“For the young the days go fast and the years go slow; for the old the days go slow and the years go fast.” – Anna Quindlen, Lots of Candles, Plenty of Cake: A Memoir of a Woman’s Life.

Secular bear markets with low returns along high volatility often deter younger investors from starting to invest, yet they offer tremendous buying opportunities. Prioritizing the long-term need to save for retirement over short-term interest is another major hurdle to starting to invest.

I wrote Living Paycheck To Paycheck and the Role of Financial Counselors to show that about seventy-five percent of Americans don’t have enough saved to cover three months of living expenses. According to surveys, many people are choosing to overspend on groceries, dining out, clothing, entertainment, food delivery services, pets, travel, and/or alcohol. How much would a person who saved and invested five dollars per weekday have at the end of ten years in a secular bear market?

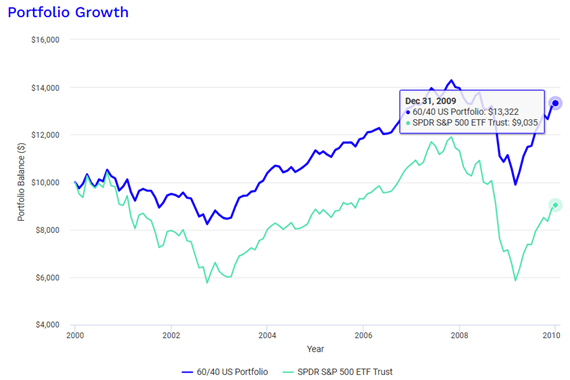

As the base case, Figure #1 shows how $10,000 invested in 2000 would have performed during the bursting of the Dotcom Bubble and the Great Financial Crisis. The traditional 60% stock/40% bond portfolio would have returned about 3% over the ten-year period, barely beating inflation.

Figure #1: Growth of $10,000 in the 2000 – 2010 Secular Bear Market

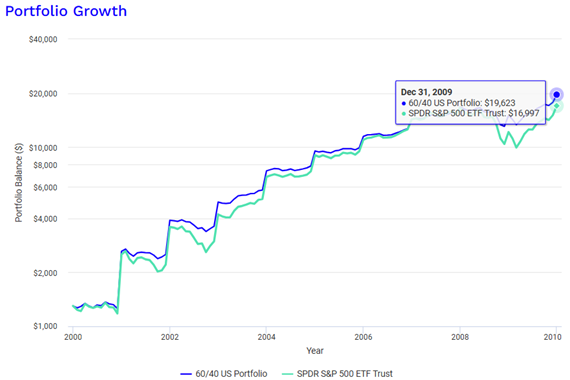

Figure #2 shows the same secular bear market for someone who starts with $1,300 and contributes that amount each year adjusted for inflation. By 2010, the investor would have been saving about $1,660 per year. The investor would have been “buying low” and was not significantly hurt by investing 100% in stocks. The annualized return would have been 31%.

Figure #2: Investment Foundation During a Secular Bear Market

Source: Author Using Portfolio Visualizer – Backtest Portfolio – Dollar Cost Averaging $1,300 / year

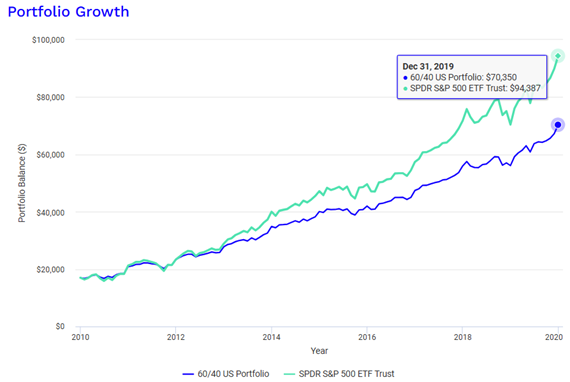

Saving $15,000 to $20,000 in ten years would have provided a springboard for the next ten years when a secular bull market started. The $16,997 at the end of 2010 would have grown to $42,328 by the end of 2019 if invested in the S&P 500, but by contributing $1,660 per year adjusted for inflation, the portfolio would have grown to $94,387 as shown in Figure #3.

