Average Canadian borrower can expect to spend an extra $2,500 a year just on debt

Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Article content

Good morning,

Advertisement 2

Article content

Article content

When the going gets tough, the American dollar gets going.

That’s the way it’s been for ages — when markets get rocky and there are few places to hide, like now, the U.S. dollar is the port in the storm investors turn to.

For example, in the depths of the financial crisis, the greenback gained 23 per cent; during the global pandemic it was up 10 per cent. Now as the global economy grapples with searing inflation and pending downturn, the U.S. dollar is once again standing strong, up 16 per cent since the summer of 2021, say TD economists Beata Caranci and James Orlando in a recent report.

Among the developed nation currencies that have depreciated against the U.S. dollar, the loonie has held up pretty well, say the economists.

Advertisement 3

Article content

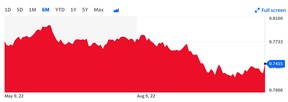

Though if you were hoping to hop across the border for some Black Friday shopping later this month, you might not think so. The loonie against the U.S. dollar hit as low as 72 cents on Oct. 17. It was trading at 74.20 this morning.

The Canadian dollar has declined about 11 per cent to the greenback this year, but TD says on a trade-weighted basis, it is only down about 5 per cent and when you strip out the U.S. dollar, the loonie is actually up nearly 1 per cent.

“We think this more accurately depicts the risks facing the Canadian economy,” they said.

Despite the storm clouds on the horizon, Canada’s economy so far has not fared too badly. GDP growth has averaged more than 3 per cent this year as higher commodity prices boosted corporate profits and government revenue, said TD. Income growth and savings have buffered Canadians against high inflation, more than their neighbours to the south.

Advertisement 4

Article content

It’s this strength that has allowed the Bank of Canada to raise interest rates rapidly this year, pretty much in lockstep with the U.S. Federal Reserve. “This, along side high commodity prices have put a floor under the CAD relative to peers,” said TD.

But that may be about to change.

Markets are betting that the Fed will end its rate hiking cycle higher than the Bank of Canada and yield curve differentials are widening, with U.S. yields more than 30 basis points higher than Canadian yields, said TD.

Caranci and Orlando say it’s not certain whether these expectations will hold, but for now it looks reasonable as inflation in Canada appears to be cooling quicker than in the United States.

The Bank of Canada increased its benchmark interest rate last month by half a percentage point to 3.75%, as it forecast the economy would stall over the next three quarters. Many economists had been expecting a larger 75 basis-point hike.

Advertisement 5

Article content

Another reason the Bank may ease up on the throttle sooner than the Fed is the higher household debt of Canadians, says TD.

“Canada has roughly two times the reliance on real estate, has experienced a sharper corrections, and has higher mortgages roll-over risks than the U.S.” said the economists.

TD estimates that by the end of the year, debt servicing costs for households will be 30 per cent higher than in the first quarter of 2021, with the average borrower spending an extra $2,500 a year just on debt.

According to Reuters, investors are betting the Bank of Canada will end its rate hiking at 4.25 per cent, about three-quarters of a percentage point less than is expected for the Federal Reserve’s terminal rate.

TD says it wouldn’t be surprised to see the loonie weaken in coming months as the full impact of rate hikes hits Canadians and the global economy weakens.

Advertisement 6

Article content

“The currency will likely flirt with 70 U.S. cents if the Fed continues its solo mission to test the upper limit of rate hikes,” said the economists.

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

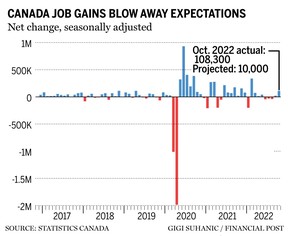

Canada’s job numbers Friday were a surprise. The economy gained 108,000 jobs in October, erasing the losses of May to September. Canadian employers added thousands more jobs than expected and wage increases continued to accelerate, a signal of growth that could complicate the Bank of Canada’s efforts to cool the economy, writes the Financial Post’ Bianca Bharti. The Bank is hoping its aggressive rate hikes will slow the economy and inflation, but this latest report suggests both are still running hot.

Advertisement 7

Article content

“The … surge in employment in October makes a mockery of claims that the economy is on the cusp of a recession,” Stephen Brown, a senior economist at Capital Economics, wrote in a client note after the data release.

There is still one more jobs report to come before the central bank must decide on rates Dec. 7. Bank of America analysts expect the Bank to slow its pace to a 25 basis point increase but in light of this latest data, now say another strong labour report could call for a higher hike.

“We expect the BoC to hike to 4.5 per cent, but we see upside risks to our call on a very resilient economy,” said BofA.

___________________________________________________

- COP27, the UN climate change conference, is underway in Egypt and today the World Trade Organization reports on trade and climate change

- Public hearing begins on Rogers Communications Inc’ $26-billion proposed takeover of Shaw Communications Inc

- Dominic LeBlanc, minister of intergovernmental affairs, infrastructure and communities; and Jeff Carr, New Brunswick minister of transportation and infrastructure, will hold a media availability following a meeting of federal, provincial and territorial infrastructure ministers

- Harjit Sajjan, minister of international development and minister responsible for the Pacific Economic Development Agency of Canada, will highlight the government of Canada’s plan to build a productive and innovative net-zero economy and announce funding for Simon Fraser University in British Columbia

- Sean Fraser, federal minister of immigration, refugees and citizenship; and Arlene Dunn, New Brunswick minister responsible for immigration and opportunities, will make a joint announcement regarding attracting skilled workers to the province

- Today’s Data: U.S. Consumer Credit

- Earnings: Franco-Nevada, Ritchie Bros Auctioneers, Ballard Power Systems, Activision Blizzard, Lyft, Mosaic, Finning International

Advertisement 8

Article content

___________________________________________________

_______________________________________________________

For beginners, investing in real estate in Canada in these challenging times means doing more research and planning more carefully before taking any action.

Advertisement 9

Article content

One way to get started is with online research, but that can be overwhelming. Our content partner StackCommerce offers a curated online training program, the Fundamentals of Real Estate Investment Bundle, as a more manageable jumping-off point. This 17-hour series of real estate investment training courses can help build your foundational knowledge and gain confidence for investing in residential or commercial properties. There’s no sure thing when you’re investing, whether in the real estate or stock market, but preparing well may mitigate some risk.

____________________________________________________

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Listen to Down to Business for in-depth discussions and insights into the latest in Canadian business, available wherever you get your podcasts. Check out the latest episode below: