Where do you prefer to make fixed income investments? Bank Fixed Deposits or a debt mutual funds?

How do you decide which is better?

The one that offers higher returns, right?

And how do you find that?

A common way is to compare the current 1-year bank FD interest rate with trailing 12-month returns of a debt mutual fund.

However, that’s not the correct approach. And in this post, we will see why. Now, if that’s not the correct approach, what do you compare 1 year FD returns against?

Before we get there, a quick comparison between Bank FDs and Debt Mutual Funds

Bank FDs vs Debt Mutual Funds

Safety: Bank fixed deposits are as safe as any investment can get. No such comfort with debt funds even though you can reduce the risk by selecting the right type of debt funds.

Predictability of returns and Volatility: Banks FDs score here too.

With bank fixed deposits, your returns are guaranteed. You can lock in the rate of interest. No volatility.

No return guarantee with debt funds. Can’t lock in your return (or YTM). The closest you come to locking in your return is through Target maturity fund (TMF) like debt funds. However, even TMFs can be extremely volatile.

Taxation: This is an area where debt funds score over bank FDs.

FD interest gets taxed at your slab rate, which is a problem if you are in higher income tax brackets. With debt funds, the taxation becomes benign if your holding period exceeds 3 years. You get the benefit of indexation and get taxed at a reduced rate of 20% (after indexation).

If you can’t compromise on safety and predictability of returns, then FDs are a clear winner.

However, if you are willing to assume some risk and volatility in search of more tax-efficient returns, then debt funds could be an alternative.

Over the past 6 months, the interest rates have risen.

And when the interest rates rise, two things happen.

#1 The bond prices fall because bond prices and interest rates are inversely related. And since debt mutual funds hold bonds, the NAV of debt funds falls too. And as the NAV falls, the past performance deteriorates. Past 6-month or 1-year return performance will go down too.

#2 However, the prospective (future) returns go up. A bond will pay a fixed coupon (interest) at regular intervals and mature at face value. Coupons and face value do not depend on the price you bought the bond at.

Hence, if you can buy a bond cheaper than investor A, you will earn better returns than investor A (if both of you hold the bond to maturity).

Investor A: Buys the bond at Rs 100.

Let’s say the interest rates rise and the price of the same bond falls to Rs 90. You buy the bond at Rs 90. Both of you earn the same coupon and get the same face value on maturity.

But you paid Rs 90 while investor A paid Rs 100. Thus, you earned better returns because you paid less for the bond.

Therefore, when the interest rates rise, the debt fund returns fall but the prospective returns rise.

How do we estimate prospective returns?

Yield-to-maturity (YTM) of a debt mutual fund (or a bond) is the best indicator of prospective returns.

Reproducing definition of YTM from Investopedia.

Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until its maturity. Yield to maturity is considered a long-term bond yield but is expressed as an annual rate. In other words, it is the internal rate of return (IRR) of an investment in a bond if the investor holds the bond until maturity, with all payments made as scheduled and reinvested at the same rate.

Read: Which are the best mutual funds when the interest rates are rising?

But there are problems with YTMs too

YTM is a reliable indicator of your returns in case of bonds if you hold the bond until maturity. This is because a bond has a finite life. There are no costs in holding and you have completely predictable cashflows from bonds.

YTM is also reasonably reliable for Target maturity funds (TMFs) like Bharat Bonds (if held until maturity). These products have limited lives and have an associated maturity date. For instance, Bharat Bond 2025 will mature in April 2025 and Bharat Bond 2030 will mature in April 2030.

The portfolio of such funds does not need much churn by design. The bonds in the portfolio are such that these mature close to product maturity date. Therefore, there is not much risk about reinvestment of principal. But there can be difference between the YTM and the actual return earned due to expenses, tracking error, and the risk associated with the reinvestment of coupons from underlying bonds.

