Updates

SEC slaps GQG: The US Securities and Exchange Commission levied a $500,000 fine against GQG Partners and Rajiv Jain for violations of whistleblower protection laws and issued a cease-and-desist order against the illegal practices. At base, GQG required (some?) new hires and one former employee to sign agreements which would make it difficult for them to disclose wrongdoing on GQG’s part. “Whether through agreements or otherwise, firms cannot impose barriers to persons providing evidence about possible securities law violations to the SEC, as GQG did,” said Corey Schuster, Co-Chief of the Division of Enforcement’s Asset Management Unit.

As of 27 September 2024, GQG’s website did not reflect any discussion of the action. Reports in other media note that GQG “acknowledged the SEC’s jurisdiction in the case …without admitting or denying the findings.” The settlement stops the matter from going to more formal proceedings, the outcome of which might have been more visible and more embarrassing. For a $150 billion firm, the fine is trivial except for the public relations bruise it represents.

SEC pats Oaktree: Oaktree Capital, similarly, was found to have violated securities law by failing to report that they owned more than 5% of the stock of several portfolio companies. There is a purely mechanical rule (13d, if you care) that says if you own more than 5% of the shares outstanding of any company, you need to report that fact because your stake is large enough to cause conflicts. Oaktree did not. Because of strong remedial action and cooperation of the Commission’s staff, the sanctions on Oaktree came to a $375,000 fine and a promise never to do it again.

Briefly Noted . . .

abrdn Focused U.S. Small Cap Equity and abrdn Emerging Markets Dividend Funds are being converted into ETFs. The investment adviser for the Funds believes shareholders in the funds could benefit from lower overall net expenses, additional trading flexibility, increased portfolio holdings transparency, and enhanced tax efficiency. Each new ETF will be managed in a substantially similar manner as the corresponding mutual fund, with identical investment objectives, investment strategies, and fundamental investment policies. If approved by the Board, it is anticipated that the conversions will occur in the first quarter of 2025.

First Eagle Global Equity ETF and First Eagle Overseas Equity ETF are in registration. Both ETFs will be actively managed by Matthew McLennan and Kimball Brooker, Jr., who will be the co-heads of both ETFs and assisted by members of the First Eagle Global Value Team.

Vanguard today announced that it will reduce the minimum asset requirement from $3,000 to $1001 for its robo-advisor service, Digital Advisor, significantly increasing accessibility for investors interested in utilizing a digital advice service to manage short- and long-term financial goals. Vanguard Digital Advisor launched in 2020 and provides an all-digital financial planning and investment advisory service that delivers highly personalized, convenient, low-cost advice. The digital advice platform helps clients identify their retirement and non-retirement goals, and then crafts and manages customized, diversified, and tax-efficient investment portfolios to achieve them.

Enrollments in Vanguard Digital Advisor require at least $100 in each Vanguard Brokerage Account. For each taxable account or traditional, Roth, rollover, or inherited IRA you wish to enroll, the entire balance must be in certain investment types (based on eligibility screening by Digital Advisor at the time of enrollment) and/or the brokerage account’s settlement fund.

Green flight in the oddest corners of the market: the Wahed Dow Jones Islamic World ETF (UMMA) “will no longer consider applying environmental, social, and governance criteria when selecting the Fund’s investments.” Similarly, effective December 10, 2024, the American Century Sustainable Equity Fund and its corresponding ETF will both be renamed Large Cap Equity and will abandon concerns for … you know, the end of the world.

Wasatch International Value Fund is in registration. The Fund invests primarily in the equity securities of foreign companies of any size though they expect a significant portion of the Fund’s assets to be invested in companies with market capitalizations of over $5 billion at the time of purchase. David Powers will be the portfolio manager. Expenses have not been stated.

Small Wins for Investors

Effective October 7, 2024, FullerThaler Behavioral Small-Mid Core Equity Fund will begin sales of C Shares (TICKER: FTWCX) and R6 Shares (TICKER: FTSFX). I’ve never understood why on earth anyone would buy “C” shares (which typically carry an astronomical expense ratio) but “R6” means the fund will be available to some retirement investors, so that’s nice.

On September 25, 2024, the Board of Trustees approved a change to the dividend payment frequency of the Osterweis Strategic Income Fund from a quarterly basis to a monthly basis. Generally, it focuses on high-grade, short-term high-yield securities. Its downside capture over the past decade is 10% while its upside capture is 70%, for an astonishing capture ratio of 700. It’s a good, conservative fund with experienced management.

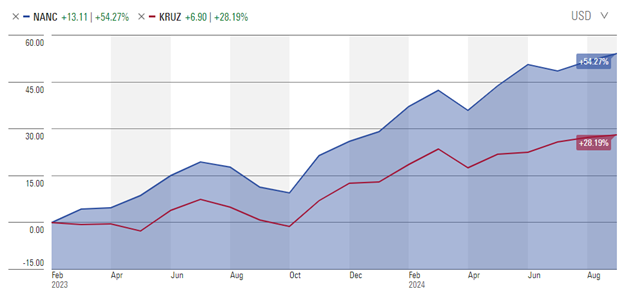

Shareholders of Unusual Whales Subversive Democratic Trading ETF and the Unusual Whales Subversive Republican Trading ETF have been invited to a proxy vote which would allow each fund to lower its expense ratio. That seems nice. The adviser is very clear about the function of the funds: it is to highlight the trading behavior of members of Congress in order to catalyze reform, rather than maximizing shareholder returns. That said, since inception trades by Democratic members of Congress have vastly outperformed those by Republican members.

