As a Real Estate Tax Strategist, I review thousands of tax returns every year. Throughout my career, I’ve detected a common area for mistakes: depreciation.

Depreciation is a fundamental tool for real estate investors. Improperly reporting it on your tax sheets could lead to paying thousands of dollars extra in taxes. That’s why in this article, I’m providing five critical items you must review on your depreciation schedules to ensure you’re getting the most out of your properties.

Reporting Depreciation

First, if you have any income generated by a long-term rental property owned by you or by a single-member LLC, you must report it on Schedule E of Form 1040.

All ordinary and necessary expenses related to your property, including depreciation, can be deducted.

But what is depreciation, anyway?

In short, depreciation represents a rental property’s declining value over time. We know that real estate tends to appreciate, but depreciation still applies and actually helps us pay less on our taxes. There are several depreciation methods, but it’s important to abide by what the IRS allows. The IRS prescribes a long set of rules and regulations on depreciating assets, including a standard useful life of 27.5 years for most residential rental properties.

Like I said, depreciation is great because it offsets some of the costs you incur throughout the year and lowers your tax basis. That’s why reviewing these next five topics are so important!

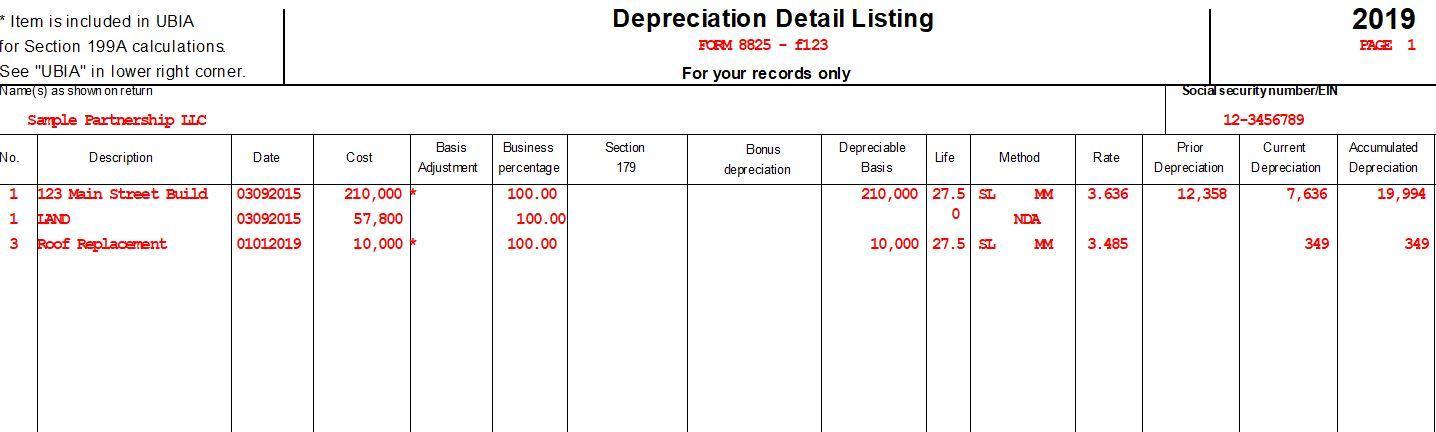

Before we get started, here’s a visual of what a depreciation schedule looks like:

Five Items To Review On Your Depreciation Schedule

1. Review All Listed Totals

It seems obvious, but the first thing you must do is check the property’s total depreciable value. For the most part, you’re just making sure the total is less than the purchase price. Keep in mind that some costs such as inspections, due diligence fees, and more will be included in your depreciable basis but the total should never equal or amount to more than your purchase price.

For instance, if the depreciable value equals $200,000 but your purchase price totaled $150,000, you should consult with your tax professional.

Errors over depreciable value occur all of the time, especially in determining land values. Since land isn’t depreciable, the solution is to use a ratio against the total value of the property, then multiply by the purchase price for a lower land value that helps reduce the tax basis. This is the same method a county tax assessor uses.

But say, for example, a tax preparer uses an actual land value of $50,000 instead of applying a ratio. With the building included, the total tax basis equals $160,000.

The problem? The client paid $120,000 for the property. This mistake accidentally gave the client an extra $40,000 on their basis!

An awful mistake like this can be prevented by simply being vigilant about the numbers posted in your depreciation schedule.

