The leaves are turning crimson and gold in Central Park. On the Upper West Side, surrounding the American Museum of Natural History, are oak trees. They line the pedestrian walkway and are swinging to the rhythm of a light chill wind, marking the beginning of fall in New York. Acorns and dry leaves crunch under our feet. There is a farmer’s market which starts on 81st and Columbus Avenue, continues down to 77th Street, and then wraps around the museum to Central Park West. Varied hot dogs, kababs, and coffee carts line the path where the farmer’s market ends. It’s not your standard Broadway street fair with trinkets; it’s a proper market where locals get their meat and vegetable shopping done for the week. The first stand on Columbus is Kernan Farms.

walkway and are swinging to the rhythm of a light chill wind, marking the beginning of fall in New York. Acorns and dry leaves crunch under our feet. There is a farmer’s market which starts on 81st and Columbus Avenue, continues down to 77th Street, and then wraps around the museum to Central Park West. Varied hot dogs, kababs, and coffee carts line the path where the farmer’s market ends. It’s not your standard Broadway street fair with trinkets; it’s a proper market where locals get their meat and vegetable shopping done for the week. The first stand on Columbus is Kernan Farms.

“I grew up near this farm in New Jersey,” says David Sherman, founder, and portfolio manager of CrossingBridge funds, one of the most consistent short-term and high-yield bond fund houses, and no stranger to the Mutual Fund Observer readers. The sweet potatoes look really good. He picks some up for his wife. But no tomatoes; they are out of season, he says.

I thought everything was in season all twelve months in Manhattan, and am happy to learn something new. I’ve been betrayed by Whole Foods.

We walk the museum loop. At a coffee stand across from where once stood the statue of Teddy Roosevelt, and now a void, David orders a hot chocolate and a coffee and proceeds to mix it.

We’ve just had a two-hour brunch at our neighborhood Italian Tarallucci e Vino, where he got an omelet, and I had a farro salad. David quizzed me about fifty things in investing in the first ten minutes. I can handle the questions. But it’s his answers I am here for.

I’d like to do a repeat of what we did for the June MFO article. I’d love to hear his take on the various asset classes and investment trends. But the conversation veers off, and we have a different bouquet of ideas this time. We must go with the flow.

David’s been investing professionally for over 40 years. He has been investing his own money through the decades, is a wide-ranging and original thinker, and teaches an investing class at NYU where he invites a range of successful money managers to speak. He is generous with his time to MFO readers, and we are grateful for that.

On MFO

David: Do you know who you are?

Devesh (to himself): I have been born countless times to find the answer to that question, but I am sure he is not talking about that. Silence.

David: You – MFO – are a content provider. And I am the content!

On India

David: INDIA: I recently invested in an India equity fund. It’s a public markets hedge fund. I met the guy, and he seems like he and his partners have good ideas and seem honest. I didn’t want to invest in Private Equity because liquidity, the ability to get out, is important to me. I didn’t want to invest in a public ETF. I think this fund has been successful in sourcing smaller companies and investing in them. I will give them a few years, and if they are down 20% in total return compounded, I might decide then, but I know I have an exit. With Private Equity, I don’t have an exit. I used to be in Indian stocks (ed note – for his mother) starting in 1999 and exited. This is a new India position for me.

