When FEMA released its Risk Rating 2.0 methodology in October 2021, thousands of homeowners in low-elevation coastal areas of the United States braced for federal flood insurance hikes.

Recently released data from the agency shows that annual flood insurance premiums will eventually double or even triple for homeowners in some U.S. zip codes, though most homeowners with flood insurance in America will pay less than they currently do.

Congress has capped annual hikes at 18%, so it will take at least five years for affected homeowners to hit the full rate. But for the past year, FEMA has required new policies to be rated under the Risk Rating 2.0 methodology, meaning buyers pay full price immediately.

The data shows that the hardest hit homeowners are predominantly in South Florida, though some zip codes in Louisiana, Kentucky, Ohio and Texas will see double or triple digit increases as well.

In Palm Beach County’s Jupiter Inlet, flood insurance will increase by an average of 342% to $3,449, according to the Miami Herald, which analyzed the FEMA data. That’s the highest rate increase in the state.

In stunning Key Biscayne, homeowners will see rates climb as high as $7,096 annually on average, up 107% from the current $3,423 average cost of flood insurance. In Miami-Dade, three zip codes will see average premium hikes north of 200%, with premiums rising by more than $1,500 for homeowners. The average flood insurance premium will eventually be over $7,000 a year in Miami-Dade.

Homeowners in Gretna, Louisiana, just outside of hurricane-prone New Orleans, will see annual flood insurance premiums jump to $3,023 a year from $1,139, according to FEMA. In Houma, the average premium will increase to $3,511 a year from $982.

In fact, most zip codes in the Southeast under Risk Rating 2.0 will see an increase in annual premiums, according to the Miami Herald’s analysis.

More than any region, the Southeast has benefited from changing migratory patterns brought on by the COVID-19 pandemic. Florida’s state population grew by 706,597 people since the 2020 Census, and the Miami-Dade metro in particular has boomed. Florida metro areas are among the fastest-appreciating U.S. housing markets, recording some of the highest year-over-year growth in March, as measured by the CoreLogic Home Price Index.

The Miami metro experienced nearly five times the U.S. home price appreciation rate, posting a 15% annual increase in March 2023 compared with the national growth rate of about 3%, according to CoreLogic.

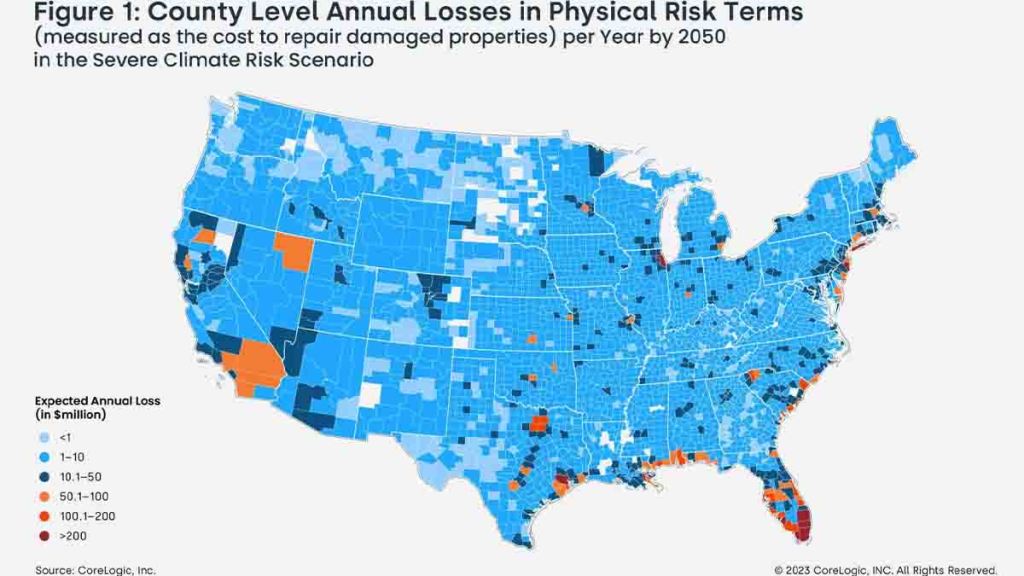

When CoreLogic ran a stress test against the most aggressive climate change scenarios, it found that U.S. counties exposed to hurricane risk have the largest estimated average annual loss figures. Miami-Dade was top of the list.

