The best way to fight inflation and get lower mortgage rates is to get more apartment units finished, and so far, this has been slower than my tortoise Grundy. One of the most frustrating data lines since COVID-19 has been housing completion data.

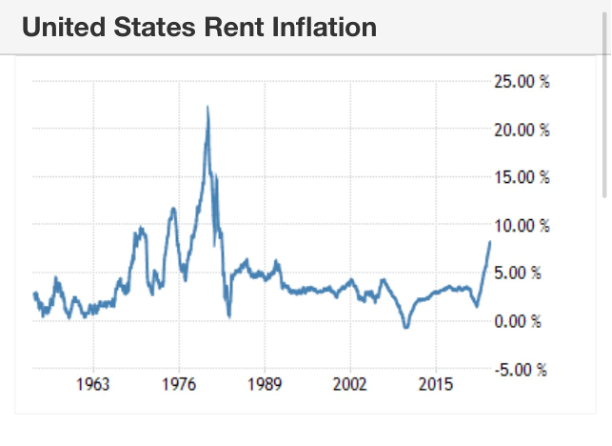

Of course, we all understood the delays during the pandemic, but those days are over. We need to ramp things up and so far, it hasn’t been spectacular. The faster we get 5-unit construction finished, the better we can fight against inflation and get lower mortgage rates. Why is this the case? It’s because shelter inflation is the biggest component of CPI inflation at 44.4%, and you can’t have a 1970’s inflation boom without rents taking off.

From Census: Housing Completions Privately‐owned housing completions in April were at a seasonally adjusted annual rate of 1,375,000. This is 10.4 percent (±9.9 percent) below the revised March estimate of 1,534,000, but is 1.0 percent (±16.4 percent)* above the April 2022 rate of 1,361,000. ingle‐family housing completions in April were at a rate of 971,000; this is 6.5 percent (±11.0 percent)* below the revised March rate of 1,039,000. The April rate for units in buildings with five units or more was 400,000.

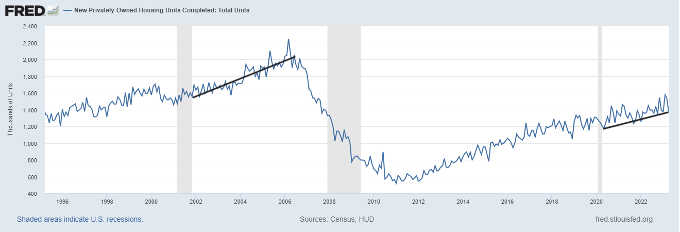

As you can see in the chart below, the lack of completion data we’ve had since COVID-19 is regrettable and it’s also bad for mortgage rates. However, you can see why construction employment has stayed firm. If you only saw this chart below, you wouldn’t know that housing starts and permits had fallen.

This has been one miscalculation people have made when looking for jobs lost in the employment of construction workers, primarily working in residential real estate.

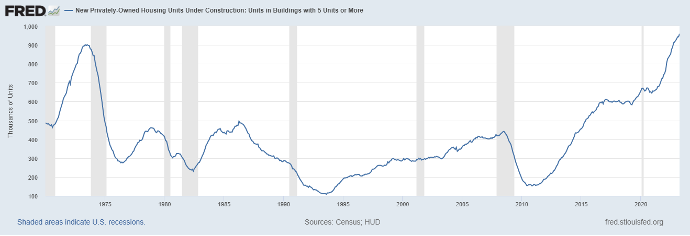

As we all know, we have a record number of apartments under construction. With rent inflation already cooling down, keeping the pressure on to fight inflation is a must because the Federal Reserve is obsessed with the 1970s inflation storyline.

I believe 1970s-style inflation can’t happen with the growth rate of rent inflation about to fade over the next year. Not only is the growth rate of shelter inflation cooling off, more supply is a punch in the gut against inflation. The chart below shows why I’m skeptical about repeating the massive rent inflation we saw in the 1970s.

So, how many 5-units under construction do we have today? It’s a record! No joke, we have more 5-units under construction right now than any other time in history. This is always positive because the best way to fight inflation is always with supply. If you try to destroy inflation with demand destruction, it’s only a short-term fix.

