Trade sanctions have become a crucial foreign policy tool globally. Companies face a complex sanctions environment with expanding regulations, increased international cooperation, and stricter enforcement. Robust compliance programs are essential for businesses engaged in international trade.

In recent years, trade sanctions have become an increasingly important, and well-used foreign policy tool for governments worldwide. Companies have to navigate a vastly expanded sanctions environment, in which regulations are multiplying, international cooperation is becoming more joined, and enforcement action is intensifying. The number of sanctions measures is also growing. They cover not just direct trade, but also trade activities further down the supply chain, and include other areas of concern like anti-money laundering (AML), terrorism, and forced labor issues.

As requirements become ever more complex and demanding, it’s clear that having robust sanctions compliance programs in place must be a top priority for businesses engaged in international trade. Key issues companies need to consider were outlined at a recent hosted by Thomson Reuters. The discussion included the following topics:

Register for the webinar and find out insights into the latest sanction measures and strategies for maintaining compliance and mitigating supply chain risks.

Global trade risk considerations are broadening

Traditionally, companies have focused on denied/restricted party, jurisdiction, and ownership structure screening, when checking those they do business with are not subject to sanctions. But that is no longer enough in today’s world: they must consider other risk factors such as evasion and circumvention, where bad actors find ways to get around systems and controls. Visibility and traceability are vital.

For example, it may seem fine to ship goods to a customer because they do not appear on any sanctions lists, but that customer (or its customers in turn) may then do business with a sanctioned entity further down the supply chain or trade in a country of concern. Or, the product itself (or one of its components) may be innocuous, but could end up going somewhere it shouldn’t or being used in a prohibited way. Nuts and bolts, which were in high demand by Russia to fix tanks during the war with Ukraine, were one example given; another was microchips that were ultimately sold into Russia or China (via non-sanctioned countries) in violation of sanctions or export rules.

Helpfully, many governments provide guidance and alerts to help ‘red flag’ foreign parties of concern that do not appear on any formal sanctions lists and so won’t be identified by screening. “Take a look at these tips, on how to catch things before they happen and not get caught out by circumvention and diversion, which is a tricky area to try and do due diligence on,” advised Karen Lobdell, Senior Product Manager at Thomson Reuters.

Cooperation and enforcement of sanctions are ramping up

“Coordination among agencies within the U.S. as well as internationally, is unprecedented,” stated Donna Daniels, Managing Director, Forensics Division at EY. Government agencies worldwide are increasingly sharing data and intelligence with each other, combining investigative efforts and harmonizing regulatory standards and enforcement penalties.

This closer cooperation can benefit companies in one sense, by providing a greater consistency of approach that reduces the burden of having to come up with multiple policies and processes to address sanctions risks and satisfy regulations in every area where they operate. However, compliance remains complex, and companies must understand the differences between – and nuances of – the various standards, and requirements.

They are increasingly expected to share data with regulatory authorities, too. The consequences of not doing so could be severe. In the U.S. for example, a “carrot and stick” approach has seen enhancements to voluntary self-disclosure programs on one hand, and large penalties and aggressive enforcement actions on the other. In addition to fines, organizations could be banned from conducting business.

It’s worth noting that agencies are increasingly well-funded, enabling them to pursue more enquiries and investigations right through to prosecution. “We’re seeing the money move…to the agencies, and they now have the staff and the resources to really dig into these issues, when necessary,” Lobdell pointed out.

Getting your sanction compliance in order

It’s clearer than ever that companies need to have robust policies, procedures, and controls in place to address potential risks associated with trade sanctions, and maintain robust records for years to come, in case regulators come knocking later.

Some companies are self-sanctioning as a risk mitigation strategy – such as taking the decision to move out of high-risk countries or to cease trading with certain entities altogether. This comes back to the idea of taking a bigger-picture look at your priorities and where your goods are really going.

