A 10-step guide to improve your current 1040 tax workflow.

Filing individual income tax returns can be a complex process, but with the right workflow, professional tax preparers and accounting firms can streamline the experience for both clients and staff.

Harnessing technology for individual income tax return filing can transform the efficiency of accounting firms. By adopting a digital tax workflow, automating repetitive tasks, leveraging cloud-based solutions, integrating e-filing and electronic signatures, and using advanced review tools, firms can streamline the entire process. This not only enhances productivity but also provides clients with faster, more accurate service, positioning firms to thrive in a competitive, digital-first marketplace.

In this guide, we provide a step-by-step checklist to help optimize your tax return preparation workflow by leveraging advanced tax software solutions like UltraTax CS and SurePrep, ensuring a seamless and compliant filing experience.

Jump to:

1. Client intake and information gathering

The first step in filing an individual income tax return is meeting with the client to understand their tax situation and gather necessary documentation. The initial consultation allows tax preparers to identify the scope of work, answer questions, and create a personal tax checklist tailored to the client’s needs.

During this initial consultation, ensure that your client provides essential documents such as:

- W-2s and 1099s

- Prior year tax returns

- Interest and dividend income statements

- Mortgage interest, charitable donations, and other deduction receipts

For most firms, requesting and gathering the necessary client documents and data is the most challenging stage of the 1040 workflow process. It is also a primary source of workload compression, as clients are often slow to submit the required information. This challenge can be especially true for firms that haven’t modernized their approach.

Today’s clients are accustomed to the conveniences and accessibility of mobile applications, even when it comes to taxes. That’s why it is essential to your modernize data collection methods — not only to remain competitive but also to improve workflow. This means leveraging client collaboration tools that facilitate data collection and integrate with your tax software to automate 1040 preparation.

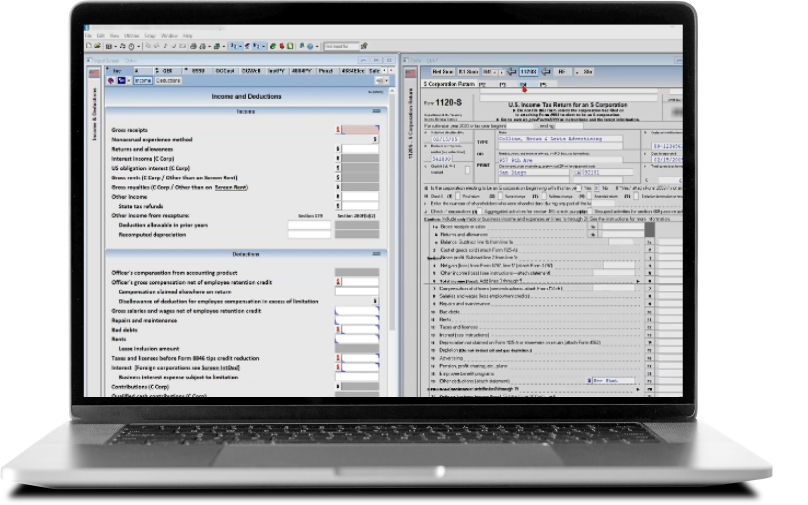

UltraTax CS automates your individual and business tax preparation workflow with powerful, time-saving tools that optimize productivity and increase profitability. Securely share documents with clients and automatically gather tax-related information that flows directly into UltraTax CS.

2. Organization and review

Once all of the necessary documents are gathered, organizing them in a systematic manner is crucial.

With an advanced scan and populate solution like SurePrep 1040SCAN and SPBinder, artificial intelligence (AI) and machine learning work together to bookmark and organize source documents into a standardized work paper index that follows the flow of the tax return. Through integration with UltraTax CS, GoSystem Tax RS, CCH Axcess Tax, and Lacerte, your firm can streamline data entry, simplify the filing of advanced returns, and maximize collaboration capabilities.

Together with UltraTax CS, advanced AI-powered diagnostics alert you to outstanding issues with an instant checklist detailing all the fields where you had entries last year but haven’t entered data for this year. Additionally, you can create a client email to note missing information.

3. Data entry

After the source documents and client data are collected, it’s time to prepare the tax return. This is the center of the workflow process and is often where firms spend a great deal of their time — particularly those firms not using the latest technology to drive greater automation.

UltraTax CS, for example, automates much of this process, importing client data directly from scanned documents, thereby reducing errors associated with manual data entry.

Together with SurePrep 1040SCAN and SPBinder, client documents are automatically bookmarked and organized into a standardized workpaper index that follows the order of the tax return. SurePrep 1040SCAN also leverages AI and machine learning capabilities with patented, AI-powered technology to auto-verify OCR data for 65% of standard documents.

4. Tax calculation and scenario analysis

Once the data has been entered, the tax return preparation software calculates the tax liability or refund amount. At this stage, accountants can analyze different filing scenarios to determine the best option for the client — such as comparing the tax impact of filing jointly versus separately for married couples.

