The great charm of traditional index funds is that they offer broad market exposure at a low cost. Critics deride their diversification as “diworsification,” where a portfolio automatically contains too little of the really great stuff and too much of the really poor stuff. Bold and confident managers have staked their careers – or at least their investors’ fortunes – on their ability to find one or two great (and greatly misunderstood) companies and then pour resources into them.

At its peak, the legendary Sequoia Fund entrusted 36% of its portfolio to a single stock, Valeant Pharmaceuticals. That turned out to be a poor idea when Valeant was exposed for running a scam. The idiosyncratic Bruce Berkowitz, who has never encountered the notion of self-doubt, has staked 76% of the Fairholme Fund’s portfolio on a single stock, the St. Joe Company, which has returned 0.65% annually over the past 15 years. Third Avenue Focused Credit Fund, former president David Barse’s brainchild, came into the summer of 2015 with something like one-third of its assets invested in illiquid securities, so-called “Level 3 securities.” As we reported then:

There are two things you need to know about illiquid securities: you probably can’t sell them (at least not easily or quickly), and you probably can’t know what they’re actually worth (which is defined as “what someone is willing to buy it for”). A well-documented panic ensued when it looked like Focused Credit would need to hurriedly sell securities for which there were no buyers. Mr. Barse ordered the fund’s assets moved to a “liquidating trust,” which meant that shareholders (a) no longer knew what their accounts were worth and (b) no longer could get to the money.

The firm lost something like $3 billion on the decision, and firm-wide assets are 90% below their peak. On the upside, Ron Baron’s faith in Tesla Motors is reflected by his decision to invest so heavily in Tesla that the stock occupies over 50% of Baron Partner’s portfolio despite Baron’s decision in 2021 to sell shares.

Confidence has consequences. Concentration has consequences. Sometimes good. Sometimes bad. Quite frequently spectacular.

In this essay, I would like to walk readers through one of the most confident and concentrated positions in the retail fund world, the case of Horizon Kinetics which has placed a spectacular bet – firm wide – on a single stock. My argument is not that their bet is imprudent or that it will harm their investors. Instead, my argument is that the managers’ decisions carry the potential for spectacularly atypical performance. Investors, current and prospective, need to understand the decision that their managers have made, need to understand its potential consequences, and to assess its appropriateness for their portfolios. To help you get there, we’ll by explaining who the players are, what they’ve done, what implications it might carry, and how a prudent individual investor might weigh it all.

Horizon Kinetics (“Kinetics”), an asset manager offering a range of investment products – mutual funds, ETFs, SMAs, alternative investments, etc. – is having a very good year. The managers predicted and planned for the return of inflation. The 2nd Quarter commentary is a must read. One of their investments – Texas Pacific Land Corp (“TPL”) – has been a huge winner since they started buying the stock in Q1 of 2019. What makes their portfolio an interesting case study now (and also highly risky) is the amount of TPL stock Kinetics has come to hold. TPL’s position size could lead to glory or seriously hurt the asset manager and the funds it manages.

Who is Horizon Kinetics?

From the website:

Horizon Kinetics LLC is a fundamental value, contrarian-oriented (fact-based) investment adviser. Founded on the belief that a short-term investment approach, widely adopted with the modernization of financial markets, ultimately produces sub-optimal returns, we believe that investors are better served not by taking more risk (emphasis by author) but by extending their investment time horizon, which affords far wider ranges of opportunity and valuation than are available to time-constrained investors.

The asset manager has been around since at least the mid-1990s, and the founding partners – Murray Stahl, Steven Bergman, and Peter Doyle – continue to play significant investing and management roles.

How much money do they manage?

According to their website, Horizon Kinetics Asset Management is an independently owned and operated investment boutique with approximately $5.3 billion in assets under management as of March 31, 2019….

Whalewisdom.com (who have kindly offered Mutual Fund Observer a complementary subscription) is a website that tracks funds and companies states: Their last reported 13F filing for Q2 2022 included $4,775,957,000 in managed 13F securities.

