In America’s heartland, Indianapolis, Indiana, has long been a gem for real estate investors seeking both stability and growth. Nestled in the crossroads of the Midwest, the Indianapolis real estate market offers a unique blend of affordability, economic resilience, and a burgeoning urban renaissance. With a solid job market, a growing population now 2.1 million strong, and a diverse range of neighborhoods, this vibrant city has emerged as a prime destination for real estate investors looking to capitalize on the potential for robust long-term growth.

In this article, we will delve into the key factors driving the Indianapolis real estate market and why it might continue to be a great place to invest in.

Population and Labor Market

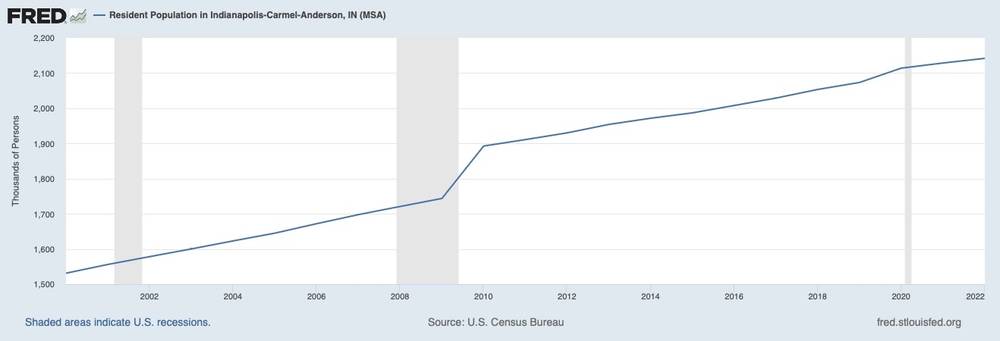

The Indianapolis MSA, encompassing Indianapolis, Carmel, and Anderson, has seen remarkable population growth, currently standing at approximately 2.1 million residents, up from 1.5 million in 2000. This upward trajectory in population has been a consistent trend over the last several years, making it an enticing prospect for real estate investors.

A burgeoning population signifies increased demand for housing, both rental and ownership, which, of course, can translate into higher property values and rental income for investors.

Indianapolis’s strong job market plays a pivotal role in attracting residents. The city is home to a diverse range of industries, including finance, healthcare, technology, and manufacturing, with big companies like Angi, Eli Lilly, and Cummins having a major presence there. In the chart below, you’ll see that Indianapolis has consistently outperformed the national unemployment rate over the past decade and had a much quicker recovery following the pandemic.

Overall, this is great news for any investor looking to get into the market for long-term growth.

Indianapolis Home Prices and Inventory

From 2019 to 2023, the real estate landscape in Indianapolis has witnessed a significant transformation, with property prices surging from $115,000 to $237,000. This remarkable increase equates to a staggering 106% rise in just four years. For real estate investors eyeing the Indianapolis market, this data presents both opportunities and risks.

On the opportunity side, the price appreciation demonstrates the city’s potential for solid ROI. The flourishing job market, growing population, and economic stability in Indianapolis have contributed to this remarkable growth. Plus, you can get better bang for buck in Indy, as homes are larger and cheaper than in other markets, which is a big draw for remote workers looking for more space.

However, it’s crucial for investors to remain vigilant, as rapid price increases can also introduce risks of overvaluation and market corrections. Indianapolis lost some of its value during the 2022 correction that stormed through the nation but has rebounded just as well as any other market. All in all, with rapid appreciation, be careful of the floor falling out.

The chart above shows supply. This doesn’t look any different from most other markets. We’re in a low-supply environment all the way around.

Indianapolis Rent Prices

The rental market in Indianapolis has shown a consistent upward trend, with rent prices increasing from $950 in 2019 to $1,339 in 2023.

This represents a substantial 41% growth over the last four years. For real estate investors looking at the Indianapolis market, this rent data offers valuable insights. Firstly, it underscores the city’s increasing attractiveness for renters, which aligns with the growing population and a good job market. As more people are drawn to the area, the demand for rental properties remains strong, providing investors with a steady income stream and the potential for healthy returns.

On the other hand, it’s rent prices are still low compared to many of the top markets in the U.S. This makes cash flow much harder to come by as interest rates have increased, but that’s the story of the times.

Cash Flow Prospects in Indianapolis

Cash flow in Indianapolis used to be possible, but with higher interest rates and exploding appreciation, it’s gotten tough. With that said, in some places, you might be able to make something happen with the right deal.

In the map above, you’ll see the rent-to-price (RTP) ratio of each ZIP code, which is an indication of cash flow viability. Generally, you want to find an RTP ratio close to 1% when looking for cash flow. In Indy, most of the best cash flow options are south and east of the city’s center. The top ZIP codes in Indianapolis for RTP are:

- 46218 – United Northeast (0.76%)

- 46222 – Westside (0.74%)

- 46241 – Marion County (0.73%)

Just keep in mind that with higher interest rates, you might find it hard to cash flow, even in a market that’s been favorable for it in the recent past.

Winning Strategies

Peter Stewart, an investor-friendly real estate agent in the Indianapolis area, says he likes “residential multi-family properties for cash flow for long-term rentals; flips; and single-family homes near downtown for the short and medium-term rental strategies.”

If you’re interested in learning more about investing in Indy, partner with a local investor-friendly real estate agent like Peter Stewart, who can guide you through which strategies, tactics, and neighborhoods to focus on.

Here’s how to contact Stewart on Agent Finder:

- Search “Indianapolis, Indiana”

- Enter your investment criteria

- Select Peter Stewart or other agents you want to contact

Since 2009, Peter has been helping people invest in real estate and has also been an avid real estate investor himself since 2011, owning multiple properties nationwide.

Find an Elite Agent in Minutes

Agent Finder makes it fast, free, and easy to find agents that know investing.

Match with market experts like Peter Stewart of Indi, Brandon Ribeiro in Philly, Dan Nelson in Chicago, and Jodi Gauthier of Houston.

Build your dream team now!

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.