Our profile of Moerus Worldwide Value ended with the note, “Moerus offers a rare and intriguing opportunity to invest alongside (in another of legendary value investor Marty. Whitman’s phrases) a distinguished ‘aggressive conservative investor.’” In the years since that profile first appeared, Moerus has posted top tier returns for the past one-, three- and five-year periods. After rising 6.4% last year (2022), the fund is up another 20.6% through July 30, 2023 which about doubles the returns of its peers.

MFO’s publisher, David Snowball, puts manager Amit Wadhwaney in the short list of the most thought-provoking people he’s spoken with. That judgment piqued my curiosity, and I sat down with Mr. Wadhwaney for a long conversation in February 2023, the results of which we published in our March 2023 issue. Mr. Wadhwaney’s continued success with a smaller cap value portfolio in a market largely obsessed with large / growth / momentum led me to reach out to him again in July 2023.

MFO’s publisher, David Snowball, puts manager Amit Wadhwaney in the short list of the most thought-provoking people he’s spoken with. That judgment piqued my curiosity, and I sat down with Mr. Wadhwaney for a long conversation in February 2023, the results of which we published in our March 2023 issue. Mr. Wadhwaney’s continued success with a smaller cap value portfolio in a market largely obsessed with large / growth / momentum led me to reach out to him again in July 2023.

What explains this good performance, and is this likely to continue? What about the current market environment is supportive of the fund’s strategy and positions? I reached out to the Moerus team once again to learn about the fund’s progress this year. We sat down in the Moerus fund’s office on West 38th Street in what once called the Garment District. Amit weaved together a tapestry of his fund and strategy, and I walked away with an even greater appreciation for their work.

My synopsis of our long and engaging conversation will highlight five issues:

- the Moerus Worldwide strategy and record

- positioning the Moerus portfolio

- the argument for fundamental analysis in portfolio building, and,

- the portfolio in its macroeconomic setting.

We’ll start with the fund.

Introduction to Moerus Worldwide Value

Moerus Worldwide Value invests in a portfolio of 15-50 great stocks with no particular interest in paralleling some index’s sector, size, or country weightings. The common themes are (1) high-quality companies, which are (2) deeply undervalued. The portfolio is constructed from the bottom-up through fundamental analysis. As of July 31, 2023, the fund is invested in 35 stocks and five other securities.

The fund is managed by Amit Wadhwaney. Prior to founding Moerus, he was portfolio manager and partner at Third Avenue Management LLC, where he managed Third Avenue International Value (TAVIX) from December 2001 to June 2014. Near the end of his tenure there, Morningstar described him as having “proved his mettle as a skilled and thoughtful investor, and his continued presence on the fund remains its main draw.” In addition to an M.B.A. in Finance from The University of Chicago, he holds degrees in economics, chemical engineering, and mathematics.

The fund launched in May 2016. Morningstar places its performance in the top tier of its peer group for every trailing period from one month to five years against its Foreign Small/Mid peer group. It likewise leads its Lipper Global Small/Mid peer group for the past one-, three- and five-year periods. The caveat is that those long-term numbers reflected four lean years (it substantially trailed its Morningstar peer group in 2017, 2018, 2019, and 2020 then crushed them in 2021, 2022, and 2023 (through 7/30).

The Moerus Fund allocations make the performance even more interesting

To understand and appreciate Moerus fund’s performance, let us look at a key few equity benchmarks for the year so far. The MSCI EAFE, which tracks non-US international developed stocks, is up 12%, and Vanguard FTSE Emerging Market ETF (VWO) is up 6.7%. Within the US market, which is up about 18%, the Vanguard Value ETF (VTV) is up 5.7%, and the Vanguard Growth ETF (VUG) is up 35.1% so far in 2023.

