With yields at high levels and inflation falling, I sold a poor-performing stock to buy two Tax-Exempt bond funds. In this article, I look at municipal money market and bond funds for tax-efficient accounts. I began this search by looking at funds that are available at Fidelity or Vanguard with no transaction fees. I further based the selection on both longer and shorter performance relative to peers, Fund Family Rating, Fidelity Fund Picks, and Morningstar Ratings among other factors.

This article is divided into the following sections:

TAX IMPLICATIONS OF MUNICIPAL BONDS

Municipal bonds (and funds) are exempt from federal taxes. J.B. Maverick describes in “How Are Municipal Bonds Taxed?” at Investopedia some aspects of taxes on municipal bonds. The key points are:

Municipal bonds are debt securities issued by state, city, and county governments to help cover spending needs.

From an investor’s perspective, munis are interesting because they are not taxable on the federal level and often not taxable at the state level.

Munis are often favored by investors in high-income tax brackets because of the tax advantages.

If an investor buys the muni bonds of another state, their home state may tax interest income from the bond.

It is beneficial to check the tax implications of each specific municipal bond before adding one to your portfolio, as you might be unpleasantly surprised by unexpected tax bills on any capital gains.

FINANCIAL PLANNING

Financial Planners try to balance multiple goals, which may include income security, transferring inheritance, gifting, and/or taxes. One factor that impacts me is the desire to convert a Traditional IRA to a Roth IRA in a tax-efficient manner (2023 Tax Rates). The Tax Cuts and Jobs Act (TCJA) of 2017 will expire (sunset) at the end of 2025, and taxes are likely to revert higher in 2026. This creates a window of opportunity for me while deferring social security, and my income is low.

Medicare Premiums are based on Modified Adjusted Gross Income levels, which include non-taxable Social Security income and tax-exempt interest. I calculated a target amount for a Roth Conversion to balance taxes with higher Medicare premiums.

I also ran a break-even analysis to determine that family social security benefits will be higher if I begin drawing benefits at age 69 instead of deferring until I reach age 70. The reason is that my wife falls under the Social Security Government Offset Provision (GOP), which reduces her Spousal and Survivor benefits by two-thirds. She can only draw spousal benefits once I have started drawing mine, and they are based on my full retirement date and don’t include a higher amount for me deferring until age 70.

These factors combined are an incentive to keep taxable income low, and tax-exempt funds are part of my financial plan. As a final note, I have already matched fixed-income ladders with withdrawal needs such as Required Minimum Distributions for Traditional IRAs.

RECESSION WATCH

The forecast from the Conference Board calls for a recession, while the Philadelphia Fed Survey of Professional Forecasters implies a “soft landing” with slowing growth. Real Consumer Spending accounts for about seventy percent of GDP and has been relatively flat for the past two years while government expenditures have been rising and helped buoy the economy. Whether the US experiences a “soft landing” or a recession remains to be seen, but growth is likely to slow and market volatility to increase. The New York Federal Reserve estimates the probability of a recession occurring during the first seven months of 2024 to be higher than fifty percent based on the yield curve.