Kinetics website says: Horizon Kinetics Asset Management LLC (“HKAM”) serves as investment adviser to Kinetics Mutual Funds, Inc. (the “Funds”), a series of nine mutual funds with combined assets under management of $1,564M as of December 31, 2021. Significant firm and employee capital is invested alongside our investors.

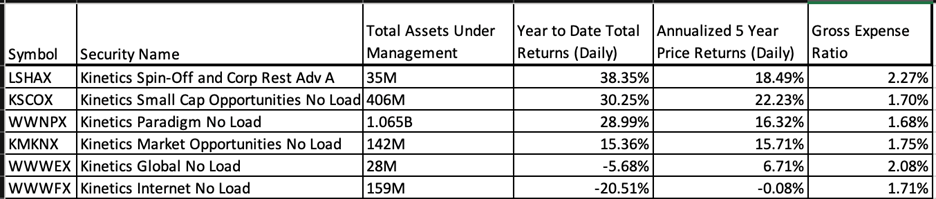

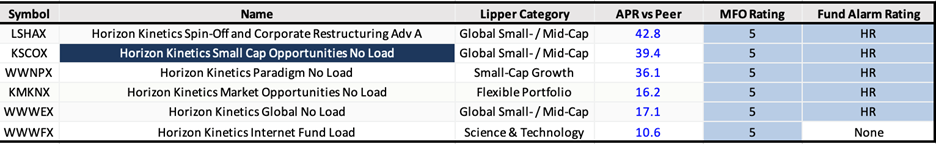

How have their mutual funds performed in 2022 and in the last 5 years?

Kinetics mutual fund returns are spectacular. As a comparison, note that the S&P 500 is down 17% for the year thus far and has a 5-year annualized return of 8.6%. Thus, Kinetics funds have beaten “the market” significantly and very much earned their 2% Gross Expense Ratios. The funds have also crushed their peers.

Since investors are tempted to chase past winners by allocating cash to winning funds, it’s important to understand the source of those victories. Understanding past returns is a way to decide if the returns are sustainable.

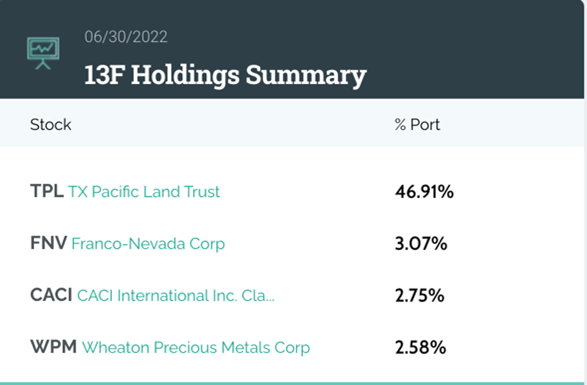

What does the asset manager’s portfolio look like?

Whalewisdom.com tracks the Horizon Kinetics portfolio at the Asset Manager level (including all their reportable investments). This is a snapshot of Kinetics’ top positions as of June 30th, 2022:

TPL accounts for a glaring 46.91% of the Manager’s total holdings. As of Q2, that was worth $2.2 billion, and since then, the rally in TPL stock has led to the position being worth $3.2 billion. It seems like the TPL stock holding accounts for the lion’s share (maybe, more than 100%) of the past returns for the asset manager. More information about their other holdings and the accompanying rationale can be found in their Commentary linked above.