Figure #3: Growth Spurt During a Secular Bull Market

Source: Author Using Portfolio Visualizer – Backtest Portfolio – Sequence Of Return Risk – $1 Million with 4% withdrawal / year

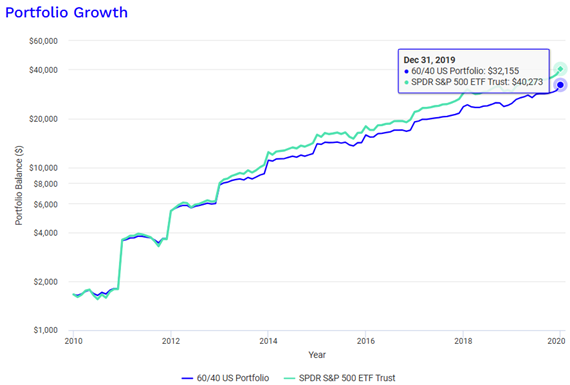

What if our young investor skipped the secular bear market from 2000 to 2010 and started investing $5 per day adjusted for inflation from 2000 ($1,660 per year)? If one began investing in 2010 with $1,660 in the S&P 500, the amount portfolio would have grown to $40,273 compared to $94387 had they been investing for the full 2000 to 2019 period. The Lesson For Young Investors: Time in the market is more important than timing the market.

Figure #4: Time In the Market Is More Important Than Timing the Market

Source: Author Using Portfolio Visualizer – Backtest Portfolio – Sequence Of Return Risk – $1 Million with 4% withdrawal / year

The real world implication is that saving $5 per working day will not achieve the elusive million-dollar retirement portfolio, but it is a start. Matt Krantz wrote If You’d Maxed Out Your 401(k) for the Last 30 Years, You’d Have This Much at The Motley Fool. He concluded that a person with an initial investment of $7,313 in 1988 which was the maximum allowed for a 401(k) that year kept investing at the maximum 401(k) limit, he or she would have accumulated a $1.4 million by 2018 not including employer matches. He assumed a starting glide path stock-to-bond ratio of 80% stocks. However, he added catch-up contributions at age 50.

I used Retirement Savings by Age: Averages, Medians, Percentiles US by DQYDJ, and Nearly half of American households have no retirement savings by USA Facts to make the following generalizations. Retirement savings by age for someone nearing retirement show that approximately one in seven people approaching retirement has about one million dollars in financial assets. Financial assets exclude home equity which is included in net worth calculations. The median household approaching retirement age has around $60,000 in retirement savings.

Jessica Walrack at U.S. News and World Report explains in “How Much You Should Save by Month and by Age?” that people should develop a personalized savings approach. She suggests devoting twenty percent of one’s paycheck towards savings and investing if possible. She adds that a reasonable target for starting a savings plan is to have the equivalent of one year of salary saved by age thirty and three times by age forty. The most reliable way to start is by automating the process.

I fit the example by Mr. Krantz fairly closely. In the early 1990’s my savings was very modest. As a two-income household, we began contributing the maximum to retirement savings. We were fortunate enough to find employers with good benefits and with pensions and stay with them until retirement. We made catch-up contributions when eligible. We invested in our homes and maintained emergency savings. One breakthrough came for me in the mid-2000s when I started reading retirement planning books like Retire Secure!: A Guide To Getting The Most Out Of What You’ve Got by James Lange because I learned about the importance of financial planning and the impact of asset location on lifetime taxes. Lesson For Young Investors: Increase your financial literacy.

As part of my own financial planning, I learned about the huge impact that working in the latter years before retirement makes because you continue to contribute to savings instead of withdrawing. Life in Retirement: Pre-Retiree Expectations and Retiree Realities by TransAmerica Center for Retirement Studies found that fifty-six percent of retirees retired sooner than planned. The most common reasons are health-related such as physical limitations, disability, or ill health, and employment reasons such as unhappiness, organizational changes, job loss, and/or a buyout. I was fortunate to work two years beyond my normal retirement date. Lesson For Young Investors: Build a “margin of safety” into your plans for the unexpected.

During my parents’ or my lifetimes, we experienced the great depression, World War II, Cold War, stagflation of the 1970s, Dotcom Bubble, and Great Financial Crisis. It conditioned me to hope for the best but prepare for the worst. Personal savings rates during the 1960s and 1970s were between 10 and 13 percent, but have fallen to around four percent currently. Retirement advice in the books that I have read recently is to have “No Regrets”. I have been fortunate to work internationally for eleven years, to put our son through a good university with no college debt, to have reasonably good health considering cancer (cured), and to have a secure retirement. I regret not having a better work/life balance. I am playing a some catch up. Lesson For Young Investors: Have work/life balance which doesn’t sacrifice saving for emergencies and the long-term.

If you have not done so yet, try setting some New Year’s resolutions to make your retirement planning successful and stick to it.