Expert says they need to sell some rentals and buy a home of their own

Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Article content

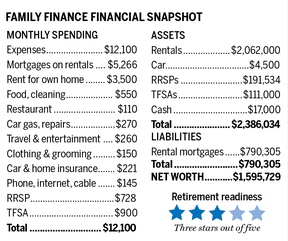

A couple we’ll call Ralph, 64, and Lucy, 60, live in British Columbia. Ralph is an academic, specializing in English literature, and Lucy is a sculptor. Together, they own five rentals, which are all profitable, but they don’t own their own home, an ironic state of affairs with significant tax implications. Their monthly income after tax is $12,100. Their goal is to retire in five years with $7,000 in after-tax retirement income.

Advertisement 2

Article content

Email andrew.allentuck@gmail.com for a free Family Finance analysis

Family Finance asked Derek Moran, head of Smarter Financial Planning Ltd. in Kelowna, B.C., to work with the couple.

About that real estate…

The first order of business is their real estate holdings, Moran says. Their status as homeless landlords means they have to pay $3,500 rent each month for their own digs. Yet they don’t have the tax advantage of being able to sell a principal residence — if they had one — with no tax on gains.

Article content

Moreover, as tenants they have to cover landlord costs — including property taxes — that are part of expenses tenants ultimately pay. But they could defer paying property taxes on a B.C. home of their own at a cost of one per cent per year, though it may rise a bit, with repayment when their own house is sold. There is no comparable property tax deferral for landlords or tenants. Meanwhile, the rents they collect after expenses are taxable.

Advertisement 3

Article content

“They need to sell some rentals and buy a home of their own,” Moran says.

The core issue is rationalization of the properties, for when one gets to the retained income after deductions, mortgage paydowns and all taxes, there is just $263 per month income from $2,062,000 of rentals. “It is a very tax-inefficient situation,” he adds.

The savings equations

Next, the couple must address retirement savings. In their tax brackets, RRSPs are more advantageous than TFSAs.

Lucy currently has $144,534 in her RRSP and $90,000 in contribution room. Ralph has $47,000 in his RRSP and an additional $47,000 of space, and should immediately consider transferring money in from his TFSA, to give them additional tax relief.

If he does so, their current total of $$238,534, growing at three per cent after inflation per year, will become $276,532 in five years and support indexed, splitable and taxable RRSP income of $13,698 per year to Lucy’s age 95.

Advertisement 4

Article content

Apart from the transfer, Ralph should not add to his RRSPs. The federal Pension Adjustment, which caps RRSP room for persons already contributing 18 per cent of income, will block further RRSP contributions.

The TFSAs, currently with a $111,000 balance, will thus have a post-transfer balance of $64,000.

They have been paying down an extra $39,000 per year to the rental mortgages. If they put that into the TFSAs instead for five years and grow it at three per cent over inflation, it should become $287,461 in 2022 dollars, Moran calculates. That capital would support non-taxable payouts of $14,238 for the 30 years to Lucy’s age 95.

Enhancing future income

Squeezing retirement income out of the rentals is tougher than just pension arithmetic. The properties generate $64,613 per year of net rent but much of this has to go to paydown of principal, which is not tax deductible. Selecting which of five is tough. The criterion to use should be minimizing capital gains. Two units have appreciated relatively little over their costs. A sale would free up about $800,000 of cash they could use to buy a home.

Advertisement 5

Article content

With two sold, net rent would decline to $23,506 per year. We’ll use this figure. Total costs of home ownership would probably be less than the $42,000 per year the couple currently pays for rent. Over the next five years, that would be a savings of $210,000 rent paid with after-tax dollars. They would forego $22,000 per year or $100,000 total for five years for units sold of taxable income, Moran estimates, so they would be $100,000 ahead over five years.

Ralph will be eligible for full $7,707 annual OAS plus a deferral bonus of 7.2 per cent per year — if he starts at age 69, that would be $9,926 per year. Lucy will have an OAS benefit at 65 based on 38 years residence in Canada out of 40 required for full benefits, net $7,322 per year. That’s a total of $17,284 per year.

Advertisement 6

Article content

In retirement starting when Ralph is 69 and Lucy is 65, their base cash flow will be Ralph’s $1,200 monthly or $14,400 yearly defined benefit pension. He will get CPP pension income of $19,300 per year based on a benefit increase of 8.4 per cent per year for four years work after age 65. Lucy will have $7,332 CPP income. They can add $13,698 RRSP income, $14,238 TFSA cash flow, $17,284 combined OAS, and $23,506 rental income for total retirement income of $109,623 before splits.

Summing up retirement income

After splits of eligible taxable income (not including TFSA income) and 13 per cent average, they would have about $97,000 per year to spend or $8,100 per month.

With rent they currently pay, $3,500 per month, removed, their present monthly allocations, $12,100, would fall to $8,600. As well, $1,628 would no longer go to RRSP and TFSA savings. They would effectively save a total of $5,128 per month.

Advertisement 7

Article content

Some of their savings could go to financing their new house after a down payment based on cash harvested from sale of the two rental units.

They would pay no rent for their dwelling, be able to sell their owner-occupied home without capital gains tax and even postpone payment of property taxes via a B.C. program that allows seniors to defer such taxes for one per cent rather than compounding interest, but perhaps a little more as interest rates rise with deferred taxes payable when their home is sold.

Rationalization of home ownership and transfer of the rent they pay for their home to mortgage payments, postponement of retirement to Ralph’s age 69 and Lucy’s age 65, and application of the B.C. property tax postponement credit, will allow the couple to exceed their $7,000 monthly after-tax retirement income target, Moran concludes. “This is a case where less is more. Simplicity is clearly its own reward.”

Retirement stars: Three *** out of five

Financial Post

Email andrew.allentuck@gmail.com for a free Family Finance analysis