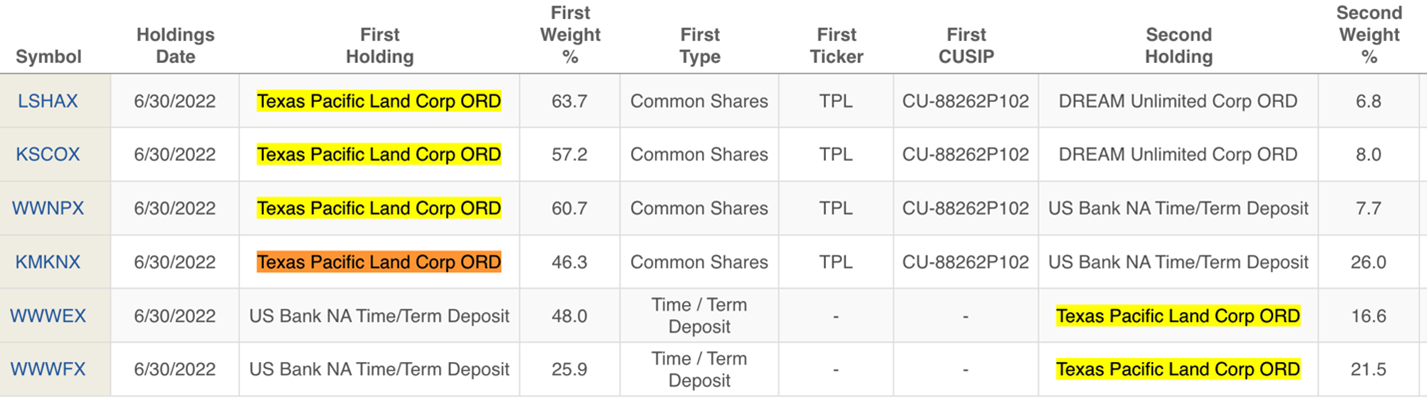

The Kinetics funds have uniformly high-to-huge allocations to TPL.

The eyebrow-raising position sizes of 63.7% in the Kinetics Spin-Off funds do not diminish the very large position weights in other funds: 57.2%, 60.7%, 46.3%, and 16.6%. The most surprising position is that Texas Pacific Land has a 21.5% position weight in the Horizon Kinetics Internet Fund!!

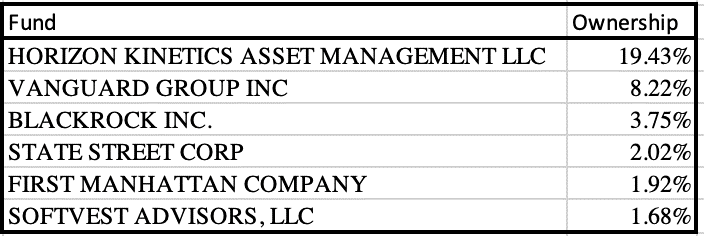

Horizon Kinetics, the asset manager, is the LARGEST shareholder in The Texas Pacific Land Corp, holding just short of a fifth of the company. The next three holders are Index Funds – Vanguard, Blackrock, and State Street.

Concentration Risk

Regardless of how good of a company The Texas Pacific Land Corp might be or what Horizon Kinetics investment philosophy might be, is it worth it for one position to be 46% of the asset manager’s portfolio? This is what we call CONCENTRATION RISK. Kinetics philosophy, “investors are better served by not taking more risk,” is perhaps not entirely aligned with a large, risky position in one stock. Yet, it’s easy to understand why they hold it: to make money.

The stock is up 70% this year alone. Who would want to miss that? Yet, profitable as the stock is, a mutual fund with daily liquidity needs to ask – is this a lot of concentration in stock?

Apologists might argue that Buffett has 40% of Berkshire Hathaway’s portfolio in a single stock, Apple, so perhaps our concern is overblown. The observation is true, but the Berkshire case is not comparable.

First, there are vast differences in the stocks’ liquidity. TPL has a market cap of $17 billion, while Apple has a market cap of $2.5 Trillion. Each day, 1% of Apple trades in the market (about $25 Billion), while just over $100 million of TPL trades (or less than 0.6%) is traded in the secondary market. More to the point, if the largest shareholder of TPL needed to sell $1 billion on the stock, would it be that easy to sell? Who would Kinetics sell the stock to? At what price?

Secondly, Berkshire operates under different rules than a mutual fund does. Kinetics’ has a responsibility to exchange fund shares for cash on demand. Meanwhile, Berkshire Hathaway has permanent capital and float.

Similarly, they might argue that other successful funds had uber-concentrated positions. The Baron Partners Fund once committed over 50% of its portfolio to Tesla and made a mint on the investment. Ron Baron had made $6 billion in profits on Tesla. Citywire’s John Coumarianos reported, “In January (2021), Morningstar downgraded the $7bn Baron Partners fund (BPTRX) from Bronze to Neutral because of its then 47% stake in the electric automaker.”