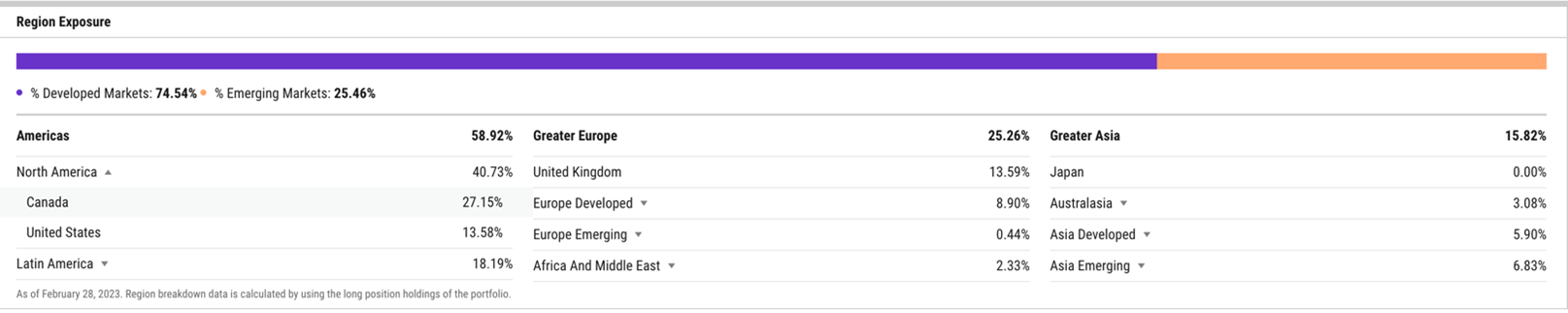

Now, let’s look at Moerus’ geographical allocation: 87% of the portfolio is outside the US.

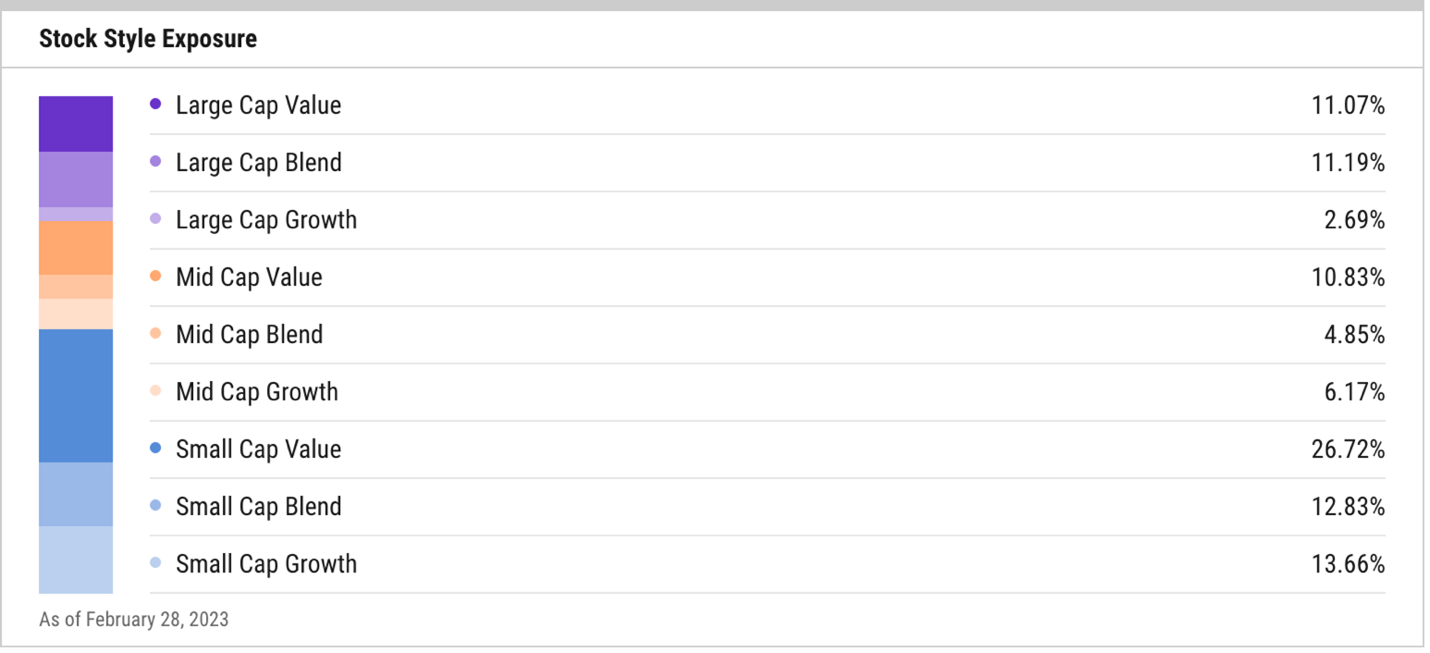

Next, compare its position in exposure, where only a quarter of the portfolio is in growth stocks. And these are not the same kind of growth stocks one would find in a technology fund.