Not as reliable for other debt funds. Most debt funds have infinite life. Hence, no concept of maturity. The portfolio keeps changing. Bonds mature and new ones replace them at prevailing yields (coupon). There is reinvestment risk for both principal and coupons. There are cash inflows and outflows. Plus, your returns will depend on YTM trajectory, rates at which maturing bonds and coupons got invested, fund expenses and the yields prevailing at the time of your exit from the fund.

While YTM can never be as reliable as an indicator as 1-year FD returns, it is far better than past 1-year returns.

Caveat: Interest rates rise. Bond prices and debt fund NAVs fall. YTM rises. However, the interest rates can always rise further. And if that happens, bond prices and debt fund NAVs will fall even more. More pain. The past performance deteriorates further. And the YTM (or prospective returns) will rise further.

This can happen in the reverse direction too. The interest rates fall. The bond prices and debt fund NAVs rise. YTM falls. However, if the interest rates were to fall further, YTM would go even lower. And bond prices and debt fund NAVs would show even higher gains.

What is the problem with comparing 1-year FD rates with trailing 12 month returns of Debt MF?

1-year FD rate is the return you will earn over the next 1 year.

Past (trailing) 12-month return of a debt mutual fund indicates how much you earned over the past 1-year.

FD 1-year interest rate is prospective. This tells you exactly how much you will earn over the next 1-year.

1-year debt return is retrospective. This does not tell you much about how much you will earn in the next few years.

Hence, comparing these two is not right, right?

The correct comparison should be with YTM.

Let’s look at the examples in this section.

If the interest rates have gone DOWN during the past 1-year

Then FD rates would have likely gone down too during the year. Hence, if you could open FD at 6% p.a. 12 months back, perhaps you can open today at 4.5% p.a. only. So, you will compare competing products against this 4.5% p.a.

During the same interval, bond prices would rise due to falling rates. The debt fund NAVs would rise too, favourably impacting short term returns. However, that is the past. Past 1-year return won’t tell you what to expect in the coming 12 months or 24 months. For that, you must focus on YTM.

Something very similar happened post the first Covid wave (March 2020). RBI cut the repo rates sharply. FD rates also dropped sharply. Debt funds would benefit from this.

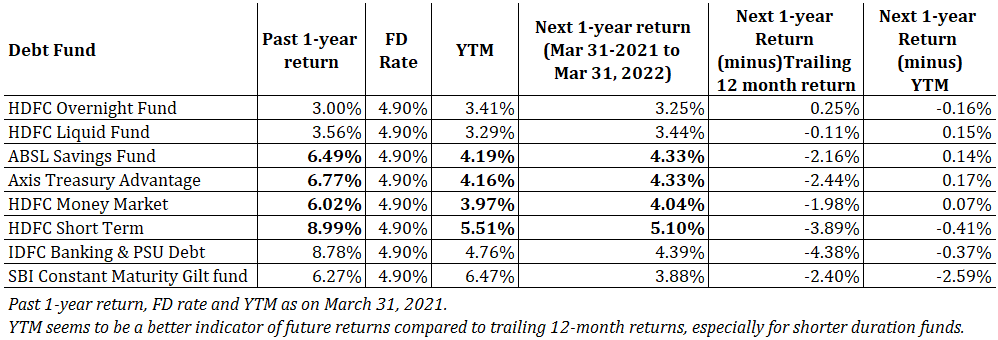

In March 2021, if you compared 1-year FD returns with trailing 12 months debt fund returns, the latter would look more compelling (capital gains due to interest rates falling).

Around that time, FD rates were about 5% p.a. This was frustrating for investors. Many clients reached out with comparison of FD rates with trailing 12-month returns of debt funds (which were shared by their RMs). Trailing 12-month debt fund returns looked impressive (because interest rates fell).

However, the YTM of debt funds were much lower than trailing 12-month returns. And YTMs were lower because these reflected the prevailing yields in the economy.

