoughts on best practices for adding new tax technologies to existing systems. Additionally, how can tax technology managers help with this process?

Davis: Well, one of the key best practices is to start with a thorough needs assessment. You want to make sure the new tech addresses the specific challenges your tax department is facing. It’s also important to align these new tools with your broader business goals. You don’t want to implement something that doesn’t fit into the bigger picture.

Involving cross-functional teams, like IT and finance, is a must. They can help ensure the new tech integrates smoothly with your existing systems and can spot any potential compatibility issues. And when they collaborate with finance, it ensures that the tech investments make sense for the company’s financial and compliance needs. Regular training and clear communication are also crucial. You want to make sure everyone feels comfortable with the new tools and understands why they’re important.

Dedicated tax technology managers play a huge role in all of this. They act as the bridge between the tax department and other units, making sure the tech solutions are a perfect fit. They can also develop a strategic roadmap for implementation, set up metrics to track how well the new tech is working, and lead efforts to keep improving and adapting as technology evolves.

How can corporate tax professionals stay current with the latest tax technology trends and innovations, and what resources are available to them?

Davis: Great question! One of the best ways for corporate tax professionals to stay current is by engaging in continuous learning. For example, attending industry conferences and webinars can be really helpful. These events are a great way to see what’s new and get insights from experts in the field.

Another useful approach is to subscribe to relevant publications. There are a lot of magazines, newsletters, and online resources that focus specifically on tax technology. They can help you stay current on the latest trends and innovations.

Joining professional organizations, like the Tax Executives Institute, is also a big plus. These organizations offer networking opportunities and educational resources that can be incredibly valuable. You can connect with other professionals and learn from their experiences.

Collaborating with technology partners and vendors is another important strategy. They usually have the latest technology and can tell you about new tools and solutions that might help your company.

Also, regular training sessions and workshops within your own organization can make a huge difference. These can help you and your team stay up-to-date and feel confident using new technologies. Overall, it’s all about staying engaged and proactive in your learning.

What are some risks companies face if they skip hiring a tax tech manager or other hybrid roles? How can they minimize these risks?

Davis: Well, one of the biggest risks is that the tax department might lack a clear strategy regarding technology direction. Without someone dedicated to this role, you could end up with inefficiencies and miss out on opportunities to enhance compliance.

To lessen these risks, companies can select someone to guide the technology strategy within the tax department and create hybrid roles that combine tax and tech skills. This way, you have team members who understand both areas and can make sure your technology solutions make sense for the tax department’s needs.

Investing in tech training for tax professionals is also key. It helps build the skills and confidence they need to use new technologies. And setting clear success metrics can help technology integration be more effective, improving business operations overall. By taking these steps, companies can reduce potential challenges and make the most of new tax technologies.

With the increasing use of advanced technology in tax departments, how do you see the evolution of hybrid tax/tech roles impacting the future workforce?

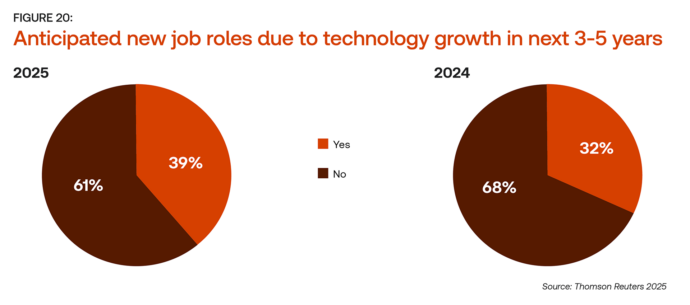

Davis: In our 2025 Corporate Tax Department Technology Report, we found that over half of employers are already hiring hybrid tax/tech roles. This really shows how important technology skills are becoming in the tax profession. I think this trend is only going to pick up speed, with new job roles popping up to bridge the gap between traditional tax functions and modern tech.

The report predicts a 7-percentage point increase in new job roles and a 14-percentage point increase in changes to existing roles. This means tax professionals will need to adapt fast by picking up technical skills alongside their tax knowledge. This shift will likely make processes smoother, increase accuracy, and improve decision-making abilities within tax departments.

Keep your team informed on the latest tax technology trends

As corporate tax departments keep evolving with advanced technology, staying up-to-date and prepared is more important than ever. Our chat with tax leader Tracy Davis really drove home the importance of collaboration, adopting best practices, and the rise of hybrid roles in shaping a strategic and efficient tax workforce.

To get a better handle on these transformative trends and prepare your organization for future challenges, we highly recommend checking out our 2025 Corporate Tax Department Technology Report. This report is packed with valuable data, trends, and strategies to help you stay informed on the latest tax technology changes.