Unicorn firms are those companies that attain a $1 billion value without being listed on the stock market, and they are every tech startup‘s goal. What elements contribute to the success of these businesses? Which are the most valuable in the world? What are the pros and cons of investing in one? We address these and other concerns in the sections that follow.

The Origin of the Term “Unicorn Company”

The name was coined in 2013 by venture capitalist Aileen Lee to emphasise the rarity of such enterprises at the time. Lee sorted over 60,000 software and internet firms that received funding between 2003 and 2013, discovering that just 39 startups were valued at more than $1 billion, making them exceptionally exclusive and opportune investments.

Unicorn companies have grown far less common over the years. Although reaching unicorn status is more frequent today than ever before, these $1 billion+ post-money values are still tremendously astounding. Unicorn businesses are being scrutinised and reported on by individuals with an interest in the most prominent participants in the private markets.

What Kind of Companies Make Unicorns?

Entrepreneurs always wonder about the keys to becoming the next unicorn but constructing a road map for creating a unicorn company is a difficult task. Many factors are involved in the success or failure of a startup, but, in the absence of miracle formulae, it is nevertheless possible to provide a series of common pointers:

Social media are a great ally

They use social media platforms such as Facebook, Twitter, and Instagram to spread their message. Because of segmentation, businesses are able to amplify their message and impact their target demographic for a much lower investment.

The customers are always at the fore

They use a customer-centric business strategy. In other words, they consider the consumer before, during, and after throughout the customer’s journey. The importance of user experience is one of the keys to success. In the past, the focus was only on the product. However, the purchasing experience is now equally or even more crucial.

Global and rapid expansion

Good businesses start with a global mindset and follow a get big fast strategy in order to, as the name suggests, get big as quickly as possible. Going all-in on internationalisation and having a scalable model is critical to attaining both of these goals.

Wide-ranging team

Unicorn companies are multidisciplinary and cross-cultural organisations. As a result, they have a highly diverse professional profile, which is one of their assets when it comes to developing new ideas. Furthermore, they are young companies that value talent and creativity.

Uncertainty is part of the daily routine

The distinction between success and failure is razor-thin. Because these companies are fully aware of this, they learn to take the rough with the smooth and develop a special resilience.

How Many Unicorns Companies Are There?

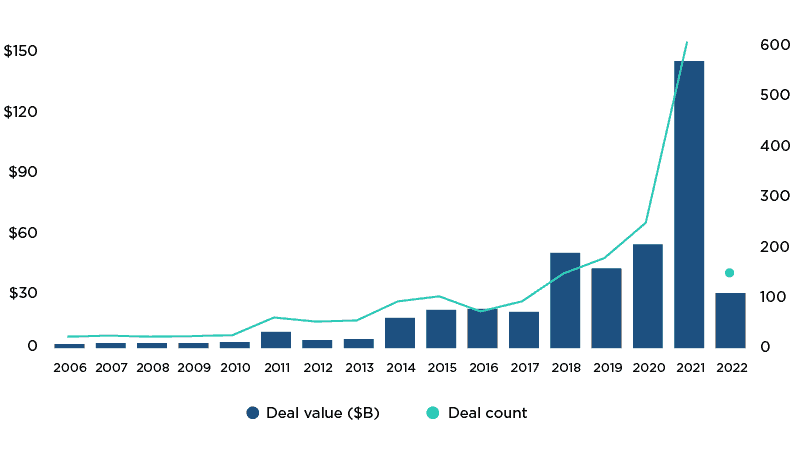

In 2019, there were 354 active unicorn firms worldwide, up from 348 the previous year. There were 439 active unicorn firms by the end of 2019, including 139 new startups. In 2020, 162 new firms gained unicorn status throughout the world, bringing the total number of active unicorn companies to 538. In 2021, there were 355 new unicorn firms, and the year finished with 537 active companies, about the same as the previous year.

According to CB Insights, the globe had 1,068 unicorn enterprises as of March 30, 2022. 519 of these privately held firms valued at $1 billion or more were “born” in 2021 alone. The worldwide unicorn herd surpassed 1,000 at the start of the current year.

Why Are There So Many Unicorn Companies Emerging?

One factor for the explosion of unicorn companies is the growing convergence of the private and public markets. Historically, corporations depended on initial public offerings (IPOs) to raise financing to grow operations. Today, companies may now raise higher sums of private capital early on, allowing them to attain billion-dollar valuations without going public.

