Due dates, instructions for extensions, automatic extensions, and more for 1040 and 1120 clients.

Jump to:

Preparers with individual and business clients likely find that filing tax extensions for Forms 1040 and 1120 isn’t uncommon. In fact, each year millions of taxpayers request an extension to file their taxes. Why?

The reasons for requesting a tax filing extension vary. Perhaps a client needs more time to gather all of the necessary source documents, or they’re dealing with an unanticipated event like a medical emergency or natural disaster, or they experienced a computer system failure. Fortunately, the IRS recognizes that events happen and sometimes taxpayers simply need more time.

To help preparers navigate some of the necessary steps for an extension, this blog will take a closer look at how to file an extension for individual tax returns and C corporation tax returns. There are several important factors to keep in mind.

When are tax return extensions due?

For those clients who need more time to file their taxes, April 15th is the deadline to file for both an extension to file a corporate tax return (Form 1120) and an individual tax return (Form 1040).

It is important for clients to understand that an extension is only for the filing of the return. An extension of time to file a return does not grant an extension of time to pay owed taxes. To avoid potential penalties, clients should estimate and pay any owed taxes by the regular due date.

Automatic extensions

It should be noted that there are times when clients do not need to file an extension request and an automatic extension will be applied.

One such instance is when a natural disaster occurs. The IRS indicates that in certain disaster areas taxpayers do not need to submit an extension electronically or on paper. The IRS automatically identifies those taxpayers located in the covered disaster area and applies filing and payment relief.

For example, the IRS announced earlier this year tax relief for individuals and businesses in San Diego County impacted by flooding and severe storms. These taxpayers now have until June 17, 2024, to file various federal individual and business tax returns and make tax payments.

An exception also applies to those U.S. citizens or resident aliens who are outside of the country. Certain taxpayers are given an automatic two-month extension (usually until June 15th) to file their tax return and pay any taxes owed without requesting an extension if they are a U.S. citizen or resident alien, and on the regular due date of the return they are either:

- In military or naval service on duty outside of the U.S. and Puerto Rico, or

- Living outside of the U.S. and Puerto Rico, and their main place of business or post of duty is outside of the U.S. and Puerto Rico.

The IRS noted that they will still have to pay interest on any tax not paid by the regular due date of the return.

How to file a tax extension for individual tax returns

The IRS allows taxpayers to request up to an additional six months to file their U.S. individual income tax return. As outlined by the IRS, there are three ways to request the extension. These methods are:

- Electronically paying all or part of their estimated income tax due and indicating that the payment is for an extension. If extension is selected when making their payment, a separate extension form is not required and they’ll receive a confirmation number for their records.

- E-filing Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. In order to qualify, properly estimate the client’s tax liability using the information available, enter their total tax liability on line 4 of Form 4868, and then file Form 4868 by the regular due date of April 15th. The IRS will also want to see the prior year’s adjusted gross income (AGI) amount for verification purpose.

- Filing a paper Form 4868. Note that fiscal year taxpayers may file extensions only by filing a paper Form 4868.

How to file a tax return extension for C corps

Preparers must use Form 7004 to request a six-month extension of time to file certain business income tax, information, and other returns, which includes Form 1120 clients.

According to the IRS, the extension will be granted if Form 7004 is properly completed, a proper estimate of the tax (if applicable) is made, and Form 7004 is filed by the regular due date of the return (and pay any tax that is due).

Some basic information that the IRS requests when completing the form includes, but is not limited to:

- If the organization is a corporation and is the common parent of a group that intends to file a consolidated return;

- The dates of the calendar and tax years; and

- Whether or not the organization is a foreign corporation that does not have an office or place of business in the U.S.

Retransmission of rejected returns

What happens if a transmitted tax return or extension is rejected? If the rejected tax return or extension was submitted on time, preparers have a specific period of time to make corrections and resubmit the forms.

For instance, there is a five-calendar day perfection period for rejected e-filed Form 1040 returns, as well as for extensions.

There is a 10-calendar day perfection period for rejected e-filed Form 1120; there is a five-calendar day grace period for extensions.

The role of clients in filing tax return extensions

Encouraging clients to file tax returns on time is, of course, ideal so they can avoid penalties and interest. This involves communicating with clients early and often to help ensure they understand all of the information needed to file accurate and timely returns.

That being said, emergencies and other unforeseen circumstances do occur and there are times when requesting an extension is necessary. Therefore, it is important that clients are aware that extensions are available if needed.

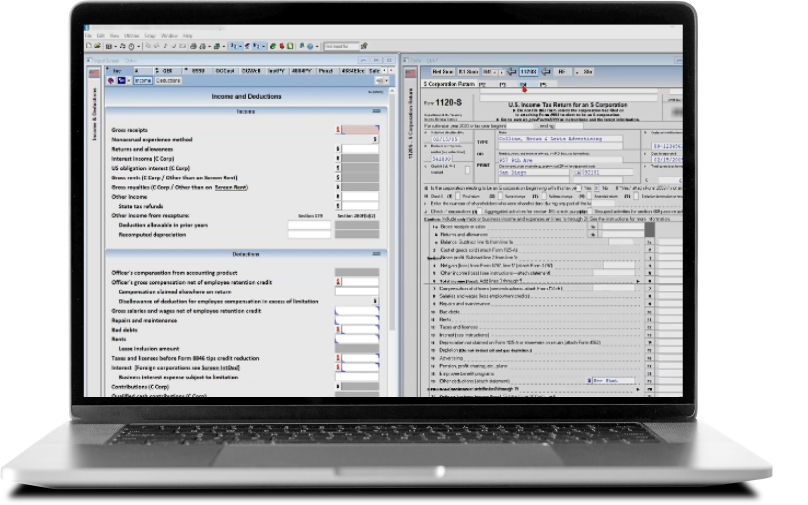

To make e-filing tax return extensions easy for Form 1040 and Form 1120 clients, turn to a solutions provider like Thomson Reuters. Thomson Reuters UltraTax CS simplifies filing returns and extensions so preparers can save time and boost productivity during the busy tax season.

With the integration of SurePrep TaxCaddy, tax professionals can use the client collaboration software to streamline communication, gather documents, questionnaires, and e-signatures, deliver tax returns, and more for 1040 clients.

|

DemoLearn how UltraTax CS can reduce your tax workflow time and increase your productivity with a customized demo. |