My retirement planning for the past two years since retiring has focused on the Bucket Approach to have the right funds in the right investment buckets to have high-risk adjusted returns while minimizing taxes over my lifetime. This article focuses on forty of the top performing ETFs that I believe can form a good foundation for the coming decade. I wrote Investing in 2025 And the Coming Decade describing why I think bonds will outperform stocks on a risk-adjusted basis because interest rates will have to stay higher for longer to finance the national debt and starting equity valuations are so high. Federal Reserve Chairman Jerome Powell basically said as much this past Wednesday and the S&P 500 dropped 3%.

I rated over five hundred ETFs that I track in over one hundred Lipper Categories, using the MFO Risk and Rating Composites, Ferguson Mega Ratio which “measures consistency, risk, and expense adjusted outperformance”, Return After-Tax Post Three Year Rating, and the Martin Ratio (risk-adjusted performance) to select the top fund for each Lipper Category. I then subjectively adjusted the funds to favor the Great Owls and for my own preferences of Fund Families. I eliminated the Lipper Categories where the final fund had a high price-to-earnings ratio and fell further than the S&P 500 following Mr. Powell’s announcement. I used the Factset Rating System to eliminate several funds. I eliminated almost twenty funds to keep the final list of funds to keep the selection diversified and simple.

What Will the Investing Environment Bring in The Next Decade?

The coming decade will bring uncertainty because:

- National debt as a percentage of gross domestic product (GDP) has not been this high since World War II.

- Federal Debt as a percentage of (GDP) is growing at six percent adding to the national debt.

- Population growth which drives economic growth has slowed for decades.

- Tax cuts are coming and are likely to reduce Federal revenue with benefits favoring the wealthy and adding to the national debt.

- Tariffs raise the cost of inflation favoring keeping rates higher for longer.

- Stock valuations are high implying below average long-term returns.

- Interest rates will likely be elevated compared to historical averages in order to finance the national debt and contain inflation.

- Geopolitical risk has risen.

- Political brinkmanship has risen.

For ideas about how to prepare for more volatile markets, I refer you to David Snowball’s article last month, “Building a chaos-resistant portfolio”, as well as mine, “Envisioning the Chaos Protected Portfolio”. The selection of ETFs in this article reflects some of these ideas from the MFO December newsletter.

Bucket Approach

The Bucket Approach is a simple concept of segregating funds into three categories to meet short-, intermediate-, and long-term spending needs. It can be more complicated in a dual-income household with separate account ownership, and different tax characteristics. For those in higher tax brackets, asset location to manage taxes is very important.

For example, if an investor owns both Traditional and Roth IRAs, then funds with lower growth and less tax efficiency should be put into the Traditional IRAs. Roth IRAs are ideal for higher growth funds that are less tax-efficient. After-Tax accounts held for the long term are best suited for tax-efficient “buy and hold” funds with low dividends and higher capital gains.

These are the concepts included in the following buckets. Investors need to select what is appropriate for their individual circumstances. Some funds can fit comfortably into multiple buckets or accounts with different tax characteristics.

I arrange my accounts in order of which ones I will withdraw money from first. The first ones are the most conservative and the last ones are the most aggressive. I prefer to consider these being in Investment Buckets. On the day that the S&P 500 fell 3%, my accounts that will fund the next ten years of living expenses fell 0.35% while producing income.

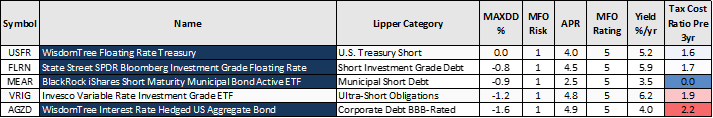

Bucket #1 – Safety and Living Expenses for Three Years

The list of funds in Bucket #1 is short because I used fund performance in 2022 and the COVID recession to push funds with high drawdowns into Bucket #2. Money market funds, certificates of deposit, and bond ladders should be considered a staple of a conservative bucket for emergencies and living expenses. The Tax Cost Ratio reflects the portion of the returns that will be lost due to taxes. The higher one’s tax brackets, the more applicable it becomes to invest in municipal bonds. For an investor wanting to minimize taxes, BlackRock iShares Short Maturity Municipal Bond Active ETF (MEAR) may be a great choice.

The blue shaded cells signify a Great Owl Fund which has “delivered top quintile risk-adjusted returns, based on Martin Ratio, in its category for evaluation periods of 3, 5, 10, and 20 years, as applicable.”

