Pandemics, inflation, rising interest rates, war in the Ukraine—uncertain times indeed! And yet, in the world of estate planning, almost every change in the zeitgeist offers its own suite of planning opportunities and applicable techniques.

Defining characteristics at this moment include prospects of the Fed driving interest rates higher, rising and volatile asset values, and the very legitimate concern that the current high level of federal gift and estate tax exemptions will sunset at the end of 2025 to much lower levels. So, what to do?

We can start with a favorite slogan at Fieldpoint Private: “The estate tax is a voluntary tax; you can pay it, or you can plan around it.” And while that’s not entirely the case, there is much truth to it. A corollary might be, there’s a tool for every job.

Let’s explore more deeply the estate planning techniques and strategies that should be considered now.

• Gifting assets out of one’s estate to irrevocable trusts for the benefit of family members. If done properly this removes the current value, and equally important, all future appreciation of those assets from one’s estate—where they would otherwise be subject to a 40% federal and any applicable state estate tax. This is a timely strategy for two reasons: 1) the federal lifetime gift tax and estate tax exemption is currently $12.06m per person. As mentioned, they will sunset at the end of 2025 to a level likely only half that amount. So, there is clearly a window closing here; 2) couple that with the fact that we are in a period of volatile asset prices, a poster child being the equity markets, or digital assets, e.g. cryptocurrency, NFTs, etc. This creates the opportunity to gift assets out of the estate when they reach short term cyclical lows that one expects will reverse. That is the ideal time because the lower the value of an asset at the time of the gift, the less the amount of the lifetime exemption that need be used. Moreover, if the assets gifted are expected to recover and appreciate there is real leverage with this strategy.

An irrevocable trust is an ideal vehicle because it can be created to custom fit the needs of the family. It can protect the assets from the “slings and arrows of outrageous fortune,” aka divorces, creditor actions, bankruptcy, etc., and if desired leave the assets in trust for multiple generations with no further estate or gift taxes to be paid. This latter flavor of irrevocable trust is known as a generation skipping or “dynasty trust.”

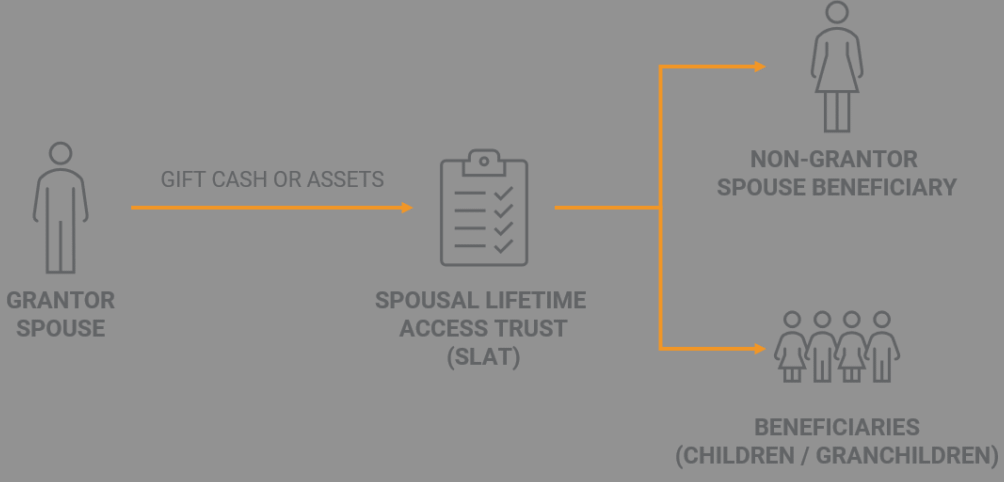

• An interesting variation on this theme is the spousal limited access trust (SLAT). It is an irrevocable trust created by one spouse for the benefit of the other and usually the children of the couple. It provides access to both income and principal during the spouse’s life and can continue for the benefit of children and grandchildren. (And if you care to supercharge, it can even be drafted as a dynasty trust.) The attractiveness is that assets can be gifted out of one’s estate to these trusts, and while the maker of the gift (the grantor) cannot be a beneficiary of the trust, his or her family can. And couples may also set up reciprocal SLATS where each is the beneficiary of the other’s trust. This is about as close to having your cake and eating it too as you will find in the estate planning world. Of course, it isn’t quite as simple as that. For example, what happens in the case of a divorce, when suddenly your spouse isn’t your spouse anymore. In that case, there are workarounds; just be sure you are in the hands of competent legal counsel.

So much for fluctuating asset levels and sunsetting high exemptions. We are also in a changing interest rate environment. Rates have been at historically low levels for a considerable time. They are now on the rise. Interest rates are a significant factor in a number of popular and effective estate planning strategies. Let’s look at an example for each.

• Interest rates are low: A grantor retained annuity trust (GRAT). A GRAT is a trust into which the grantor contributes assets and enjoys a fixed annuity stream for the life of the trust. At the end of the trust term any remaining assets are distributed generally to family members or a trust for their benefit. In order to avoid a gift tax on the calculated remainder, otherwise due when the trust is created, most GRATs are of the “zeroed-out” variety. That means that the present value of the annuity stream to the grantor is equal to the amount of the initial funding of the trust. And so, because you basically get back what you put in, no taxable gift occurs. Importantly, the lower the interest rate, the higher the value of the income stream. That means the grantor can take a lower annuity amount and with respectable appreciation of the assets in the trust there will be a meaningfully larger amount as a remainder for heirs. Although beyond the range of this article, other trust techniques that benefit from a low interest rate environment are charitable lead annuity trusts (CLATs) and sales to intentionally defective grantor trusts (IDGTs).