“On the current climate change path, nationwide estimated annual losses may increase to $23.5 billion per year by 2050 from the base period in severe climate-risk scenario,” economists at CoreLogic said.

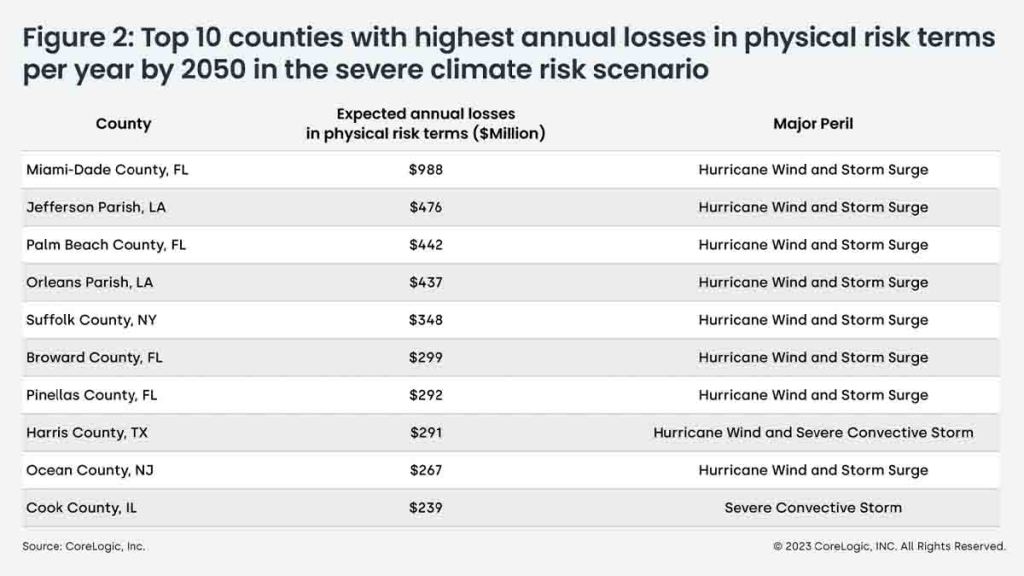

Here are the 10 counties with the highest annual loss projections through 2050. You’ll notice that four counties in South or Central Florida alone account for about $2 billion in annual losses.

It’s no secret that the National Flood Insurance Plan (NFIP) flood maps are outdated by several decades and don’t account for tens of billions of dollars in annual risk. The rates also have not been sufficient to cover the cost of annual flood claims – the program had a $20.5 billion shortfall as of 2020. The agency argues the new flood program better accounts for physical risk, and that’s likely true, even if the true level of risk still isn’t close to being budgeted for. Flood insurance rates would have to be astronomical for Miami-Dade’s actual risk to be met. There’s no political will to do that, not in Miami, not anywhere.

In the meantime, the combination of higher flood insurance rates and elevated mortgage rates is already cooling the housing market in Miami a bit. And it’s not because homebuyers suddenly appreciate the climate threat in a visceral way.

“I don’t think the climate is as much on peoples’ radar as the cost to insure,” Christina Pappas, vice president of the Keyes Company, told HW Media Editor-in-Chief Sarah Wheeler in late April. “It really is about the risk for insurance carriers. The flip side of that is for so long, especially in the Southeast and high-risk areas, we haven’t even had private companies in our marketplace. Florida created a state insurance product called Citizens Insurance as a backup to those homes that are high risk, that were unable to get private insurance. It has become the largest insurance carrier in the state.”

The Florida legislature has made big changes to encourage private insurers to re-enter the market, which would provide another option beyond Citizens Insurance (which requires policyholders to have flood insurance) and FEMA’s NFIP. That is a big step and arguably makes Florida a model for other states with similar climate-risk challenges.

For homeowners, it does mean they are going to pay a lot more for flood insurance over the next decade and beyond.

“We are seeing quotes for $1 million, $2 million, $3 million houses at $80,000 a year in insurance,” Pappas said. “OK, let me put a new roof on and it goes down to $60,000…You are seeing a really big conversation now around the insurance rates. Is that going to affect affordability? Absolutely.”

Are you in an area that saw a big increase in flood insurance premiums? How are you and your clients handling it? Share your thoughts with me at [email protected].

In our weekly DataDigest newsletter, HW Media Managing Editor James Kleimann breaks down the biggest stories in housing through a data lens. Sign up here! Have a subject in mind? Email him at [email protected]