A 6-step guide to improve your current business tax return workflow.

Filing business tax returns is no doubt an intricate process, but with the right workflow, accounting firms can streamline the process, reduce errors, and ensure compliance.

By implementing a digital tax workflow that automates repetitive tasks and integrates cloud-based collaboration tools, accounting firms and tax preparers can streamline the entire business tax return process from start to finish. This modernized approach not only optimizes workflows but also strengthens client relationships, positioning firms to thrive in a competitive, digital-first landscape.

In this guide, we provide a step-by-step checklist how to efficiently file a business tax return by leveraging advanced tax software solutions like UltraTax CS and SurePrep to ensure a seamless and compliant filing experience.

Jump to ↓

1. Gather and organize client documents

The first step in efficiently filing a business tax return is collecting all necessary documentation. Depending on the type of business structure, required documents can vary. Let’s take a look.

- Sole proprietorship: Income statements, expense reports, and details of any personal expenses separate from business expenses for Schedule C.

- Partnership. Form 1065, Schedule K-1 for each partner, and records of income, deductions, and credits to be allocated among the partners.

- Corporation. Financial statements, dividend records, and documentation of corporate-specific deductions for Form 1120.

- S corporation. Similar to partnerships with Form 1120S and Schedule K-1 for shareholders.

- LLC. Documents correspond to how the LLC is taxed (as a sole proprietorship, partnership, or corporation).

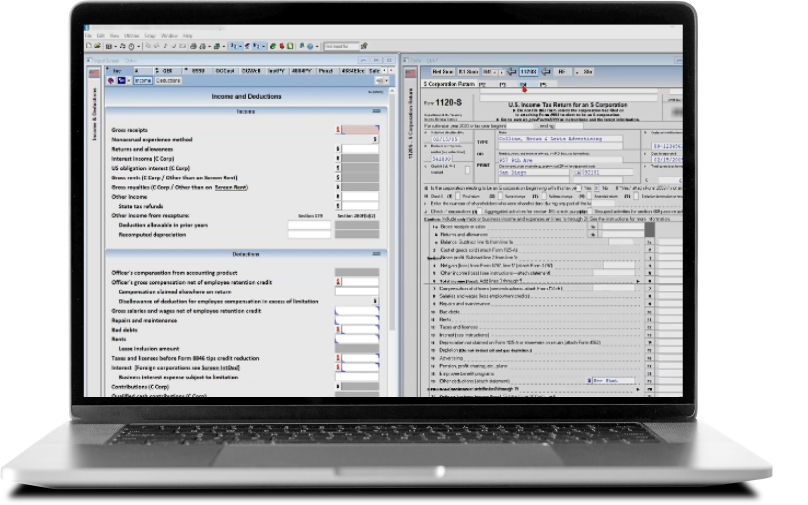

UltraTax CS offers a full line of federal, state, and local tax programs for individual and business clients, including 1040 individual, 1120 corporate, 1065 partnership, 1041 estates and trusts, multi-state returns, and more. By automatically populating all pertinent areas of the business tax return, it eliminates the need for repetitive data entry, reducing the chance of errors, and saving valuable time.

In addition, UltraTax CS automatically identifies the appropriate forms for each business type. You can even offer your clients the ability to securely upload their documents via secure, integrated access to a client portal, where tax documents are automatically sorted and categorized for quick access.

2. Review deduction and credit opportunities

The next step is identifying all eligible deductions and credits is crucial for maximizing tax savings. The type of deductions available often varies by business structure.

- Sole proprietorship: Deduct business-related expenses such as office supplies, utilities, and home office expenses.

- Partnership: Allocate deductions for business expenses like rent, equipment, and salaries among the partners on Schedule K-1.

- Corporation: Corporations can claim deductions for salaries, bonuses, and benefits paid to employees, as well as specific corporate credits like the Research & Development Tax Credit.

- S corporation: S corporations follow similar deduction rules to partnerships but must comply with additional rules related to reasonable compensation for shareholders.

- LLC: The deductions depend on the tax treatment, but generally include ordinary and necessary business expenses.

With UltraTax CS, your firm can run various scenarios and automate the calculation of tax deductions and credits, ensuring tax savings are accurately applied and reducing the likelihood of errors or omissions.