Bucket #1 – Safety and Living Expenses for Three Years

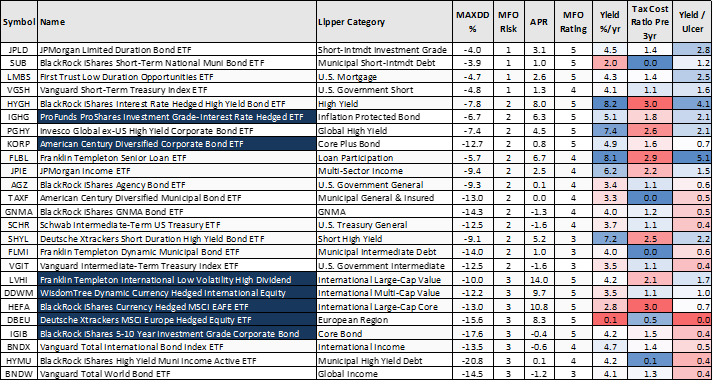

Bucket #2 – Intermediate (three to ten years) Spending Needs

There is a very important distinction between MFO Risk and MFO Rating. MFO Risk is based on risk as measured by the Ulcer Index which is a measure of the depth and duration of a drawdown. MFO Risk applies to all funds. MFO Rating is the quintile rating of risk-adjusted performance as measured by the Martin Ratio for funds with the same Lipper Category.

I recently changed my investment strategy for Bucket #2 from Total Return to Income because interest rates are historically high. In the table below, I calculate the Yield to Ulcer ratio to see how much risk I might be taking for that income. The risk over the past three years has come from rising rates and the anticipation of a recession which may have transformed into a soft landing. I expect interest rates to remain relatively high for longer but gradually fall. I favor bonds with intermediate durations.

Bond portfolios should be high quality, but riskier bond funds can be added to diversify for higher income or total return. High Yield, Loan Participation, and Multi-Sector Income funds carry more risk than quality bond funds but are typically less risky than equity funds.

Several International Equity Funds make it into Bucket #2 because the valuations are lower and they have lower volatility. Franklin Templeton International Low Volatility High Dividend Index ETF (LVHI) stands out for having a high yield and Yield/Ulcer ratio along with high returns, but it is not particularly tax-efficient.

Bucket #2 is where I see the most opportunity over the next five to ten years because of high starting interest rates. I will be tracking higher-risk bond funds and income-producing funds to potentially add.

Bucket #2 – Intermediate (three to ten years) Spending Needs

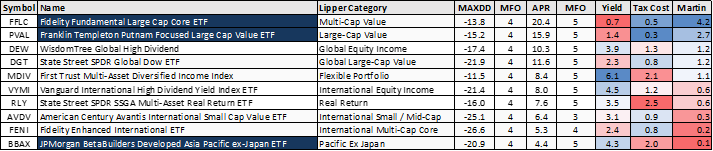

Bucket #3 – Passing Along Inheritance, Longevity, Growth

My concerns about Bucket #3 are mostly high valuations. The theme in Bucket #3 is growth at a reasonable price. Equity funds may do well in 2025 and 2026 because of tax cuts. I offer fewer funds to consider in Bucket #3 because I excluded those with high valuations and high recent volatility.

I was thinking of buying Berkshire Hathaway next year, but now favor Fidelity Fundamental Large Cap Core ETF (FFLC) instead.

Bucket #3 – Passing Along Inheritance, Longevity, Growth

Closing

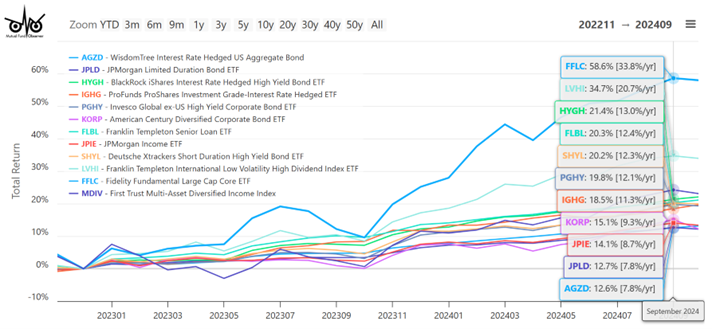

I have delayed making some small changes to my portfolio until next year in order to keep taxes lower in 2024. I plan to make normal withdrawals from riskier investments to lower my stock-to-bond ratio. Below is a chart of Total Return of some of the funds that I am tracking with the most interest.

Figure #1: Selected Author’s ETF Picks for 2025

I wish everyone and productive and pleasant new year.