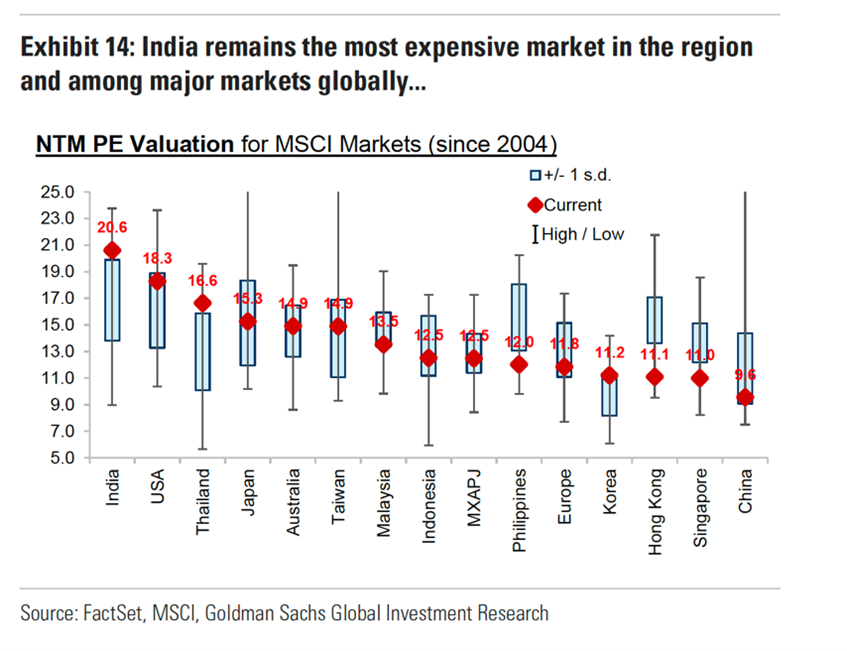

Devesh: I know he’s liked India in the past and is bullish about the Lollapalooza effect. Everything is coming together for Mother India to have sustainable growth for decades ahead. One of my friends who runs another Indian hedge fund, Nischay Goel of Duro Capital out of Singapore, calls the investment opportunity in India over the next ten years Ridonculous!! The success of the South Pole moon landing, the G20, the dominance of Narendra Modi’s political party, and the common man finally being full of pride and seeing the benefits accrue from progress is a sight to behold. Infrastructure is improving throughout the country, and there’s going to be a truckload of billionaires being minted in India over the next ten years. $39 billion dollars of domestic money flows into stocks each year as domestic wealth generation and liquidity events unbound, and most investors cannot take their money abroad. The flip side: Indian stocks are expensive, at the highest valuation in Emerging Markets.

On Japan

David: JAPAN: I bought into a Japan Passive-Active fund lately. In Japan, it is still difficult to get board seats and change the company’s direction. But you are allowed to tender for shares. And when you accumulate enough stock position, you can then partner with a larger player and buy out the company. The fund I’ve invested in does that. It’s active in the sense that it buys substantial quantities of shares of public companies. But it’s passive in that it’s going to roll up its equity stake into the privatization of companies to make them more profitable. Japanese markets have gone up decently over the last few years, but I still like them.

Devesh: Readers should note that these investments are for Qualified Investors. There is information in both the vehicle and the assets he has picked. He is long Equities in Japan and India. But he is not buying a passive ETF. He is selecting a fund that is appropriate for his needs. Individual investors should read that these are where VERY LONG-TERM opportunities must exist. When to buy and what to buy is up to each investor. I ask him to refresh his thoughts for the readers on domestic US assets, recalling he feels US stocks are expensive.

On venture capital and his personal investments

David: Two years ago, I sold practically all of my US stocks. When Venture Capital was fighting with each other to throw money at any startup, it felt like a low-quality investment opportunity to be invested in US stocks. I sold everything. (Sips his hot coffee/chocolate concoction).

David: I also didn’t need to take a mortgage, but they were letting me borrow money at 2.5%, so I took one! Imagine a world where there were trillions of negative-yielding instruments. Why would someone buy them? Only because they would think they would lose less money in those bonds than they would in other assets. Something has to be massively wrong with the world for a long time. We’ve seen what’s happened to inflation and interest rates since the era of negative rates. And when the cost of interest rates goes up for the US Government, it goes up for everyone. Some stocks looked okay when the 10-year Interest rates were at 2.5% but not as good at 5% interest rates.

Warren, Berkshire, and Sherman

Devesh: I asked him his thoughts on Berkshire Hathaway. He had liked Buffett’s moves in Japan and elsewhere when we last met.

David: When I sold in the US, my intent wasn’t to hold on to one stock. I sold practically everything. Berkshire is a great private equity + mutual fund manager. It’s very well managed. Munger and Buffett’s ages have to be taken into consideration. What’s the P/E of Berkshire?

Devesh: It’s trading at 1.35x book value, and it also has $147 Billion in Cash with the Optionality value to do something with it. Let’s put the number at about 20 times operating earnings.

David: At 20x earnings, you are basically buying an investment with an Earnings Yield of 5% (1 divided by 20).

Devesh: He leaves the conclusion to me. I ask him about the fiscal debt, the deficit, the potential money printing, and higher inflation, the need for companies with real assets, companies that have large ground prints, and companies with the ability to reset prices.

Inflation, the dollar as global currency, and your future

David: We don’t know what inflation in the future is going to look like. We just don’t. And inflation is particular to you and to me. Once you have lifestyle creep, I have news for you: your expenses are not going down. And we haven’t figured out what to do when and if the US Dollar is no longer the reserve currency of the world. What are you going to do then?! If you are thinking about inflation, you should think about the reserve currency status as well.

Devesh: The conversation is unsettling. Most individual investors don’t do much other than allocating across some funds, stocks, and bonds. If David makes no money in his investments, he is fine with it, as long as he doesn’t lose in investments he doesn’t like. Being invested for the sake of being invested is anathema to David.

On benchmarking your investments

Meanwhile, as a standalone investor, long-term investing and earning risk premium across asset classes is all I have. When I ask him which benchmark an investor must follow to be comfortable not being invested in US stocks (the way he is), I get a sharp poke in the eye.

David: What is YOUR FASCINATION with BENCHMARKS!!

Devesh: If you look at what a majority of institutions do around the world, they follow benchmarks. Trillions upon trillions of dollars follow indexing, benchmarks, diversification, passive or active, and deploy their funds accordingly. Without a benchmark, how do you know if you are doing well and if the fund you invested in is doing well in its asset category? A benchmark is what brings discipline to the average investor.

David: What you are suggesting is that if a benchmark tells you to buy a lemon, you should buy a lemon!

Devesh: If David doesn’t think an asset class, let’s say, US or International Developed or Emerging Markets equities as an asset class, is interesting, he is not going to waste his time finding a fund manager in these places. He is OUT. Benchmark is irrelevant. The Bogle three-fund or four-fund solution or 60/40 or whatever is immaterial if the asset on offer is a lemon.