And, in case you’re wondering, Republican members of Congress aren’t buying Trump. Or, at the very least, they’re not willing to buy Trump Media stock. The Republican fund once owned a big 36 shares of DJT but seems to have dumped them in spring, 2024.

Closings (and related inconveniences)

Old Wine, New Bottles

BlackRock High Yield Municipal Fund will be reorganized into the iShares High Yield Muni Active ETF. The reorganization is anticipated to close as of the close of trading on February 7, 2025.

The Essential 40 Stock Fund will be converted into an exchange-traded fund, the Essential 40 Stock ETF on October 17, 2024. The portfolio is composed of “forty stocks believed to represent the companies that are believed to be essential to the American way of life.” The fund has landed at or below the 50th percentile for six of its past seven years.

The Essential 40 Stock Fund will be converted into an exchange-traded fund, the Essential 40 Stock ETF on October 17, 2024. The portfolio is composed of “forty stocks believed to represent the companies that are believed to be essential to the American way of life.” The fund has landed at or below the 50th percentile for six of its past seven years.

Effective November 26, 2024, the passive ETF known as MUSQ Global Music Industry ETF will become the passive ETF known as MUSQ Global Music Industry Index ETF. The fund has only $22 million in assets and has lost 4.5% since inception, so we hope that the impending tweaks to the underlying index does some good. And if that doesn’t work, perhaps they might adopt the strategy used by the (deceased) Artist Formerly Known as Prince.

TCW MetWest Corporate Bond Fund is being reorganized into the TCW Corporate Bond ETF, Class M shares will be reorganized into Class I shares prior to the reorganization on or about November 4.

Off to the Dustbin of History

The AMG TimesSquare Global Small Cap and AMG TimesSquare Emerging Markets Small Cap Funds will be liquidated on or about December 11, 2024.

AXS Alternative Value Fund will be liquidated on or about September 27.

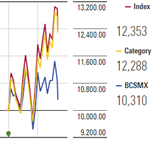

BCM Focus Small/Micro-Cap Focus Fund will be liquidated on or about October 11, 2024. Hmmm … “micro-cap” and “focus” go together like “bran flakes” and “ketchup,” for what that’s worth. The portfolio holds 20 microcap growth stocks, of which eight have declined by 25-80% in the past years. The result is illustrated by Morningstar’s performance graph where the blue line is below 99% of its peers for the past … well, most periods.

BCM Focus Small/Micro-Cap Focus Fund will be liquidated on or about October 11, 2024. Hmmm … “micro-cap” and “focus” go together like “bran flakes” and “ketchup,” for what that’s worth. The portfolio holds 20 microcap growth stocks, of which eight have declined by 25-80% in the past years. The result is illustrated by Morningstar’s performance graph where the blue line is below 99% of its peers for the past … well, most periods.

Innovator Hedged TSLA Strategy ETF will be liquidated effective as of the close of business on October 4, 2024.

John Hancock Government Income Fund is being reorganized into the John Hancock Investment Grade Bond Fund. If shareholders approve the reorganization during the January 2025 meeting, then the reorganization will occur on or about February 14, 2025.

Per CityWire (9/30/2024), Morgan Stanley Investment Management is closing down its listed real estate and infrastructure business, liquidating all the funds it offers that invest in this asset class. The move will impact funds offered in the US, as well as in Asia and Europe.” That affects over $700 million in assets. The case for exiting real estate is rather clearer to us than the case for existing infrastructure.

Natixis Loomis Sayles Short Duration Income ETF will be liquidated on or about September 30.

Nuveen Social Choice Low Carbon Equity Fund will be reorganized into the Nuveen Large Cap Responsible Equity Fund. The reorganization is not subject to approval by the shareholders of the Target fund or the Acquiring fund. It is anticipated that the reorganization will be consummated in late 2024.

Rondure New World Fund will be liquidated on or about October 18. The trigger for the liquidation of the fund, and subsequent closure of the firm, understandably, was not spelled out in the SEC filing. We discuss it, and wish Ms Geritz godspeed, in this month’s Publisher’s Letter.

SmartETFs Advertising & Marketing Technology ETF will be canceled on or about October 30.

TCW Enhanced Commodity Strategy Fund, TCW MetWest AlphaTrak 500 Fund (M class), and TCW Short Term Bond Fund (I class) will all be liquidated on or about October 31,

TCW MetWest Corporate Bond Fund will merge with and into TCW Corporate Bond ETF on or about October 11, 2024.

As of Halloween, the strategy for the USCF Aluminum Strategy Fund will be “to cease operations, liquidate its assets, and distribute proceeds to shareholders.”

VanEck Dynamic High Income ETF will be liquidated, wound down, and terminated on or about Tuesday, October 15, 2024.

The Western Asset Total Return ETF will be merged with Western Asset Bond ETF sometime in the first quarter of 2025. While Western’s CIO has “gone on leave” because of an SEC investigation about 17,000 suspicious trades, that scandal seems to have no bearing here. This is just a bad fund going away.