Source: Ycharts data

Moerus shows that it is possible to be invested in stocks other than Mega cap US Tech and still be up 17.5% for the year. Investors often talk about the lack of diversification and the market’s narrow breadth in the US. The Moerus portfolio is sourcing returns from small and micro, international, and value. That’s diversification and breadth right there!

What does Moerus own?

The top six holdings in the Moerus fund as of June 2023 are Cia. Brasileira de Distribuição (CBD), Despegar.com Corp, Tidewater Inc, Spectrum Brands Holdings Inc., EXOR, Westaim Corp, and Conduit. These stocks account for about 26% of the fund.

To be candid, I know nothing about the business model of the stocks in the Moerus portfolio. Among the 35 stocks in the fund as of May 2023, I could probably list the business models of no more than five stocks. Here’s what I learnt: the fund managers at Moerus know these stocks cold.

Wadhwaney spent almost 90 minutes explaining to me the minutiae of many of his stock investments and the related thesis. The Fund Performance and Attribution section of the Q2 2023 Quarterly Review and Outlook brings out some of those stories. To repeat and in addition to what the report says:

-

- SPB Spectrum Brands: Spectrum is a global consumer products company; you might recognize brands like Black Flag, Iams pet foods, or Remington razors. “You would also know them if you bought any locks like Baldwin or Kwikset,” relates Wadhwaney. “Recently, they sold their Locks business for net proceeds of USD 3.6 Billion. The company’s entire Market Cap was USD 3.2 Billion. They will be buying back USD 1 Billion in shares. The market trades on earnings and momentum, trading the stock like a yo-yo, but the Sum of the Parts works out nicely if you do the work.”

- IDFC First Bank in India: where the CEO has merged a Non-Bank Financial Company (First Bank) with a deposit-taking bank (IDFC) and has been working on reducing funding costs by depending on retail banking. As the interest costs decline for the combined entity, earnings will improve.

- Wheaton: “Usually, we do not invest in precious metals companies since they have something magical built into their price. They are disconnected from reality and very expensive. But Wheaton has a silver streaming business and has now expanded into gold and cobalt streaming. In the streaming business, the company makes an upfront investment with a mining company. In return, the streaming company gets a deeply discounted price for purchasing the mined metals. Wheaton had collapsed at one point, and we bought it and we have been sitting on it for years.”

Why should we look at the investment thesis stock-by-stock?

There are two main reasons: The first reason is to make it clear that these stocks are not about Artificial Intelligence, Cryptocurrency, Quantum Mechanics, Electric Vehicles, Virtual Reality, or Social Media related advertising. Yes, there is life in the investment universe outside of the themes that get pummeled into our heads because companies like Microsoft, Apple, and Google are everywhere.

“There is nothing wrong with growth stocks. I just won’t pay up for them,” says Wadhwaney.

The second reason to lay out these stocks is to gain an appreciation that this kind of asset-based investing requires a different kind of investment skill set than ready-shoot-aim investing in the world of meme stocks and faith-based technology companies. There is a graveyard of deep-value stocks in the world. Many of them are traps. A sophisticated hand with a deep history of these businesses and the people who start/operate these businesses is required to navigate through the opportunity set. The Moerus team has that experience and a steady hand.

What kind of market environment works for the fund’s strategy?

Wadhwaney believes periods of mild or moderate inflation are good for the companies that make the portfolio. “Inflation gooses activity and boosts asset values. In addition, periods where financing is harder to get, are also good for these companies. If the capital equity markets are more difficult, or when banks refuse to give funding, then the existing assets on the company’s books start becoming more valuable. Corporate activity follows, which then leads to unlocking of embedded value.” There is more on this in the Quarterly outlook.

In Conclusion

Thoughtful investors want small, want international, and need value in the portfolio. The Moerus fund provides that answer. It’s run by a thoughtful team with decades of experience in value investing and with very good pedigree. Investors should take notice.

Moerus Worldwide Value website