Figure #1: Real GDP Estimates

| REAL GDP | |||

| Year | Quarter | Conference Board | Philadelphia Fed Reserve Survey |

| 2023 | Q2 | 2.4 | 2.4 |

| Q3 | 1.3 | 1.9 | |

| Q4 | -1.0 | 1.2 | |

| 2024 | Q1 | -0.8 | 1.1 |

| Q2 | 1.0 | 1.0 | |

| Q3 | 2.1 | 1.3 | |

Source: Conference Board, Philadelphia Fed Survey of Professional Forecasters

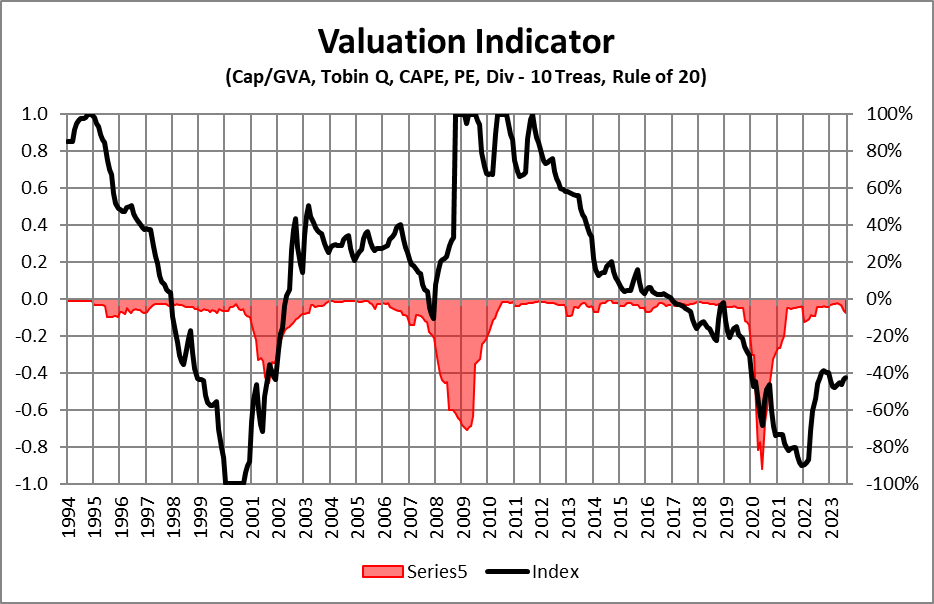

Easy monetary policy has driven up asset prices. Over the past decade, there have been so many reasons presented describing why the stock market was not overvalued, such as low interest rates and inflation. I have incorporated some of these methodologies into my Valuation Indicator, where +1 is very favorable, and -1 is very unfavorable. With money market funds paying 5% and intermediate Treasuries paying over 4%, bond funds continue to be attractive relative to stocks, in my opinion. Of course, investors should maintain diversified portfolios.

Figure #2: Author’s Valuation Indicator

Source: Author Using St. Louis Federal Reserve and S&P Global

Stocks outperform bonds over sufficiently long periods of time. I prefer a tilt toward bonds over the intermediate term because of a likely economic slow-down or recession, high equity valuations, and high yields with falling inflation.

TAX-EXEMPT MONEY MARKET FUNDS

Tax-exempt money market funds may be suitable for investors concerned about taxes, particularly when rates are rising, as well as for meeting short-term expenses. Since rates appear to be plateauing, longer-term funds might be better located in bond funds with longer durations.

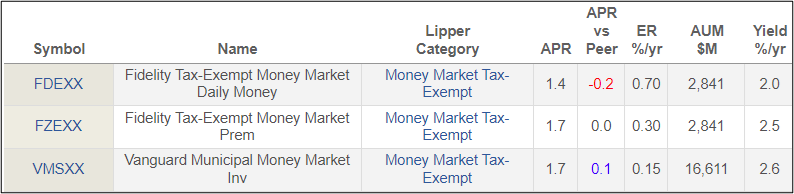

Fidelity Tax-Exempt Money Market Fund (FDEXX) has a seven-day yield of 2.51%, while the premium version (FZEXX) has a seven-day yield of 2.99%. The Vanguard Municipal Money Market Fund (VMSXX) has a seven-day yield of 3.15%. By comparison, Treasury money market funds like FZFXX have a seven-day yield of nearly 5%. Tax-exempt funds are more applicable to those in higher income brackets.

Table #1: Money Market Tax-Exempt (YTD)

MUNICIPAL SHORT-TERM DEBT

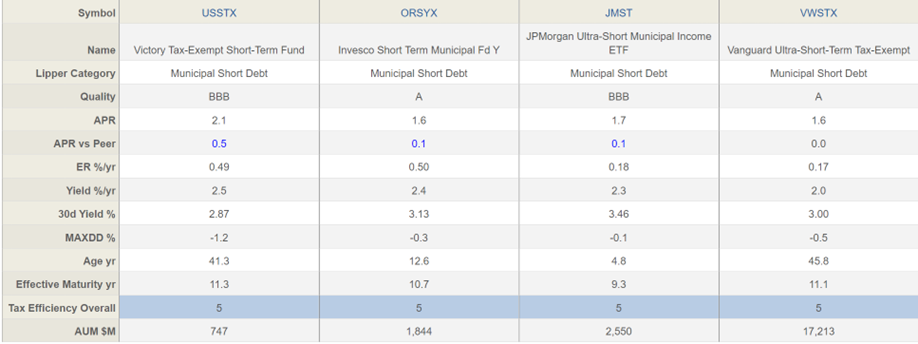

Short-term municipal bonds will generally be less volatile than bond funds with longer durations. Currently, they are benefiting from high yields from an inverted yield curve. Yields on Treasuries with durations less than two years are generally higher than five percent. These will benefit to a small extent as yields start to normalize. Yields on these short-term municipal bond funds range from 2.87% to 3.46%.