A few months later, founder Ron Baron became concerned over the impact of the position. On March 8th, 2021, Ron Baron told CNBC that he sold the share due to “risk management. . . where [the stock] became a very large percentage of two funds that I manage – became over 50% of those funds’ assets – and I thought risk mitigation was appropriate.” Despite that selldown, Tesla’s subsequent price appreciation means it’s back to 52% of the portfolio.

Position concentrations have consequences. Running a fund management business with daily liquidity has consequences. Clearly, fund investors who want to maximize returns must be celebrated, provided the gains can be banked. Ron Baron was able to sell Tesla and book profits. Will Murray Stahl be able to do that with the TPL position? He is not only the biggest investor but also sits on the Board of Directors at TPL. He must be working overtime trying to figure out an exit plan. Or, maybe, he is not worried at all and is confident that investors in his fund actually want him to take such bets. If you are an investor in the funds, you better be on board with this concentration risk.

Texas Pacific Land Corp: a “Pure Play in the Permian Basin.”

The website: Texas Pacific Land Corporation is the corporate successor to Texas Pacific Land Trust, which was formed in 1888. TPL is one of the largest landowners in the State of Texas, operating under two business segments: Land and Resource Management and Water Services and Operations.

It had a Quarterly Net Income of $119mm. Its last 12 months’ net income is $379mm. Let’s assume the forward 12 months’ income will be $500mm. At a market cap of $17.9 Billion, it trades at north of a 35 multiple to Earnings.

Neither do I understand the fundamentals of this company, nor do I know how to value the stock. My focus is simply on the fund that holds it and the accompanying risks to investors.

The blog – The Texas Pacific Land Trust Investor – has a very detailed and thoughtful commentary on the company and stock and makes for an interesting read.