How to spend your time

David: Most people pay sufficient attention to their careers. One gets feedback, one looks at reviews, and one tries to improve their skill set so they can get paid well for the amount of stress they are willing to take.

Every investor similarly needs to spend time on their investment portfolio.

- Start with identifying how much you need in years 1, 2, 3, 5, 10, and longer periods.

- Avoid leverage in investments and trading. It’s one thing that kills most investors.

- If you truly want to be levered, borrow money against your house for 30 years and let that cost of mortgage funding be your leverage. If your mortgage cost is 8% and you can’t find an investment to beat that, maybe there isn’t much that leverage can do for you.

- In practice, you don’t need more than one stock manager and one bond manager. Spend time with a wealth advisor to pick the right manager for your needs.

- Understand that the best investors go through periods of mediocre performance. Buffett sucked wind for a large part of the last decade. So did Ron Baron recently. But in the end, investors who stick with the really good quality managers are okay.

- The majority of investors who get involved in long-short strategies, options, and other complex strategies are trying to avoid volatility. But why are they managing the volatility of their portfolio? It’s because they have not fully thought about their portfolio.

- If your bases and needs are covered, what do you care what the market “benchmark” does? It’s irrelevant. Since inception, RSIIX has barely underperformed the Morningstar US HY BD TR USD by less around a cumulative 100 bp or less than 10 bp per year. There have been periods of significant outperformance (particularly recently) and periods of significant underperformance. But volatility and consistency have been far superior. Does it matter? Return of capital matters more than return on capital. The quality/risk of our portfolio is much better than the passive index.

- You want your manager to follow the two rules. Rule 1: don’t lose money. Rule 2: don’t forget rule 1.

Devesh: This is good, very good. It helps me understand how David Sherman thinks about the risk, rewards, and simplicity of investing. It also reconciles his own investment positions for his personal assets with academic theory as we understand it. I elaborate on my thoughts later in the article.

On the Middle East

I asked David for his thoughts on the situation in the Middle East. As he describes his observations and analysis of the options available for peace and war, I can see he feels the situation viscerally.

The situation in the Middle East is tragic for everyone! There are no good outcomes.

“On a very personal basis, you have to understand that antisemitism is still present. And what starts as antisemitism can easily end in generalized bigotry.”

We continue walking. The River Ranch farm stand makes paneer and mango lassi. The Caucasian farmer spent time in India, worked with a Punjabi employee, and now is our go-to guy for milk products every weekend. All of the employees for Kernan Farms are Nepalese. That we all understand and embrace this multi-cultural melting pot as ours is a gift. That we also understand that peace is hard to achieve and keep and that the Middle East is going to see countless deaths, and that most of us will be unable to change a thing is also a curse for us to accept and live with.

I thank David Sherman for a thought-provoking and insightful meal. He has given our readers a lot to process. Until next time, David.

Note and afterthoughts

All investment returns for all market participants combined can come from just three different buckets:

- Asset Allocation (which assets – stock/bond/real estate + private/public)

- Security Selection (which fund, which stock, or bond particularly)

- Market Timing (deciding when to be in or out)

David’s asset liability equation may not be yours or mine. His choice of being indifferent to the benchmarks, and avoiding asset allocation if there is a lemon, is incredibly thoughtful, for him.

I know people in their 80s who hold 60 to 80% of their positions in US equities for reasons many readers will recognize:

- Their liabilities (expenses) are covered.

- These investments are for their children and grandchildren, who, in turn, have a much longer investing window.

- American companies do a third of their business abroad. In the past, they saw reasons to hold foreign stocks, but they don’t anymore because business has changed. They are okay with their asset allocation being mostly American stocks.

- In the past, picking individual stocks worked because US equities were under-owned, and because there weren’t as many hedge funds as today with their computers. Now, it doesn’t. Security selection for the average investor provides questionable value.

- What about market timing?

There is a recent article by Howard Marks, Further Thoughts on Sea Change (5/30/2023). Here, Marks specifically wants to shake the status quo. I paraphrase him here: Look, you don’t need to own equities right now and all the volatility that equities will bring because you can earn 9% in high yield.

Marks knows we are not going to liquidate stocks, but he is still saying we should consider it because the world of interest rates has changed entirely compared to the last forty years.

David Sherman’s choice to be out of US equities and Howard Marks’ article are infinitely wise and probably prescient because these investors are ahead of the game. They have thought through the risk rewards, and when the world changes in the future, they will rethink them quickly again and act on it.

Meanwhile, the average investor has also learnt. It’s a difficult thing to outsmart the market. The only thing an investor can do is allocate across assets, take the volatility, and hope, that, in the long run, they earn the risk premium embedded in various asset classes. This is why many choose to avoid market timing.

There is an in-between place, though. None of this precludes investors from reducing risk in one place and adding in another. We don’t have to be in or out. We can reduce and increase allocations. That is in our hands.

Finally, let us also accept that none of us knows the future.