UltraTax CS offers detailed tax calculation tools that allow preparers to run various scenarios quickly and accurately. Using these calculations, your firm can anticipate potential issues and make informed decisions based on the potential tax implications.

5. Review and compliance check

Before submitting the tax return to the client for approval, it is essential to review it for accuracy to ensure it is compliance with current tax laws. Tax professionals must verify that all deductions, credits, and exemptions have been applied correctly.

Automated compliance checks in UltraTax CS can help ensure that the tax return adheres to both federal and state tax laws, minimizing the risk of audit. This helps partners review more work from more managers — and managers can review more work from staff. Robust diagnostics and hyperlinks to industry-leading guidance and research also support a best-in-class review process.

|

|

6. Client review

Once the tax return has been reviewed internally, schedule a meeting with the client to go over the details. During this meeting, explain the tax return in plain language, address any client questions, and provide a clear explanation of how the tax liability or refund was calculated. This is also an excellent opportunity to discuss future tax planning strategies, helping your clients make informed decisions for the upcoming tax year.

UltraTax CS allows you to quickly spot clients affected by new tax laws or changes in your service so you can identify advisory opportunities and manage client services more effectively.

7. Finalization

After the client has reviewed and approved the tax return, it’s time to finalize the process. Obtain necessary signatures and arrange payment of taxes or specify the preferred method for receiving a refund.

UltraTax CS offers integrated eSignature capabilities, allowing your clients to sign forms digitally with an added layer of security by capturing signatures with knowledge-based authentication (KBA).

8. Filing

With the return approved and signed, the next step is to file the tax return. Most firms today prefer to e-file returns, which is faster and more secure than paper filing.

UltraTax CS simplifies e-filing by integrating with the IRS’s electronic systems and providing real-time confirmation of filing. If necessary, the return can also be filed by mail, but e-filing is generally recommended for both speed and security.

9. Post-filing support and record keeping

Filing a tax return doesn’t end with submission. Post-filing support is crucial for maintaining a strong relationship with your clients. Provide them with a copy of their return, ensure proper record-keeping for future reference, and offer guidance on planning for the next tax year.

Helping taxpayers interpret and consume the information is obviously important, as well as mining the data for additional growth opportunities. Therefore, it is important not to overlook the value of customizable data mining tools.

For instance, UltraTax CS can help you identify clients that fall into specific categories — such as qualified business income (QBI) deduction and cryptocurrency — and are ideal for additional tax planning or advisory services.

10. Client feedback and continuous improvement

Client feedback and continuous improvement are essential for accounting firms looking to optimize the individual tax return filing process. Feedback provides valuable insights into clients’ experiences, helping firms identify pain points, streamline workflows, and enhance the overall service. By actively seeking client input, accounting firms can tailor their processes to meet evolving needs, ensuring greater client satisfaction and loyalty.

Continuous improvement, driven by both client feedback and internal reviews, enables firms to stay competitive. Tax regulations and technology are constantly changing, and a proactive approach to refining processes ensures firms remain agile. For example, feedback might reveal that clients prefer faster document uploads or more frequent status updates, prompting firms to implement secure client portals or automated communication systems. These incremental adjustments enhance efficiency and accuracy, reduce the risk of errors, and expedite the tax filing process.

Furthermore, incorporating client feedback fosters trust and transparency, as it demonstrates a commitment to delivering high-quality service. By leveraging feedback and focusing on continuous improvement, accounting firms can better address client needs, optimize workflows, and maintain a strong competitive edge in the digital tax preparation landscape.

Adopting a digital tax workflow for a more efficient individual tax return process

A digital tax workflow is the foundation for a more efficient tax filing process. By replacing manual, paper-based processes with automated workflow solutions, firms can reduce the time spent on administrative tasks like gathering client documents, entering data, and tracking down missing information. Platforms such as UltraTax CS and SurePrep offer comprehensive digital tax solutions that automate many aspects of tax return preparation, from document collection to data extraction.

In the age of digital transformation, clients expect fast, efficient service and seamless digital interactions with their accounting firms. A digital tax workflow allows firms to meet these expectations by providing more responsive service. Cloud-based tax solutions enable clients to securely upload documents, sign forms electronically, and track the status of their returns in real-time. This transparency builds trust and keeps clients engaged throughout the tax preparation process.

Moreover, a digital workflow allows firms to be more agile in responding to client needs. For instance, with all client data securely stored and organized in the cloud, accountants can quickly access information, provide real-time insights, and make data-driven decisions — offering a personalized service that sets them apart from competitors.

In today’s fast-evolving digital landscape, accounting firms face growing pressure to enhance their efficiency, accuracy, and client service to remain competitive. Investing in a digital tax workflow is a key strategy for firms looking to thrive amid these challenges.

By embracing technology, accounting firms can streamline tax processes, improve compliance, and offer higher-value services to clients — ultimately positioning themselves for success in an increasingly digital world.

|

|