Technology has a vital role to play here, enabling organizations to assimilate and analyze data, assess risk, and gain visibility over their potential trade sanctions exposure, especially as regulations become more stringent. From advanced screening tools to platforms for export management, traceability capabilities, and risk monitoring software, there are plenty of solutions available to help you stay ahead of the curve on regulatory compliance.

Data analytics is a key area because companies increasingly must tie together data from different sources gathered for different purposes, such as combining AML data with sanctions data, to get a clearer perspective overall. Organizations may also need to look at their data in new ways to spot unexpected changes or unusual patterns that require further investigation. AI and machine learning are coming to the fore in this respect, facilitating trend spotting, red-flagging and reporting. Regulatory authorities are deploying data analytics tactics and using tech tools to uncover non-compliance, and are expecting companies to do the same to add rigor to their compliance efforts.

Solutions for managing global trade sanctions

To learn more about these issues, listen to the webinar on-demand, or discover how technology tools can make your organization’s sanctions compliance more robust with Denied party screening software.

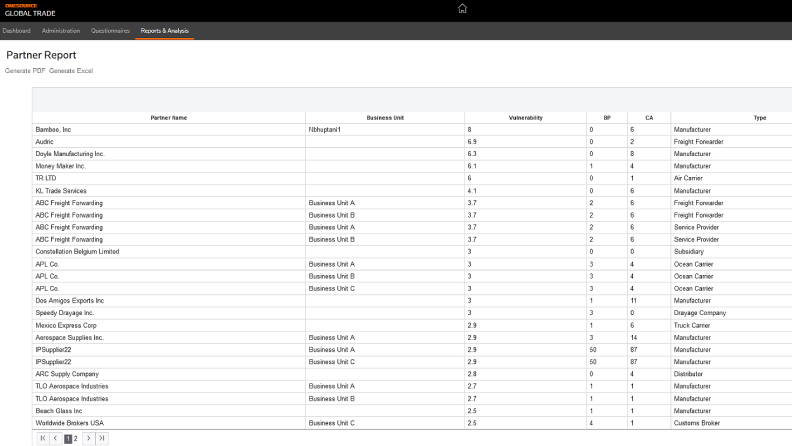

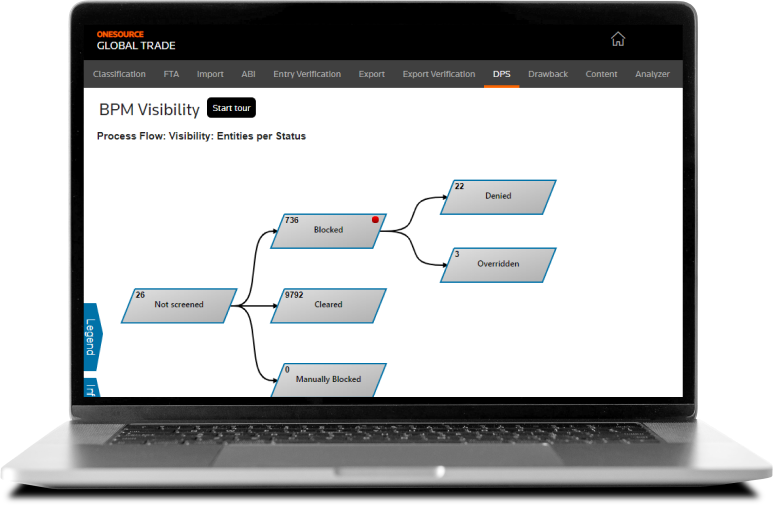

ONESOURCE Denied Party Screening allows you to screen 715+ global lists for restricted persons, companies, and sanctioned or embargoed countries. Its sophisticated search engine can be fully tailored and configured to let you manage an appropriate level of risk for your company — minimizing false positives without missing actual hits.

Combining ONESOURCE Denied Party Screening with provides a more proactive and robust approach to

|

|

|

|