Table #2: Municipal Short Debt (YTD)

MUNICIPAL SHORT-INTERMEDIATE TERM DEBT

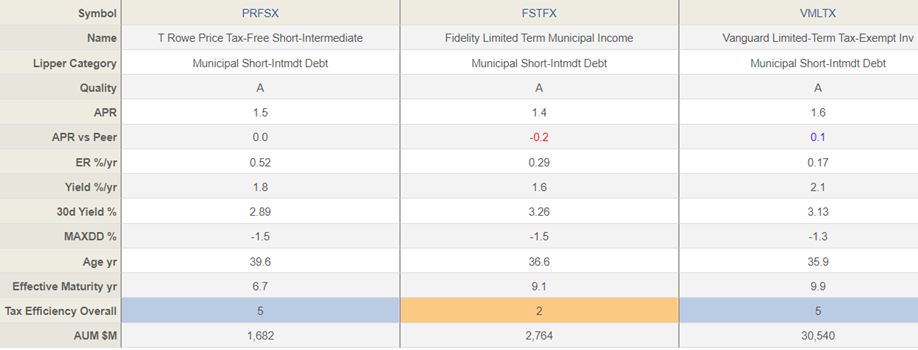

Short-intermediate term bond funds may be suitable for someone who does like the volatility of higher duration bond funds.

Table #3: Municipal Short-Intermediate Debt (YTD)

MUNICIPAL INTERMEDIATE TERM DEBT

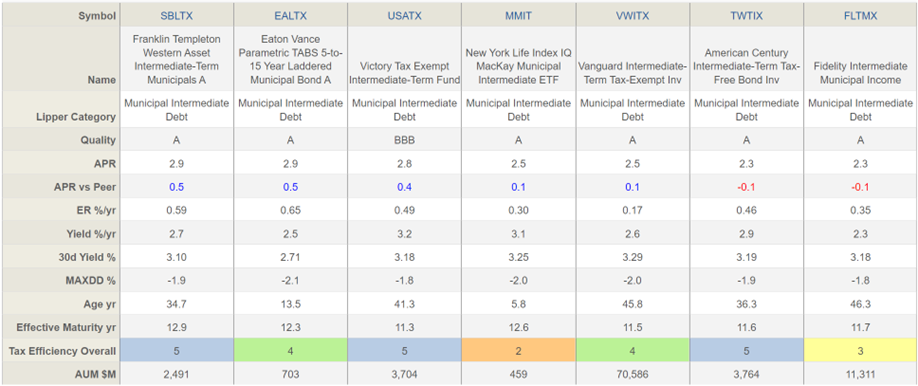

Yields on intermediate bonds are lower than most short-term bond funds because of inverted yield curves. Buying intermediate bond funds may be beneficial for investors wishing to lock in yields for longer periods and will benefit more than short-duration bond funds when yields start to fall, as happens when the economy slows. This is one of the Lipper Categories that I am most interested in.

Each of the Municipal Intermediate Funds shown in Table #4 are quality funds. USATX is available at Fidelity with a transaction fee. Vanguard’s VWITX has an expense ratio advantage, followed by MMIT. For convenience in an account at Fidelity and low expense ratio, I like FLTMX and MMIT. For long term performance, I like EALTX.