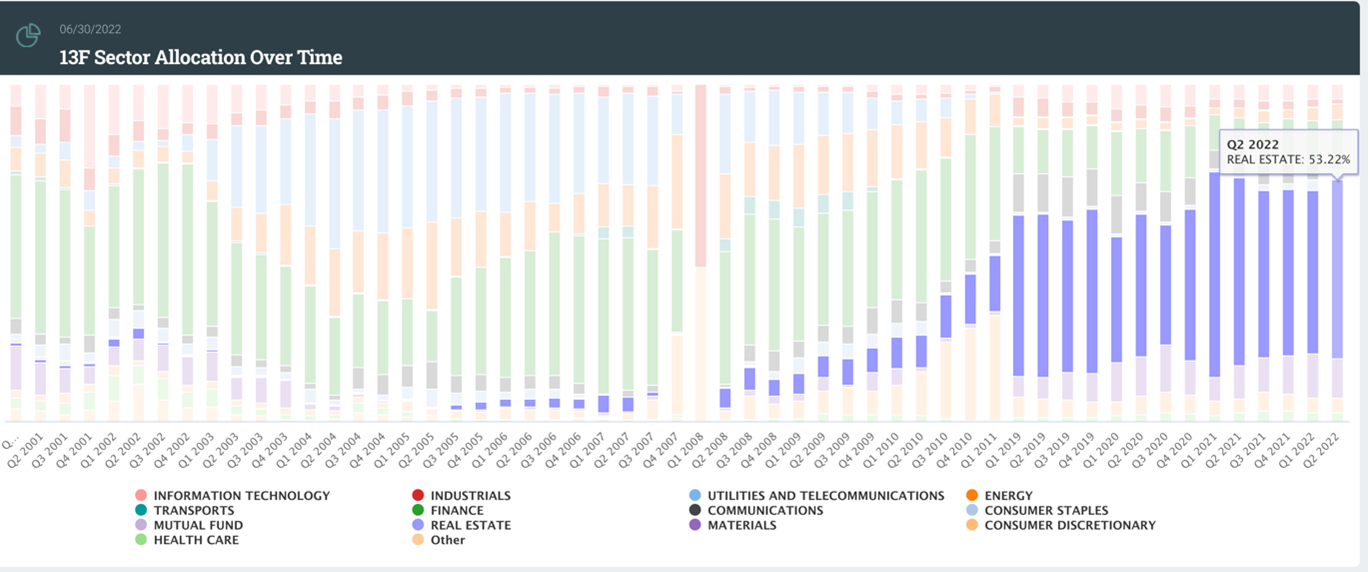

Horizon Kinetics has thought a lot about what kind of company thrives during inflation. They’ve concluded that companies with tangible assets are a starting point. But these mining companies can have high expenses from labor and energy. Instead, they prefer asset-rich companies to earn royalties by renting out the land and earning a slice of the revenue. TPL fits that profile perfectly. 53.22% of TPL’s portfolio is to be invested in “Real Estate” as of Q2, 2022.

Going for the Jugular

There is something admirable about fund managers who take a contrarian, research-based, long-term stand in order to go for the jugular. But there comes the point when the outcome becomes binary. They better win because otherwise, they are going to lose.

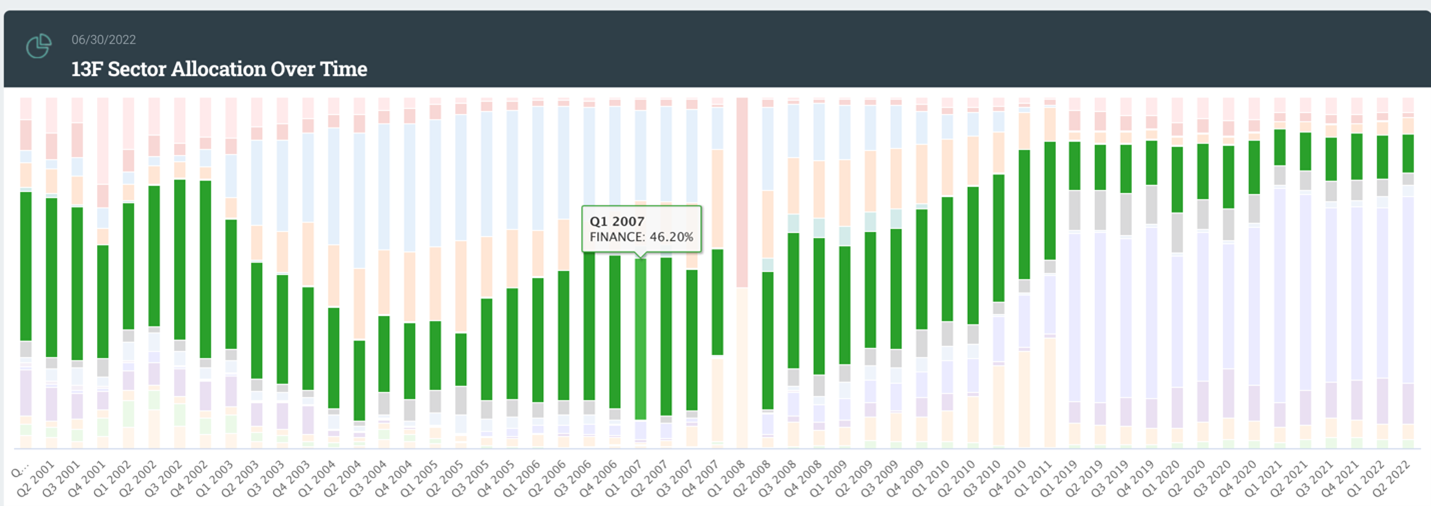

History offers lessons for the careful reader. Before the 2007-2008 crisis, the financial sector was considered a money machine. Kinetics’ position in the Financial sector circa Q1 2007 was 46% of their overall portfolio.

