Overpayments and repayments are two of the most common anomalies that could complicate year-end and W-2 processing. Now is a great time to sort out any potential difficulties.

Jump to:

What is an overpayment on taxes?

In simple terms, an overpayment on taxes is paying more than what is owed. Overpayments and repayments may seem complicated, but they generally boil down to one simple rule of thumb: Recover net from overpayments that are repaid in the current year and gross from overpayments that aren’t repaid until a subsequent year.

What are the IRS guidelines on overpayment of wages?

As outlined by the IRS in the Publication 15, (Circular E), Employer’s Tax Guide, if your employee repays you for wages they received in error, do not offset the repayments against current year wages unless the repayments are for amounts received in error in the current year.

To further explain, let’s look at both overpayments and repayments in the current and subsequent years.

Overpayments and repayments in the current year

Overpayments are considered paid when received and must be included in the employee’s income when received. If the employee repays the advance or overpayment during the same year they received it, the employer should exclude the amount from the employee’s income when filing the W-2.

The employee should repay the net amount and the employer will need to submit properly amended federal and state returns. In these cases, it’s also important to watch state and federal unemployment, as they may be overstated. If this happens, amendments may need to be filed for the affected quarters.

Let’s look at an example:

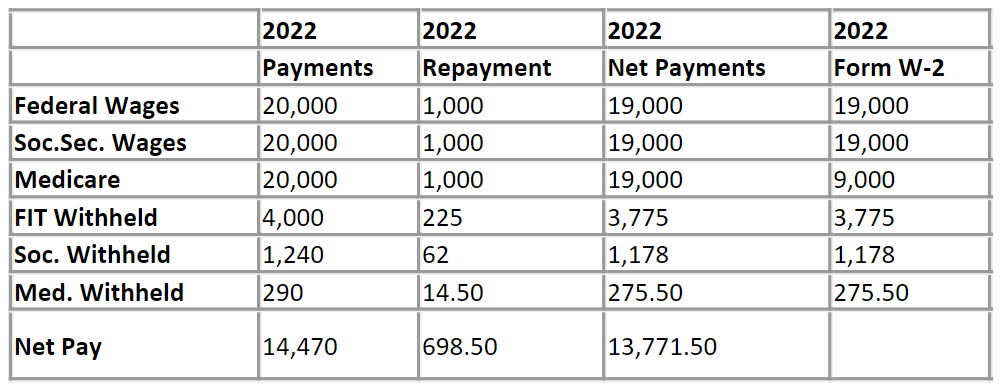

ABC Company hires Mike on May 1, 2022 at a salary of $3,000 per month. Mike receives a sign-on bonus of $1,000 that he must repay if he leaves ABC within one year of hire. Mike resigns on December 2, 2022 and repays the sign-on bonus. Because he repaid the bonus in the same year it was originally paid, he owes only the net amount of $698.50. ABC will issue the net transaction on Mike’s W-2.

Here’s how Mike’s W-2 would appear in this scenario:

Reporting repayment of current year wages

According to the IRS, if a company receives repayments for wages paid during a prior quarter in the current year, they must report adjustments on Form 941-X to recover income tax withholding and social security and Medicare taxes for the repaid wages.

Overpayments and repayments in subsequent years

Things get a bit more complicated when an overpayment isn’t repaid until a subsequent year. Again, overpayments are considered paid when received and must be included in the employee’s income when received.

If the employee doesn’t repay the advance or overpayment until a subsequent year, they’ll need to repay the gross amount — the net amount they received plus any federal or state income tax. The employer cannot collect federal or state income tax withheld in a prior year, so no correction can be made for income taxes withheld. The employee can, however, claim a deduction on their personal income tax return for the tax they repaid.

Let’s look at an example:

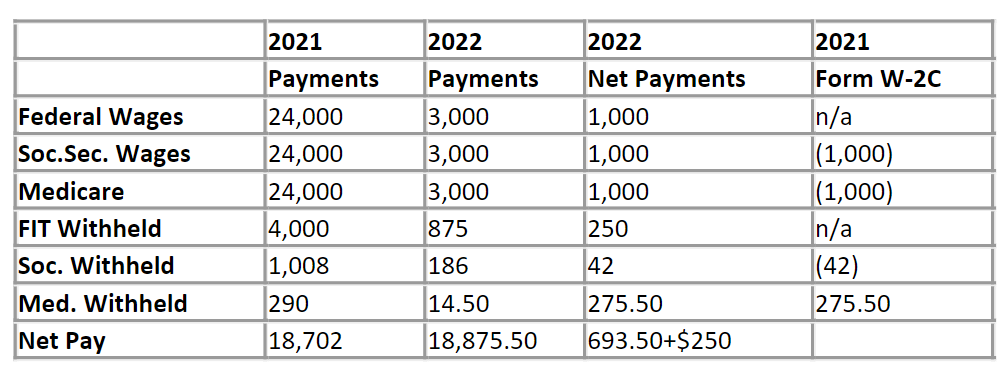

ABC Company hires Mike on May 8, 2021 at a salary of $3,000 per month. Mike also receives a sign-on bonus of $1,000 that he must repay if he leaves ABC within one year of hire. Mike resigns on January 31, 2022 and repays the sign-on bonus. Because the repayment took place in a different year than the original payment, Mike owes the net amount of $693.50, plus the $250 in federal tax that was withheld and remitted to the IRS. ABC will issue the gross transaction on Mike’s W-2C. Mike will deduct the $250 from his 2022 income tax return.

Reporting repayment of prior year wages

As explained by the IRS, if a company receives repayments for wages paid during a prior year it must report an adjustment on Form 941-X or Form 944-X to recover the social security and Medicare taxes. The employer cannot make an adjustment for income tax withholding because the wages were income to the employee for the prior year, the agency noted.

The IRS also states that an employer also cannot make an adjustment for Additional Medicare Tax withholding because the employee determines liability for Additional Medicare Tax on the employee’s income tax return for the prior year. The company must also file Forms W-2c and W-3c with the Social Security Administration (SSA) to correct social security and Medicare wages and taxes. Provide the employee with a copy of Form W-2c.

Preventing tax overpayments

Recover net from current-year repayments and gross from subsequent-year repayments. Remembering this one simple rule can help ease confusion and headaches when tax season rolls around.

However, it is obviously best to prevent tax overpayments and other payroll errors from happening in the first place. This means having the right tools and resources in place such as a full-service payroll software solution.

It is important to keep in mind that tax overpayments, as well as underpayments, can also arise in the indirect tax process. This is especially true when companies take a manual approach to the P2P tax process, which can involve dozens of time-consuming steps that drain resources.

If you’re a payroll professional, watch a demo of Thomson Reuters Accounting CS® Payroll in action. If you work in indirect tax, leverage a global tax determination software to prevent tax overpayments, underpayments, and penalties that can accumulate and weaken your company’s financial strength. Try the software out with a free demo.