The Most Valuable Unicorn Businesses

Unicorns are rare and difficult to come by. Something similar occurs in these types of startups. Below, we list the 5 most highly valued:

- Uber: mobile taxi app

- WeWork: job sharing company

- Airbnb: holiday & tourist accommodation platform

- Stripe: a company that allows individuals and businesses to receive payments via the Internet.

- Epic Games: video games company

Advantages & Disadvantages of Investing in Unicorns

Investing in a unicorn firm, like any other investment, has advantages and disadvantages.

| Advantages | Disadvantages |

|---|---|

| You Likely Know the Company | Billion-Dollar Valuations Don’t Necessarily Mean Profits |

| Some Unicorns Really Do Fly | Ridiculous Overvaluations |

| Innovation Has Long-Term Value | Lack of History |

Advantages of Investing in Unicorns

Investing in unicorn firms has various advantages which include:

You likely know the company. Unicorn firms don’t reach billion-dollar valuations before going public for no reason. These businesses have produced something really unique. If they have a product on the market, it is most certainly a very popular one. If it hasn’t yet entered the market, a huge portion of the population is probably aware that it is on the way. Investing in firms you’ve heard of and are familiar with has a strategic advantage. Remember that intelligent investment increases the investor’s chances of witnessing growth.

Some unicorns really do fly. Some unicorn firms, like their mythological counterparts, soar after their initial public offering. Zoom is an excellent example of a successful unicorn firm. The stock debuted in 2019 at a low price of $36 per share. After a year, the stock was trading much above $100 per share, momentarily exceeding $500 per share in late 2020. Even after major consolidation, the corporation is now valued at well over $40 billion, with shares trading in the triple digits.

Innovation has long-term value. Unicorn firms are the kings of innovation, and their worth is enormous. Those who do strike tend to hit hard, resulting in massive long-term rewards. Consider the case of Tesla. Since its IPO at $17 per share in 2010, the stock has never gone below its IPO price. After only 11 years, the stock is now worth approximately $1,000 per share.

Disadvantages of Investing in Unicorns

While there are several obvious advantages to investing in unicorn companies, even the most beautiful rose has thorns. When investing in these equities, there are a few downsides to consider.

Billion-dollar valuations don’t necessarily mean profits. Although all unicorn firms have a valuation of $1 billion or greater, many of them lack one key component: earnings. Consider Uber, which has a market capitalization of more than $65 billion. However, it has yet to make a single profit. Every quarter, the corporation loses millions of dollars. Many other unicorn firms follow suit, making them riskier investments. After all, a corporation that is losing money will ultimately run out of money.

Ridiculous overvaluations. In general, unicorn firms are valued differently than others in their industry. As a result, when looking at basic valuation criteria like price-to-sales or price-to-book value, these firms are often overvalued. That is, when you invest in a unicorn firm, you are betting on the company being enormously successful and expanding at a significantly higher rate than the typical company in its field. That might be a hazardous bet to make.

Lack of history. The billion-dollar value of a unicorn firm comes from venture capitalists and institutions that invest in it early on. However, because these firms are pre-IPO, the market hasn’t had a chance to price them. Often, the market does not feel the firm is as valuable as institutions do, resulting in a drop after the shares are listed on the public stock exchange. However, without a trading history, it is impossible to predict how the broader market will value the firm.

Conclusion

Unicorn stocks are fascinating. These firms develop technology or services that are so far ahead of their time that they have the potential to alter the whole industry in which they operate. As a result, they fly to billion-dollar valuations well ahead of their peers.

There is, however, a catch. Unicorns in the market, unlike the mythological animals after whom they are called, are not all flawless and lovely. While some have the ability to yield substantial returns, others have the potential to cause substantial losses.

So, instead of making a FOMO (fear of missing out)-driven move, if you’re thinking about investing in these companies, do your homework and critically assess if the technology that keeps the unicorn’s ticker ticking is something you believe to be revolutionary. Dive into the company’s accounts and make an informed judgement whether the company’s billion-dollar valuation is justified.

References

Do startups dream of unicorns?

Global Unicorn Herd Now Counts 1,000+ Companies

What Is a Unicorn Company and Should You Invest in a Startup Business?