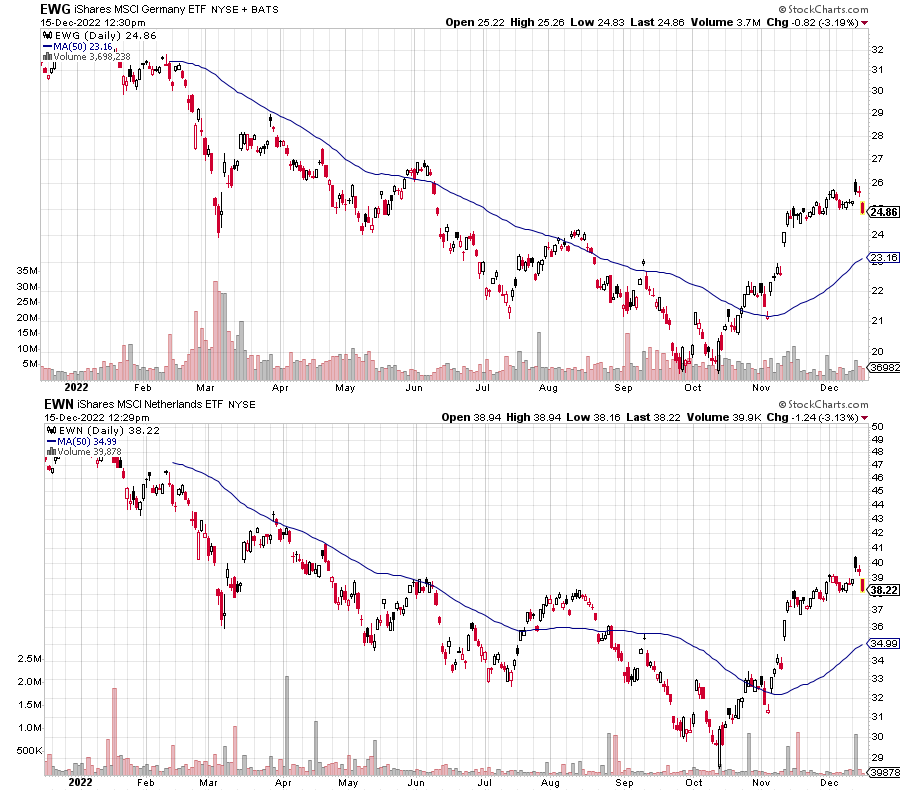

iShares Germany (EWG) and iShares MSCI Netherlands (EWN) both climbed thirty-five positions in the The Global Momentum Guide’s relative momentum rankings the past month. Both funds rallied close to 40 percent off their lows, boosted by a double-digit rally in the euro versus the U.S. dollar. Neither fund has climbed enough to make it near the top-10, but both could get there quickly if their rally continues.

Other European funds have joined them such as the iShares EMU Index (EMU), iShares MSCI Austria (EWO), iShares MSCI Sweden (EWD) and iShares Dow Jones Euro STOXX 50 (FEZ). The latter fund did make it into the top-10 of the rankings.

On the plus side, these funds are all climbing in the rankings. In a clear bull market, this would move them into momentum portfolio in a few more weeks. In a rangebound or bear market, these momentum moves often run out of steam once they make a run towards the top-10.

Working against them are new and existing headwinds. The latter first. The war in Ukraine and Russian sanctions in response have cost Germany about $500 billion thus far in bailouts and subsidies amid soaring energy costs. That’s roughly 10 percent of their economy. Other European countries, aside from those such as Norway that have ample energy supplies, are seeing similar costs. It is somewhat surprising how well their economy had held up to this point. Germany’s IfW, an economic research institute and think tank, raised its 2023 GDP growth forecast to 0.3 percent this month versus the prior 0.7 percent decline. If their economy manages any positive growth with energy such a massive headwind, it speaks to the underlying strength in Europe’s most important economy.

A new headwind is the European Central Bank. It raised interest rates by 50 basis points in December, matching the Federal Reserve’s hike, and it also announced quantitative tightening will start in March. It’ll start off slowly with 15 billion euros per month until the end of June before reassessing. The Bank of England also hiked 50 basis points despite the United Kingdom’s economy being in recession. Europe’s move is not surprising considering how much is being spent on energy and related costs. Spending money when energy costs rise is what helped entrench high inflation in the 1970s. As the Bank of England showed, and both the Federal Reserve and ECB have warned, central bankers will fight inflation even if the economy weakens.

The next couple of weeks will determine whether developed European markets can move back into leadership among international funds or if this is a bear market rally that has run out of steam. The weakest economies such as Italy and Greece have moved back into the top-10 because they are more volatile to the upside and downside. The euro’s exchange rate with the dollar will play an important role, as will the performance of emerging markets that currently rank ahead of countries such as Germany and the Netherlands.