Now let’s see what happened over the next 12 months. March 31, 2021, to March 31, 2022.

As you can see, YTMs proved to be a much better indicator of the next 1-year returns, especially for shorter duration funds. In fact, 1-year FD has done better than most debt funds in the next 1 year.

For FD rates, I rely on this publication from the Reserve Bank of India. While the RBI presents data for 1-3 year duration, I take the lower end for FD rates. 3-year FD rates will likely be higher than 1-year FD rates.

If the interest rates have gone UP during the past 1-year

Then it is likely that FD rates are at a higher level than they were 1 year ago.

Hence, it is possible you can open FD today at 6% p.a. but you could open it at only 4.5% p.a. about a year ago. You will compare competing products against 6% p.a.

Now, the interest rates have risen, the debt funds would have suffered because of rising rates. Thus, the recent past performance would also look bad. By the way, the adverse impact of rising interest rates is more on funds that hold long duration bonds (compared to debt funds holding shorter duration bonds).

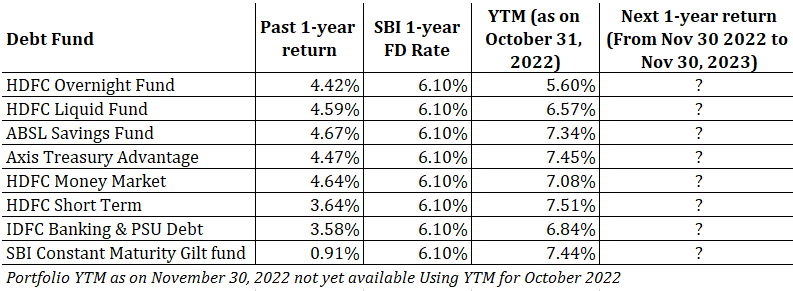

Now, let’s go back to November 2021. The interest rates have risen in the past 12 months.

Here we see some divergence between YTM as on November 30 2021 and returns over the next 12 months for liquid and overnight funds. The reason is that these funds hold very short-term securities.

Overnight (1 day) and Liquid fund (up to 90 days). Portfolio churns very quickly. Bonds mature and get replaced. Hence, these funds benefit as reinvestments happen at higher rates.

What is the position today?

The interest rates have risen over the past 6 months, this would affect debt fund returns adversely. However, 1-year FD rates have risen. SBI offers 1-year FD at 6.1% p.a.

While trailing 12-month returns are poor for debt funds, you need to focus on the YTM. As the rates have risen, YTMs have also gone up.

1-year FD rate > Past 1-year return of all the debt funds considered.

But, as discussed, we need to focus on YTMs.

If you are worried about interest rates rising further (may or may not happen), pick shorter duration funds or if you want to lock-in yields, you can consider Target maturity funds. For more on this, refer to this post.

Do not reach a wrong conclusion

I am not suggesting that debt funds are better than bank FDs at the current juncture (December 2022). Both have their own merits and demerits.

I trust your judgement.

I just want to highlight 2 aspects.

- Do not focus on trailing returns of debt funds while comparing a debt fund to a bank FD. Or even while comparing 2 debt funds. You might go in the wrong direction. This applies even when you are selecting debt funds.

- Focus on YTM (Yield-to-maturity). While YTM is not failsafe, this is still the best indicator of prospective returns from debt funds, especially for shorter duration debt funds.

When it comes to predicting performance in the short term, YTM seems a more reliable indicator for shorter duration funds (overnight, liquid, ultra-short, low duration, and money market). These funds usually hold bonds that mature within 1 year. This is because such funds are less sensitive to interest rate movements.

With longer maturity bond funds (SBI Constant Maturity Gilt fund), sensitivity to interest rate movements makes it difficult to estimate short term returns unless you have a view on interest rate movements (your view turns out correct). By the way, YTM is also a decent predictor of returns for long duration bond funds provided you hold the fund for a longer period.