Revolutionize your organizations tax operations with cutting-edge technology and industry insights.

Today, organizations are under increasing pressure to navigate the complexities of global tax regulations, ensure compliance, and optimize workflow processes using the latest advanced technology. Corporate tax leaders across all industries are looking for ways to simplify their tax, trade, and financial reporting workflows with tools that reduce risk, save time, and increase accuracy.

Harnessing the power of alliances for more than two decades, Thomson Reuters and KPMG LLP (KPMG) have brought insight-driven, cross-company collaboration to corporate tax leaders across all industries. This alliance has enabled them to navigate the most complex challenges, transforming tax, trade, and finance functions from reactive to proactive.

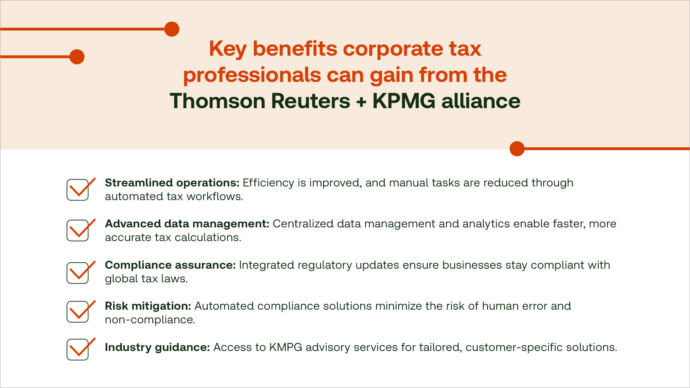

By combining the industry experience of KPMG with the technological prowess of Thomson Reuters, this alliance presents an opportunity for corporate tax teams looking to stay ahead in a complex and fast-moving environment. It enables corporate tax departments to become better business partners and allows the overall business to become more nimble, supporting wider growth advancement ambitions. Here’s how:

Highlights:

|

Jump to ↓

A strategic alliance for tax and technology expertise

In today’s fast-paced world of tax and digital transformation, staying ahead demands more than just keeping up with change — it requires agility, foresight, and partners who can expertly navigate the complexities with you. It requires a rare combination of tax and technology expertise to be successful.

That’s why Thomson Reuters is committed to partnering with KPMG as a leading implementer of the ONESOURCE suite of products. Our alliance ensures that our customers benefit from cutting-edge tax solutions (direct, indirect tax and trade processes among others) that streamline operations, boost efficiency, and enhance automation.

One of the key benefits of this alliance is the instant access to a wealth of knowledge and resources. KPMG is a leading participant in the ONESOURCE Certified Implementer Program, ensuring that customers receive the highest level of support when implementing and integrating new tax technologies into their business operations.

Through this collaboration, tax professionals can tap into both the trusted insights of KPMG and the technology-driven solutions provided by Thomson Reuters. The result is a seamless integration of tax technologies that help businesses manage their tax operations more effectively and position themselves for future growth.

|

|

Streamlining tax operations in the digital era

The digital transformation of tax brings with it significant opportunities, but it also presents new challenges for tax professionals. As many tax authorities and governments around the world embrace technologies like generative AI to better access data, tax leaders must reevaluate their strategies and invest in similar technologies to keep pace amidst increased scrutiny.

Today’s tax departments must have the ability to access, organize, and manage vast amounts of data from multiple sources for tax calculations, compliance, and reporting. Without the right tools, these processes are inefficient, time-consuming, and prone to significant risks.

As a trusted tax advisory and consulting firm, KPMG works closely with Thomson Reuters to equip clients with customized technology to streamline tax operations in the digital era. Innovative tax technology services from KPMG, enabled by Thomson Reuters comprehensive tax and accounting software, empowers companies to modernize their tax systems. This alliance empowers professionals across tax, trade, and financial reporting teams with cross-functional, connected thinking to enhance operational efficiency in compliance, data management, and reporting capabilities.

Enhanced data analytics and seamless global compliance

For many organizations, data accessibility and management are key pain points when it comes to tax compliance and accurate reporting. The alliance between Thomson Reuters and KPMG addresses these challenges by providing innovative data management and analytics tools that enable tax leaders to gain real-time insights into their tax data, resulting in better decision-making and strategic planning.

With the power of Thomson Reuters ONESOURCE coupled with KPMG guidance, organizations can harness data-driven insights to enhance the accuracy of their tax reporting and increase visibility into their tax positions. Corporate tax professionals can unlock efficiencies across the entire corporate tax and trade lifecycle by facilitating compliance with global tax requirements and ensuring reporting data is collected, analyzed, and processed efficiently.

With increasing regulations and rapidly changing tax laws in jurisdictions worldwide, staying compliant is a major challenge for corporate tax teams. The alliance between Thomson Reuters and KPMG helps manage this complexity by streamlining data and automation processes with the ONESOURCE platform. This approach ensures seamless tax compliance worldwide, transforming tax departments with insights that mitigate risks and ensure compliance.

Innovation solutions and continuous improvements

Thomson Reuters and KPMG are committed to driving innovation in the tax sector. Together, they continuously refine and update their solutions to ensure clients stay ahead of emerging tax trends and regulatory changes.

Advanced technologies such as artificial intelligence (AI) and powerful analytics, help institutions streamline tax processes, improving their data accuracy and reporting capabilities. AI has become pivotal in automating intricate tax tasks, detecting fraud, and delivering insightful data analysis.

Whether it’s automating data collection, applying powerful analytics, or using AI algorithms to analyze tax data, KPMG and Thomson Reuters work together to help tax leaders harness ONESOURCE to optimize tax processes and keep pace with the ever-evolving digital tax landscape. This alliance helps corporate tax professionals keep pace with shifting tax regulations, uncover cost-saving opportunities, and unlock potential business growth.

Elevating the role of tax and trade for organizations

With KPMG and Thomson Reuters, your organization can confidently navigate the complexities of big data, unlock actionable insights, and foster a data-driven culture that propels your business towards sustained growth and competitive advantage. This alliance delivers tailored, scalable solutions that elevate the role of tax and trade within an organization. Together, we are not just delivering data management solutions; we are transforming data into a company’s most valuable strategic asset.

Explore how the Thomson Reuters and KPMG alliance can transform your tax operations. Visit our Corporate Tax Software & Services page to learn more about ONESOURCE and how it can benefit your organization.

|

|