In addition, you can anticipate potential issues and make informed, proactive decisions for a wide variety of client tax scenarios. Instantly see the implications of each entry on the spot so you can offer meaningful advice and valuable tax benefits to your business clients, thus strengthening relationships and opening the door to advisory-based services.

3. Prepare and review the tax return

With the documents collected and tax forms determined, the next step is to prepare the return. Digital tools can expedite this process by pre-filling forms with client data and checking for inconsistencies or errors in real-time.

With the integrated review features in UltraTax CS, you can be sure that all income, expenses, and credits are accurately reported and that all required forms are included as it will automatically flag missing or inconsistent data.

For businesses operating in multiple states, UltraTax CS ensures compliance with each state’s specific tax rules using different state tax forms and automating the calculation of state-specific taxes.

4. File electronically and track the return

Once the return is prepared and reviewed, it is time to file it electronically for faster processing. E-filing reduces the turnaround time and provides immediate confirmation of receipt from the IRS or state tax authorities.

UltraTax CS enables you to submit tax returns directly to the IRS and track their status in real-time. For additional efficiency, built-in e-signature tools enable you to obtain client approvals digitally. This not only speeds up the process but also ensures compliance with IRS regulations.

5. Post-filing review and client follow-up

After the return is filed, it’s important to follow up with the client and provide them with a summary of the tax return, including key financial highlights. This is also an opportunity to discuss tax planning strategies for the following year in terms of managing future tax liabilities and positioning your firm as a proactive advisor.

Helping businesses interpret and consume their tax information is obviously important, but so is mining their tax data for additional growth opportunities. Therefore, don’t to overlook the value of customizable data mining tools.

UltraTax CS offers data mining tools to help you easily identify advisory opportunities and quickly spot clients affected by new tax laws. You can also create customized reports for clients, providing a clear breakdown of their tax situation, which adds value to your services and strengthens client relationships.

6. Client feedback and continuous improvement

If your accounting firm is aiming to optimize the business tax return filing process, client feedback and a focus on continuous improvement are invaluable. Feedback offers crucial insights into client experiences, helping you pinpoint pain areas, refine workflows, and elevate overall service quality. By actively gathering client input, you can tailor processes to evolving needs, which boosts client satisfaction and loyalty.

Continuous improvement, spurred by client feedback and internal reviews, also keeps firms competitive. As tax regulations and technology evolve, firms that prioritize process refinement stay agile. For example, if your feedback shows that clients want more frequent status updates, you may want to implement automated communication systems to address this need.

Moreover, seeking client feedback fosters trust and transparency, underscoring a commitment to exceptional service. By leveraging feedback and focusing on continual enhancement, your firm can better meet client expectations, streamline workflows, and maintain a strong edge over the competition.

Enabling a shift to advisory services

Efficiently filing a business tax return requires a structured, technology-driven workflow that minimizes errors and maximizes productivity. By harnessing the power of UltraTax CS and SurePrep, your accounting firm can streamline every step of the process, from gathering documents to filing returns.

Ultimately, UltraTax CS supports a digital-first approach to advisory services, making the transition from compliance-based work to value-based engagements achievable and efficient. These tools allow accountants like you to identify opportunities, engage in data-driven discussions, and focus on high-value work that directly contributes to your clients’ financial success.

By making the shift to advisory-based services, you can deepen client relationships and diversify your revenue streams beyond seasonal tax work. UltraTax CS supports this shift by enabling accountants like you to deliver high-value advice that positions your firm as trusted financial partner rather than solely a tax return provider. Moreover, clients often appreciate a holistic advisory approach, which goes beyond the tax return to cover financial planning, risk management, and tax-efficient growth strategies.

So not only does UltraTax CS streamline tax workflows, but it also create new opportunities to provide high-value advisory services by giving you deep insight into your clients’ financial positions, potential tax-saving strategies, and long-term planning needs.

Whether handling returns for sole proprietorships, partnerships, corporations, S corporations, or LLCs, adopting a digital tax workflow helps accounting firms like yours provide faster, more accurate services to clients. This ultimately boosts client satisfaction and helps you stay competitive in an increasingly digital tax landscape.

|

|