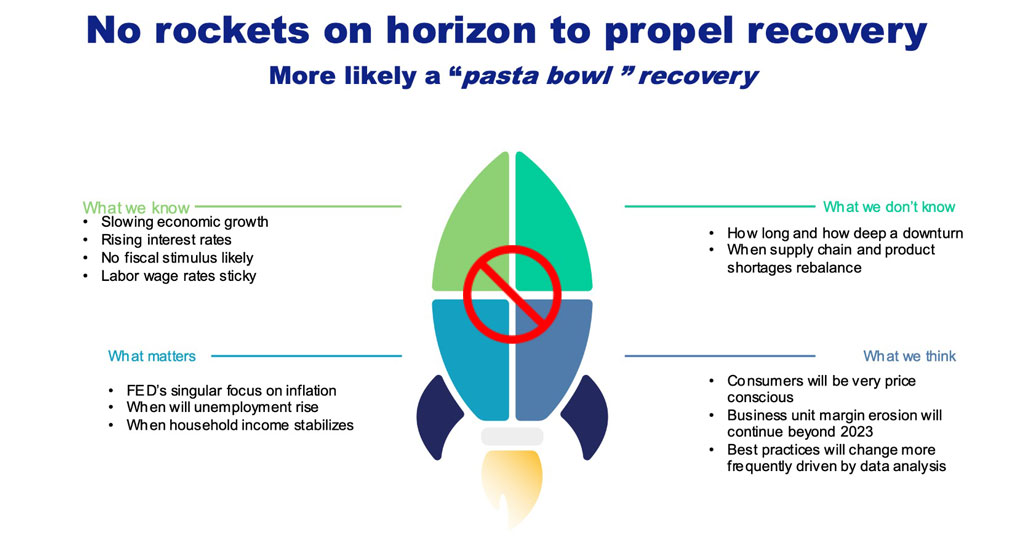

With 2023 planning well under way, it would be helpful to know what kind of economy we’re heading into. While it’s clear we’re heading into an uncertain 18–24 months, there are enough indicators to form some base assumptions.

Let’s start with the consumer. In 2021, we saw pandemic-driven government programs and general consumer optimism boost household wealth; that is now decreasing. More importantly, household income has eroded. Disposable income and savings rates are declining, as are core personal consumption expenditures. Consumer discretionary cash is down double digits from 2021. All this is forcing businesses into a battle for wallet share, and the wallet is getting thinner. In this environment it is hard for businesses to offset slowing demand by raising prices.

How long with this trend last? Ask the Fed. Current Fed Chair Powell seems committed to impersonating Paul Volker, whose policies as Fed chair from 1979–1987 were credited with ending the high inflation of the time. That took several years, so in an attempt to shorten the pain associated with such hard-to-swallow medicine, the Fed has instituted a very aggressive interest rate rise.

When will the Fed blink? It seems their primary benchmark is the unemployment rate. Until that shows a material easing, we should expect a strong inflation-fighting posture, which very likely means a base planning assumption of a tough economy in 2023 and into 2024, with a pasta bowl recovery down the road.

Capital access

Let’s turn to capital access. The good news is that banks are in strong shape. This is not another 2008 scenario where they basically shut down lending for a couple of years. Therefore, the availability of capital is strong.

The challenge franchisors must prepare for is getting access to funding for their franchisees in 2023. Lenders are looking at the same economic forecasts as you are, which is pushing them to use more conservative underwriting standards. They know labor and input costs have risen. Now interest rates have as well, which affects unit economics. Your prospects must be more financially qualified in 2023 than many you accepted in the past 24 months. Further, lenders are asking franchisors for more information about the performance of their franchise systems, such as:

- How is the brand dealing with inflationary and macroeconomic pressures?

- What is the impact of increased cost of capital on the bottom line?

- How will demand for the brand’s goods or services change in 2023+?

- Is the brand prepared to survive an economic downturn?

- Does the business model hold up to a pro forma stress test?

The clear implications for franchisors are to prepare to show how well their system navigated the pandemic, how they are addressing inflationary pressures on unit economics, and how well their product or service pricing has held up.

Understand how lenders are thinking today. They have internal portfolio questions to address around both brand and sector concentrations. Transparency will be a key mantra for most lenders. We are seeing a fair amount of movement in FUND Scores because of transparency issues, and banks are adjusting their appetite using such tools.

Those base assumptions create a foundation of what all this means for franchising. We know how franchising typically behaves in economic downturns, and what recent trends in franchise activity suggest about where you should focus your resources and management attention in 2023.

How it may play out

According to FranConnect’s client data, total leads and closed deals in Q3 2022 were down more than 37% YOY. Yet half of the franchisors they polled anticipated double-digit increases in 2023 franchise sales. Are they being too optimistic?

FRANdata’s information, which spans four recessions, paints a clear pattern over economic downturns. In the early stages, closures and transfers rise and “signed but not open” becomes a more significant issue. That is followed by unit consolidation through franchisor buybacks and multi-unit operators acquiring units from smaller operators. As a recession plays out and a bigger pool of displaced workers appears, franchise sales pick up at a pace that exceeds the general economic expansion.

If our 2023 economic forecast holds, we will have a longer contraction trough and a more gradual recovery than most are expecting. As you plan for 2023, it might be in your brand’s long-term interest to temper growth expectations and focus a greater amount of management attention on existing system dynamics.

Darrell Johnson is CEO of FRANdata, an independent research company supplying information and analysis for the franchising sector since 1989. He can be reached at 703-740-4700 or djohnson@frandata.com.