After the 1974 recession started, we can see a collapse in this data, so I know we are running on a recession time clock, but I hope we get these 5-units up as fast as possible. We can see we have under built apartments over the decades, so the big build-up recently is greatly appreciated.

I don’t believe we will be back in the 1970s, with inflation spiraling out of control, so if the labor market breaks, with jobless claims rising above 323,000, the Fed should have less fear of wild 1970s inflation. When Americans are losing their jobs, the Fed should do what is necessary to prevent even more people from losing their jobs.

We are at the economic cycle stage where we need to be more concerned about what the Fed doesn’t do during a recession since the rate hike story is ending. Part of the problem is that as banking credit gets tighter and demand gets weaker, this economic sector can get hit hard like it did in the 1974 recession. So, get these apartments up as soon as possible, otherwise we could be on the cusp of this positive data fading in the future.

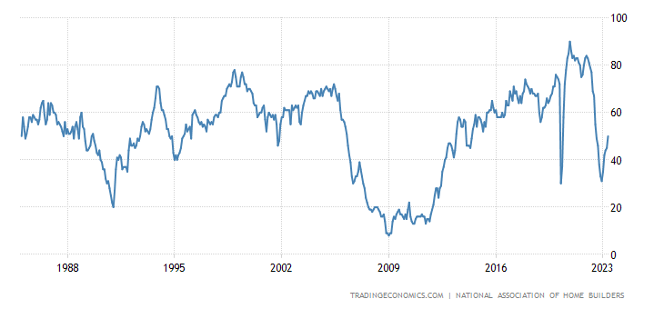

Builder’s confidence is back!

The homebuilders’ confidence index is back, out of negative territory after the waterfall collapse in the index in 2022. This index hit 50, the line between positive and negative. Historically, the housing market has already bottomed when the index goes from a negative to a positive. As the chart below shows, that first bounce higher with legs is a good sign for the housing market.

Robert Dietz, chief economist of the National Association of Homebuilders, tweeted yesterday: “May NAHB / Wells Fargo Housing Market Index rises 5 points to key break-even level of 50. 5th straight month of increase and first level at 50 or higher since July 2022. Builder sentiment supported by lack of existing home supply.”

Of course, the builders have taken advantage of their position: not only are active listings in the U.S. near all-time lows, but builders can entice buyers by offering lower mortgage rates than what a buyer of an existing home can get. It’s perfect timing considering they still having a backlog of homes to work off.

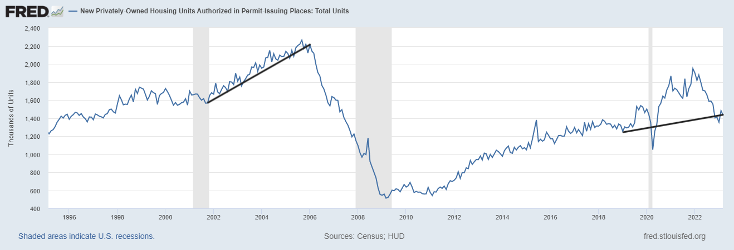

However, even with better confidence, the builders are not cracking out new housing permits. This makes perfect sense to me, because while they’re feeling better about their future, they still have too much monthly supply of homes to start to look out in the future in a big way.

From Census: Building Permits Privately‐owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,416,000. This is 1.5 percent below the revised March rate of 1,437,000 and is 21.1 percent below the April 2022 rate of 1,795,000. Single‐family authorizations in April were at a rate of 855,000; this is 3.1 percent above the revised March figure of 829,000. Authorizations of units in buildings with five units or more were at a rate of 502,000 in April.

As you can see in the chart below, while the housing permit data has stabilized, it’s not lighting a fire on future growth.

I have a simple model for this: as long as the monthly supply of homes is over 6.5 months, the builders don’t traditionally grow their permits significantly. Since the last new home sales report had 7.6 months, I am not looking for anything meaningful to happen.

We don’t have anything too surprising in this housing starts report; however, we should have urgency to get these apartments out as fast as possible to fight inflation. While the housing starts data, like most housing data, is finding some stabilization at these levels, the question is when will we see growth in the data lines going out? This, of course, can be helped out with lower mortgage rates, and while the builders are feeling better about their business, they’re not firing out housing permit data.