Table #4: Municipal Intermediate Debt (YTD)

MUNICIPAL GENERAL & INSURED DEBT

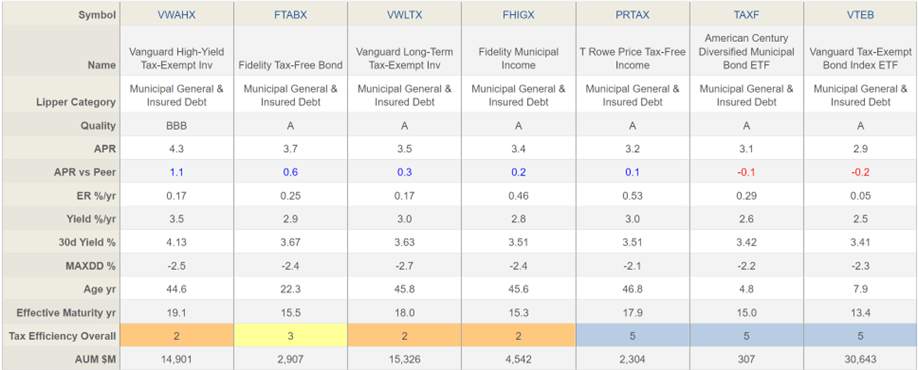

General & Insured Municipal Debt Funds are those that generally invest in the top four credit ratings. I favor this category in this environment, in addition to intermediate bond funds. Again, Table #5 contains quality funds. For a Fidelity account, I favor FTABX for its long-term performance and for its low fees, followed by TAXF.

Table #5: Municipal General and Insured Debt (YTD)

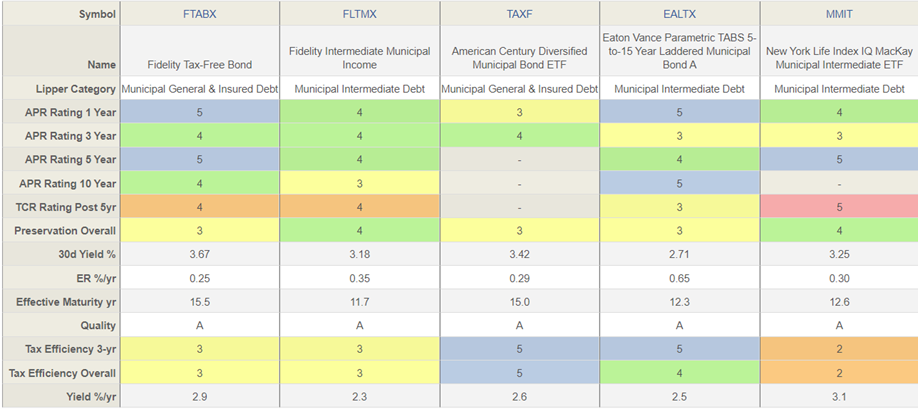

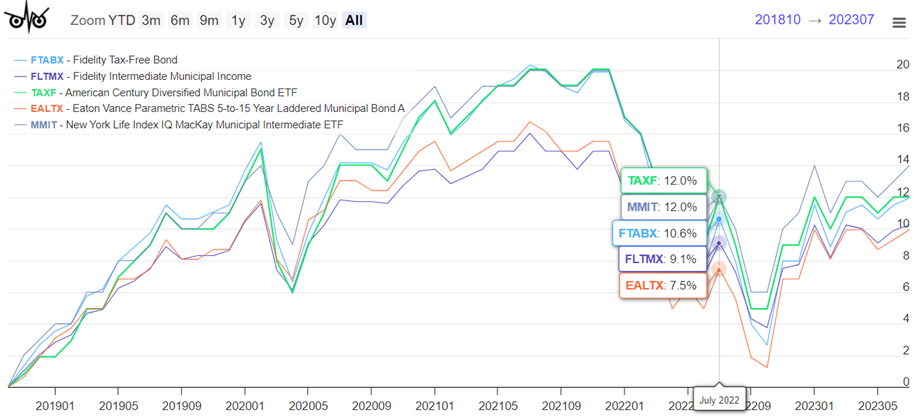

COMPARISON OF SHORT-LISTED FUNDS

Table #6 and Figure #3 are comparisons of the Municipal Intermediate and General & Insured Debt funds that I identified in this article.

Table #6: Comparison of Author’s Short-Listed Funds

Figure #3: Comparison of Author’s Short-Listed Funds

For tax-exempt bond funds in a Fidelity account, I favor the Fidelity Tax-Free Bond Fund (FTABX) and American Century Diversified Municipal Bond ETF (TAXF). FTABX has a minimum investment of $25,000. FLTMX is a good alternative with a lower minimum investment.

Closing Thoughts

As a result of writing this article, I invested in Fidelity Tax-Free Bond Fund (FTABX). I also bought a single-state municipal bond where I live because interest will be deductible from state income taxes.