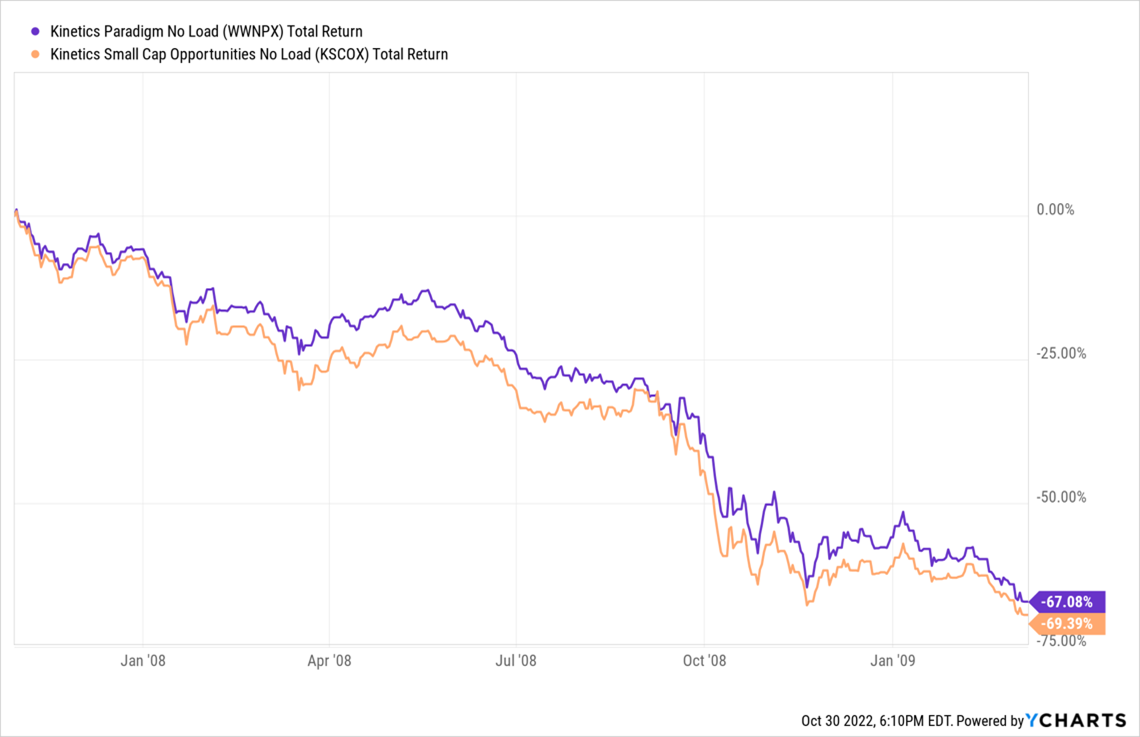

In the bloodbath that ensued, from Q4 2007 to the lows in March 2009, two Kinetics funds went down by two-thirds in price.

Position concentrations in any one sector (and especially one stock) can be extremely injurious to the portfolio’s health. Investors need portfolio managers with conviction to make money, but such conviction also brings risk. And sometimes, the risk doesn’t go in one’s favor.

The Past Need Not Repeat.

Human ingenuity cannot be underestimated. There is no reason to believe that the fund managers at Kinetics are going to repeat the mistakes of the past. This time around, it does look like inflation is stickier, energy prices will be higher for longer, and what they own is prime Permian property. All good, but they need to figure out how to bank some of their gains. In the current risk-reward setup, the problem is that the role of luck has become way too big for the fund holders of Kinetics. One mistake, and the floor is unknown. Diversification may not make one very wealthy, but it does prevent the worst-case scenario. With large concentration risk, you are either right or wrong. No in between.

Conclusion

I am not savvy enough to know the future path of inflation, energy prices, TPL’s business model, Kinetics investing acumen, and the various creative paths that can be pursued to exit the position. But there are certain rules of portfolio management and position concentration, which, once transgressed, are enough of a precondition for investors to become hyper-alert.

When investors invest in a fund, they assume the fund manager is on the same side. But that is complicated to know. Do we want a fund manager maximizing profits or a fund manager managing risks prudently? Sometimes, the goals are mutually exclusive.

If they manage to pull a rabbit, Kinetics is on its way to the Hall of Fame of investment returns in an otherwise awful market year. If Lady Luck decides not to cooperate, the risk for investors in Kinetics funds could be substantial. At the minimum, the large position concentration size of TPL in Kinetics portfolio seems diametrically opposite to their belief that investors are better served not by taking more risk…

Kinetics Fund investors be hyperalert.