2. Make Sure Land Is Accounted For

To expand further on the topic of land, it’s important that your depreciation schedule accounts for it, despite it not being depreciable.

What do I mean?

If you paid $200,000 for a rental property and all $200,000 is listed as the depreciable amount, something is wrong. You’re essentially stating that you are, in fact, depreciating the land, since the purchase price is equal to the depreciable amount.

You cannot do this. As mentioned earlier, you should use the county tax assessors ratio to determine a proper land value in depreciation.

In the event you fail to do this and continue to deduct depreciation year-over-year, you’ll be facing serious back pay when the error is found and corrected.

3. Make Sure Renovation Expenses Are Broken Down When Possible

If you had a major renovation, see if it is listed as a lump sum amount on the depreciation schedule. If you spend $40,000 on a renovation that included $10,000 worth of landscaping and $5,000 on new appliances, there may be a more advantageous way of reporting it.

A major renovation is assumed to be a 27.5-year improvement, the same useful life of a rental. However, there are certain assets that have been specifically assigned shorter lives.

Landscaping, for example, falls into a category known as land improvements, which have a life of 15 years. Additionally, any assets with a life of less than 20 years can potentially be expensed in the first year of ownership using bonus depreciation.

There are lots of potential savings with renovations. I highly recommend having a conversation about it with your tax professional.

Beware of errors, though.

For instance, we once had a client who was considered a real estate professional (meaning they could deduct unlimited rental losses). They had been buying 2-3 new rentals each year, completing major renovations on each. Their prior depreciation schedule listed “$82,000 Renovations ? 27.5-years” for every property. This resulted in a depreciation deduction of about $2,980 for the year.

However, when we broke down the components of the renovations, there was a lot of depreciation left on the table:

- $8,000- Landscaping

- $6,200- Appliances

- $2,000- New fencing

- Total: $16,200 – Assets with a life of fewer than 20 years, qualifying for year one bonus depreciation

- Total value: $63,800

With these numbers, the client could have taken a depreciation deduction of $18,520 for the year.

4. If You’re Using Delayed Financing Methods, Make Sure Your Tax Pros Know

If you run a delayed financing strategy where you place your renovation costs into escrow when you purchase, your tax professional may be shorting you on depreciation. This is because many tax professionals do not realize the structure of this type of transaction. They are likely taking the full renovation amount and lumping it into the purchase price, then allocating the total amount between land versus building.

This is incorrect because the allocation should only apply to the purchase price. The renovation amount should be accounted for separately.

Let’s say a client’s prior CPA took the full amount of his HUD property — where they prepaid renovation costs to allow for earlier refinancing via the BRRRR method — as their purchase price. The totals would show $30,000 for the purchase price and $40,000 for the renovation escrow (ignoring miscellaneous closing costs).

Their initial depreciation was calculated as:

$70,000 Purchase price * 82% building value (per the tax assessor’s ratio) = $57,400 depreciable value at 27.5 years for a deduction of $2,087 per year.

However, because of the strategy the client used, the depreciation should have been:

$30,000 purchase price * 82% building value = $24,600 depreciable value at 27.5 years for a deduction of $895 per year and a $40,000 renovation value (which could have likely been broken down further as we did earlier) at 27.5 years for a deduction of $1,454 per year. That amounts to a total annual depreciation deduction of $2,350 per year.

This might not seem like a lot, but this client had nearly ten properties that were all set up using the traditional, but incorrect method. As you can see, it resulted in a lost depreciation deduction of close to $4,000 per year, across multiple years.

The good news is that we were able to correct it by utilizing Form 3115 and recoup the deduction.

5. Be Aware Of Service Dates

Your rental is eligible for depreciation when it is “in service”, meaning ready and available for rent.

Important note: Normal vacancies or spans of non-occupancy for renovation do not take a property out of service. If you were to buy a rental with tenants in it, issue them a 60-day notice to vacate, then spend 90 days on a renovation, the property is still in service throughout that time.

Review the dates listed for your rental asset and any renovation dates. Many preparers will ask for an in-service date, but won’t ask if the rental was occupied when first purchased. They’ll just utilize the purchase date.

That’s why it’s important to note if a property is purchased vacant. If you buy on January 1st but require a six-month renovation, the property won’t be in service until the end of those six months.

Conclusion

With tax day quickly approaching, it’s important to review depreciation concepts and make sure you’re on top of your filing requirements.

Hopefully, this checklist has served as a useful guide for you and your business!